Atam Valves Adjusts Valuation Grade Amid Competitive Auto Ancillary Landscape

2025-04-02 08:03:02Atam Valves, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment, reflecting its current financial standing. The company reports a price-to-earnings (P/E) ratio of 14.16 and an enterprise value to EBITDA ratio of 9.88, indicating a competitive position within its industry. The price-to-book value stands at 2.96, while the dividend yield is noted at 0.76%. In terms of profitability, Atam Valves showcases a return on capital employed (ROCE) of 23.09% and a return on equity (ROE) of 20.94%, which are strong indicators of its operational efficiency. When compared to its peers, Atam Valves presents a more favorable valuation profile. For instance, competitors like IST and Enkei Wheels exhibit significantly higher P/E ratios, suggesting that Atam Valves may be positioned more attractively in terms of valuation metrics. However, the company has faced challenges in rece...

Read More

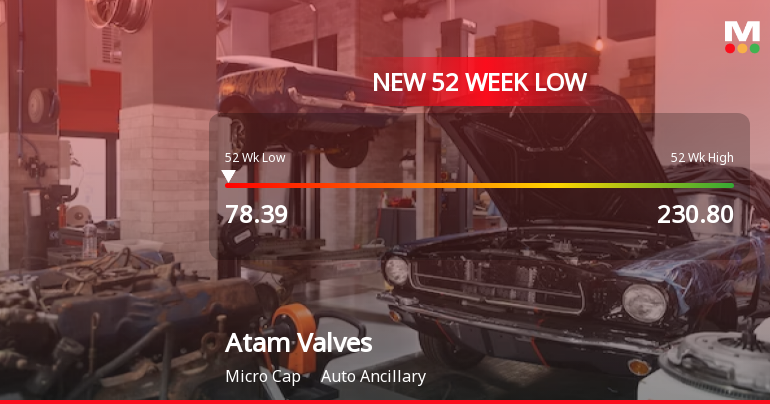

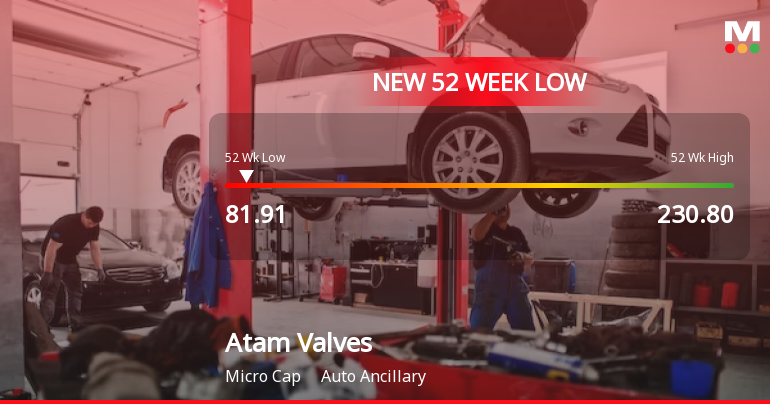

Atam Valves Faces Market Volatility Despite Strong Management Efficiency and Growth Potential

2025-03-27 13:37:58Atam Valves, a microcap in the auto ancillary sector, has hit a new 52-week low amid significant volatility, underperforming its sector and the broader market over the past year. Despite this, the company shows strong management efficiency and healthy long-term growth in net sales and profit after tax.

Read More

Atam Valves Faces Significant Stock Volatility Amid Strong Management Efficiency and Sales Growth

2025-03-17 15:44:23Atam Valves, a microcap in the auto ancillary sector, has seen significant stock volatility, hitting a new 52-week low. Over the past year, it has faced a substantial decline, contrasting with broader market trends. However, the company demonstrates strong management efficiency and healthy annual net sales growth.

Read More

Atam Valves Faces Significant Stock Decline Amidst Strong Operational Metrics

2025-03-17 15:44:22Atam Valves, a microcap in the auto ancillary sector, has reached a new 52-week low amid a significant decline over the past year. Despite this, the company shows strong management efficiency with a high return on capital employed and healthy annual net sales growth, alongside a recent increase in profit after tax.

Read More

Atam Valves Faces Significant Volatility Amid Broader Market Decline and Strong Management Metrics

2025-03-13 15:39:58Atam Valves, a microcap in the auto ancillary sector, has faced notable volatility, reaching a new 52-week low. The stock has declined significantly over the past four days and has underperformed its sector. Despite these challenges, the company demonstrates strong management efficiency and healthy annual net sales growth.

Read MoreAtam Valves Experiences Valuation Grade Change Amid Competitive Market Dynamics

2025-03-13 08:00:54Atam Valves, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently boasts a price-to-earnings (P/E) ratio of 14.58 and an EV to EBITDA ratio of 10.15, indicating a competitive position within its industry. Additionally, Atam Valves demonstrates strong return metrics, with a return on capital employed (ROCE) of 23.09% and a return on equity (ROE) of 20.94%. In comparison to its peers, Atam Valves stands out with a significantly lower P/E ratio than Z F Steering and Enkei Wheels, which are categorized as expensive. Other competitors, such as Rane (Madras) and Sar Auto Products, exhibit less favorable financial metrics, with Rane being loss-making and Sar Auto Products classified as risky. Despite recent fluctuations in stock price, with a current price of 87.15, down from a previous close of 90.50, ...

Read MoreAtam Valves Experiences Valuation Grade Change Amid Competitive Market Dynamics

2025-03-13 08:00:54Atam Valves, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently boasts a price-to-earnings (P/E) ratio of 14.58 and an EV to EBITDA ratio of 10.15, indicating a competitive position within its industry. Additionally, Atam Valves demonstrates strong return metrics, with a return on capital employed (ROCE) of 23.09% and a return on equity (ROE) of 20.94%. In comparison to its peers, Atam Valves stands out with a significantly lower P/E ratio than Z F Steering and Enkei Wheels, which are categorized as expensive. Other competitors, such as Rane (Madras) and Sar Auto Products, exhibit less favorable financial metrics, with Rane being loss-making and Sar Auto Products classified as risky. Despite recent fluctuations in stock price, with a current price of 87.15, down from a previous close of 90.50, ...

Read MoreAtam Valves Experiences Valuation Grade Change Amidst Market Performance Challenges

2025-03-05 08:01:04Atam Valves, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's current price stands at 89.65, reflecting a notable shift from its previous close of 86.00. Over the past year, Atam Valves has experienced a significant decline in stock performance, with a return of -47.08%, contrasting sharply with a mere -1.19% return from the Sensex during the same period. Key financial metrics for Atam Valves include a PE ratio of 15.00 and an EV to EBITDA ratio of 10.42, which position it competitively within its industry. The company also boasts a robust return on capital employed (ROCE) of 23.09% and a return on equity (ROE) of 20.94%. In comparison to its peers, Atam Valves shows a more favorable valuation profile against companies like Rane (Madras), which is currently facing losses, and Sar Auto Products, which is categorized as risky. Other competitors, s...

Read More

Atam Valves Faces Sustained Downward Trend Amidst Sector Underperformance

2025-03-03 11:05:40Atam Valves, a microcap in the auto ancillary sector, has faced significant volatility, hitting a new 52-week low. The stock has declined consecutively over four days, with a notable drop over the past year, underperforming compared to the broader market and trading below key moving averages.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended on March 31st 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window in terms of the Code for prevention of Insider Trading read with the SEBI (Prohibition of Insider Trading) Regulations 2015

Intimation Of Appointment Of Secretarial Auditor As Per Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

21-Mar-2025 | Source : BSEAppointment of M/s P.S. Rally & Associates Company secretaries as Secretarial Auditor of the Company for the Financial Year 2024-25 to conduct Secretarial Audit of the company.

Corporate Actions

No Upcoming Board Meetings

Atam Valves Ltd has declared 7% dividend, ex-date: 23 Sep 24

No Splits history available

Atam Valves Ltd has announced 1:1 bonus issue, ex-date: 21 Oct 22

No Rights history available