Atul Auto Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-04-02 08:04:55Atul Auto, a small-cap player in the Automobile Two & Three Wheelers sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 506.00, showing a notable increase from the previous close of 441.40. Over the past year, Atul Auto has experienced a stock return of 0.70%, while the Sensex has returned 2.72% in the same period. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis and a mildly bearish outlook monthly. The Bollinger Bands also indicate a mildly bearish sentiment, consistent with the moving averages, which reflect a similar trend. The KST shows a bearish stance weekly and mildly bearish monthly, while the Dow Theory presents a mildly bullish view on a weekly basis, contrasting with its monthly assessment. Atul Auto's performance over various time frames highlights its resilience, particularly over...

Read MoreAtul Auto Experiences Valuation Grade Change Amidst Competitive Market Landscape

2025-04-02 08:01:13Atul Auto, a small-cap player in the Automobile Two & Three Wheelers sector, has recently undergone a valuation adjustment. The company's current price stands at 506.00, reflecting a notable increase from the previous close of 441.40. Over the past year, Atul Auto has shown a return of 0.70%, which is modest compared to the Sensex's 2.72% return in the same period. Key financial metrics reveal a PE ratio of 70.88 and an EV to EBITDA ratio of 29.69, indicating a premium valuation relative to its peers. The company's return on capital employed (ROCE) is reported at 5.66%, while the return on equity (ROE) is at 4.02%. In terms of performance, Atul Auto has outperformed the Sensex over the last three and five years, with returns of 200.39% and 270.42%, respectively. However, the year-to-date performance shows a decline of 12.92%, contrasting with the Sensex's slight drop of 2.71%. This evaluation revision h...

Read More

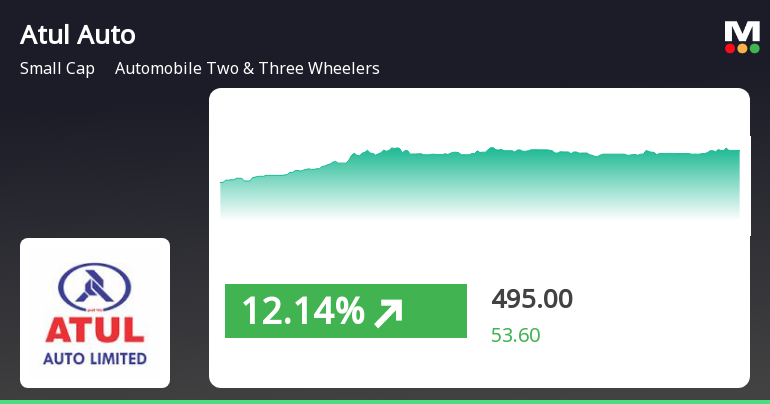

Atul Auto Shows Strong Rebound Amid Broader Market Decline, Signaling Potential Recovery

2025-04-01 11:40:24Atul Auto, a small-cap in the two and three-wheelers sector, experienced a notable rebound on April 1, 2025, after four days of decline. The stock outperformed its sector and has shown significant long-term growth, despite recent challenges. It is currently trading above several short-term moving averages.

Read More

Atul Auto Faces Significant Volatility Amidst Weak Long-Term Financial Fundamentals

2025-03-13 09:41:56Atul Auto, a small-cap player in the two and three-wheelers sector, has faced significant volatility, reaching a new 52-week low. The company has underperformed its sector and reported a decline in operating profits over five years, despite recent growth in net profit and consistent positive quarterly results.

Read More

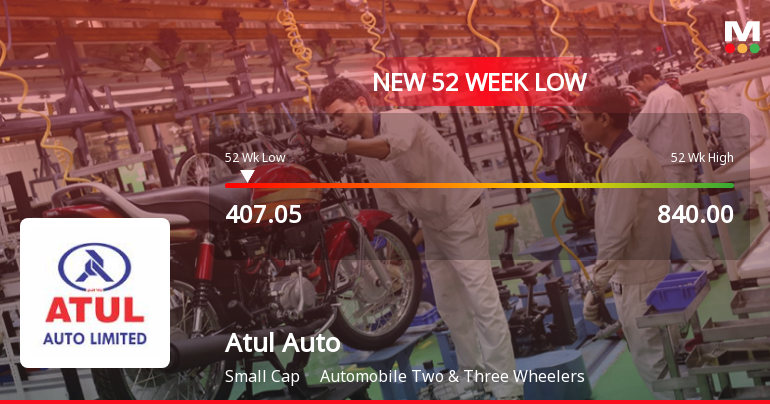

Atul Auto Faces Significant Volatility Amidst Weak Long-Term Fundamentals and Market Concerns

2025-03-13 09:41:55Atul Auto, a small-cap automobile manufacturer, has faced significant volatility, hitting a new 52-week low. The stock has underperformed its sector and declined over the past four days. Despite a notable increase in net profit for the December quarter, long-term fundamentals remain weak, raising market concerns.

Read More

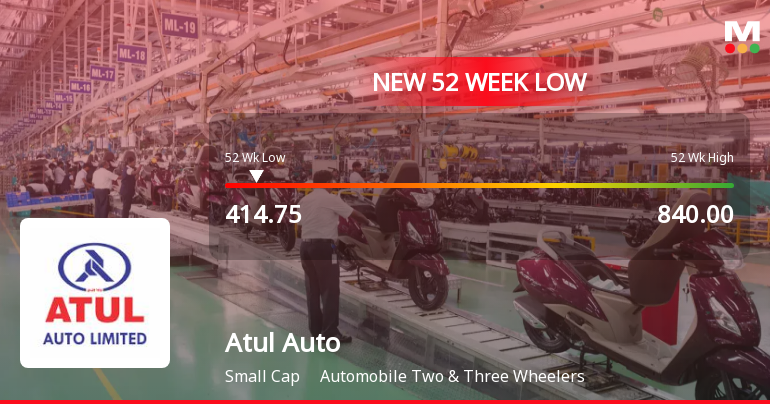

Atul Auto Faces Market Challenges Amidst Recent Stock Fluctuations and Weak Fundamentals

2025-03-04 10:01:05Atul Auto, a small-cap player in the two and three-wheelers sector, reached a new 52-week low amid a four-day loss streak. Despite recent fluctuations and a challenging year with a 17.50% decline, the company reported a significant net profit growth of 55.8% in December 2024.

Read More

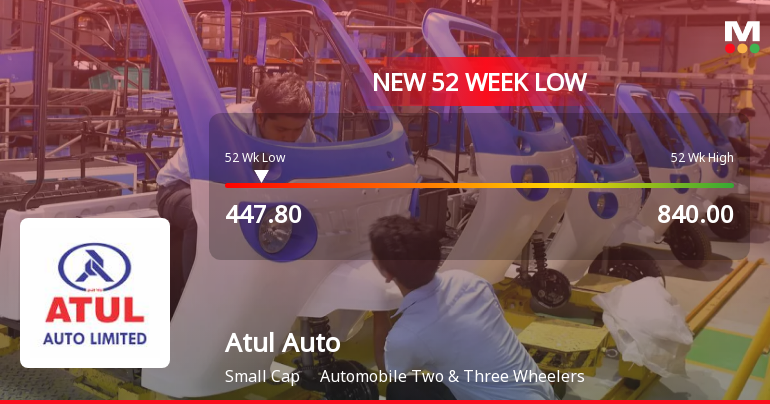

Atul Auto Faces Continued Volatility Amidst Ongoing Industry Challenges

2025-03-03 10:36:00Atul Auto, a small-cap player in the two and three-wheelers sector, has reached a new 52-week low amid ongoing volatility. The stock has underperformed its sector and recorded a significant decline over the past year, reflecting challenges within the competitive automobile industry.

Read More

Atul Auto Faces Significant Market Challenges Amidst Ongoing Stock Decline

2025-02-28 09:36:59Atul Auto, a small-cap player in the two and three-wheelers sector, has reached a new 52-week low amid significant volatility. The stock has underperformed its sector and has seen a consecutive decline over the past three days, reflecting ongoing challenges in the market.

Read More

Atul Auto Hits 52-Week Low Amid Broader Market Trends and Sector Challenges

2025-02-19 09:36:35Atul Auto, a small-cap player in the two and three-wheelers sector, reached a new 52-week low today, reflecting a year-over-year decline. Despite recent trading challenges and being below key moving averages, the stock showed signs of a potential trend reversal after four days of decline.

Read MoreAnnouncement under Regulation 30 (LODR)-Monthly Business Updates

01-Apr-2025 | Source : BSESales Performance of the month of March 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Trading Window Closure of Quarter/Year ending on March 31 2025.

Intimation Of Litigation Filed By The Company

13-Mar-2025 | Source : BSEThe Company has filed the winding up petition against one of its operational debtors namely M/s. Echo Motors and Automobiles Private Limited before the Honble National Company Law Tribunal Guwahati bench.

Corporate Actions

No Upcoming Board Meetings

Atul Auto Ltd has declared 30% dividend, ex-date: 21 Nov 19

Atul Auto Ltd has announced 5:10 stock split, ex-date: 12 Sep 14

Atul Auto Ltd has announced 1:2 bonus issue, ex-date: 03 Jul 12

Atul Auto Ltd has announced 1:4 rights issue, ex-date: 02 Sep 11