AU Small Finance Bank Shows Resilience Amid Market Volatility and Sector Outperformance

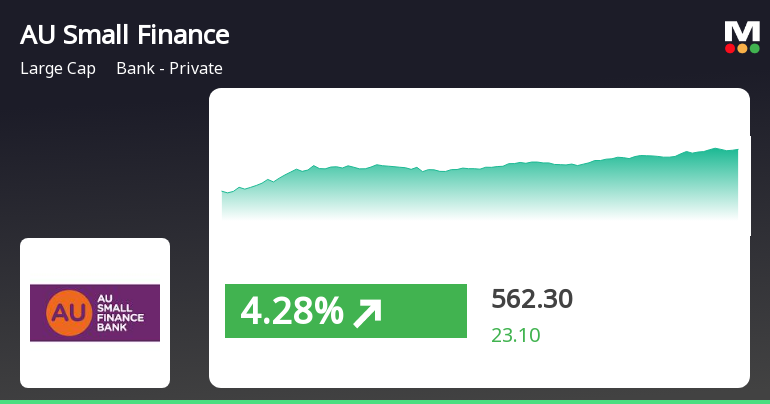

2025-04-03 10:35:27AU Small Finance Bank has demonstrated strong performance, gaining 3.69% on April 3, 2025, and outperforming its sector. The stock has risen consecutively over two days, reaching an intraday high of Rs 558.2. Its resilience is notable amid broader market volatility, with small-cap stocks leading the gains.

Read MoreAU Small Finance Bank Faces Technical Trend Shifts Amid Market Volatility

2025-04-03 08:05:54AU Small Finance Bank, a prominent player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 539.20, showing a slight increase from the previous close of 530.30. Over the past year, the stock has experienced a high of 755.00 and a low of 479.00, indicating a notable range of volatility. In terms of technical indicators, the bank's MACD signals a bearish trend on both weekly and monthly charts, while the Relative Strength Index (RSI) shows no significant signals at this time. Bollinger Bands also reflect a mildly bearish stance on both weekly and monthly evaluations. Daily moving averages indicate a bearish trend, contrasting with the KST, which shows a mildly bullish outlook on a weekly basis but remains bearish monthly. When comparing the bank's performance to the Sensex, AU Small Finance Bank has fa...

Read More

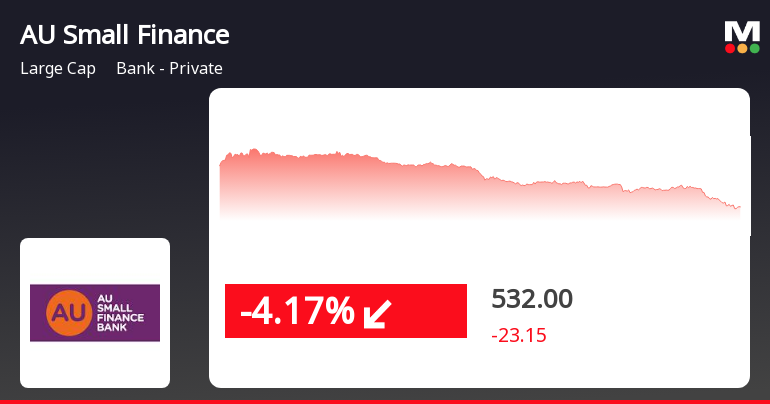

AU Small Finance Bank Faces Continued Stock Decline Amid Broader Market Challenges

2025-03-28 15:20:26AU Small Finance Bank's stock has declined for two consecutive days, resulting in a total drop of 6.6%. The bank's performance has lagged behind its sector, trading below key moving averages. Year-to-date, the stock has decreased by 4.56%, contrasting sharply with the Sensex's growth.

Read MoreAU Small Finance Bank Faces Bearish Technical Trends Amid Mixed Performance Signals

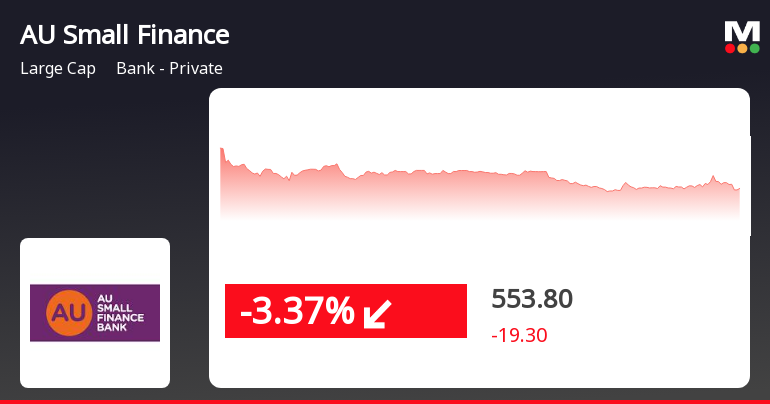

2025-03-28 08:03:44AU Small Finance Bank, a prominent player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 555.15, down from a previous close of 573.10, with a 52-week high of 755.00 and a low of 479.00. Today's trading saw a high of 573.10 and a low of 544.70. In terms of technical indicators, the bank's performance shows a bearish sentiment across several metrics. The MACD indicates bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect a bearish outlook for the monthly period. Moving averages on a daily basis further support this trend. The KST presents a mildly bullish stance weekly but shifts to bearish monthly, indicating mixed signals in the short term. When comparing the bank's returns to the Sensex, AU Small Finance Bank has shown varied performance. Over the past week, it...

Read More

AU Small Finance Bank Faces Potential Trend Reversal Amid Broader Market Resilience

2025-03-27 11:35:25AU Small Finance Bank's stock declined on March 27, 2025, following a four-day gain streak, reaching an intraday low. While it remains above some short-term moving averages, it is below longer-term ones, indicating mixed performance. In contrast, the broader market, represented by the Sensex, has shown resilience and growth.

Read MoreAU Small Finance Bank's Technical Indicators Show Mixed Signals Amid Market Evaluation Revision

2025-03-27 08:03:37AU Small Finance Bank, a prominent player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 573.10, showing a notable increase from the previous close of 556.95. Over the past week, the stock has demonstrated a return of 8.98%, significantly outperforming the Sensex, which returned 2.44% in the same period. In terms of technical indicators, the bank's MACD signals a bearish trend on both weekly and monthly scales, while the Bollinger Bands indicate a bullish stance weekly but a mildly bearish outlook monthly. The moving averages suggest a mildly bearish trend on a daily basis, with the KST showing a mildly bullish trend weekly but bearish monthly. The On-Balance Volume (OBV) reflects a mildly bullish trend weekly, indicating some positive momentum. Despite the mixed technical signals, AU Small Finance...

Read MoreSurge in Open Interest Signals Increased Trading Activity for AU Small Finance Bank

2025-03-26 15:00:42AU Small Finance Bank Ltd (AUBANK) has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 53,138 contracts, up from the previous figure of 45,375, marking a change of 7,763 contracts or a 17.11% increase. The trading volume for the day reached 84,658 contracts, indicating robust market engagement. In terms of performance, AU Small Finance Bank has outperformed its sector by 4.12%, continuing a positive trend with gains over the last four consecutive days, totaling a return of 9.64% during this period. The stock reached an intraday high of Rs 580.35, reflecting a 4.02% increase for the day. Additionally, the stock's moving averages indicate it is performing above the 5-day, 20-day, 50-day, and 100-day averages, although it remains below the 200-day moving average. Notably, delivery volume has surged to 22.09 lakh shares, a ...

Read MoreSurge in Open Interest Signals Increased Trading Activity for AU Small Finance Bank

2025-03-26 14:00:30AU Small Finance Bank Ltd (AUBANK) has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 52,379 contracts, up from the previous 45,375, marking a change of 7,004 contracts or a 15.44% increase. The trading volume for the day reached 77,210 contracts, indicating robust market engagement. In terms of performance, AU Small Finance Bank has outperformed its sector by 3.56%, continuing a positive trend with four consecutive days of gains, accumulating an impressive 8.99% return over this period. The stock reached an intraday high of Rs 580.35, reflecting a 4.02% increase for the day. Additionally, the stock's moving averages indicate it is currently above the 5-day, 20-day, 50-day, and 100-day averages, although it remains below the 200-day moving average. Notably, delivery volume has surged to 22.09 lakh shares, a 50.16% incr...

Read MoreSurge in Open Interest Signals Increased Trading Activity for AU Small Finance Bank

2025-03-26 13:00:22AU Small Finance Bank Ltd (AUBANK) has experienced a significant increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 52,112 contracts, up from the previous figure of 45,375, marking a change of 6,737 contracts or a 14.85% increase. The trading volume for the day reached 68,965 contracts, contributing to a total futures value of Rs 100,428.034 lakhs. In terms of price performance, AU Small Finance Bank has outperformed its sector by 3.71%, with the stock gaining 9.74% over the last four consecutive days. Today, it reached an intraday high of Rs 580.35, reflecting a 4.02% increase. The stock is currently trading above its 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. Additionally, the delivery volume has seen a notable rise, with 22.09 lakh shares delivered on March 25, representing a 5...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEWe herewith submit the confirmation certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025 received from the MUFG Intime India Pvt. Ltd. (Formerly Known as Link Intime India Pvt. Ltd.) Registrar and Share Transfer Agent of the Bank. This is for your information and records.

Announcement under Regulation 30 (LODR)-Credit Rating

03-Apr-2025 | Source : BSECRISIL Ratings has re-affirmed rating of CRISIL AA; Stable (Double A; Outlook: Stable) to the Long-Term Debt Instruments (Tier-II Bonds) of the Bank. Please refer attached intimation.

Intimation Under SEBI (Listing Obligations And Disclosure Requirements) Regulation 2015

03-Apr-2025 | Source : BSEPursuant to SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 and the Code of Fair Disclosure and Conduct and in terms of Regulation 8 of SEBI (Prohibition of Insider Trading) Regulations 2015 the Bank would like to place the following information on record pertaining to its performance in the quarter and financial year ended March 31 2025.

Corporate Actions

No Upcoming Board Meetings

AU Small Finance Bank Ltd has declared 10% dividend, ex-date: 12 Jul 24

No Splits history available

AU Small Finance Bank Ltd has announced 1:1 bonus issue, ex-date: 09 Jun 22

No Rights history available