Surge in Aurionpro Solutions Trading Activity Signals Increased Investor Interest

2025-03-28 10:00:09Aurionpro Solutions Ltd, a mid-cap player in the IT software industry, has experienced significant trading activity today, hitting its upper circuit limit with a high price of Rs 1652.45. The stock closed at Rs 1652.45, reflecting a notable change of Rs 275.4, or 20%. Throughout the trading session, Aurionpro Solutions saw a total traded volume of approximately 3.3 lakh shares, resulting in a turnover of around Rs 51.62 crore. The stock's performance today, however, showed it underperformed its sector by 3.89%, with an intraday low of Rs 1372.55. Despite this, the stock has maintained a position above its 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. Notably, investor participation has surged, with delivery volume increasing by 329.61% compared to the 5-day average. In summary, Aurionpro Solutions Ltd's trading activity today highlights a str...

Read More

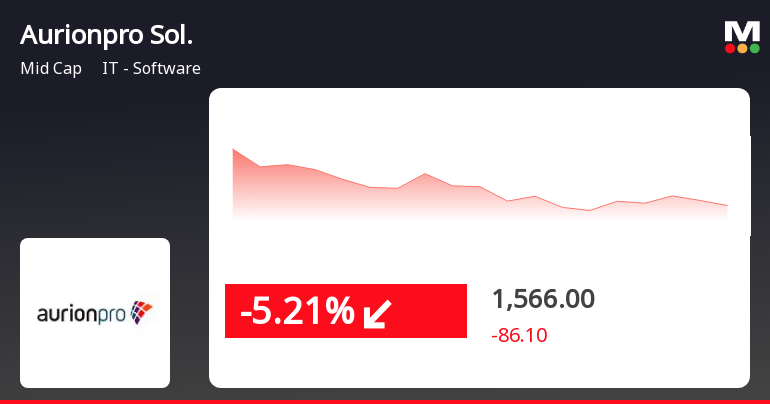

Aurionpro Solutions Faces Volatility Amidst Strong Long-Term Growth Trends

2025-03-28 09:30:16Aurionpro Solutions, a midcap IT software firm, saw a significant decline on March 28, 2025, underperforming against the broader market. Despite this drop, the stock has shown positive trends over the past week and month, with impressive long-term growth over three and five years.

Read MoreAurionpro Solutions Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-28 08:00:47Aurionpro Solutions, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 1652.10, showing a notable increase from the previous close of 1380.00. Over the past year, Aurionpro has demonstrated a strong performance with a return of 54.34%, significantly outpacing the Sensex, which recorded a return of 6.32% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals on both weekly and monthly charts. Bollinger Bands indicate bullish trends on both timeframes, suggesting some volatility in price movements. Daily moving averages are mildly bearish, and the KST reflects a bearish stance on the weekly chart, transitioning to mildly bearish on a monthly basis. Aurionpro's...

Read More

Aurionpro Solutions Shows Signs of Trend Reversal Amid Broader Market Resilience

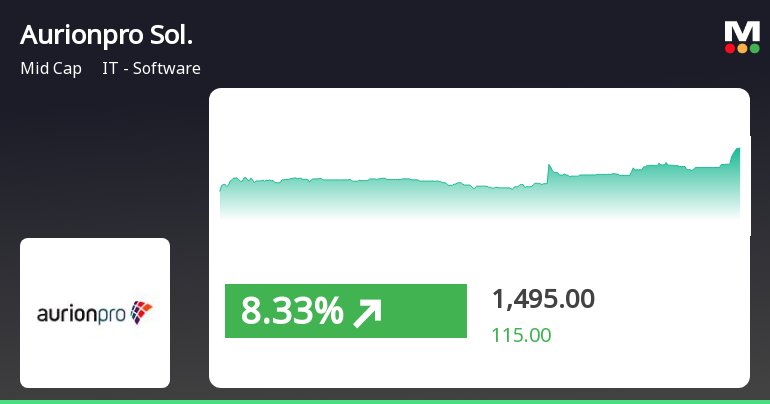

2025-03-27 14:15:19Aurionpro Solutions has shown a notable rebound after two days of decline, with its stock reaching an intraday high despite an initial drop. In the broader market, the Sensex has recovered from an early dip, reflecting overall resilience, while Aurionpro's recent performance presents a mixed outlook.

Read More

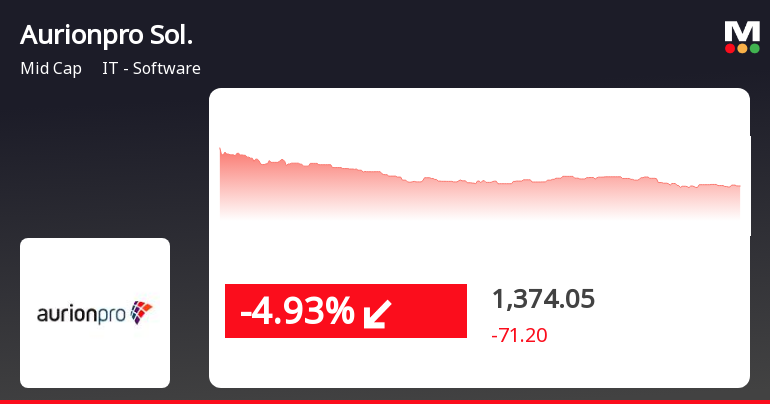

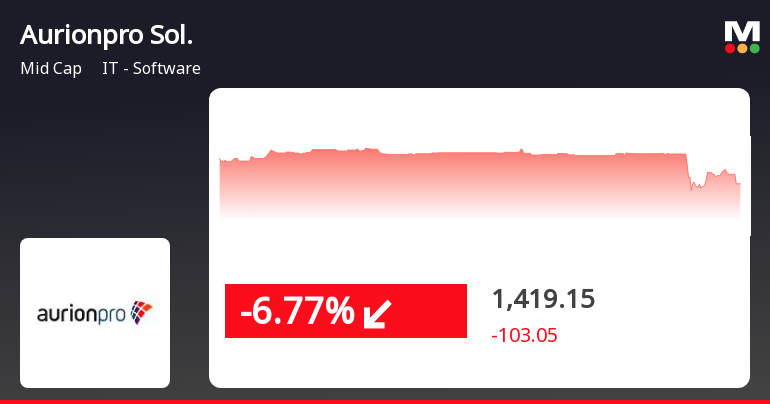

Aurionpro Solutions Faces Continued Decline Amid Broader Market Challenges

2025-03-26 14:15:19Aurionpro Solutions has seen a significant decline in its stock price, marking a consecutive drop over two days. Currently trading below key moving averages, the stock has experienced a notable loss over the past three months, despite a modest gain in the last month and a strong annual performance. Meanwhile, the broader market, represented by the Sensex, has also faced challenges but shows resilience in the short term.

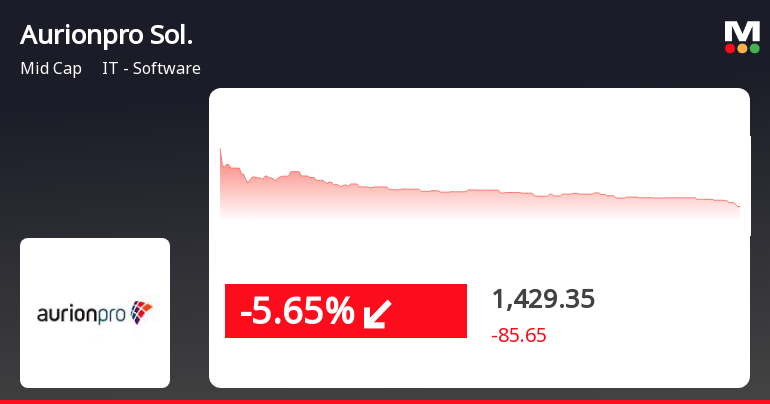

Read MoreAurionpro Solutions Faces Technical Trend Shifts Amid Mixed Market Sentiment

2025-03-26 08:01:05Aurionpro Solutions, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,445.25, down from a previous close of 1,515.00, with a notable 52-week high of 1,989.95 and a low of 980.03. Today's trading saw a high of 1,547.95 and a low of 1,429.35. The technical summary indicates a bearish sentiment in the weekly MACD and KST metrics, while the monthly indicators show a mildly bearish trend. The Bollinger Bands present a mixed picture, with weekly readings leaning mildly bearish and monthly readings indicating bullishness. The moving averages reflect a bearish stance on a daily basis, contributing to the overall technical outlook. In terms of performance, Aurionpro Solutions has shown resilience compared to the Sensex. Over the past week, the stock returned 4.50%, outperforming the Sensex's 3.61%. ...

Read More

Aurionpro Solutions Faces Mixed Trends Amid Broader Market Gains and Long-Term Growth

2025-03-25 13:15:18Aurionpro Solutions, a midcap IT software firm, saw a significant decline on March 25, 2025, despite an initial gain. The stock's performance has been mixed, with short-term gains over the past week but a notable decline over the last three months. Long-term trends remain strong, showing substantial growth over five years.

Read More

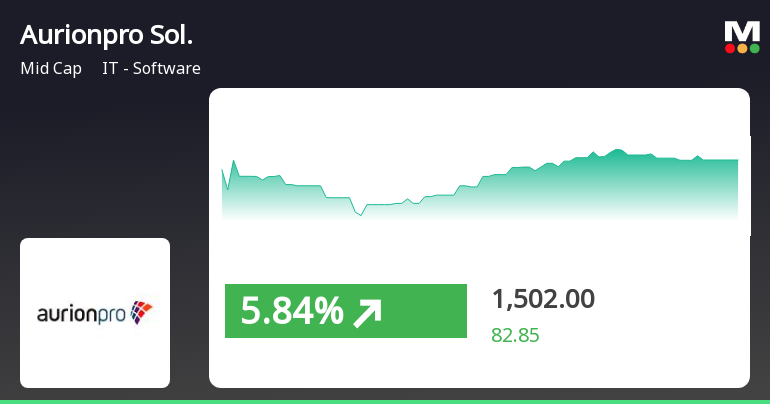

Aurionpro Solutions Shows Strong Short-Term Gains Amid Long-Term Growth Trends

2025-03-24 10:15:21Aurionpro Solutions has experienced notable stock activity, gaining 5.43% on March 24, 2025, and outperforming the Sensex. The stock is currently above its short-term moving averages, with significant gains over the past week and year, despite a recent decline in the last three months.

Read More

Aurionpro Solutions Faces Volatility Amid Mixed Performance Trends in IT Sector

2025-03-21 16:00:19Aurionpro Solutions, a midcap IT software firm, saw a notable decline on March 21, 2025, following a four-day gain streak. The stock's performance varied against its sector, with significant volatility observed. While it has outperformed the Sensex over the past week, its three-month performance shows a decline.

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEIntimation regarding closure of Trading Window

Integrated Filing (Financial)

11-Feb-2025 | Source : BSEIntegrated filing (financials) for the quarter and nine months ended December 31 2024

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

05-Feb-2025 | Source : BSEIntimation of Schedule of Analyst / Institutional Investor Meet

Corporate Actions

No Upcoming Board Meetings

Aurionpro Solutions Ltd has declared 10% dividend, ex-date: 04 Feb 25

No Splits history available

Aurionpro Solutions Ltd has announced 1:1 bonus issue, ex-date: 27 Jun 24

No Rights history available