Austin Engineering Adjusts Valuation Grade Amid Competitive Market Position and Growth Potential

2025-03-26 08:00:05Austin Engineering Company, a microcap player in the bearings industry, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company's PE ratio stands at 11.69, while its price-to-book value is noted at 0.84. Additionally, Austin Engineering's EV to EBIT and EV to EBITDA ratios are recorded at 7.77 and 5.45, respectively. The company also showcases a PEG ratio of 0.33, indicating its growth relative to earnings. In terms of performance, Austin Engineering has a return on capital employed (ROCE) of 9.04% and a return on equity (ROE) of 6.71%. When compared to its peers, Austin Engineering demonstrates a competitive edge with lower valuation metrics, particularly in the EV to EBITDA category, where it outperforms several competitors. While the stock has faced challenges in the short term, reflected in its returns over various periods, it has shown signifi...

Read More

Austin Engineering Hits 52-Week Low Amid Broader Market Decline and Sector Resilience

2025-03-03 15:10:49Austin Engineering Company has reached a new 52-week low, reflecting a significant year-over-year decline. Despite this, the company outperformed its sector. The broader market, represented by the Sensex, has also faced challenges, experiencing a notable drop while mid-cap stocks showed some resilience.

Read More

Austin Engineering Company Faces Significant Stock Volatility Amidst Ongoing Market Struggles

2025-02-17 10:05:18Austin Engineering Company has faced significant volatility, reaching a new 52-week low today. The stock is trading below all major moving averages and has declined 17.10% over the past year, contrasting with the Sensex's 4.06% gain, indicating ongoing challenges in a competitive market.

Read More

Austin Engineering Company Hits 52-Week Low Amid Ongoing Downward Trend

2025-02-14 14:35:14Austin Engineering Company has reached a new 52-week low, continuing a six-day decline that has resulted in an 11.11% decrease. Despite this, it has outperformed its sector, which declined by 2.51%. Over the past year, the company's stock has decreased by 17.89%, contrasting with the Sensex's gain.

Read More

Austin Engineering Hits 52-Week Low Amid Sustained Downward Trend in Bearings Sector

2025-02-12 12:35:12Austin Engineering Company has faced significant volatility, hitting a new 52-week low of Rs. 152 and experiencing a total decline of 10.23% over the past four days. The stock has underperformed its sector and is trading below multiple moving averages, indicating a sustained downward trend.

Read More

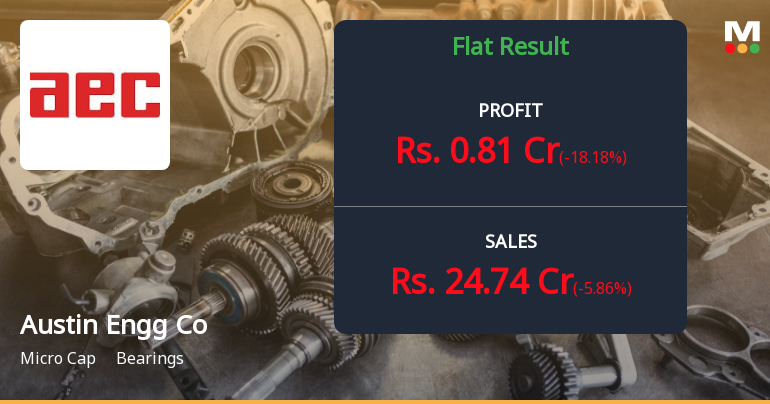

Austin Engineering Reports Flat Q3 Results for FY 2024-2025 Amid Score Adjustment

2025-02-10 18:15:53Austin Engineering Company announced its financial results for the quarter ending in 202412 on February 10, 2025, reporting flat performance for the third quarter of fiscal year 2024-2025. The company's evaluation score has notably decreased, reflecting current trends in the bearings industry as a microcap entity.

Read More

Austin Engineering Hits 52-Week Low Amid Broader Sector Struggles and Market Challenges

2025-01-27 10:05:13Austin Engineering Company, a microcap in the bearings industry, reached a new 52-week low today, reflecting ongoing challenges. Despite a recent modest gain and outperforming its sector, the stock remains below key moving averages and has declined over the past year, contrasting with broader market trends.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEAttached confirmation certificate of Reg.74(5) of SEBI DP Reg.2018 for the quarter ended 31st March2025 from R&T MUFG intime india Pvt.Ltd.

Closure of Trading Window

22-Mar-2025 | Source : BSETrading window closed with effect from 1st April2025 till 48 hours after the declaration of Audited/unaudited financial results for the quarter/year ended 31st March2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

11-Feb-2025 | Source : BSENew papers clipping of the Unaudited Financial Results of the company for the quarter/nine months ended 31st December2024

Corporate Actions

No Upcoming Board Meetings

Austin Engineering Company Ltd has declared 5% dividend, ex-date: 18 Sep 19

No Splits history available

No Bonus history available

No Rights history available