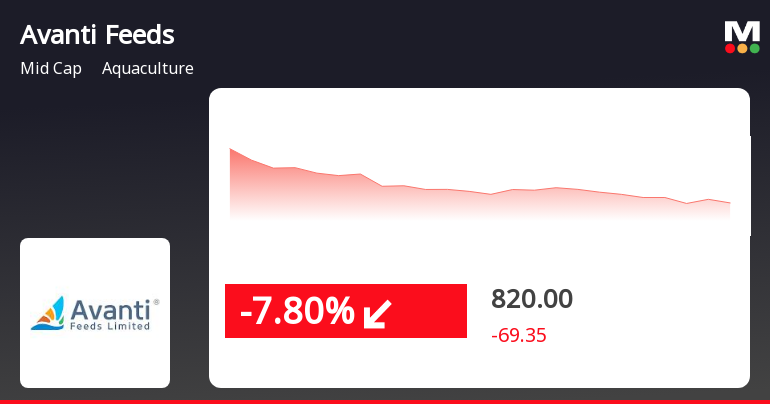

Avanti Feeds Faces Intraday Volatility Amid Strong Long-Term Growth Trends

2025-04-03 09:30:27Avanti Feeds, a midcap aquaculture company, faced significant volatility in trading, with a notable decline on April 3, 2025. Despite this short-term downturn, the company has demonstrated strong long-term growth, outperforming the Sensex over the past year and showing resilience in recent months.

Read MoreAvanti Feeds Adjusts Valuation Grade Amid Strong Financial Performance Indicators

2025-04-02 08:01:09Avanti Feeds, a midcap player in the aquaculture industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings ratio stands at 24.74, while its price-to-book value is noted at 4.73. Other key metrics include an EV to EBITDA ratio of 17.03 and a PEG ratio of 0.66, indicating a favorable growth outlook relative to its earnings. The company has demonstrated strong performance indicators, with a return on capital employed (ROCE) of 78.56% and a return on equity (ROE) of 16.63%. Additionally, Avanti Feeds offers a dividend yield of 0.77%, contributing to its overall financial attractiveness. In terms of market performance, Avanti Feeds has shown resilience, with a year-to-date return of 28.03%, significantly outperforming the Sensex, which has recorded a decline of 2.71% in the same period. Over the past year, the stock has surged by 74.08%,...

Read More

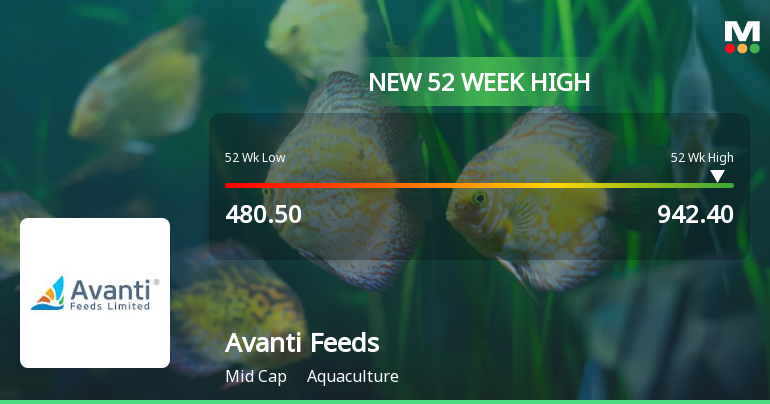

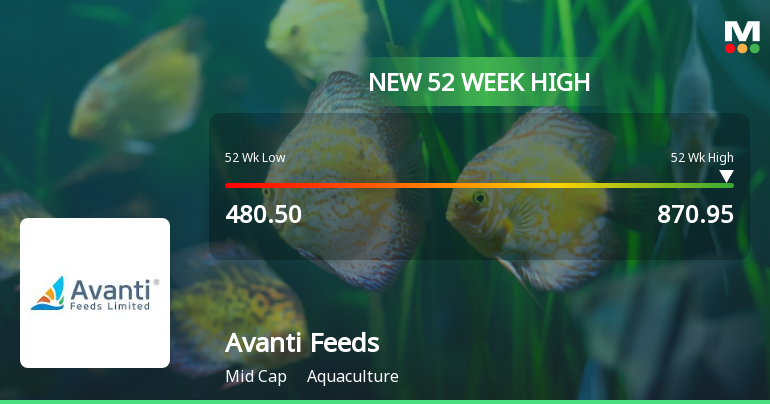

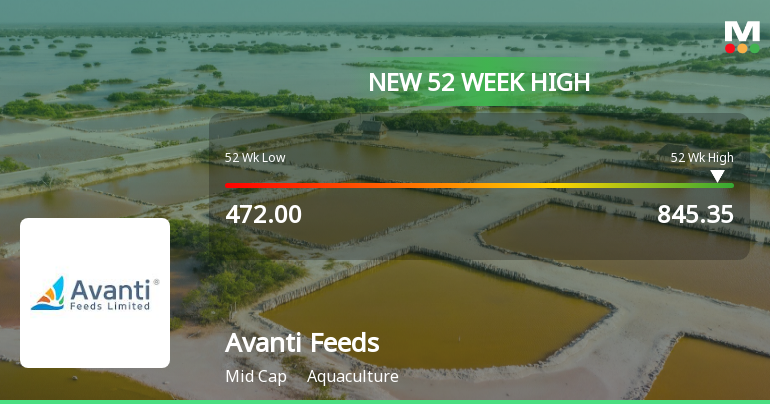

Avanti Feeds Achieves 52-Week High Amid Strong Financial Performance and Market Optimism

2025-03-24 09:39:00Avanti Feeds has reached a new 52-week high of Rs. 965, reflecting its strong performance in the aquaculture sector. The company boasts impressive financial metrics, including a 16.33% return on equity and a low debt-to-equity ratio, alongside consistent profit growth over the past three quarters.

Read More

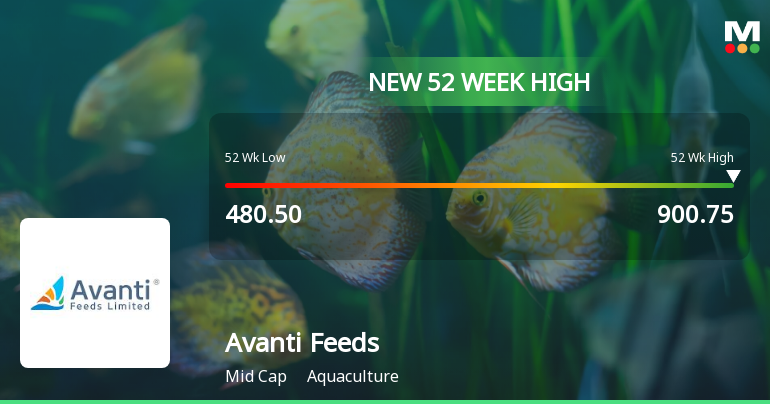

Avanti Feeds Approaches 52-Week High Amid Strong Financial Performance and Market Position

2025-03-20 13:05:48Avanti Feeds is nearing its 52-week high, reflecting a notable increase in stock performance. The company boasts strong financial metrics, including a high return on equity and capital employed, alongside a low debt-to-equity ratio. Its one-year performance significantly outpaces the broader market, highlighting its robust position in the aquaculture sector.

Read More

Avanti Feeds Achieves 52-Week High Amid Strong Financial Performance and Market Outperformance

2025-03-18 09:46:05Avanti Feeds has reached a new 52-week high, reflecting strong performance in the aquaculture sector. The company boasts a high return on equity and low debt-to-equity ratio, alongside impressive profit growth. With significant institutional holdings, it continues to demonstrate both growth and stability in the market.

Read More

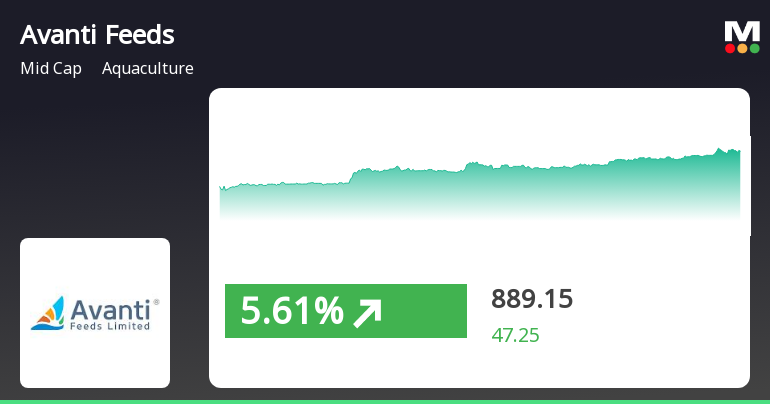

Avanti Feeds Achieves New High Amid Strong Midcap Market Momentum

2025-03-17 15:05:19Avanti Feeds has achieved a new 52-week high, reflecting strong momentum in its stock performance. The company has consistently gained over the past three days and is trading above multiple moving averages, indicating a robust upward trend. Its performance significantly surpasses that of the broader market and its sector.

Read More

Avanti Feeds Achieves 52-Week High Amid Strong Financial Performance and Market Leadership

2025-03-17 11:07:09Avanti Feeds has reached a new 52-week high, showcasing strong financial health with a high return on equity and low debt-to-equity ratio. The company has consistently reported positive results, achieving significant profit growth and outperforming the broader market, solidifying its leadership in the aquaculture sector.

Read More

Avanti Feeds Reaches New Stock Milestone Amid Strong Financial Performance and Market Position

2025-03-13 11:05:55Avanti Feeds has reached a new 52-week high, reflecting strong performance in the aquaculture industry. The company showcases impressive financial metrics, including a high return on equity and low debt-to-equity ratio. With significant institutional holdings and consistent positive results, it remains a notable player in the market.

Read MoreAvanti Feeds Adjusts Valuation Grade Amid Strong Performance Metrics and Market Position

2025-03-11 08:00:15Avanti Feeds, a midcap player in the aquaculture industry, has recently undergone a valuation adjustment, reflecting a shift in its financial assessment. The company currently exhibits a price-to-earnings (P/E) ratio of 23.27 and a price-to-book value of 4.45, indicating its market valuation relative to its earnings and assets. Additionally, its enterprise value to EBITDA stands at 15.82, while the enterprise value to sales ratio is 1.68. The company has demonstrated strong performance metrics, including a return on capital employed (ROCE) of 78.56% and a return on equity (ROE) of 16.63%. Avanti Feeds also offers a dividend yield of 0.82%, which may appeal to income-focused investors. In terms of stock performance, Avanti Feeds has outperformed the Sensex over various periods, with a notable 1-year return of 47.68% compared to a flat return for the index. Over a 5-year horizon, the company has achieved a ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulation 2018

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation of Trading Window Closure

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

10-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Thai Union Asia Investment Holdings Ltd

Corporate Actions

No Upcoming Board Meetings

Avanti Feeds Ltd. has declared 675% dividend, ex-date: 30 Jul 24

Avanti Feeds Ltd. has announced 1:2 stock split, ex-date: 26 Jun 18

Avanti Feeds Ltd. has announced 1:2 bonus issue, ex-date: 26 Jun 18

No Rights history available