AWFIS Space Solutions Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-04-01 08:03:46AWFIS Space Solutions, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 662.90, showing a notable increase from the previous close of 627.30. Over the past week, AWFIS has demonstrated a return of 6.75%, significantly outperforming the Sensex, which recorded a return of 0.66% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the daily moving averages indicate a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish sentiment on a weekly basis. The On-Balance Volume (OBV) shows a mildly bullish trend weekly, contrasting with its monthly performance, which is mildly bearish. AWFIS's performance over the past month has yielded a return of 1.66%, while the Sensex returned 5.76%. Year-to-date, AWFIS has faced challenges with a r...

Read MoreAWFIS Space Solutions Faces Technical Challenges Amid Market Volatility and Bearish Indicators

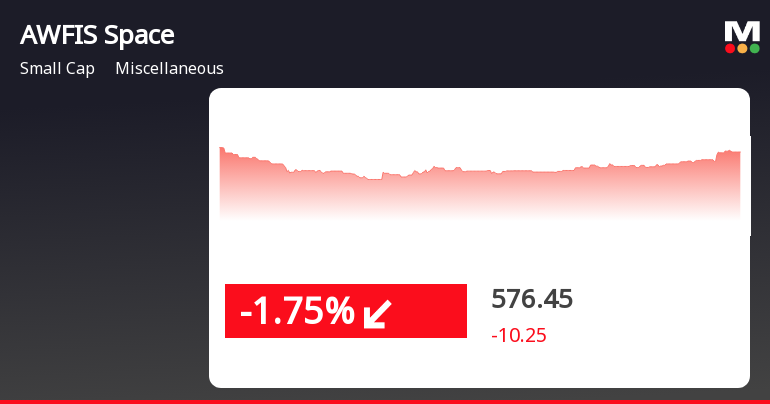

2025-03-19 08:05:18AWFIS Space Solutions, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 578.85, showing a notable change from its previous close of 565.25. Over the past year, the stock has experienced significant volatility, with a 52-week high of 945.70 and a low of 371.75. In terms of technical indicators, the weekly MACD is positioned in a bearish trend, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish stance on a weekly basis, and the Dow Theory shows no clear trend in the weekly analysis. The On-Balance Volume (OBV) also suggests a mildly bearish outlook on a monthly basis. When comparing AWFIS's performance to the Sensex, the stock has faced challenges, with a return of -6.33% over the past week and -19.99% year-to-date, contrasting w...

Read More

AWFIS Space Solutions Faces Continued Volatility Amid Broader Market Declines

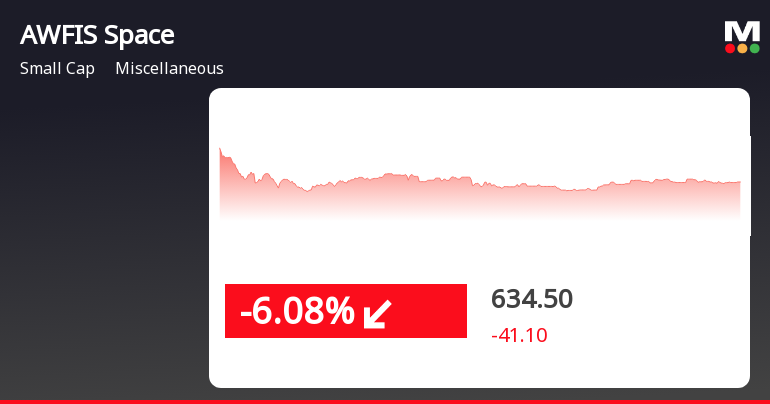

2025-03-12 13:05:26AWFIS Space Solutions has faced notable volatility, with a significant decline over the past two days. After an initial gain, the stock reversed sharply, reflecting an intraday fluctuation. It has underperformed its sector and is trading below key moving averages, indicating a challenging market position.

Read MoreAWFIS Space Solutions Faces Technical Trend Adjustments Amid Market Volatility

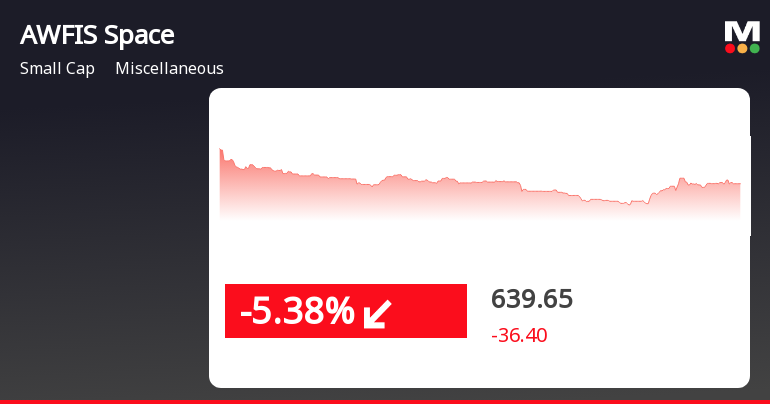

2025-03-11 08:05:48AWFIS Space Solutions, a small-cap player in the miscellaneous industry, has recently undergone a technical trend adjustment. The company's current stock price stands at 637.00, slightly above the previous close of 630.70. Over the past year, the stock has experienced a 52-week high of 945.70 and a low of 371.75, indicating significant volatility. In terms of technical indicators, the MACD is currently bearish on a weekly basis, while the Bollinger Bands reflect a mildly bearish sentiment. The Dow Theory also suggests a mildly bearish trend on a weekly basis, with no discernible trend on a monthly scale. The Relative Strength Index (RSI) shows no signal for both weekly and monthly evaluations, and the On-Balance Volume (OBV) indicates no trend for the same periods. When comparing the company's performance to the Sensex, AWFIS has faced challenges. Over the past week, the stock returned -1.11%, while the S...

Read MoreAWFIS Space Solutions Faces Mixed Technical Trends Amid Market Volatility

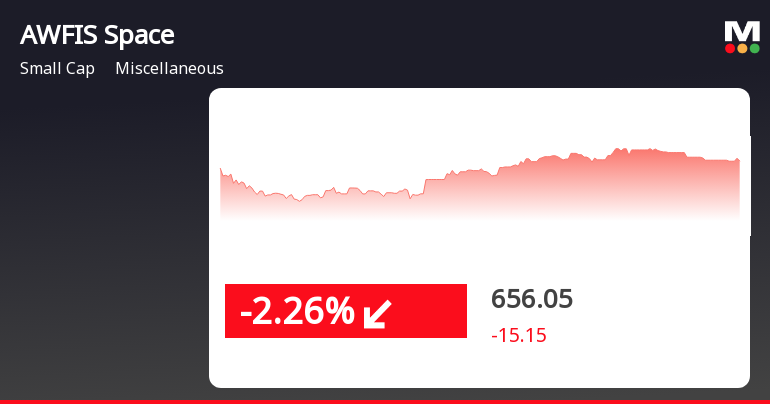

2025-03-05 08:03:53AWFIS Space Solutions, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 654.70, showing a slight increase from the previous close of 644.15. Over the past year, the stock has experienced a 52-week high of 945.70 and a low of 371.75, indicating significant volatility. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a mildly bearish sentiment, while the Dow Theory and On-Balance Volume (OBV) indicate a mildly bullish outlook on a weekly basis. The Relative Strength Index (RSI) shows no signal, suggesting a neutral position in the market. When comparing the stock's performance to the Sensex, AWFIS has faced challenges, with a year-to-date return of -9.51%, which is notably worse than the Sensex's decline of -6.59%. However, over a three-year horizon, the Sensex...

Read More

AWFIS Space Solutions Faces Significant Stock Decline Amid Market Volatility in February 2025

2025-02-14 13:46:02AWFIS Space Solutions has faced notable challenges, with its stock declining significantly on February 14, 2025. The company has experienced high volatility and is trading below key moving averages, reflecting a consistent downward trend. Its performance over the past month has also lagged behind broader market indices.

Read More

AWFIS Space Solutions Reports Mixed Financial Results Amid Rising Interest Expenses and Non-Operating Income Concerns

2025-02-12 11:53:10AWFIS Space Solutions has announced its financial results for the quarter ending December 2024, reporting a notable Profit After Tax of Rs 28.94 crore and record net sales of Rs 317.72 crore. However, rising interest expenses and a heavy reliance on non-operating income raise concerns about the sustainability of its financial model.

Read More

AWFIS Space Solutions Faces Sustained Stock Decline Amid Broader Market Challenges

2025-02-12 09:45:56AWFIS Space Solutions has faced notable challenges, with its stock price declining significantly over recent days. The company has underperformed compared to its sector and broader market indices, trading below key moving averages. This trend raises concerns about its performance amid a difficult market environment.

Read More

AWFIS Space Solutions Faces Significant Decline Amid Broader Market Challenges

2025-01-27 13:35:27AWFIS Space Solutions has faced notable challenges, experiencing a significant decline of 7.15% on January 27, 2025. The stock has underperformed compared to its sector and the broader market, with a total drop of 9.3% over two days and a 13.97% decrease over the past month.

Read MoreClosure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window for Financial Results for Quarter and Financial Year ending on March 31 2025

Announcement under Regulation 30 (LODR)-Memorandum of Understanding /Agreements

24-Mar-2025 | Source : BSERevision of Credit Facilty availed with Kotak Mahindra Bank Limited.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

13-Mar-2025 | Source : BSEIntimation of Virtual Meet with group of Investors on 20th March 2025 at 04:00 P.M.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available