Axtel Industries Adjusts Evaluation Score Amid Mixed Market Signals and Valuation Concerns

2025-04-02 08:04:43Axtel Industries, a microcap engineering firm, has recently seen a change in its evaluation score due to various technical and valuation factors. The stock exhibits mixed momentum signals, while its valuation metrics indicate it is trading at a premium compared to peers, raising concerns about long-term growth potential.

Read MoreAxtel Industries Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-02 08:00:48Axtel Industries, a microcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 484.85, showing a notable increase from the previous close of 465.00. Over the past week, Axtel has demonstrated a strong performance with a return of 4.27%, contrasting sharply with the Sensex's decline of 2.55%. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) shows no signal on a weekly basis but indicates bullish momentum monthly. Bollinger Bands reflect a bullish trend weekly, although the monthly view is mildly bearish. Moving averages present a mildly bearish stance on a daily basis, while the KST shows a mildly bullish trend weekly and a mildly bearish trend monthly. Axtel's per...

Read MoreAxtel Industries Adjusts Valuation Grade Amid Competitive Engineering Sector Landscape

2025-04-02 08:00:19Axtel Industries, a microcap player in the engineering sector, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company's price-to-earnings ratio stands at 42.16, while its price-to-book value is noted at 6.38. Additionally, Axtel's enterprise value to EBITDA ratio is 27.06, and its enterprise value to EBIT is 31.41, indicating a robust valuation framework. The company also showcases a solid return on capital employed (ROCE) of 44.20% and a return on equity (ROE) of 15.14%, which are significant indicators of its operational efficiency. Axtel's dividend yield is recorded at 1.03%, providing a modest return to shareholders. In comparison to its peers, Axtel Industries presents a higher valuation profile, particularly when looking at its price-to-earnings and enterprise value metrics. Competitors like Gensol Engineering and A B Infrabuild exhibit varyin...

Read MoreAxtel Industries Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-10 08:00:13Axtel Industries, a microcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 463.00, showing a notable increase from the previous close of 440.00. Over the past year, Axtel has experienced a decline of 21.06%, contrasting with a slight gain of 0.29% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) presents no signal on a weekly basis but indicates bullish momentum monthly. Bollinger Bands and moving averages reflect a mildly bearish sentiment, suggesting caution in the short term. Despite recent challenges, Axtel Industries has demonstrated resilience over longer periods, with ...

Read More

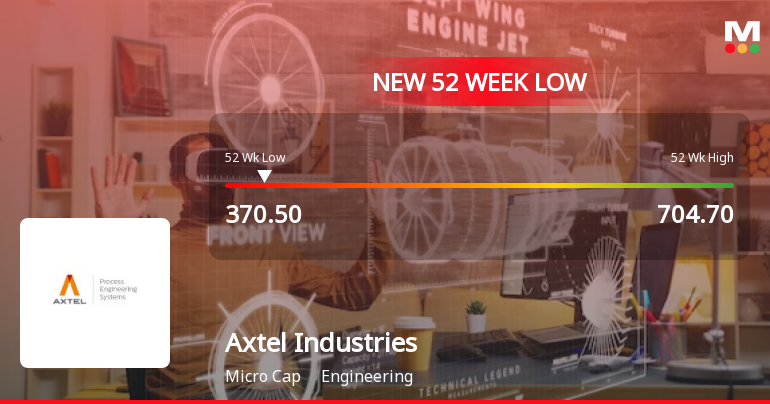

Axtel Industries Faces Significant Volatility Amidst Ongoing Market Challenges

2025-01-31 09:35:14Axtel Industries has faced significant volatility, hitting a new 52-week low of Rs. 370.5 and underperforming its sector. The stock has declined 44.86% over the past year, contrasting with the Sensex's gains. It is currently trading below multiple moving averages, indicating a persistent downward trend.

Read More

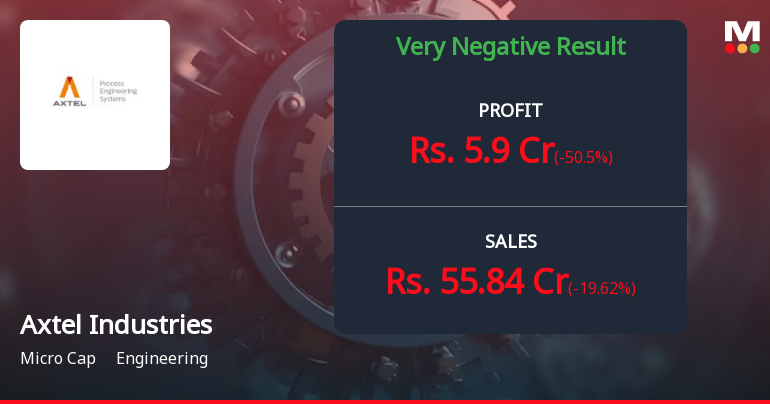

Axtel Industries Reports Q3 FY24-25 Results Amid Significant Evaluation Shift

2025-01-30 19:00:47Axtel Industries has released its financial results for Q3 FY24-25, revealing a significant adjustment in its performance evaluation. The company's score has declined, indicating challenges faced during the quarter. Stakeholders are encouraged to monitor the factors influencing this shift as the engineering industry continues to evolve.

Read More

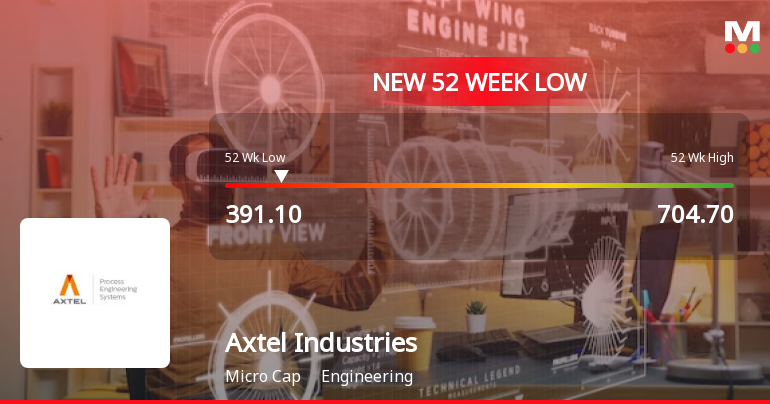

Axtel Industries Faces Significant Volatility Amidst Ongoing Market Challenges

2025-01-28 10:05:14Axtel Industries has faced significant volatility, reaching a new 52-week low of Rs. 420.2 after a four-day decline totaling 11.46%. The stock has underperformed its sector and is trading below all major moving averages, reflecting ongoing challenges in a competitive market environment.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEWe hereby submit Intimation for trading window Closure with effect from 1st April 2025 for all designated persons pursuant to SEBI (PIT) Regulations 2015.

Board Meeting Outcome for Declaration Of Interim Dividend

15-Mar-2025 | Source : BSEWe hereby intimate that the Board of Directors of the Company have declared dividend @ Rs. 5.00 per share i.e. 50% per equity share of Rs. 10 each for the financial year 2024-25 and fixed 20th March 2025 as Record Date for the purpose of determining entitlement of the shareholders for interim dividend.

Announcement under Regulation 30 (LODR)-Dividend Updates

15-Mar-2025 | Source : BSEWe hereby intimate that the Board of Directors of the Company have declared Interim Dividend @Rs. 5.00 per share i.e 50% per equity share of Rs. 10 each for the financial year 2024-25 and fixed 20th March 2025 as Record Date for determining entitlement of the shareholders for Interim Dividend.

Corporate Actions

No Upcoming Board Meetings

Axtel Industries Ltd has declared 50% dividend, ex-date: 20 Mar 25

No Splits history available

No Bonus history available

No Rights history available