Azad Engineering Faces Technical Trend Challenges Amidst Market Evaluation Revision

2025-04-02 08:10:39Azad Engineering, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,388.00, showing a slight increase from the previous close of 1,362.05. Over the past year, Azad Engineering has experienced a stock return of 2.83%, which is marginally better than the Sensex's return of 2.72% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the moving averages indicate a bearish trend on a daily basis. The Bollinger Bands suggest a mildly bearish sentiment, while the KST and Dow Theory show no definitive trends. The Relative Strength Index (RSI) does not signal any significant movement in either the weekly or monthly assessments. When comparing the company's performance to the Sensex, Azad Engineering has shown a notable return of 9.83% over the past month, s...

Read MoreAzad Engineering Faces Technical Trend Adjustments Amid Mixed Market Signals

2025-03-26 08:05:14Azad Engineering, a midcap player in the auto ancillary sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 1,410.50, a decline from the previous close of 1,466.05. Over the past year, Azad Engineering has experienced a stock return of 5.97%, which is notably lower than the Sensex's return of 7.12% during the same period. In terms of technical indicators, the MACD and Bollinger Bands reflect a bearish sentiment on a weekly basis, while the daily moving averages also indicate a bearish trend. The On-Balance Volume (OBV) shows a mildly bearish stance on a weekly basis, suggesting a cautious outlook among traders. The Dow Theory presents a mildly bullish signal on a weekly basis, but overall, the technical summary indicates a challenging environment for the stock. Despite the recent adjustments, Azad Engineering has shown resilience in the short term, with...

Read MoreAzad Engineering Experiences Technical Trend Shift Amidst Market Performance Metrics

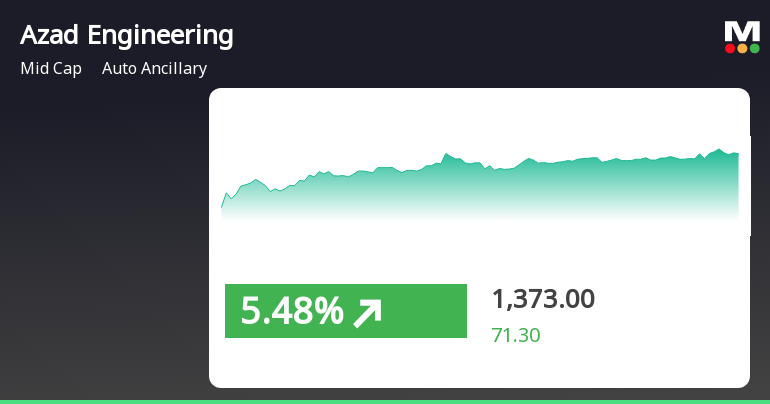

2025-03-24 08:03:08Azad Engineering, a midcap player in the auto ancillary sector, has recently undergone a technical trend adjustment, reflecting shifts in its market performance metrics. The stock is currently priced at 1,436.45, showing a notable increase from the previous close of 1,389.35. Over the past week, the stock has demonstrated a return of 12.57%, significantly outperforming the Sensex, which returned 4.17% in the same period. In terms of technical indicators, the Moving Averages and On-Balance Volume (OBV) suggest a mildly bearish sentiment on a daily and weekly basis. The MACD remains bearish on a weekly timeframe, while the Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. The Bollinger Bands also indicate a mildly bearish trend, reflecting the stock's current market dynamics. Despite a year-to-date return of -16.59%, Azad Engineering has shown resilience wit...

Read MoreAzad Engineering Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-21 08:03:28Azad Engineering, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1389.35, showing a slight increase from the previous close of 1380.20. Over the past year, Azad Engineering has demonstrated a return of 14.96%, significantly outperforming the Sensex, which recorded a return of 5.89% in the same period. In terms of technical indicators, the weekly MACD is positioned in a bearish trend, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish outlook on a weekly basis, and the On-Balance Volume (OBV) shows a mildly bearish trend as well. Notably, the Relative Strength Index (RSI) does not signal any significant movement on both weekly and monthly charts. The company's performance over various time frames reveals a strong short-term return...

Read MoreAzad Engineering Shows Mixed Technical Trends Amid Market Evaluation Revision

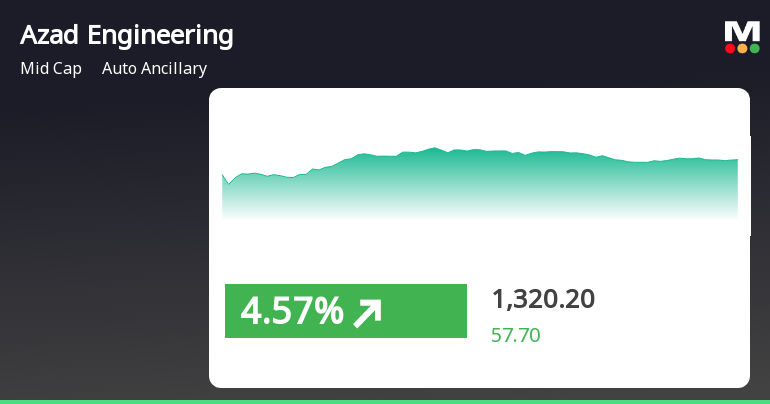

2025-03-20 08:04:22Azad Engineering, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1380.20, showing a notable increase from the previous close of 1301.70. Over the past week, the stock has reached a high of 1397.05 and a low of 1310.00, indicating some volatility. In terms of technical indicators, the weekly MACD remains bearish, while the RSI shows bullish momentum. The Bollinger Bands indicate a mildly bearish trend, and the daily moving averages also reflect bearish sentiment. The KST and Dow Theory present a mixed picture, with the latter showing a mildly bullish stance on a weekly basis. The On-Balance Volume (OBV) suggests a mildly bearish trend for both weekly and monthly evaluations. When comparing Azad Engineering's performance to the Sensex, the company has demonstrated a strong return over the pa...

Read More

Azad Engineering Shows Strong Short-Term Recovery Amid Mixed Long-Term Performance

2025-03-19 10:35:31Azad Engineering, a midcap auto ancillary firm, has experienced a notable short-term recovery, outperforming its sector and the Sensex in recent trading. While it has shown gains over the past week, longer-term performance remains challenged, with significant declines observed over three months and year-to-date.

Read MoreAzad Engineering Faces Technical Trend Shifts Amid Market Evaluation Revision

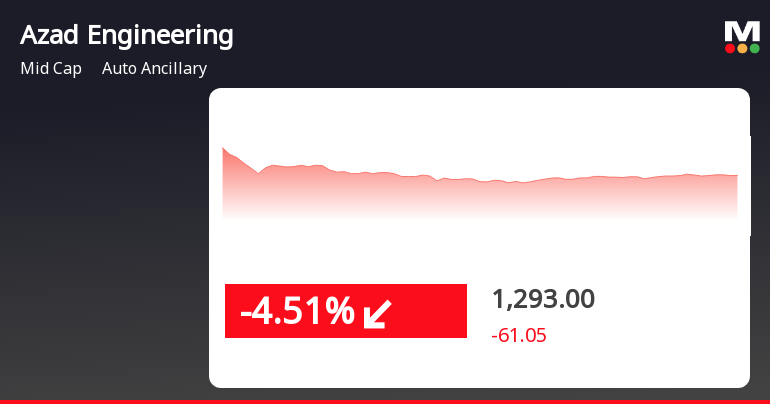

2025-03-17 08:01:40Azad Engineering, a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1276.05, slightly down from the previous close of 1285.10. Over the past year, Azad Engineering has shown a return of 4.74%, outperforming the Sensex, which recorded a return of 1.47% in the same period. However, the stock has faced challenges in the short term, with a year-to-date return of -25.9%, compared to the Sensex's -5.52%. The technical summary indicates a bearish sentiment in various indicators, including the MACD and moving averages, while the RSI shows a bullish signal on a weekly basis. The Bollinger Bands and KST also reflect bearish trends, suggesting a cautious outlook. In terms of price movement, Azad Engineering has experienced fluctuations, with a 52-week high of 2,080.00 and a low of 1,157.65. Today's tra...

Read More

Azad Engineering Faces Significant Stock Volatility Amid Broader Market Underperformance

2025-03-06 10:05:25Azad Engineering's stock has faced notable volatility, declining after a brief period of gains. The stock has underperformed relative to its sector and broader market, with significant declines over the past month and year-to-date. Current moving averages indicate a challenging market position for the company.

Read More

Azad Engineering's Recent Gains Suggest Potential Shift in Market Momentum

2025-03-05 09:46:02Azad Engineering, a midcap auto ancillary firm, experienced significant gains on March 5, 2025, outperforming its sector. The stock reached an intraday high and has shown consecutive gains over two days. Despite recent negative performance, these developments suggest a potential shift in momentum for the company.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation of closure of Trading Window.

PRESS RELEASE DATED 12TH MARCH 2025

12-Mar-2025 | Source : BSEWith reference to the captioned subject we are enclosing herewith the Press Release titled Azad Engineering Inaugurates First Exclusive lean manufacturing facility for Mitsubishi Heavy Industries and Wins Prestigious Global 2024 Partner of the Year Award

Exclusive Lean Manufacturing Facility Inaugurated By Senior Vice President GTCC Business Division Of Mitsubishi Heavy Industries Limited Japan (MHI).

12-Mar-2025 | Source : BSEAzad Engineering has inaugurated its First Exclusive Lean Manufacturing Facility at its new plant in Tunikibollaram IP Hyderabad for Mitsubishi Heavy Industries. The facility was inaugurated by Mr. Masahito Kataoka Senior Vice President GTCC Business Division MHI Japan in the presence of Mitsubishis senior leadership team from Japan and the USA. This facility will serve and support the supply of highly engineered and complex rotating and stationary Airfoils for advanced gas and thermal power turbine engines meeting MHIs global demand in the power generation industry. On this momentous occasion Azad Engineering has been honored with the prestigious global 2-24 Partner of the Year Award from Mitsubishi Heavy Industries - an exclusive recognition among MHIs global network of over 1000 suppliers. This award underscores our over a decade-long partnership with MHI which began in 2012 with just a few machines and since evolved into a world-class manufacturing center.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available