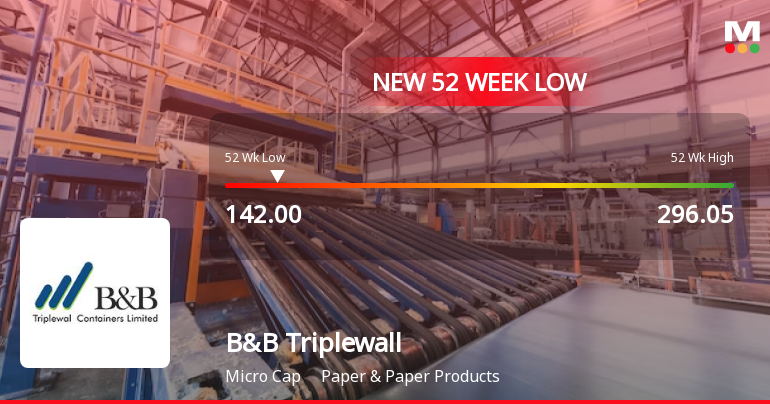

B&B Triplewall Containers Faces Financial Struggles Amid Market Volatility and Declining Profits

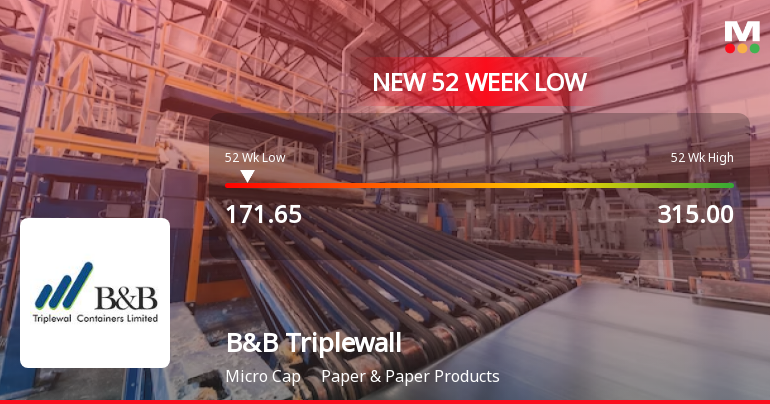

2025-03-13 13:45:19B&B Triplewall Containers, a microcap in the Paper & Paper Products sector, has faced significant volatility, hitting a 52-week low and underperforming the market over the past year. The company shows concerning financial health, with declining operating profits and high debt levels, despite appearing undervalued compared to peers.

Read More

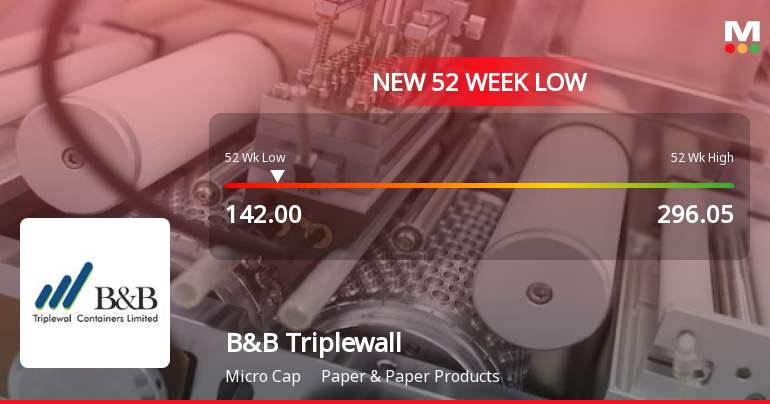

B&B Triplewall Containers Faces Financial Struggles Amidst Declining Stock Performance

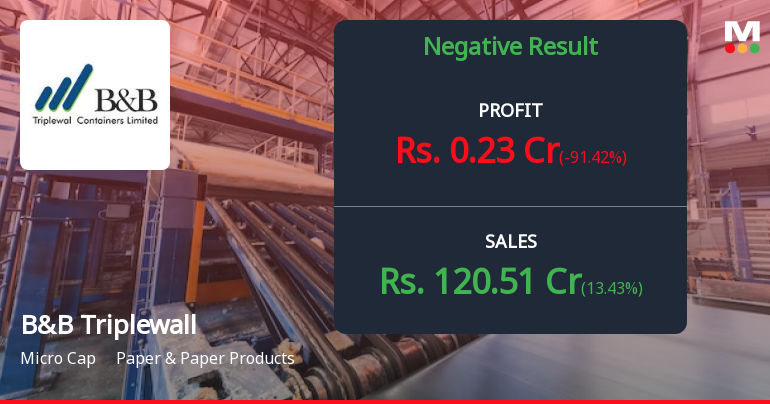

2025-03-07 09:40:23B&B Triplewall Containers, a microcap in the Paper & Paper Products sector, has faced significant volatility, reaching a new 52-week low. The company has reported negative results for three consecutive quarters, with declining operating profits and a high debt-to-EBITDA ratio, raising concerns about its financial health and long-term viability.

Read More

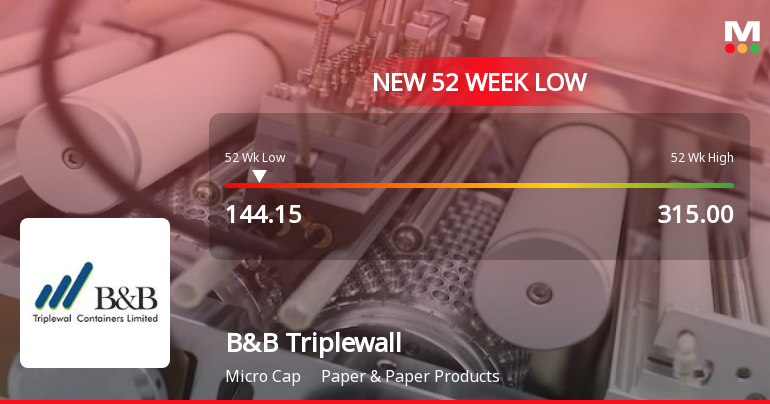

B&B Triplewall Containers Faces Financial Struggles Amid Market Volatility and Declining Performance

2025-03-06 09:42:00B&B Triplewall Containers, a microcap in the Paper & Paper Products industry, hit a new 52-week low today amid significant volatility. The company has reported negative results for three consecutive quarters, with concerning financial metrics and a bearish technical trend, raising questions about its long-term viability.

Read More

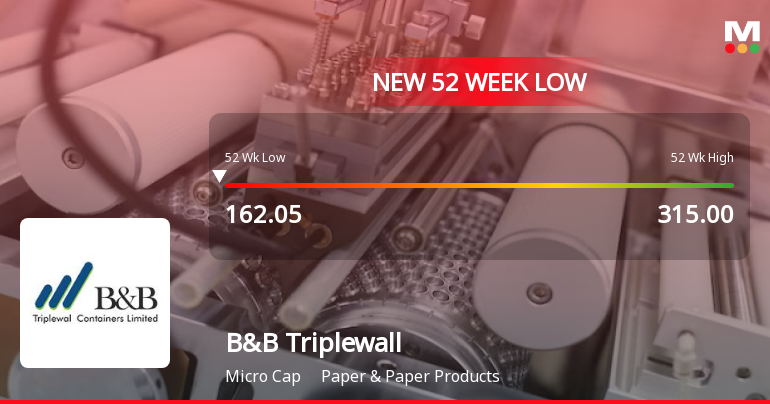

B&B Triplewall Containers Faces Market Challenges Amid Significant Volatility and Weak Fundamentals

2025-03-06 09:41:49B&B Triplewall Containers has faced significant volatility, reaching a new 52-week low and experiencing a brief recovery during trading. The company has reported declining profitability, negative results for three consecutive quarters, and a high debt-to-EBITDA ratio, indicating ongoing operational challenges in a difficult market environment.

Read MoreB&B Triplewall Containers Faces Valuation Grade Change Amid Financial Challenges

2025-03-06 08:01:24B&B Triplewall Containers, a microcap player in the Paper & Paper Products industry, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of -321.51, indicating significant challenges in profitability. Its Price to Book Value stands at 2.67, while the EV to EBIT ratio is reported at 41.14, suggesting a high valuation relative to earnings before interest and taxes. The EV to EBITDA ratio is 15.88, and the EV to Sales ratio is 1.20, reflecting its market position. In terms of returns, B&B Triplewall has faced notable declines over various periods, with a year-to-date return of -20.17% and a one-year return of -45.57%, contrasting sharply with the Sensex's performance. The company's dividend yield is at 0.64%, and its ROCE and ROE are recorded at 6.78% and 8.52%, respectively. When compared to its peers, B&B Triplewall's valuation metrics present a mixed picture. W...

Read More

B&B Triplewall Containers Faces Persistent Challenges Amid Significant Stock Volatility

2025-02-19 09:37:56B&B Triplewall Containers, a microcap in the Paper & Paper Products sector, has faced notable volatility, nearing a 52-week low. The stock has declined for four consecutive days, down 28.9%, and is trading below multiple moving averages, indicating ongoing challenges in the market compared to broader indices.

Read More

B&B Triplewall Containers Faces Sustained Decline Amid Industry Challenges

2025-02-18 11:57:16B&B Triplewall Containers has hit a new 52-week low amid significant volatility, reflecting broader challenges in the Paper & Paper Products industry. The stock has declined consecutively over three days, with a notable drop over the past year, underperforming compared to the overall market.

Read More

B&B Triplewall Containers Faces Significant Volatility Amidst Ongoing Market Struggles

2025-02-17 09:41:35B&B Triplewall Containers has faced significant volatility, reaching a new 52-week low today. The stock has underperformed its sector and experienced a consecutive decline over the past two days. Additionally, it is trading below multiple moving averages, indicating a persistent downward trend amid a challenging market environment.

Read More

B&B Triplewall Containers Reports Record Sales Amid Declining Profitability Challenges in December 2024

2025-02-15 12:23:07B&B Triplewall Containers has reported its highest quarterly net sales at Rs 123.44 crore for the quarter ending December 2024, indicating consistent growth. However, the company faces challenges with a declining profit after tax and reduced operating profit margin, reflecting a mixed financial performance.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEClosure of trading window for trading in the equity shares of the Company for the purpose declaration of Financial Results for the Year and Quarter ended March 31 2025.

Announcement under Regulation 30 (LODR)-Acquisition

31-Mar-2025 | Source : BSEDisclosure pursuant to Regulation 30 of the SEBI (LODR) Regulations 2015

Announcement under Regulation 30 (LODR)-Newspaper Publication

16-Feb-2025 | Source : BSENewspaper Advertisement of publication of unaudited financial results for the quarter ended December 31 2024.

Corporate Actions

No Upcoming Board Meetings

B&B Triplewall Containers Ltd has declared 10% dividend, ex-date: 23 Sep 24

No Splits history available

No Bonus history available

No Rights history available