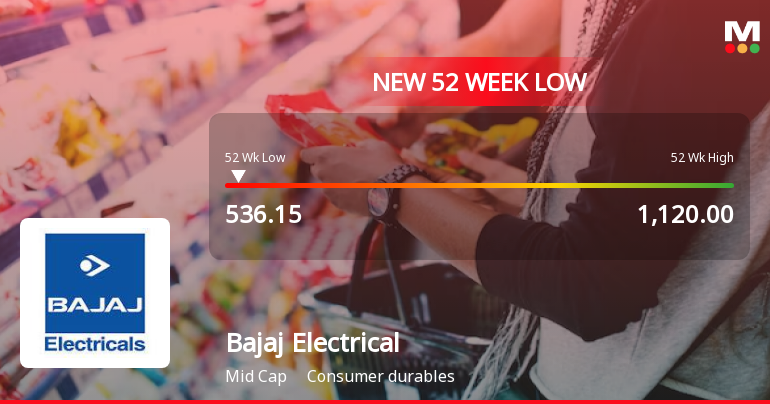

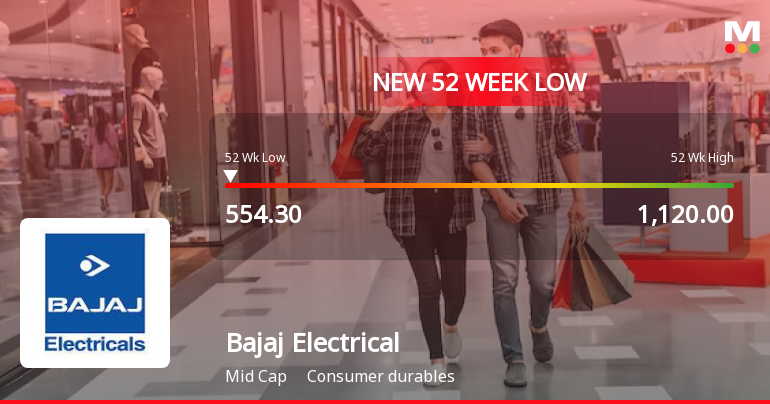

Bajaj Electricals Hits 52-Week Low Amid Declining Sales and Profit Trends

2025-04-01 11:57:15Bajaj Electricals has reached a new 52-week low amid a four-day price decline, despite a slight intraday recovery. Over the past year, the company has seen a significant drop in performance, with declining net sales and operating profit, alongside low return on capital employed and reduced cash reserves.

Read More

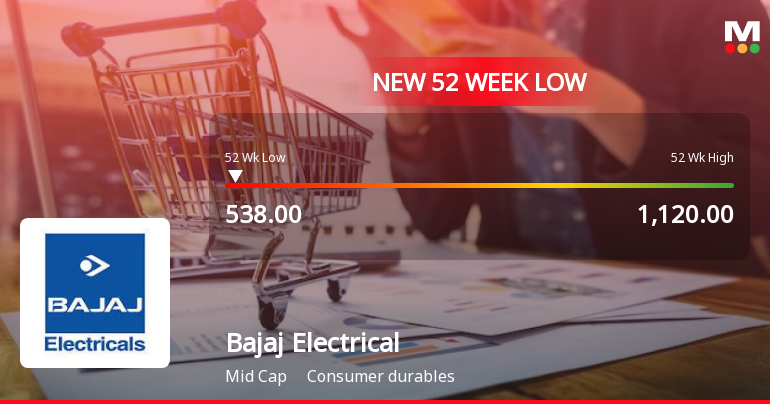

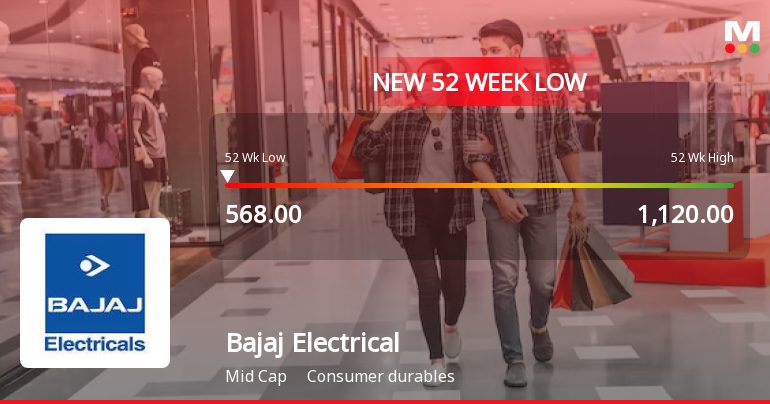

Bajaj Electricals Faces Significant Volatility Amid Declining Financial Performance and Market Trends

2025-03-27 15:09:34Bajaj Electricals has faced significant volatility, reaching a new 52-week low and underperforming its sector. The stock has declined consecutively over three days, with a notable drop in its annual performance. Financial metrics indicate challenges, including reduced net sales and operating profit, alongside low cash reserves and a concerning valuation.

Read More

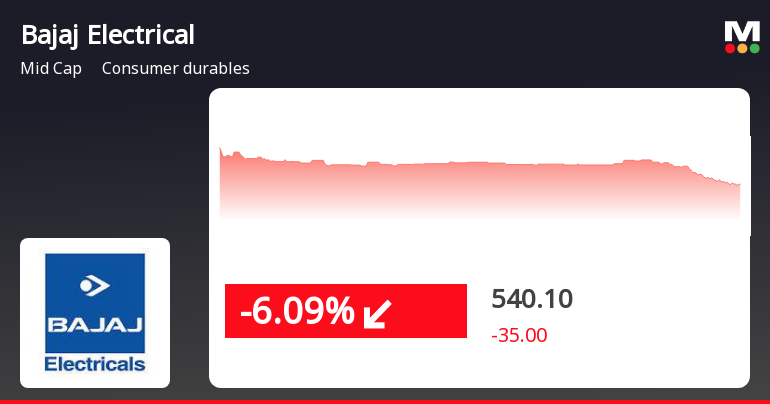

Bajaj Electricals Faces Significant Market Challenges Amid Broader Recovery Trends

2025-03-27 14:35:31Bajaj Electricals has faced a notable decline, trading just above its 52-week low and experiencing a cumulative drop over the past three days. The stock is underperforming compared to the broader market, which has shown resilience, highlighting ongoing challenges for the company in a recovering environment.

Read MoreBajaj Electricals Adjusts Valuation Grade Amidst Competitive Consumer Durables Landscape

2025-03-24 08:00:51Bajaj Electricals, a midcap player in the consumer durables sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 66.16, while its price-to-book value is recorded at 4.69. Additionally, Bajaj Electricals shows an EV to EBITDA ratio of 26.56 and an EV to EBIT ratio of 53.50, indicating a premium valuation relative to its peers. In terms of profitability, the company has a return on capital employed (ROCE) of 6.66% and a return on equity (ROE) of 7.36%. The dividend yield is relatively modest at 0.50%. When compared to its industry peers, Bajaj Electricals' valuation metrics appear elevated, particularly in the context of its price-to-earnings ratio, which is higher than that of competitors like Bata India and Relaxo Footwear. Over the past year, Bajaj Electricals has faced challenges, with a stock...

Read MoreBajaj Electricals Adjusts Valuation Amidst Declining Stock Performance and Competitive Pressures

2025-03-18 08:00:52Bajaj Electricals, a midcap player in the consumer durables sector, has recently undergone a valuation adjustment. The company's current price stands at 541.90, reflecting a notable decline from its previous close of 564.10. Over the past year, Bajaj Electricals has experienced a significant drop in stock performance, with a return of -41.74%, contrasting sharply with a modest gain of 2.10% in the Sensex. Key financial metrics for Bajaj Electricals include a PE ratio of 60.29 and an EV to EBITDA ratio of 24.25, which position it within a competitive landscape. The company's return on capital employed (ROCE) is reported at 6.66%, while the return on equity (ROE) is at 7.36%. In comparison to its peers, Bajaj Electricals' valuation metrics indicate a higher PE ratio than companies like Bata India and V-Guard Industries, which have lower ratios and varying performance indicators. Despite the challenges refle...

Read More

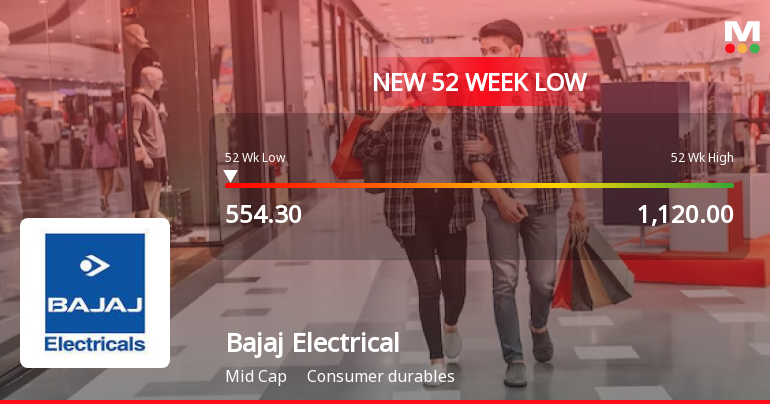

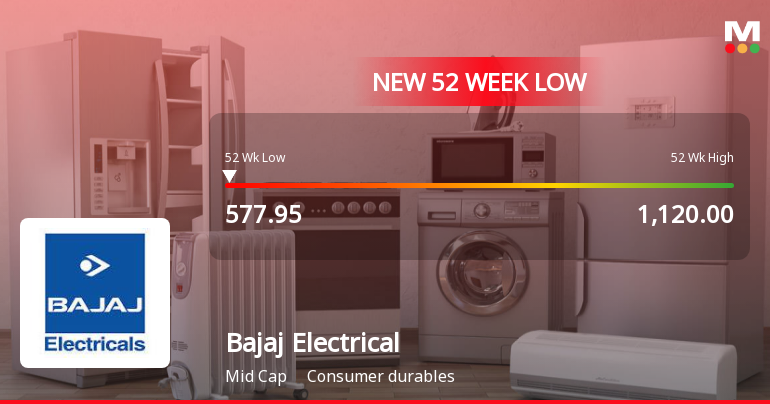

Bajaj Electricals Faces Financial Struggles Amid Significant Stock Volatility and Declining Performance

2025-03-17 09:53:44Bajaj Electricals has reached a new 52-week low, continuing a downward trend with significant volatility. The stock is underperforming its sector and has seen a notable decline over the past year. Financial challenges include decreased net sales and low cash reserves, raising concerns among investors.

Read More

Bajaj Electricals Faces Continued Decline Amid Weak Growth Prospects and Market Volatility

2025-03-17 09:53:42Bajaj Electricals has faced notable volatility, reaching a new 52-week low amid a downward trend. The company's long-term growth prospects appear weak, with declining net sales and operating profit. Despite a broader market uptick, Bajaj Electricals' one-year performance significantly lags behind major indices, reflecting investor caution.

Read More

Bajaj Electricals Faces Significant Volatility Amid Declining Performance Metrics

2025-03-13 14:37:39Bajaj Electricals has faced notable volatility, reaching a new 52-week low and underperforming its sector. The company has seen a significant decline in net sales and operating profit over the past five years, with low return on capital employed. Its stock is trading below key moving averages amid high institutional holdings.

Read More

Bajaj Electricals Faces Continued Volatility Amid Significant Yearly Decline in Stock Performance

2025-03-03 09:37:31Bajaj Electricals has faced notable volatility, hitting a new 52-week low amid a downward trend. Despite an initial gain, the stock has struggled to maintain momentum and is trading below key moving averages. Over the past year, it has declined significantly compared to the broader market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate pursuant to Regulation 74(5) of the Securities and Exchange Board of India (Depositories and Participants) Regulations 2018

Announcement under Regulation 30 (LODR)-Change in Management

28-Mar-2025 | Source : BSEThe Board of Directors at its Meeting held today has inter alia approved the following: 1. Appointment of Mr. Sanjay Sachdeva as the Managing Director & CEO of the Company w.e.f. April 15 2025; 2. Designation as a KMP of the Company w.e.f. April 15 2025; 3. Designation of Mr. Anand Joshi existing Chief Technology Officer as a Senior Management Personnel of the Company

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Bajaj Electricals Ltd has declared 150% dividend, ex-date: 19 Jul 24

Bajaj Electricals Ltd has announced 2:10 stock split, ex-date: 28 Jan 10

Bajaj Electricals Ltd has announced 1:1 bonus issue, ex-date: 28 Aug 07

Bajaj Electricals Ltd has announced 13:118 rights issue, ex-date: 05 Feb 20