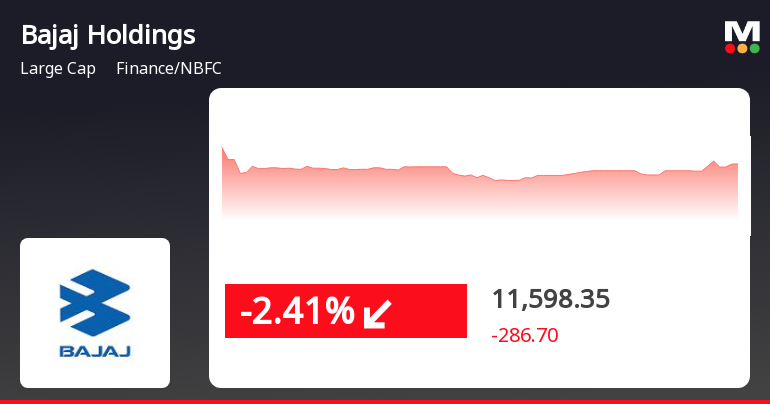

Bajaj Holdings Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:03:52Bajaj Holdings & Investment, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 11,519.90, showing a notable shift from its previous close of 11,885.05. Over the past year, Bajaj Holdings has demonstrated a strong performance with a return of 36.82%, significantly outpacing the Sensex, which recorded a return of 3.67% in the same period. The technical summary indicates a mixed outlook, with the MACD showing a mildly bearish trend on a weekly basis while remaining bullish on a monthly scale. The Bollinger Bands and moving averages suggest a mildly bullish sentiment, indicating some positive momentum. However, the KST remains bullish on both weekly and monthly charts, reflecting underlying strength. In terms of price performance, Bajaj Holdings has experienced fluctuations, with a 52-week high ...

Read More

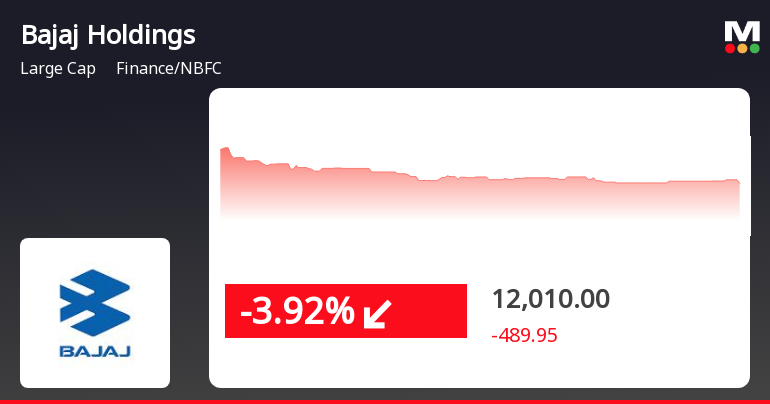

Bajaj Holdings Faces Continued Decline Amid Broader Market Resilience

2025-04-02 10:05:22Bajaj Holdings & Investment's shares have declined for four consecutive days, resulting in an overall drop of 8.23%. Despite recent challenges, the stock has performed well over the past year, significantly outperforming the broader market. Current moving averages indicate mixed short-term momentum for the stock.

Read More

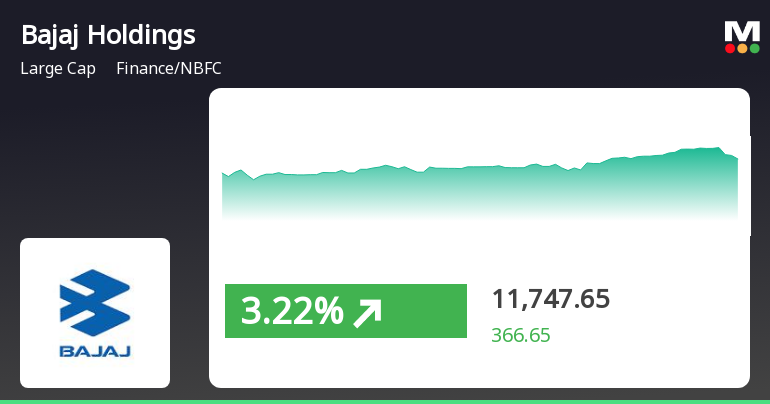

Bajaj Holdings Faces Continued Decline Amid Broader Market Volatility

2025-04-01 11:40:43Bajaj Holdings & Investment has faced a decline for three consecutive days, with a total drop of 4.06%. Despite being above several long-term moving averages, it is currently below its 5-day average. The broader market also struggled, as indicated by a significant drop in the Sensex.

Read MoreBajaj Holdings Shows Strong Technical Trends Amid Market Dynamics and Resilience

2025-03-24 08:01:30Bajaj Holdings & Investment, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 12,330.00, showing a notable increase from the previous close of 12,034.00. Over the past year, Bajaj Holdings has demonstrated impressive performance, with a return of 50.39%, significantly outpacing the Sensex's return of 5.87% during the same period. The technical summary indicates a generally positive outlook, with several indicators such as MACD and Bollinger Bands signaling bullish trends on both weekly and monthly scales. However, the Relative Strength Index (RSI) presents a mixed picture, showing no signal on a weekly basis while indicating bearishness monthly. The moving averages also reflect bullish sentiment, contributing to the overall positive technical landscape. In terms of stock performance, Bajaj ...

Read MoreBajaj Holdings Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-21 08:01:50Bajaj Holdings & Investment, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 12,034.00, showing a slight increase from the previous close of 11,875.00. Over the past year, Bajaj Holdings has demonstrated significant resilience, achieving a remarkable return of 47.97%, compared to the Sensex's 5.89% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bearish trend, while the monthly outlook remains bullish. The Relative Strength Index (RSI) shows no signal on a weekly basis but indicates a bearish stance monthly. Notably, the Bollinger Bands and KST indicators are bullish on both weekly and monthly scales, suggesting a positive momentum in the stock's performance. Bajaj Holdings has also shown impressive long-term returns, with a staggering 824.98% ...

Read MoreBajaj Holdings Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-20 08:02:01Bajaj Holdings & Investment, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 11,875.00, showing a notable increase from the previous close of 11,570.00. Over the past year, Bajaj Holdings has demonstrated strong performance, with a return of 44.98%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. The technical summary indicates a mixed outlook, with the MACD showing a mildly bearish trend on a weekly basis while maintaining a bullish stance monthly. The Bollinger Bands and Moving Averages suggest a bullish sentiment, further supported by the KST indicators. However, the On-Balance Volume (OBV) reflects a mildly bearish trend on both weekly and monthly scales. In terms of stock performance, Bajaj Holdings has consistently outperformed the Sensex ...

Read MoreBajaj Holdings Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-12 08:01:43Bajaj Holdings & Investment, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 11,400.00, with a previous close of 11,611.95. Over the past year, Bajaj Holdings has demonstrated a robust performance, achieving a return of 32.41%, significantly outpacing the Sensex, which recorded a mere 0.82% during the same period. In terms of technical indicators, the weekly MACD shows a mildly bearish trend, while the monthly perspective remains bullish. The Relative Strength Index (RSI) indicates no signal on a weekly basis but leans bearish monthly. Bollinger Bands reflect a mildly bullish stance in both weekly and monthly evaluations. Daily moving averages suggest a mildly bullish trend, while the KST remains bullish on both weekly and monthly fronts. Bajaj Holdings has shown resilience over ...

Read MoreBajaj Holdings Shows Strong Technical Bullish Sentiment Amid Market Dynamics

2025-03-10 08:01:11Bajaj Holdings & Investment, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 11,770.15, showing a notable increase from the previous close of 11,381.00. Over the past year, Bajaj Holdings has demonstrated a robust performance with a return of 36.04%, significantly outpacing the Sensex, which recorded a mere 0.29% return in the same period. The technical summary indicates a strong bullish sentiment across various indicators, including MACD and Bollinger Bands, both on weekly and monthly scales. While the Relative Strength Index (RSI) shows no signal, the moving averages and KST also reflect a bullish trend. However, the Dow Theory presents a mixed view, indicating mildly bearish conditions on a weekly basis but mildly bullish on a monthly basis. In terms of stock performance, Bajaj Holdings...

Read More

Bajaj Holdings Outperforms Sector Amid Mixed Market Conditions, Signaling Strong Momentum

2025-03-07 10:30:54Bajaj Holdings & Investment has demonstrated strong performance, gaining 4.25% on March 7, 2025, and outperforming its sector. The stock is trading above all key moving averages, reflecting positive momentum. Over the past year, it has increased by 37.16%, contributing to a notable five-year rise of 275.30%.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31 March 2025

Closure of Trading Window

31-Mar-2025 | Source : BSEThe trading window shall remain closed till the declaration of audited standalone and consolidated financial results for the quarter and financial year ending 31 March 2025 and 48 hours thereafter.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

24-Mar-2025 | Source : BSEPursuant to Regulation 44 of the SEBI Listing Regulations 2015 we hereby submit the result of the e-voting pursuant to the Postal Ballot for the special resolution as specified in the Postal Ballot Notice dated 30 January 2025

Corporate Actions

No Upcoming Board Meetings

Bajaj Holdings & Investment Ltd has declared 650% dividend, ex-date: 25 Sep 24

No Splits history available

No Bonus history available

No Rights history available