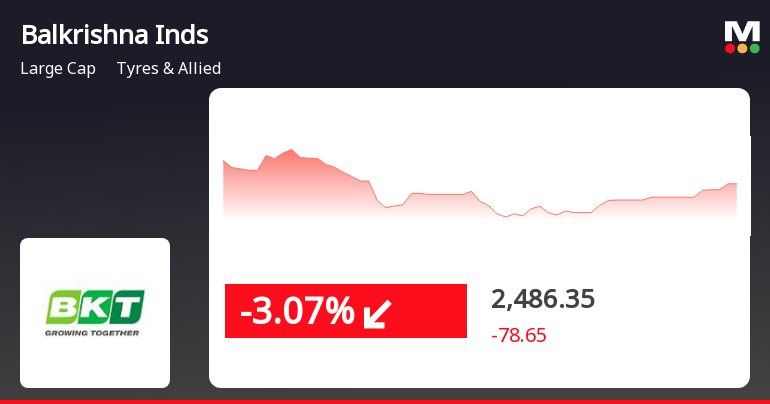

Balkrishna Industries Faces Short-Term Challenges Amid Long-Term Growth Potential

2025-04-03 09:45:18Balkrishna Industries has faced a decline in stock performance, trading below key moving averages and showing a decrease over the past week and month. Despite recent challenges, the company has achieved notable growth over the past year and significant gains over the longer term, outperforming the broader market.

Read MoreBalkrishna Industries Sees Surge in Open Interest Amidst Market Challenges

2025-03-25 15:00:33Balkrishna Industries Ltd. (BALKRISIND), a prominent player in the Tyres & Allied industry, has experienced a significant increase in open interest today. The latest open interest stands at 14,526 contracts, reflecting a rise of 2,091 contracts or 16.82% from the previous open interest of 12,435. The trading volume for the day reached 12,289 contracts, contributing to a futures value of approximately Rs 43,491.36 lakhs. Despite this notable uptick in open interest, the stock has underperformed its sector by 1.11%, with a 1D return of -1.97%. The stock has seen a trend reversal, falling after two consecutive days of gains, and touched an intraday low of Rs 2,552.35, marking a decline of 2.22%. Additionally, Balkrishna Industries is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. On a positive note, the delivery volume has increased signif...

Read MoreBalkrishna Industries Sees Surge in Open Interest Amid Increased Derivatives Activity

2025-03-25 14:00:22Balkrishna Industries Ltd. (BALKRISIND), a prominent player in the Tyres & Allied industry, has experienced a significant increase in open interest today. The latest open interest stands at 14,185 contracts, reflecting a rise of 1,750 contracts or 14.07% from the previous open interest of 12,435. This uptick comes alongside a trading volume of 10,555 contracts, indicating heightened activity in the derivatives market. In terms of price performance, Balkrishna Industries has underperformed its sector by 1.05%, with the stock falling after two consecutive days of gains. The stock reached an intraday low of Rs 2,552.35, marking a decline of 2.22%. Notably, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a bearish trend. Despite the recent price decline, there has been a notable increase in delivery volume, which rose by 50.22% compared to the 5...

Read MoreBalkrishna Industries Sees Surge in Open Interest Amidst Declining Stock Performance

2025-03-25 13:00:16Balkrishna Industries Ltd. (BALKRISIND), a prominent player in the Tyres & Allied industry, has experienced a notable increase in open interest today. The latest open interest stands at 13,814 contracts, reflecting a rise of 1,379 contracts or 11.09% from the previous open interest of 12,435. The trading volume for the day reached 8,575 contracts, contributing to a total futures value of approximately Rs 29,521.53 lakhs. Despite this surge in open interest, the stock has underperformed its sector, declining by 1.76% compared to a sector decline of 0.94%. The stock touched an intraday low of Rs 2,556.50, marking a decrease of 2.06%. Additionally, Balkrishna Industries is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. Interestingly, there has been a rise in investor participation, with delivery volume increasing by 50.22% against the 5-da...

Read MoreBalkrishna Industries Sees Significant Open Interest Surge Amid Increased Trading Activity

2025-03-24 15:00:28Balkrishna Industries Ltd., a prominent player in the Tyres & Allied industry, has experienced a significant increase in open interest today. The latest open interest stands at 14,695 contracts, marking a rise of 2,773 contracts or 23.26% from the previous open interest of 11,922. This uptick in open interest coincides with a trading volume of 11,950 contracts, indicating heightened activity in the stock. In terms of price performance, Balkrishna Industries has underperformed its sector by 0.81% today, with a modest one-day return of 0.47%. Over the past two days, the stock has shown a slight upward trend, gaining 0.78%. The stock is currently trading above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. Additionally, the stock has seen a notable increase in delivery volume, which reached 311,000 shares on March 21, reflecting a substantial...

Read MoreBalkrishna Industries Sees Significant Surge in Open Interest Amid Increased Trading Activity

2025-03-24 14:00:19Balkrishna Industries Ltd., a prominent player in the Tyres & Allied industry, has experienced a significant increase in open interest today. The latest open interest stands at 14,081 contracts, reflecting a rise of 2,159 contracts or 18.11% from the previous open interest of 11,922. This surge in open interest coincides with a trading volume of 9,733 contracts, indicating heightened activity in the derivatives market. In terms of financial performance, Balkrishna Industries has underperformed its sector by 0.5% today, with a stock return of 0.13%. The stock is currently trading above its 5-day and 20-day moving averages, yet remains below its 50-day, 100-day, and 200-day moving averages. Notably, the delivery volume has seen a remarkable increase of 255.23% compared to the 5-day average, reaching 311,000 shares. With a market capitalization of Rs 50,842 crore, Balkrishna Industries continues to maintain ...

Read MoreBalkrishna Industries Sees Significant Open Interest Surge Amid Increased Trading Activity

2025-03-24 13:00:19Balkrishna Industries Ltd., a prominent player in the Tyres & Allied industry, has experienced a significant increase in open interest today. The latest open interest stands at 13,769 contracts, reflecting a rise of 1,847 contracts or 15.49% from the previous open interest of 11,922. This uptick in open interest coincides with a trading volume of 8,153 contracts, indicating heightened activity in the stock. In terms of performance, Balkrishna Industries has underperformed its sector by 0.4% today, although it has shown a modest gain of 0.71% over the past two days. The stock's current price is positioned above its 5-day and 20-day moving averages, yet remains below the 50-day, 100-day, and 200-day moving averages, suggesting mixed momentum in the short to medium term. Additionally, the stock has seen a notable increase in delivery volume, with 311,000 shares delivered on March 21, marking a 255.23% rise c...

Read More

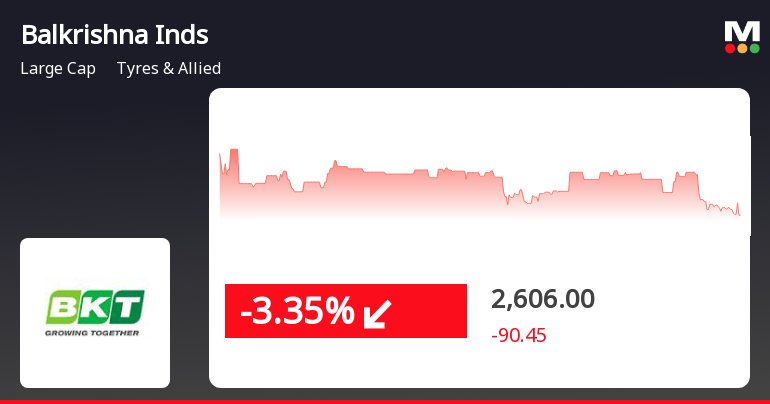

Balkrishna Industries Faces Continued Stock Decline Amid Broader Market Weakness

2025-03-04 11:00:17Balkrishna Industries Ltd. has faced a decline for three consecutive days, with a total drop of 6.92%. The stock is trading below key moving averages and has underperformed relative to its sector. Meanwhile, the broader market, represented by the Sensex, is also experiencing a downturn.

Read More

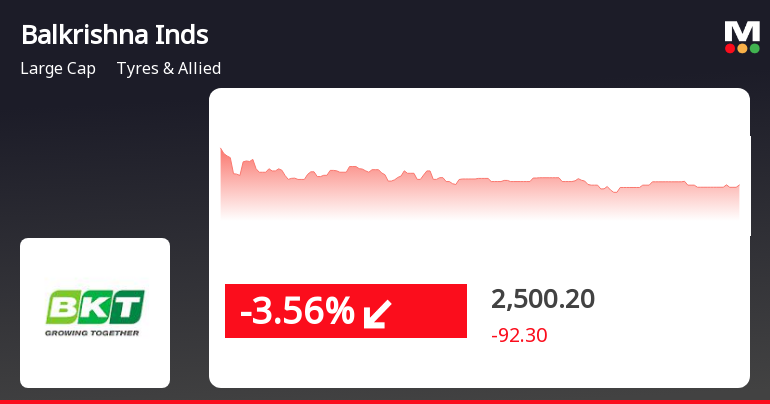

Balkrishna Industries Faces Stock Decline Amidst Broader Market Challenges

2025-02-28 15:35:14Balkrishna Industries has faced a significant decline in stock performance, dropping 3.32% on February 28, 2025. The stock is trading below key moving averages and has underperformed relative to its sector and the broader market, reflecting ongoing challenges in a competitive landscape.

Read MoreCompliances-Half Yearly Report (SEBI Circular No. CIR/IMD/DF-1/67/2017)

08-Apr-2025 | Source : BSEIn terms of Regulation 17 of SEBI (Issue and Listing of Non Convertible Securities) Regulations 2021 read with SEBI Master Circular No. SEBI/HO/DDHS/PoD1/P/CIR/2024/54 dated 22.05.2024 for issue and listing of Non Convertible Securities Securitized Debt Instruments Security Receipts Municipal Debt Securities and Commercial papers please find attached herewith the Statement containing the details of Debt Securities as on 31.03.2025

Intimation Under Regulation 60(2) Of SEBI LODR Regarding Fixation Of Record Date For Payment Of Interest And Redemption Amount Of Non Convertible Debentures (NCD)

07-Apr-2025 | Source : BSEPlease find attached herewith confirmation letter in respect of third partial and final redemption of Non Convertible Debentures is through reduction in No. of NCDs for all record date payment for ISIN/Scrip Code INE787D08021/973556 respectively and third and final redemption is not an early full redemption.

Intimation Under Regulation 60(2) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 Regarding Fixation Of Record Date For Payment Of Interest And Redemption Amount Of Non-Convertible Debentures (Ncds).

01-Apr-2025 | Source : BSEPursuant to Regulation 60(2) of SEBI LODR 2015 and Private Placement Memorandum dated 28th October 2021 details of record date for payment of interest and third redemption amount payable to the holders of 5000 Rated Listed Unsecured Redeemable Non Convertible Debentures issued by the Company is Friday the 11th April 2025.

Corporate Actions

No Upcoming Board Meetings

Balkrishna Industries Ltd has declared 200% dividend, ex-date: 30 Jan 25

Balkrishna Industries Ltd has announced 2:10 stock split, ex-date: 20 Dec 10

Balkrishna Industries Ltd has announced 1:1 bonus issue, ex-date: 21 Dec 17

No Rights history available