Balrampur Chini Mills Adjusts Evaluation Amid Strong Market Performance and Technical Indicators

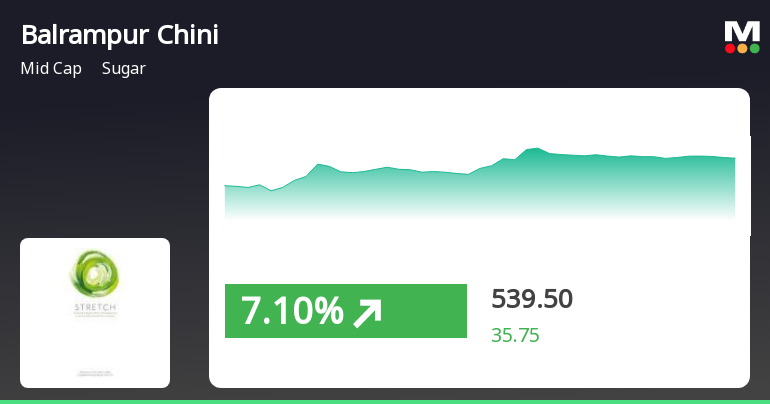

2025-04-02 08:17:48Balrampur Chini Mills, a key player in the sugar sector, has recently experienced a change in its evaluation, reflecting a shift in market sentiment. The company showcases strong management efficiency with a return on capital employed of 17.07% and a low debt-to-equity ratio, despite recent profit challenges.

Read MoreBalrampur Chini Mills Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-02 08:07:37Balrampur Chini Mills, a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 556.45, showing a notable increase from the previous close of 547.30. Over the past year, Balrampur Chini has demonstrated strong performance, with a return of 47.42%, significantly outpacing the Sensex, which recorded a return of 2.72% during the same period. The technical summary indicates a mixed outlook, with the MACD showing a mildly bullish trend on a weekly basis, while the monthly perspective remains mildly bearish. Bollinger Bands and KST metrics suggest a bullish sentiment in both weekly and monthly evaluations. However, moving averages indicate a mildly bearish stance on a daily basis, reflecting some volatility in short-term trading. In terms of stock performance, Balrampur Chini has shown resilience, parti...

Read More

Balrampur Chini Mills Shows Strong Market Resilience Amid Positive Sugar Sector Trends

2025-03-19 09:35:19Balrampur Chini Mills has demonstrated strong performance in the sugar industry, gaining 5.71% on March 19, 2025, and outperforming its sector. The stock has shown positive momentum with a cumulative return of 12.82% over three days and is trading above key moving averages, reflecting its robust market position.

Read MoreBalrampur Chini Mills Adjusts Valuation Amidst Competitive Sugar Industry Landscape

2025-03-19 08:00:47Balrampur Chini Mills, a midcap player in the sugar industry, has recently undergone a valuation adjustment, reflecting its current financial standing. The company’s price-to-earnings ratio stands at 24.74, while its price-to-book value is recorded at 2.87. Other key metrics include an EV to EBIT ratio of 20.99 and an EV to EBITDA ratio of 15.71, indicating its operational efficiency. The company also shows a return on capital employed (ROCE) of 12.21% and a return on equity (ROE) of 12.17%, suggesting a stable performance in generating returns for shareholders. In comparison to its peers, Balrampur Chini's valuation appears elevated, particularly when juxtaposed with EID Parry and Triveni Engineering Industries, which exhibit varying valuation metrics. While Balrampur Chini has a competitive edge in certain financial indicators, its peers reflect a broader spectrum of valuation scenarios within the sugar ...

Read More

Balrampur Chini Mills Shows Strong Performance Amid Broader Sugar Sector Gains

2025-03-18 15:15:53Balrampur Chini Mills has experienced significant gains, marking its second consecutive day of increases. The stock is currently above its shorter-term moving averages, while the broader sugar sector also shows positive movement. In contrast, the Sensex has risen but remains below its 50-day moving average, indicating longer-term bearish trends.

Read MoreBalrampur Chini Mills Shows Mixed Technical Trends Amid Strong Long-Term Performance

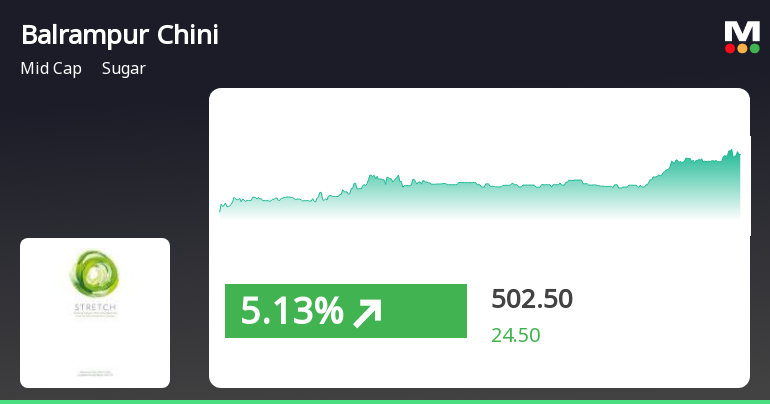

2025-03-13 08:01:55Balrampur Chini Mills, a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 486.45, showing a notable increase from the previous close of 449.75. Over the past year, Balrampur Chini has demonstrated a strong performance with a return of 33.68%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no significant signals on both weekly and monthly bases. Bollinger Bands suggest a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment, while the KST presents a mixed picture with a bearish weekly trend and a bullis...

Read MoreBalrampur Chini Mills Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-13 08:01:55Balrampur Chini Mills, a midcap player in the sugar industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 486.45, showing a notable increase from the previous close of 449.75. Over the past year, Balrampur Chini has demonstrated a strong performance with a return of 33.68%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no significant signals on both weekly and monthly bases. Bollinger Bands suggest a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment, while the KST presents a mixed picture with a bearish weekly trend and a bullis...

Read MoreBalrampur Chini Mills Adjusts Valuation Amid Strong Performance in Sugar Industry

2025-03-13 08:00:41Balrampur Chini Mills, a midcap player in the sugar industry, has recently undergone a valuation adjustment. The company's current price stands at 486.45, reflecting a notable increase from the previous close of 449.75. Over the past year, Balrampur Chini has demonstrated a stock return of 33.68%, significantly outperforming the Sensex, which returned just 0.49% in the same period. Key financial metrics for Balrampur Chini include a PE ratio of 23.89 and an EV to EBITDA ratio of 15.20. The company also reports a dividend yield of 0.62% and a return on capital employed (ROCE) of 12.21%. In comparison to its peers, Balrampur Chini's valuation metrics indicate a competitive position, although some peers exhibit higher valuation levels. For instance, EID Parry and Piccadily Agro are noted for their elevated valuation metrics, while Sh. Renuka Sugar is categorized as loss-making. Overall, Balrampur Chini's per...

Read MoreBalrampur Chini Mills Adjusts Valuation Amid Strong Performance in Sugar Industry

2025-03-13 08:00:41Balrampur Chini Mills, a midcap player in the sugar industry, has recently undergone a valuation adjustment. The company's current price stands at 486.45, reflecting a notable increase from the previous close of 449.75. Over the past year, Balrampur Chini has demonstrated a stock return of 33.68%, significantly outperforming the Sensex, which returned just 0.49% in the same period. Key financial metrics for Balrampur Chini include a PE ratio of 23.89 and an EV to EBITDA ratio of 15.20. The company also reports a dividend yield of 0.62% and a return on capital employed (ROCE) of 12.21%. In comparison to its peers, Balrampur Chini's valuation metrics indicate a competitive position, although some peers exhibit higher valuation levels. For instance, EID Parry and Piccadily Agro are noted for their elevated valuation metrics, while Sh. Renuka Sugar is categorized as loss-making. Overall, Balrampur Chini's per...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Intimation For Re-Appointment Of Registrar And Share Transfer Agent Of The Company

31-Mar-2025 | Source : BSERe-appointment of KFin Technologies Limited as the Registrar and Share Transfer Agent of the Company for a period of three years w.e.f 1st April 2025.

Announcement under Regulation 30 (LODR)-Credit Rating

28-Mar-2025 | Source : BSEUpdate on Credit Rating

Corporate Actions

No Upcoming Board Meetings

Balrampur Chini Mills Ltd has declared 300% dividend, ex-date: 25 Nov 24

No Splits history available

No Bonus history available

No Rights history available