Bambino Agro Industries Faces Technical Shift Amid Debt Concerns and Modest Growth

2025-04-03 08:08:46Bambino Agro Industries, a microcap in the FMCG sector, has recently adjusted its evaluation amid shifting technical trends. The company faces challenges, including a high Debt to EBITDA ratio and modest growth in net sales and operating profit. However, it maintains an attractive valuation compared to peers.

Read More

Bambino Agro Industries Faces Market Sentiment Shift Amid Valuation Challenges

2025-03-27 08:09:08Bambino Agro Industries, a microcap in the FMCG sector, has undergone a recent evaluation adjustment, highlighting shifts in technical indicators and valuation metrics. While the company shows attractive valuation characteristics, it also faces challenges related to its debt levels, reflecting a complex market position.

Read MoreBambino Agro Industries Adjusts Valuation Grade Amid Competitive FMCG Landscape

2025-03-26 08:00:31Bambino Agro Industries, a microcap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (P/E) ratio of 27.72 and a price-to-book value of 2.74, indicating its market valuation relative to its earnings and assets. Additionally, its enterprise value to EBITDA stands at 13.15, while the EV to sales ratio is at 1.00, showcasing its operational efficiency. In terms of profitability, Bambino Agro has a return on capital employed (ROCE) of 12.57% and a return on equity (ROE) of 9.88%, which are critical indicators of its financial health. The company also offers a modest dividend yield of 0.47%. When compared to its peers, Bambino Agro's valuation metrics present a competitive landscape. For instance, while Vadilal Enterprises is positioned at a significantly higher valuation, other companies li...

Read More

Bambino Agro Industries Faces Valuation Shift Amid Financial Challenges and Market Trends

2025-03-20 08:06:28Bambino Agro Industries has recently experienced an evaluation adjustment reflecting changes in its financial metrics and market position. The company's valuation grade has shifted to a fair classification, influenced by key financial indicators and a mildly bearish stock trend, raising concerns about its debt servicing capabilities.

Read MoreBambino Agro Industries Adjusts Valuation Amidst Competitive FMCG Landscape

2025-03-20 08:00:39Bambino Agro Industries, a microcap player in the FMCG sector, has recently undergone a valuation adjustment. The company's current price stands at 349.45, reflecting a notable increase from the previous close of 327.00. Over the past year, Bambino has delivered a stock return of 12.49%, outperforming the Sensex, which recorded a return of 4.77% in the same period. Key financial metrics for Bambino include a PE ratio of 28.24 and an EV to EBITDA ratio of 13.34. The company's return on capital employed (ROCE) is reported at 12.57%, while the return on equity (ROE) is at 9.88%. Additionally, the dividend yield is relatively modest at 0.46%. In comparison to its peers, Bambino Agro Industries presents a mixed picture. While it maintains a competitive PE ratio, other companies in the sector exhibit varying valuation metrics, with some peers showing significantly higher valuations. This context highlights Bamb...

Read More

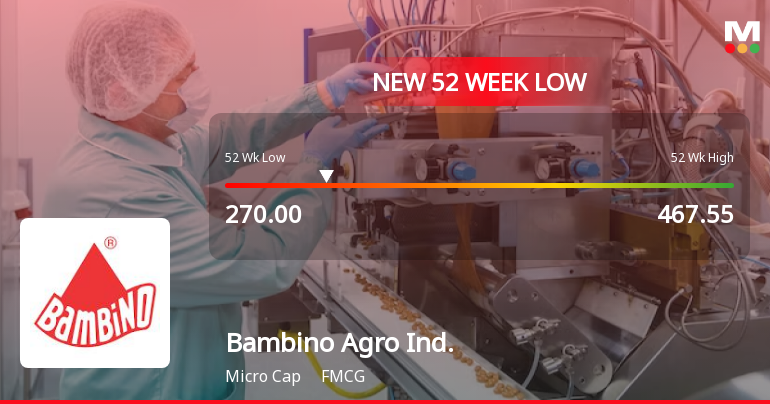

Bambino Agro Industries Faces Significant Volatility Amidst Financial Challenges and Underperformance

2025-03-17 09:47:33Bambino Agro Industries, a microcap in the FMCG sector, has faced notable volatility, hitting a new 52-week low. The stock's performance has been weak, underperforming its peers and the broader market. Financial metrics indicate challenges, including a high Debt to EBITDA ratio and modest sales growth.

Read More

Bambino Agro Industries Faces Significant Volatility Amid Broader Market Gains

2025-03-17 09:47:27Bambino Agro Industries, a microcap in the FMCG sector, hit a new 52-week low today, reflecting significant volatility. The company faces challenges with a high Debt to EBITDA ratio and declining quarterly results, despite a five-year growth in net sales and operating profit. It continues to underperform against market benchmarks.

Read More

Bambino Agro Industries Faces Significant Volatility Amidst Financial Challenges and Underperformance

2025-03-17 09:47:25Bambino Agro Industries, a microcap in the FMCG sector, reached a new 52-week low today amid significant volatility. The company faces challenges with a high Debt to EBITDA ratio and disappointing recent financial results, while its stock has underperformed market benchmarks over the past year.

Read More

Bambino Agro Industries Faces Significant Volatility Amid Declining Stock Performance

2025-03-03 10:36:22Bambino Agro Industries has faced significant trading volatility, hitting a new 52-week low and experiencing consecutive losses over the past three days. The stock has underperformed its sector and is trading below multiple moving averages, reflecting a challenging year compared to the broader market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulations 74(5) of SEBI (DP) Regulations2018 for the Quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Change in Directorate

31-Mar-2025 | Source : BSEResignation of Mr. Prabhnoor Singh Grewal as Whole -tiime Director of the Company .

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation on Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Bambino Agro Industries Ltd has declared 16% dividend, ex-date: 19 Dec 24

No Splits history available

No Bonus history available

No Rights history available