Banco Products Adjusts Technical Indicators Amid Strong Debt Servicing and Growth Metrics

2025-04-03 08:07:28Banco Products (India) has recently experienced a score adjustment reflecting changes in its technical indicators, now showing a mildly bearish trend. Despite this, the company exhibits strong debt servicing capabilities and healthy long-term growth, with significant returns and increased institutional investor participation over the past year.

Read MoreBanco Products Faces Mixed Technical Trends Amid Strong Long-Term Performance in Auto Ancillary Sector

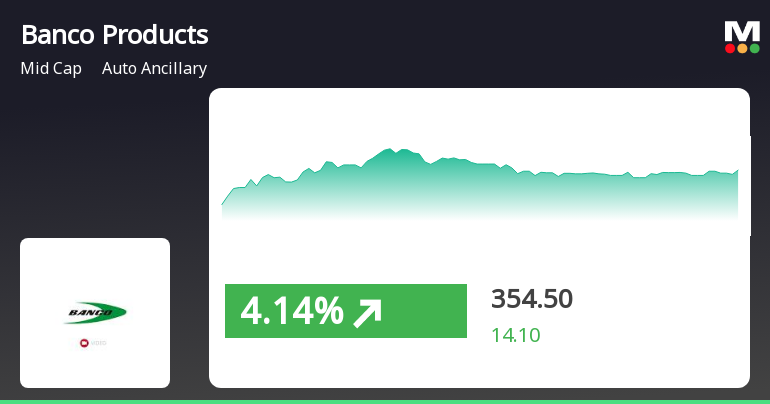

2025-04-03 08:05:11Banco Products (India), a midcap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 353.75, showing a notable increase from the previous close of 343.70. Over the past year, Banco Products has demonstrated a return of 16.69%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages reflect a bearish sentiment on a daily basis, while the KST shows a similar mildly bearish trend monthly. Banco Products has shown impressive long-term pe...

Read More

Banco Products Faces Technical Shift Amid Declining Sales but Strong Debt Management Remains Intact

2025-03-25 08:15:31Banco Products (India) has recently experienced a change in evaluation due to shifts in its technical indicators, reflecting fluctuating performance metrics, including declines in net sales and profit. Despite these challenges, the company shows strong debt servicing capability and healthy long-term growth, attracting increased institutional investor interest.

Read MoreBanco Products Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:04:43Banco Products (India), a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 362.85, showing a notable increase from the previous close of 353.15. Over the past week, the stock has reached a high of 367.90 and a low of 355.05, indicating some volatility. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) does not signal any significant movement in either timeframe. The Bollinger Bands present a mildly bearish outlook weekly, contrasting with a bullish stance monthly. Moving averages indicate a bearish trend on a daily basis, while the KST reflects a bearish sentiment weekly and mildly bearish monthly. When comparing the stock's performance to the Sensex, Banco Products has demonstrated strong return...

Read MoreBanco Products Faces Mixed Technical Trends Amidst Strong Long-Term Performance

2025-03-24 08:02:10Banco Products (India), a midcap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 353.15, showing a notable increase from the previous close of 344.50. Over the past week, Banco Products has demonstrated a stock return of 5.31%, outperforming the Sensex, which recorded a return of 4.17% in the same period. In terms of technical indicators, the weekly MACD is bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. The Bollinger Bands present a mildly bearish outlook on a weekly basis, contrasting with a bullish stance on a monthly basis. Daily moving averages are bearish, and the KST reflects a bearish trend weekly, with a mildly bearish view monthly. Looking at the company's performance over various...

Read MoreBanco Products Shows Resilience with Strong Long-Term Returns Amid Market Challenges

2025-03-21 18:00:32Banco Products (India) Ltd, a midcap player in the auto ancillary industry, has shown significant activity in the stock market today, with a notable increase of 2.51%. This performance stands in contrast to the Sensex, which rose by 0.73%. Over the past year, Banco Products has delivered a robust return of 20.97%, significantly outperforming the Sensex's 5.87% gain. Despite a challenging year-to-date performance, where the stock has declined by 25.73% compared to the Sensex's 1.58%, Banco Products has demonstrated resilience over longer time frames. The company has achieved an impressive 387.61% increase over the past three years and a staggering 935.63% over the last five years, showcasing its strong growth trajectory. With a market capitalization of Rs 5,007.00 crore and a price-to-earnings ratio of 16.48, Banco Products operates in a sector where the industry average P/E stands at 31.03. This indicates...

Read MoreBanco Products Shows Mixed Technical Trends Amid Strong Historical Performance in Auto Ancillary Sector

2025-03-20 08:03:01Banco Products (India), a midcap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 350.60, showing a notable increase from the previous close of 340.40. Over the past year, Banco Products has demonstrated a return of 18.81%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. The Bollinger Bands indicate a mildly bearish trend on a weekly basis but shift to bullish on a monthly scale. Daily moving averages suggest a mildly bullish sentiment, contrasting with the bearish signals from the KST and Dow Theory on a weekly basis. The company's performance over various...

Read More

Banco Products Shows Strong Short-Term Gains Amid Broader Market Uptrend

2025-03-19 09:50:21Banco Products (India) has demonstrated notable performance in the auto ancillary sector, gaining 5.82% on March 19, 2025, and achieving an 8.82% return over two days. The stock is currently above its short-term moving averages and offers a dividend yield of 3.23%, despite a year-to-date decline.

Read MoreBanco Products Faces Mixed Technical Trends Amid Market Volatility and Performance Variability

2025-03-11 08:04:06Banco Products (India), a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 336.65, down from a previous close of 361.00, with a notable 52-week high of 594.80 and a low of 252.68. Today's trading saw a high of 364.35 and a low of 335.05, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect a bearish stance. Moving averages show a mildly bullish trend on a daily basis, suggesting some short-term resilience. However, the KST and Dow Theory metrics lean towards a bearish outlook, with no significant trends identified in the OBV. In terms of performance, Banco Products has shown varied returns compared to the Sensex. Over the past week, the stock returned 10.59%, sig...

Read MoreAnnouncement under Regulation 30 (LODR)-Resignation of Director

05-Apr-2025 | Source : BSEPlease find attached herewith Intimation of Resignation of Ms. Himali H. Patel as Whole-time Director & CFO of the Company.

Announcement under Regulation 30 (LODR)-Resignation of Chief Financial Officer (CFO)

05-Apr-2025 | Source : BSEPlease find attached herewith Intimation of Resignation of Ms. Himali H. Patel as Whole-time Director & CFO of the Company.

Announcement under Regulation 30 (LODR)-Change in Management

05-Apr-2025 | Source : BSEPlease find attached herewith Intimation of Resignation of Ms. Himali H. Patel as Whole-time Director & CFO of the Company.

Corporate Actions

No Upcoming Board Meetings

Banco Products (India) Ltd has declared 550% dividend, ex-date: 14 Feb 25

Banco Products (India) Ltd has announced 2:10 stock split, ex-date: 23 Nov 07

Banco Products (India) Ltd has announced 1:1 bonus issue, ex-date: 30 Dec 24

No Rights history available