Bank Of India Outperforms Sector Amid Broader Market Volatility and Recovery Trends

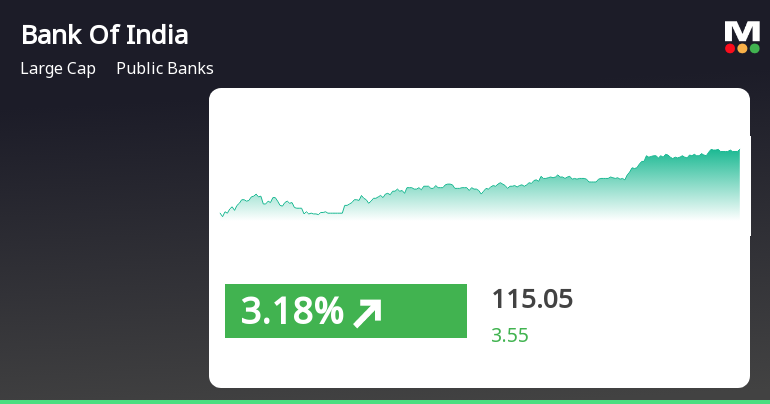

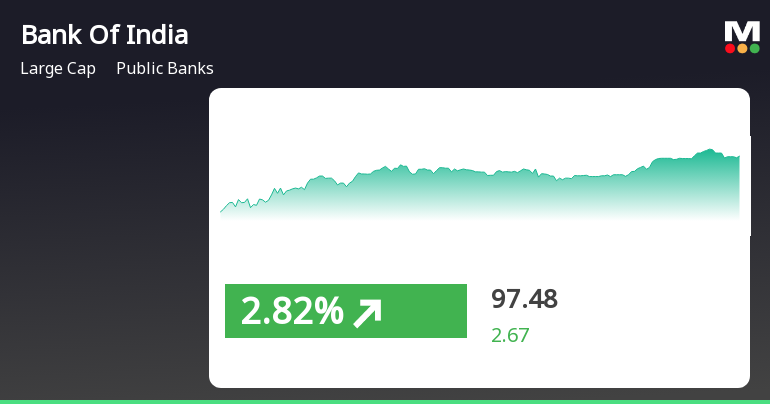

2025-04-03 12:50:19Bank Of India has demonstrated strong stock performance, gaining 3.18% on April 3, 2025, and achieving a total return of 7.42% over three days. The bank is trading above all key moving averages, indicating a positive trend, while its year-to-date increase stands at 12.65%.

Read MoreBank of India Shows Mixed Technical Trends Amidst Market Volatility

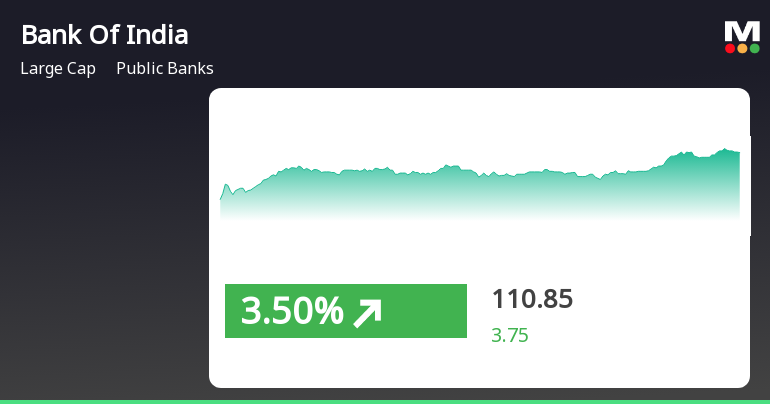

2025-04-02 08:07:04Bank of India, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 110.30, showing a notable increase from the previous close of 107.10. Over the past year, the stock has experienced a high of 158.00 and a low of 90.00, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands also reflect a bullish trend on a weekly basis, contrasting with a mildly bearish stance monthly. Moving averages indicate a mildly bearish trend on a daily basis, which aligns with the overall mixed technical signals. When comparing the stock's performance to the Sensex, Bank of India has shown resilience in various time frames. Over the past week, the stock returned...

Read More

Bank of India Outperforms Sector Amid Broader Market Challenges and Long-Term Gains

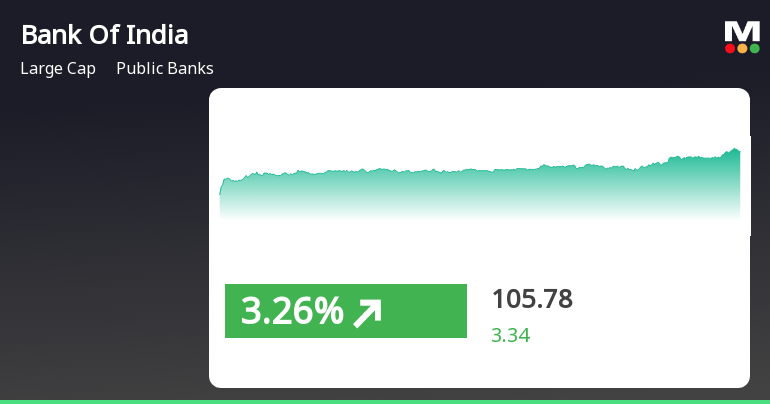

2025-04-01 12:20:17Bank of India has demonstrated strong performance, gaining 3.22% on April 1, 2025, and outperforming its sector. The stock is trading above key moving averages, with a notable rise of 5.02% over the past week and 16.43% over the last month, despite a year-over-year decline.

Read MoreBank of India Shows Mixed Technical Trends Amid Market Volatility

2025-03-25 08:04:16Bank of India, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 107.60, showing a slight increase from the previous close of 105.83. Over the past year, the stock has experienced significant volatility, with a 52-week high of 158.00 and a low of 90.00. In terms of technical indicators, the weekly MACD and KST suggest a mildly bullish sentiment, while the monthly metrics indicate a mildly bearish outlook. The Bollinger Bands show a bullish trend on a weekly basis, contrasting with a mildly bearish stance on a monthly scale. The daily moving averages reflect a mildly bearish trend, indicating mixed signals across different time frames. When comparing the company's performance to the Sensex, Bank of India has shown notable returns over various periods. In the last week, the stock returned 13...

Read More

Bank Of India Shows Resilience Amid Market Fluctuations and Sector Outperformance

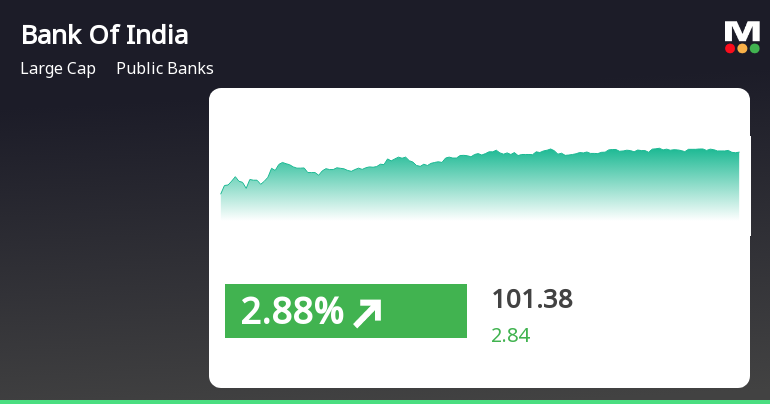

2025-03-21 15:05:19Bank Of India has experienced significant trading activity, outperforming its sector and reaching an intraday high. The stock's performance is mixed, positioned above several moving averages but below the 200-day average. The broader market, led by small-cap stocks, has also shown notable recovery.

Read More

Bank of India Adjusts Evaluation Amid Strong Profit Growth and Market Challenges

2025-03-20 08:04:11Bank of India has recently experienced a score adjustment, reflecting its strong long-term fundamentals, including a notable CAGR of 56.11% in net profits and 14 consecutive quarters of positive financial results. Key metrics show low gross and net non-performing assets, alongside robust earnings, despite recent stock challenges.

Read MoreBank of India Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-20 08:02:38Bank of India, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 103.00, showing a notable increase from the previous close of 98.54. Over the past week, the stock has demonstrated a return of 9.74%, significantly outperforming the Sensex, which returned 1.92% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish trend, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands and moving averages indicate a mildly bearish sentiment on a daily basis, with the KST reflecting mixed signals across weekly and monthly evaluations. Looking at the company's performance over various time frames, it has delivered a return of 114...

Read More

Bank Of India Shows Strong Short-Term Gains Amid Mixed Long-Term Trends

2025-03-19 11:35:19Bank Of India has experienced a notable rise, marking its fourth consecutive day of gains and outperforming its sector. The stock is currently above its short-term moving averages but below its longer-term ones. Year-to-date, it has slightly declined, yet it has significantly outperformed the Sensex over three and five years.

Read More

Bank Of India Shows Short-Term Gains Amid Mixed Long-Term Performance Trends

2025-03-18 12:05:18Bank Of India experienced notable activity, gaining 3.1% on March 18, 2025, with consecutive gains over three days totaling 3.75%. While the stock is above its 5-day moving average, it remains below longer-term averages. Year-to-date, it has declined 4.45%, contrasting with significant long-term growth.

Read MoreAnnouncement under Regulation 30 (LODR)-Interest Rates Updates

09-Apr-2025 | Source : BSERevision in RBLR w.e.f.09.04.2025

Intimation Under Regulation 30 Of SEBI (LODR) Regulations 2015: Amalgamation Of Regional Rural Banks.

09-Apr-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015: Amalgamation of Regional Rural Banks.

Certificate Of RTA In Compliance Of Regulation 74(5) Of The SEBI (Depositories And Participants) Regulation 2018

08-Apr-2025 | Source : BSECertificate of RTA in compliance of Regulation 74(5) of the SEBI (Depositories & Participants) Regulation 2018

Corporate Actions

No Upcoming Board Meetings

Bank Of India has declared 28% dividend, ex-date: 18 Jun 24

No Splits history available

No Bonus history available

No Rights history available