Barak Valley Cements Faces Evaluation Shift Amidst Flat Financial Performance and High Debt Challenges

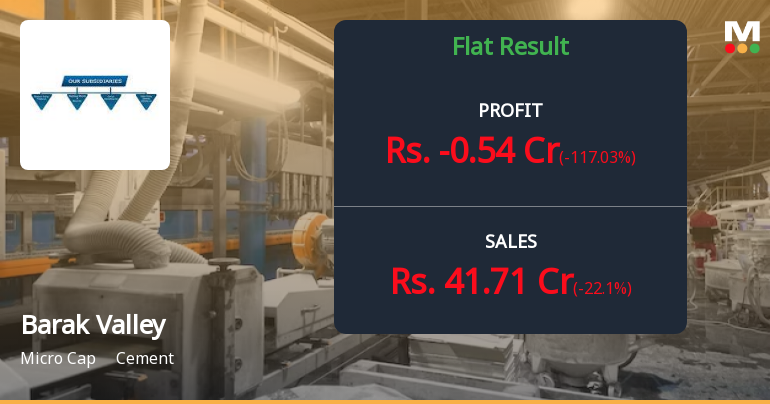

2025-03-25 08:18:51Barak Valley Cements has undergone a recent evaluation adjustment, reflecting a cautious outlook amid flat financial performance for the quarter ending December 2024. The company has faced challenges, including declining operating profits and a high debt-to-EBITDA ratio, contributing to its underperformance in the market.

Read More

Barak Valley Cements Faces Financial Challenges Amidst Market Evaluation Adjustments

2025-03-18 08:16:52Barak Valley Cements has recently adjusted its evaluation, reflecting its current market position amid flat financial performance for the quarter ending December 2024. The company faces challenges with declining operating profits, high debt levels, and limited profitability, while exhibiting an attractive valuation relative to its capital employed.

Read More

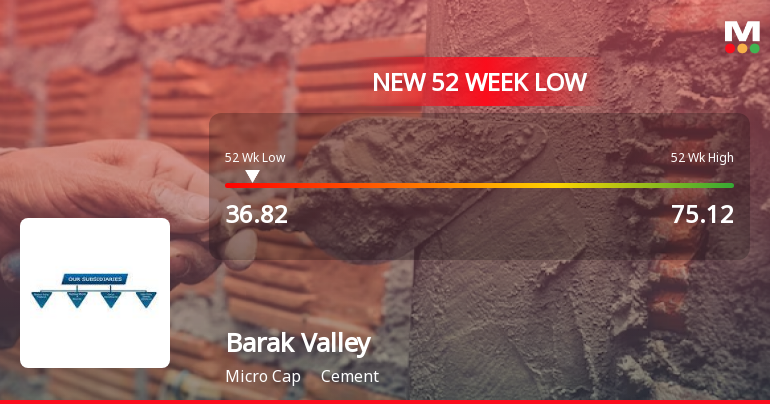

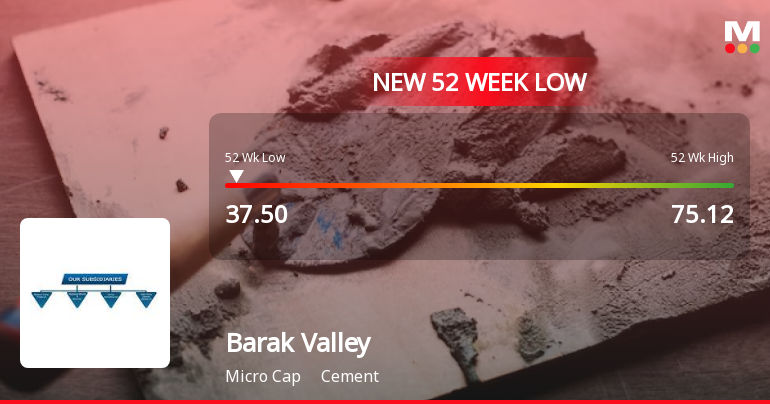

Barak Valley Cements Hits 52-Week Low Amidst Increased Market Volatility

2025-03-03 11:05:32Barak Valley Cements has reached a new 52-week low, reflecting significant volatility during trading. The stock has underperformed its sector and is trading below multiple moving averages, indicating a sustained downward trend. Over the past year, the company's performance has sharply declined compared to the broader market.

Read More

Barak Valley Cements Hits 52-Week Low Amid Industry Volatility and Decline

2025-02-28 14:35:18Barak Valley Cements has reached a new 52-week low while showing signs of a potential trend reversal after three days of decline. Despite underperforming in the past year, the stock has outperformed the cement sector recently, reflecting ongoing volatility and challenges in the market.

Read More

Barak Valley Cements Hits 52-Week Low Amid Ongoing Market Challenges

2025-02-27 14:05:25Barak Valley Cements has reached a new 52-week low, reflecting a significant decline over the past three days and a year-long downturn. The stock has underperformed its sector and is trading below key moving averages, indicating ongoing challenges in a competitive market environment.

Read More

Barak Valley Cements Hits 52-Week Low Amid Ongoing Downward Trend and Market Challenges

2025-02-17 11:35:24Barak Valley Cements has reached a new 52-week low, continuing a downward trend with a notable decline over the past four days. The stock is trading below all key moving averages and has seen a significant drop over the past year, contrasting with broader market gains.

Read More

Barak Valley Cements Reports Significant Growth in Financial Metrics for December 2024

2025-02-15 11:45:30Barak Valley Cements announced its financial results for the quarter ending December 2024, revealing significant growth in key metrics. Profit Before Tax reached Rs 2.74 crore, while Profit After Tax was Rs 1.36 crore, indicating an improvement in the company's financial health and performance trends.

Read More

Barak Valley Cements Hits 52-Week Low Amid Broader Cement Sector Challenges

2025-02-12 10:35:53Barak Valley Cements has reached a new 52-week low, reflecting a significant decline of 37.30% over the past year, contrasting with the Sensex's modest gain. Despite underperforming the broader market, the company has slightly outpaced the cement sector's decline, highlighting ongoing challenges in the industry.

Read More

Barak Valley Cements Faces Significant Volatility Amidst Broader Industry Challenges

2025-02-10 10:05:23Barak Valley Cements has faced significant volatility, hitting a new 52-week low of Rs. 40 and underperforming its sector. The stock has declined 10.01% over two days and 45.05% over the past year, contrasting with the Sensex's gains. It is trading below multiple moving averages, indicating ongoing challenges.

Read MoreFormat of the Annual Disclosure to be made by an entity identified as a LC - Annexure B2

08-Apr-2025 | Source : BSEFormat of the Annual Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Barak Valley Cements Ltd |

| 2 | CIN NO. | L01403AS1999PLC005741 |

| 3 | Report filed for FY | 2024-2025 |

| Details of the Current block (all figures in Rs crore): | ||

| 4 | 2 - year block period (Specify financial years)* | 2023-24 2024-25 |

| 5 | Incremental borrowing done in FY (T)(a) | 0.00 |

| 6 | Mandatory borrowing to be done through debt securities in FY (T) (b) = (25% of a) | 0.00 |

| 7 | Actual borrowing done through debt securities in FY (T)(c) | 0.00 |

| 8 | Shortfall in the borrowing through debt securities if any for FY (T - 1) carried forward to FY (T) (d) | 0 |

| 8 | Quantum of (d) which has been met from (c)(e)* | 0 |

| 9 | Shortfall if any in the mandatory borrowing through debt securities for FY (T) { after adjusting for any shortfall in borrowing for FY(T - 1) which was carried forward to FY(T)}(f) = (b) - [(c) - (e)]{ If the calculated value is zero or negative write nil}* | 0 |

| Details of penalty to be paid if any in respect to previous block (all figures in Rs crore): | |

| 2 - year Block period (Specify financial years) | 2023-24 2024-25 |

| Amount of fine to be paid for the block if applicable Fine = 0.2% of {(d) - (e)}# | 0.00 |

| Name of the Company Secretary :- | RACHNA GAMBHIR |

| Designation :- | COMPANY SECRETARY |

| Name of the Chief Financial Officer :- | RAJESH AGGARWAL |

| Designation : - | CFO |

Date: 08/04/2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under regulation 74(5) of SEBI (DP) Regulations 2018

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

08-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Barak Valley Cements Ltd |

| 2 | CIN NO. | L01403AS1999PLC005741 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 11.07 |

| 4 | Highest Credit Rating during the previous FY | BBB- |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CRISIL LTD. |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: COMPANY SECRETARY

EmailId: CS@BARAKCEMENT.COM

Designation: CFO

EmailId: RAJESH@BARAKCEMENT.COM

Date: 08/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Corporate Actions

No Upcoming Board Meetings

Barak Valley Cements Ltd has declared 10% dividend, ex-date: 29 Jul 10

No Splits history available

No Bonus history available

No Rights history available