Barbeque-Nation Adjusts Valuation Amidst Mixed Industry Financial Health Indicators

2025-03-12 08:00:52Barbeque-Nation Hospitality has recently undergone a valuation adjustment, reflecting its current financial standing within the lifestyle industry. The company’s PE ratio stands at -127.89, indicating a challenging earnings scenario, while its price-to-book value is recorded at 2.91. The enterprise value to EBITDA ratio is 8.50, suggesting a moderate valuation relative to earnings before interest, taxes, depreciation, and amortization. In terms of performance metrics, Barbeque-Nation's return on capital employed (ROCE) is at 4.62%, and the return on equity (ROE) is noted at -2.33%, highlighting areas of concern regarding profitability. The company’s dividend yield is not applicable, reflecting its current financial strategy. When compared to its peers, Barbeque-Nation's valuation metrics present a mixed picture. For instance, Vaibhav Global shows a PE ratio of 25.38, while Siyaram Silk maintains a strong ...

Read MoreBarbeque-Nation Faces Stock Volatility Amid Broader Market Challenges

2025-03-11 09:35:19Barbeque-Nation Hospitality, a small-cap player in the lifestyle industry, has experienced significant volatility in its stock performance today. The stock opened with a notable loss of 5.01%, reflecting a broader trend of underperformance, as it lagged behind its sector by 1.83%. Over the past two days, Barbeque-Nation has seen a cumulative decline of 6%, indicating a challenging period for the company. During today's trading session, the stock reached an intraday low of Rs 283.35, further emphasizing its downward trajectory. In terms of moving averages, Barbeque-Nation is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day averages, which may suggest ongoing challenges in maintaining upward momentum. In the context of broader market performance, Barbeque-Nation's one-day decline of 3.69% stands in contrast to the Sensex, which only fell by 0.53%. Over the past month, the stock has de...

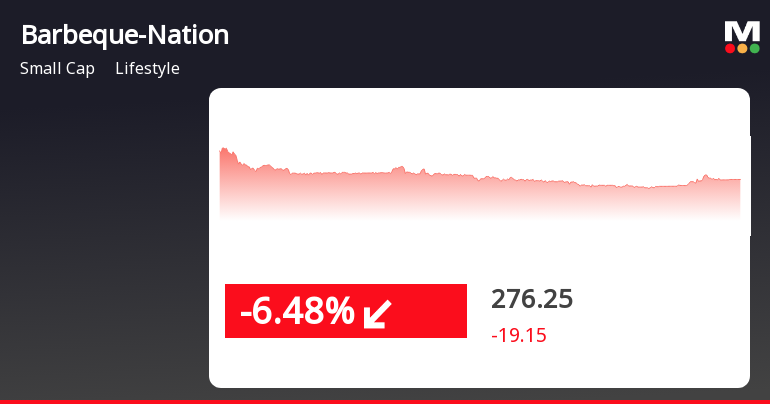

Read MoreBarbeque-Nation Stock Hits All-Time Low Amid Ongoing Volatility and Sector Underperformance

2025-03-03 09:50:17Barbeque-Nation Hospitality, a small-cap player in the lifestyle industry, has experienced significant volatility in its stock performance today. The stock opened with a notable loss of 6.72%, reaching a new 52-week and all-time low of Rs. 262.35. This decline marks a continued downward trend, as the stock has now fallen for five consecutive days, resulting in a total decrease of 12.64% over this period. In terms of market performance, Barbeque-Nation has underperformed its sector by 3.15% today, with a one-day performance of -4.16% compared to the Sensex's slight decline of 0.13%. Over the past month, the stock has seen a more substantial drop of 13.47%, while the Sensex has decreased by 5.29%. Additionally, Barbeque-Nation is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a persistent bearish trend. Investors and market watchers will be keen to observ...

Read More

Barbeque-Nation Hospitality Faces Ongoing Market Struggles Amid Significant Stock Decline

2025-03-03 09:37:56Barbeque-Nation Hospitality has faced significant volatility, hitting a new 52-week low and underperforming its sector. The stock has dropped consecutively over the past five days and is trading below key moving averages, reflecting ongoing challenges and a substantial decline in performance over the past year.

Read MoreBarbeque-Nation Adjusts Valuation Amidst Mixed Financial Metrics and Market Underperformance

2025-03-01 08:00:33Barbeque-Nation Hospitality has recently undergone a valuation adjustment, reflecting its current market position within the lifestyle industry. The company's financial metrics present a mixed picture, with a notably high PE ratio of -127.50, indicating challenges in profitability. The price-to-book value stands at 2.90, while the EV to EBITDA ratio is reported at 8.48, suggesting a moderate valuation relative to earnings before interest, taxes, depreciation, and amortization. In terms of performance, Barbeque-Nation has experienced significant declines in stock returns over various periods. Year-to-date, the stock has fallen by 36.4%, and over the past year, it has decreased by 52.58%. Comparatively, the broader Sensex index has shown a modest gain of 1.24% over the same timeframe, highlighting the underperformance of Barbeque-Nation relative to the market. When compared to its peers, Barbeque-Nation's v...

Read More

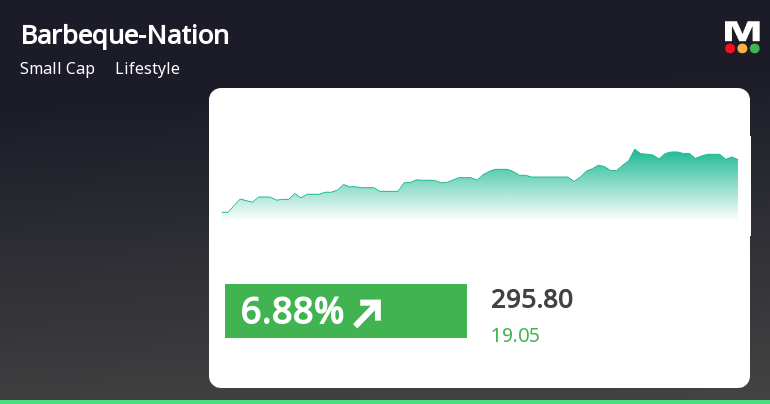

Barbeque-Nation Hospitality Shows Strong Short-Term Gains Amid Broader Market Decline

2025-02-20 12:50:24Barbeque-Nation Hospitality experienced notable stock activity on February 20, 2025, with significant gains and high volatility. The stock outperformed its sector and reached an intraday high, while also showing a mixed performance over the past month compared to broader market indices.

Read More

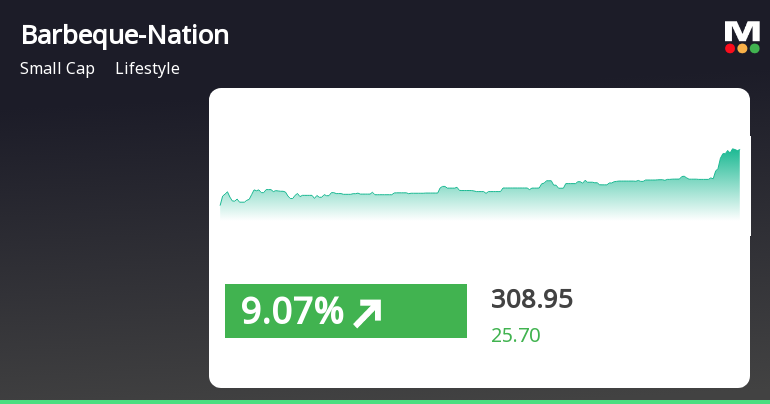

Barbeque-Nation's Stock Surge Signals Potential Market Sentiment Shift Amid Volatility

2025-02-19 10:35:38Barbeque-Nation Hospitality experienced notable trading activity on February 19, 2025, reversing a two-day decline with a significant gain. The stock opened higher and reached an intraday peak, outperforming its sector. Despite this, it remains below several key moving averages, indicating mixed long-term trends amid recent volatility.

Read More

Barbeque-Nation Hits All-Time Low Amidst Sustained Market Volatility and Underperformance

2025-02-12 13:50:25Barbeque-Nation Hospitality's stock has faced notable volatility, hitting a new 52-week low and declining significantly over the past three days. The stock underperformed its sector and is trading below multiple moving averages, reflecting ongoing challenges in the market, with a substantial drop over the past month.

Read More

Barbeque-Nation Hospitality Faces Significant Stock Volatility Amid Market Challenges

2025-02-12 09:38:21Barbeque-Nation Hospitality has faced notable volatility, reaching a new 52-week low and experiencing an 8.63% decline over three days. The stock underperformed its sector and is trading below key moving averages, reflecting ongoing challenges in the lifestyle industry amid a significant year-over-year decline.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECompliance Certificate under Reg. 74 (5) of SEBI (D & P) Regulations 2018 - Q4FY25

Update On Incorporation Of A Step-Down Subsidiary In The Kingdom Of Saudi Arabia

08-Apr-2025 | Source : BSEUpdate on incorporation of Step-Down Subsidiary in the Kingdom of Saudi Arabia

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on March 28 2025 for Sayaji Housekeeping Services Ltd

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available