Bayer CropScience Faces Mixed Technical Signals Amid Market Evaluation Revision

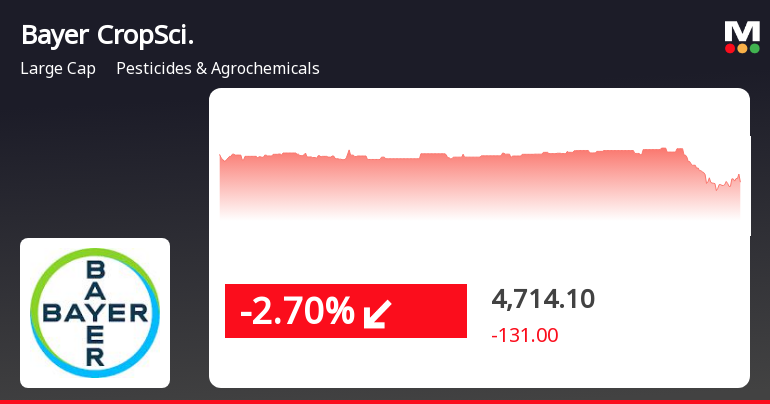

2025-04-02 08:04:17Bayer CropScience, a prominent player in the Pesticides and Agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,805.30, down from a previous close of 4,909.00, with a notable 52-week high of 7,189.90 and a low of 4,220.05. Today's trading saw a high of 4,935.05 and a low of 4,770.70, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and moving averages indicate bearish trends, suggesting caution in the short term. Additionally, the KST reflects a bearish stance on the weekly chart, while the monthly view is mildly bearish. In terms of performance, Bayer CropScience's stock return over the past year has been negative at -1...

Read MoreBayer CropScience Faces Mixed Technical Trends Amid Market Evaluation Revision

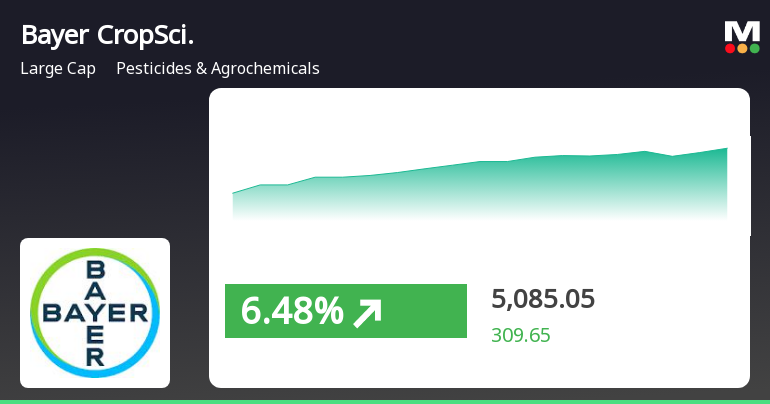

2025-04-01 08:01:27Bayer CropScience, a prominent player in the Pesticides and Agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 4,909.00, showing a notable increase from the previous close of 4,775.40. Over the past year, Bayer has experienced fluctuations, with a 52-week high of 7,189.90 and a low of 4,220.05. In terms of technical indicators, the weekly MACD and KST are showing bearish trends, while the monthly indicators reflect a mildly bearish stance. The Bollinger Bands and moving averages also align with this assessment, indicating a cautious outlook. The Dow Theory presents a mixed picture, with a mildly bullish weekly trend contrasted by a mildly bearish monthly trend. When comparing Bayer's performance to the Sensex, the stock has shown varied returns. Over the past month, Bayer's return stands at 3.37%, while t...

Read More

Bayer CropScience Experiences Notable Trend Reversal Amid Market Volatility

2025-03-28 09:30:22Bayer CropScience experienced notable trading activity on March 28, 2025, reversing a three-day decline with a significant intraday high. The stock demonstrated high volatility and is currently positioned above several short-term moving averages, while the broader market showed mixed performance, particularly among small-cap stocks.

Read More

Bayer CropScience Faces Continued Decline Amid Broader Market Resilience

2025-03-27 15:15:28Bayer CropScience's stock has declined for three consecutive days, reflecting a broader bearish trend as it underperforms against the sector. Currently trading below key moving averages, the stock has seen significant year-to-date and annual declines, contrasting with the Sensex's recent recovery and gains.

Read More

Bayer CropScience Faces Bearish Trends Amid Declining Financial Performance and Elevated Valuation Concerns

2025-03-26 08:08:11Bayer CropScience has experienced a recent evaluation adjustment, reflecting changes in its technical trends. The company has faced challenges in financial performance, with declines in key metrics and a negative return over the past year, raising concerns about its long-term growth potential compared to peers.

Read MoreBayer CropScience Faces Technical Challenges Amidst Market Underperformance and Evaluation Revision

2025-03-26 08:01:56Bayer CropScience, a prominent player in the Pesticides and Agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,872.00, down from a previous close of 4,954.30. Over the past year, Bayer has experienced a decline of 4.25%, contrasting with a 7.12% gain in the Sensex, highlighting a notable underperformance relative to the broader market. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Bollinger Bands on a weekly basis. The moving averages also reflect a bearish trend, suggesting a challenging environment for the stock. Despite these technical indicators, the company has shown resilience over longer periods, with a 5-year return of 53.66%, although this still lags behind the Sensex's impressive 173.40% return over the same timeframe. In terms of recent performance, B...

Read MoreBayer CropScience Faces Mixed Technical Signals Amidst Market Divergence

2025-03-25 08:02:14Bayer CropScience, a prominent player in the pesticides and agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,954.30, showing a notable increase from the previous close of 4,876.80. Over the past year, Bayer has experienced a 2.63% decline in stock return, contrasting with a 7.07% gain in the Sensex, highlighting a divergence in performance relative to the broader market. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook leans towards a mildly bearish stance. The Bollinger Bands and moving averages also indicate a mildly bearish trend, suggesting caution among market participants. The KST reflects a bearish position on both weekly and monthly scales, further emphasizing the mixed signals present in the stock's technical landscape. Bayer's performance...

Read MoreBayer CropScience Faces Technical Trend Shifts Amid Market Evaluation Adjustments

2025-03-24 08:01:05Bayer CropScience, a prominent player in the Pesticides & Agrochemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,876.80, down from a previous close of 4,959.00, with a notable 52-week high of 7,189.90 and a low of 4,220.05. Today's trading saw a high of 4,999.00 and a low of 4,840.00. The technical summary indicates a bearish sentiment in the weekly MACD and daily moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands and KST also reflect a similar mildly bearish stance on a monthly basis. Notably, the Dow Theory suggests a mildly bullish trend on a weekly basis, contrasting with the overall bearish indicators. In terms of performance, Bayer CropScience's returns have varied significantly over different periods. Year-to-date, the stock has seen a decline of 12.19%, while the Se...

Read More

Bayer CropScience Faces Financial Challenges Amid Declining Profitability and Market Scrutiny

2025-03-21 08:02:30Bayer CropScience has experienced a recent evaluation adjustment, reflecting changes in its technical trends amid ongoing financial challenges. The company has reported declining profitability and negative results for four consecutive quarters, raising concerns about its market position and performance relative to industry peers.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEThis is to certify that the details of securities dematerialized / rematerialized during the period January 01 2025 to March 31 2025 as required under Regulation 74(5) of SEBI DP Regulations 2018 have been furnished by the RTA of the Company.

Announcement under Regulation 30 (LODR)-Newspaper Publication

04-Apr-2025 | Source : BSEPursuant to Regulation 47 of SEBI LODR Regulations 2015 we hereby enclose the copies of the outcome of Postal Ballot published in Financial Express in English language and Loksatta in Marathi language on April 04 2025.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

03-Apr-2025 | Source : BSEPursuant to Regulation 44(3) of the SEBI Listing Regulations 2015 we herewith attach the details of voting results of the Postal Ballot Notice dated February 11 2025 along with Scrutinizers Report.

Corporate Actions

No Upcoming Board Meetings

Bayer CropScience Ltd has declared 900% dividend, ex-date: 28 Nov 24

No Splits history available

No Bonus history available

No Rights history available