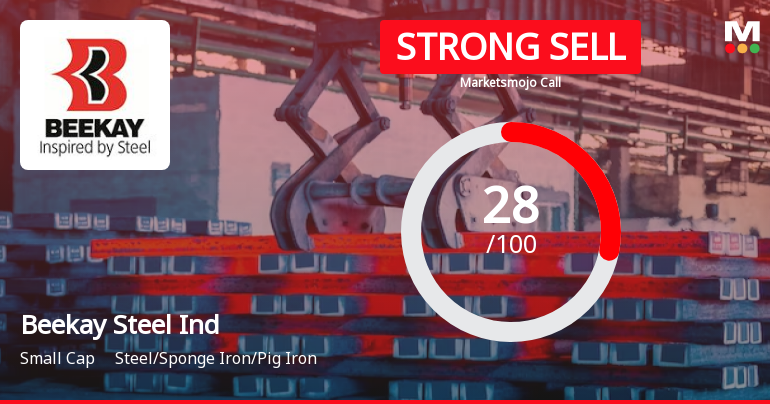

Beekay Steel Industries Adjusts Valuation Amidst Mixed Financial Performance Indicators

2025-04-03 08:00:14Beekay Steel Industries has recently experienced a change in its valuation grade, indicating a shift in its market evaluation. Key financial metrics include a PE ratio of 8.12 and a price-to-book value of 0.98, although the company has faced challenges with declining operating profit growth and negative results in recent quarters.

Read MoreBeekay Steel Industries Adjusts Valuation Grade Amid Competitive Market Landscape

2025-04-03 08:00:04Beekay Steel Industries has recently undergone a valuation adjustment, reflecting its current standing in the steel industry. The company, categorized as a microcap, showcases a price-to-earnings (PE) ratio of 8.12 and a price-to-book value of 0.98, indicating a relatively low valuation compared to its peers. Its enterprise value to EBITDA stands at 8.98, while the enterprise value to sales is recorded at 1.14, suggesting a competitive position in the market. In terms of financial performance, Beekay Steel Industries has a return on capital employed (ROCE) of 8.52% and a return on equity (ROE) of 12.66%. The company's dividend yield is modest at 0.19%. When compared to its peers, Beekay Steel's valuation metrics appear more favorable, particularly against companies like Gandhi Special Tube and Espire Hospital, which are positioned at higher valuation levels. Over the past year, Beekay Steel has experience...

Read More

Beekay Steel Industries Faces Financial Challenges Amidst Market Evaluation Adjustments

2025-03-12 08:00:15Beekay Steel Industries has recently adjusted its evaluation, reflecting challenges in its financial performance for Q3 FY24-25. Key metrics indicate a decline in operating profit and return on capital employed, although the company shows a strong capacity to manage debt. Its valuation remains attractive compared to peers.

Read MoreBeekay Steel Industries Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-07 08:00:35Beekay Steel Industries has recently undergone a valuation adjustment, reflecting its current standing in the steel, sponge iron, and pig iron industry. The company reports a price-to-earnings (P/E) ratio of 8.28 and a price-to-book value of 1.00, indicating a competitive position in terms of valuation metrics. Its enterprise value to EBITDA stands at 9.14, while the enterprise value to EBIT is recorded at 12.28, suggesting a balanced approach to earnings and operational efficiency. In terms of returns, Beekay Steel has shown varied performance against the Sensex. Over the past week, the stock returned 2.28%, contrasting with a slight decline in the Sensex. However, on a year-to-date basis, the company has experienced a decline of 22.36%, while the Sensex has only dipped by 4.86%. Notably, over a three-year period, Beekay Steel has achieved a return of 32%, although this is slightly lower than the Sensex's...

Read More

Beekay Steel Industries Faces Financial Challenges Amidst Market Evaluation Adjustments

2025-03-07 08:00:14Beekay Steel Industries has recently experienced a change in evaluation, reflecting its current market dynamics. The company reported negative financial performance in Q3 FY24-25, with declining operating profit and profitability metrics. Despite challenges, it retains a strong capacity to service debt, though its stock has underperformed against market indices.

Read More

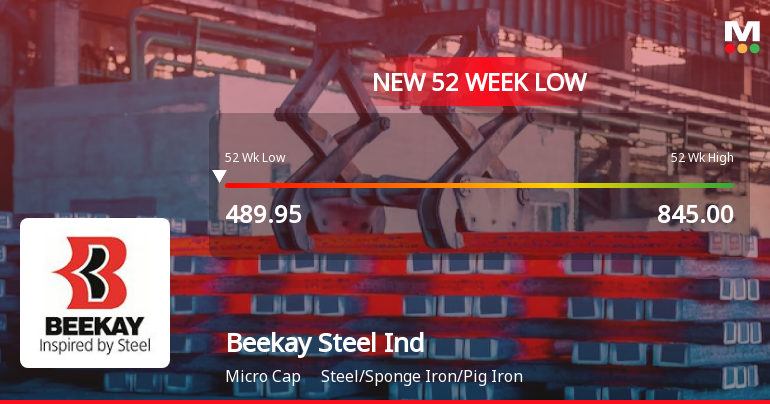

Beekay Steel Industries Faces Significant Volatility Amid Broader Market Challenges

2025-03-03 09:35:16Beekay Steel Industries has reached a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The stock has experienced consecutive losses over the past week and is trading below multiple moving averages, indicating a bearish trend. Its one-year performance shows a notable decline.

Read MoreBeekay Steel Industries Adjusts Valuation Grade Amid Competitive Industry Metrics

2025-03-01 08:00:33Beekay Steel Industries has recently undergone a valuation adjustment, reflecting its financial metrics and market position within the steel industry. The company currently exhibits a price-to-earnings (P/E) ratio of 7.72 and a price-to-book value of 0.93, indicating a favorable valuation relative to its assets. Additionally, its enterprise value to EBITDA stands at 8.61, while the enterprise value to sales is recorded at 1.09, suggesting efficient revenue generation. The company's return on capital employed (ROCE) is at 8.52%, and return on equity (ROE) is 12.66%, highlighting its ability to generate profits from its equity base. In comparison to its peers, Beekay Steel Industries demonstrates a competitive edge with a lower P/E ratio than several companies in the sector, such as Steel Exchange and Gandhi Special Tube, which have significantly higher valuations. Despite recent stock performance showing a...

Read More

Beekay Steel Industries Faces Financial Challenges Amidst Debt Servicing Resilience

2025-02-28 18:20:11Beekay Steel Industries has recently experienced an evaluation adjustment due to ongoing financial challenges, including three consecutive quarters of negative outcomes and declining operating profit growth. Despite these issues, the company demonstrates strong debt servicing capacity and a competitive return on capital employed, indicating potential resilience in its market position.

Read More

Beekay Steel Industries Hits 52-Week Low Amid Ongoing Market Challenges

2025-02-28 10:05:15Beekay Steel Industries has reached a new 52-week low, continuing a downward trend over the past four days with a total decline of 5.38%. Despite this, the company outperformed its sector slightly. The stock is trading below key moving averages and has declined 17.26% over the past year.

Read MoreDisclosure By Large Entity

04-Apr-2025 | Source : BSEDisclosure by entity not falling under large entity

Disclosure Under Reg 31(4) Of SEBI SAST

04-Apr-2025 | Source : BSEDisclosure under Reg 31(4) of SEBI SAST

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Apr-2025 | Source : BSENewspaper publication of Notice Postal Ballot & E-Voting

Corporate Actions

No Upcoming Board Meetings

Beekay Steel Industries Ltd has declared 10% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available