Bhageria Industries Adjusts Valuation Grade Amid Mixed Industry Performance Metrics

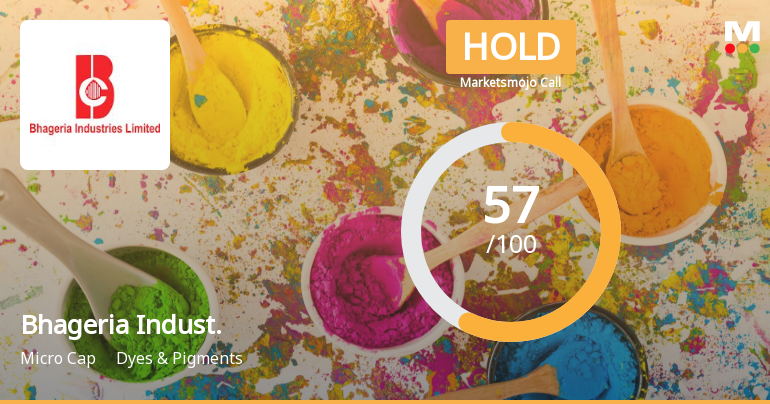

2025-02-25 10:22:33Bhageria Industries, a microcap player in the Dyes & Pigments sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of 23.27 and a price-to-book value of 1.38, indicating its current market positioning. Additionally, Bhageria's EV to EBIT stands at 20.47, while its EV to EBITDA is recorded at 10.73. The PEG ratio is notably low at 0.28, suggesting a unique valuation perspective. In terms of performance, Bhageria Industries has shown varied returns compared to the Sensex. Over the past week, the stock returned 2.29%, contrasting with a decline of 1.73% in the Sensex. However, on a year-to-date basis, the company has faced a decline of 13.14%, while the Sensex has decreased by 4.46%. When compared to its peers, Bhageria's valuation metrics present a mixed picture. For instance, Amal is positioned at a higher valuation, while companies like Dynemic Products...

Read More

Bhageria Industries Reports Strong Quarterly Growth Amid Long-Term Profit Concerns

2025-02-11 18:55:25Bhageria Industries, a microcap in the Dyes & Pigments sector, recently adjusted its evaluation following a strong quarterly performance, with a 78.09% increase in net profit and a 27.1% rise in net sales. However, long-term growth challenges persist, highlighted by a decline in operating profit over five years.

Read More

Bhageria Industries Reports 78% Profit Growth Amid Long-Term Growth Concerns

2025-02-06 18:37:20Bhageria Industries, a microcap in the Dyes & Pigments sector, reported a 78.09% increase in net profit for the quarter ending December 2024, alongside a 27.1% rise in net sales. Despite strong recent performance, the company faces challenges related to long-term growth and elevated valuation metrics.

Read More

Bhageria Industries Reports Strong Q2 FY24-25 Performance Amid Long-Term Growth Concerns

2025-01-31 19:05:14Bhageria Industries, a microcap in the Dyes & Pigments sector, has recently seen an evaluation adjustment amid positive second-quarter financial results for FY24-25. Despite a significant increase in Profit After Tax and net sales, the company faces long-term growth challenges, reflected in its declining operating profit over five years.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEWe are enclosing herewith a copy of the certificate received from MUFG Intime India Private Limited Registrar and share transfer agent of the Company for the Quarter and Year ended March 31 2025

Investor Grievance Redressal Report For The Quarter Ended March 31 2025

04-Apr-2025 | Source : BSEInvestor Grievance redressal Report for the Quarter ended March 31 2025

Closure of Trading Window

20-Mar-2025 | Source : BSEWe hereby informed that the Trading window for dealing of Securities of the Company shall remain closed for all designated person of the Company and their immediate relative from April 1 2025 till 48 hours after declaration of Audited Financial result for the year ended and quarter ended March 31 2025

Corporate Actions

No Upcoming Board Meetings

Bhageria Industries Ltd has declared 20% dividend, ex-date: 23 Aug 24

Bhageria Industries Ltd has announced 5:10 stock split, ex-date: 26 Oct 16

Bhageria Industries Ltd has announced 1:1 bonus issue, ex-date: 17 Jul 19

No Rights history available