Bhagiradha Chemicals Shows Mixed Technical Trends Amid Strong Historical Performance

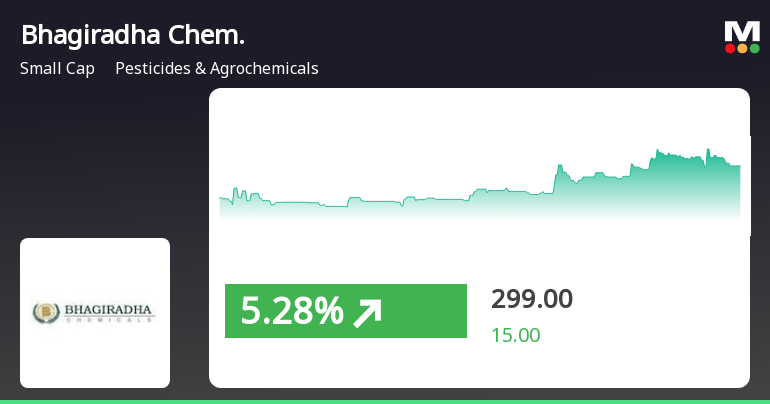

2025-04-02 08:00:13Bhagiradha Chemicals & Industries, a small-cap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 284.65, showing a notable increase from the previous close of 276.50. Over the past year, Bhagiradha Chemicals has demonstrated impressive performance, with a return of 73.65%, significantly outpacing the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate a mildly bearish trend weekly, contrasting with a bullish stance on a monthly basis. Moving averages reflect a bearish sentiment on a daily scale, while the KST presents a mixed picture with a bearish weekly trend and a bullish monthly trend. The compa...

Read MoreBhagiradha Chemicals Faces Mixed Technical Trends Amid Strong Long-Term Growth Performance

2025-03-26 08:00:07Bhagiradha Chemicals & Industries, a small-cap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 282.00, slightly down from the previous close of 283.20. Over the past year, Bhagiradha has shown a remarkable return of 73.59%, significantly outperforming the Sensex, which recorded a return of 7.12% in the same period. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators present a mixed picture with some mildly bullish signals. The Relative Strength Index (RSI) shows a bearish trend on a monthly basis, suggesting a cautious outlook. Additionally, the Bollinger Bands and KST metrics reflect varied trends, with the latter indicating bullishness on a monthly scale. In terms of stock performance, Bhagiradha Chemicals has demon...

Read MoreTechnical Indicators Signal Bearish Sentiment for Bhagiradha Chemicals Amid Market Fluctuations

2025-03-03 08:01:06Bhagiradha Chemicals & Industries, a small-cap player in the pesticides and agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 284.35, down from a previous close of 292.55, with a notable 52-week high of 448.00 and a low of 152.50. Today's trading saw a high of 295.25 and a low of 283.20. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) presents a bearish outlook for the month, and Bollinger Bands reflect a bearish trend weekly, although mildly bullish on a monthly scale. Moving averages also indicate a bearish stance, and the KST shows a mixed signal with a bearish weekly trend and bullish monthly outlook. In terms of performance, Bhagiradha Chemicals has demo...

Read MoreBhagiradha Chemicals Faces Bearish Technical Trends Amid Strong Long-Term Performance

2025-03-02 08:01:05Bhagiradha Chemicals & Industries, a small-cap player in the pesticides and agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 284.35, down from a previous close of 292.55, with a 52-week high of 448.00 and a low of 152.50. Today's trading saw a high of 295.25 and a low of 283.20. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) presents a bearish signal for the month, and Bollinger Bands reflect a bearish trend weekly, although mildly bullish on a monthly basis. Moving averages also indicate a bearish stance, and the KST shows a bearish trend weekly, contrasting with a bullish monthly outlook. In terms of performance, Bhagiradha Chemicals has demonstrated ...

Read MoreBhagiradha Chemicals Faces Technical Trend Shifts Amid Mixed Market Signals

2025-03-01 08:01:04Bhagiradha Chemicals & Industries, a small-cap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 284.35, down from a previous close of 292.55, with a 52-week high of 448.00 and a low of 152.50. Today's trading saw a high of 295.25 and a low of 283.20. In terms of technical indicators, the weekly MACD and RSI suggest a bearish sentiment, while the monthly indicators present a mixed picture with some mildly bullish signals. The Bollinger Bands indicate a bearish trend on the weekly scale, contrasting with a mildly bullish outlook on the monthly scale. Moving averages and KST also reflect bearish tendencies, particularly on a daily and weekly basis. When examining the company's performance against the Sensex, Bhagiradha Chemicals has shown resilience over the long term. Over the past year, ...

Read MoreBhagiradha Chemicals Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-02-28 08:01:08Bhagiradha Chemicals & Industries, a small-cap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 292.55, showing a notable increase from the previous close of 286.80. Over the past year, the company has demonstrated impressive performance, with a return of 68.31%, significantly outpacing the Sensex, which recorded a return of 2.08% during the same period. The technical summary indicates a mixed outlook, with various indicators showing differing trends. The MACD reflects a bearish stance on a weekly basis while being bullish monthly. Similarly, the Bollinger Bands and KST present a contrasting picture, with weekly indicators leaning towards a mildly bearish trend, while monthly indicators suggest bullish momentum. In terms of price action, Bhagiradha Chemicals has experienced a 52-week h...

Read MoreBhagiradha Chemicals Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-02-27 08:01:59Bhagiradha Chemicals & Industries, a small-cap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 286.80, slightly down from the previous close of 290.00. Over the past year, Bhagiradha has shown a remarkable return of 65.04%, significantly outperforming the Sensex, which recorded a return of just 2.00% in the same period. In terms of technical indicators, the weekly MACD and RSI suggest a bearish sentiment, while the monthly indicators present a mixed picture with some mildly bullish signals. The Bollinger Bands indicate bearish conditions on a weekly basis, contrasting with a mildly bullish outlook on a monthly scale. Moving averages and KST also reflect bearish trends, indicating a cautious market sentiment. Notably, Bhagiradha's performance over longer periods is impressive, with a st...

Read MoreBhagiradha Chemicals Exhibits Mixed Technical Trends Amid Strong Long-Term Performance

2025-02-25 10:25:43Bhagiradha Chemicals & Industries, a small-cap player in the Pesticides and Agrochemicals sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company’s stock price is currently at 293.90, showing a slight increase from the previous close of 290.00. Over the past year, Bhagiradha Chemicals has demonstrated significant resilience, with a remarkable return of 69.12%, far surpassing the Sensex's modest gain of 2.05% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly perspective shows a bullish trend. The Relative Strength Index (RSI) indicates no signal on a weekly basis but leans bearish monthly. Bollinger Bands and KST also reflect mixed signals, with weekly trends showing mild bearishness and monthly trends indicating bullishness. The company has shown impressive long-term performance, with a staggering ...

Read More

Bhagiradha Chemicals Shows Resilience Amid Market Fluctuations in February 2025

2025-02-14 15:15:12Bhagiradha Chemicals & Industries, a small-cap in the pesticides sector, experienced notable activity on February 14, 2025, outperforming its sector. The stock reached an intraday high amid volatility and has shown resilience over the past month, contrasting with a decline in the broader market index.

Read MoreDisclosure Under Regulation 31 (4) Of SEBI (Substantial Acquisition Of Shares And Takeovers) Regulations 2011 Received From The Promoters/Promoter Group Of The Company

04-Apr-2025 | Source : BSEDisclosure under Regulation 31(4) of SEBI (Substantial Acquisition of shares and Takeover) Regulations 2011 received from the Promoters/Promoters Group of the company

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

01-Apr-2025 | Source : BSECompliance Certificate under Reg 74 (5) of SEBI (DP) Regulations 2018

Closure of Trading Window

22-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Bhagiradha Chemicals & Industries Ltd has declared 10% dividend, ex-date: 02 Aug 24

Bhagiradha Chemicals & Industries Ltd has announced 1:10 stock split, ex-date: 02 May 24

No Bonus history available

Bhagiradha Chemicals & Industries Ltd has announced 4:17 rights issue, ex-date: 07 Apr 22