Bhakti Gems & Jewellery Ltd Sees 20.54% Surge Amid Market Volatility

2025-04-01 15:25:20Bhakti Gems & Jewellery Ltd is witnessing significant buying activity today, marking a notable performance in the diamond and gold jewellery sector. The stock has surged by 20.54% in a single day, contrasting sharply with the Sensex, which has declined by 1.80%. This uptick comes after six consecutive days of declines, indicating a potential trend reversal. The stock opened with a gap up of 5.53% and reached an intraday high of Rs 12.8, reflecting a 20.08% increase. Despite this strong performance today, Bhakti Gems has faced challenges over the longer term, with a year-to-date decline of 12.53% compared to the Sensex's drop of only 2.71%. Over the past three years, the stock has decreased by 29.16%, while the Sensex has appreciated by 28.25%. The high volatility observed today, with an intraday fluctuation of 8.66%, suggests active trading and investor engagement. Bhakti Gems is currently trading below i...

Read More

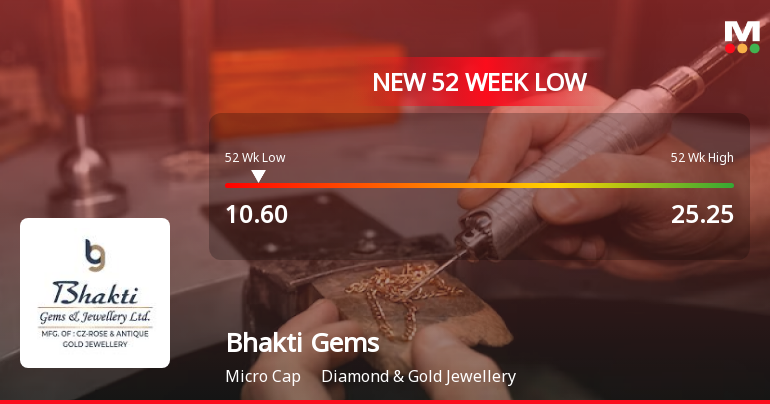

Bhakti Gems & Jewellery Faces Market Challenges Amid Potential Trend Reversal

2025-03-28 14:07:41Bhakti Gems & Jewellery, a microcap in the diamond and gold jewellery sector, has seen notable market activity as it hit a 52-week low. Despite recent declines, it has outperformed its sector. The company's long-term fundamentals show concerning trends, including declining operating profits and low return on equity.

Read More

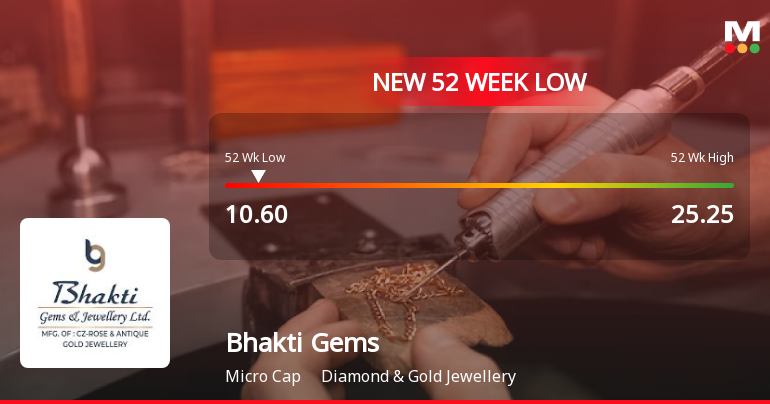

Bhakti Gems & Jewellery Faces Significant Volatility Amid Weak Long-Term Fundamentals

2025-03-27 10:08:15Bhakti Gems & Jewellery, a microcap in the diamond and gold jewellery sector, has faced notable volatility, reaching a new 52-week low. The stock has underperformed its sector and shows a bearish trend across various moving averages. Long-term fundamentals indicate weak growth and challenges in debt servicing.

Read More

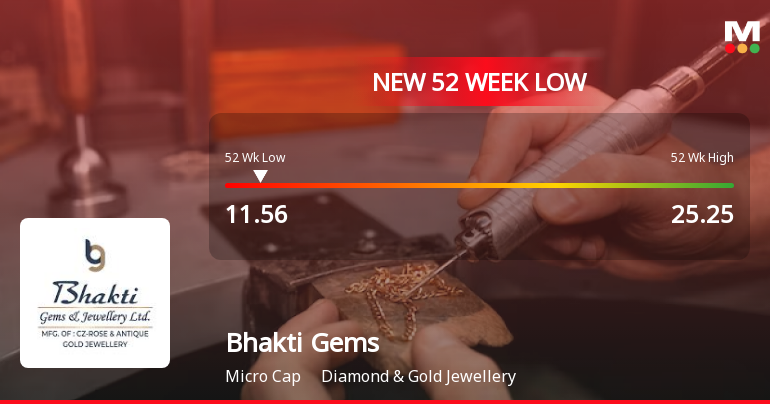

Bhakti Gems & Jewellery Faces Ongoing Challenges Amid Broader Market Recovery

2025-03-27 10:08:12Bhakti Gems & Jewellery has reached a new 52-week low, continuing a downward trend with a five-day drop. The company's stock underperforms its sector, and its long-term fundamentals show weak growth and low return on equity. Additionally, concerns about debt servicing persist amid a challenging market environment.

Read More

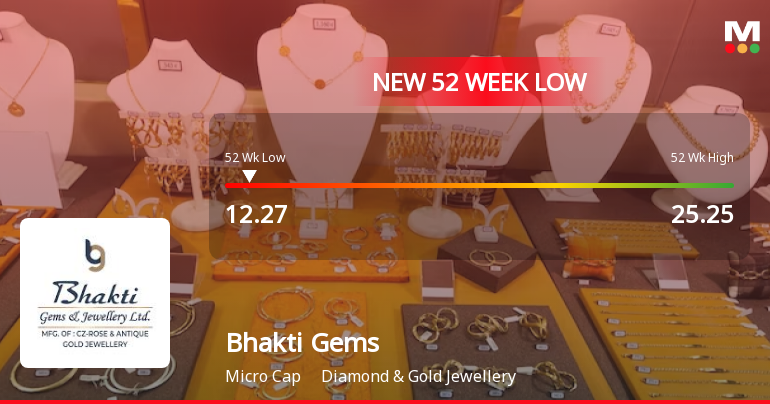

Bhakti Gems Faces Ongoing Challenges Amid Significant Stock Volatility and Declining Profitability

2025-03-26 10:39:41Bhakti Gems & Jewellery has faced notable volatility, reaching a new 52-week low and experiencing a decline for four consecutive days. The company's one-year performance has decreased significantly, contrasting with broader market gains. Weak operating profit margins and low return on equity highlight ongoing challenges in profitability and growth.

Read More

Bhakti Gems & Jewellery Faces Significant Volatility Amid Weak Fundamentals and Bearish Trends

2025-03-25 09:43:30Bhakti Gems & Jewellery, a microcap in the diamond and gold jewellery sector, has hit a new 52-week low and has underperformed its sector. The stock has declined over the past three days and shows weak long-term fundamentals, including negative growth in operating profits and low return on equity.

Read More

Bhakti Gems & Jewellery Faces Continued Decline Amid Broader Market Gains

2025-03-25 09:43:20Bhakti Gems & Jewellery, a microcap in the diamond and gold jewellery sector, has hit a new 52-week low amid ongoing volatility. The company faces challenges with weak long-term fundamentals, including declining operating profits and a concerning debt servicing ability, while the broader market shows positive momentum.

Read More

Bhakti Gems & Jewellery Faces Continued Decline Amid Weak Financial Fundamentals

2025-03-17 12:37:14Bhakti Gems & Jewellery has faced significant volatility, reaching a new 52-week low and continuing a downward trend. The company has underperformed its sector and recorded a notable decline over the past year. Weak long-term fundamentals and concerns about debt servicing further complicate its market position.

Read MoreBhakti Gems & Jewellery Experiences Valuation Grade Change Amidst Competitive Market Challenges

2025-03-17 08:00:56Bhakti Gems & Jewellery, a microcap player in the diamond and gold jewellery industry, has recently undergone a valuation adjustment. The company's current price stands at 13.27, with a 52-week range between 12.50 and 25.25. Key financial metrics reveal a price-to-earnings (PE) ratio of 19.96 and an EV to EBITDA ratio of 12.43, indicating its market positioning within the sector. In comparison to its peers, Bhakti Gems shows a relatively competitive PE ratio, although it trails behind some companies like Manoj Vaibhav, which has a significantly lower PE ratio of 10.11. The company's return on capital employed (ROCE) is reported at 8.39%, while its return on equity (ROE) is at 2.51%. When examining performance over various time frames, Bhakti Gems has experienced declines, with a year-to-date return of -9.67%, contrasting with a positive return of 1.47% for the Sensex. Over a three-year period, the stock ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find the certificate under Regulation 74(5) of SEBI (DP) Regulation 2018 for the quarter ended on 31st March 2025 in the attached PDF.

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

05-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Bhakti Gems and Jewellery Ltd |

| 2 | CIN NO. | L36910GJ2010PLC060064 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 1.53 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary

EmailId: compliancebhakti@gmail.com

Designation: Chief Financial Officer

EmailId: compliancebhakti@gmail.com

Date: 05/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Closure of Trading Window for the quarter and year ended on 31st March 2025 in the PDF attached.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

Bhakti Gems & Jewellery Ltd has announced 15:100 bonus issue, ex-date: 04 Oct 19

Bhakti Gems & Jewellery Ltd has announced 1:2 rights issue, ex-date: 31 May 23