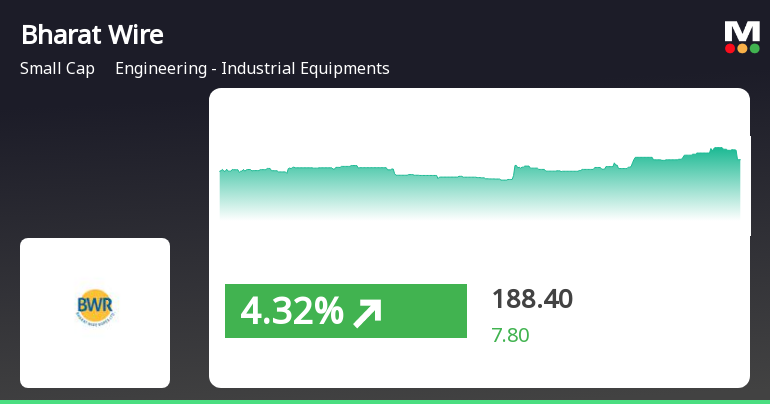

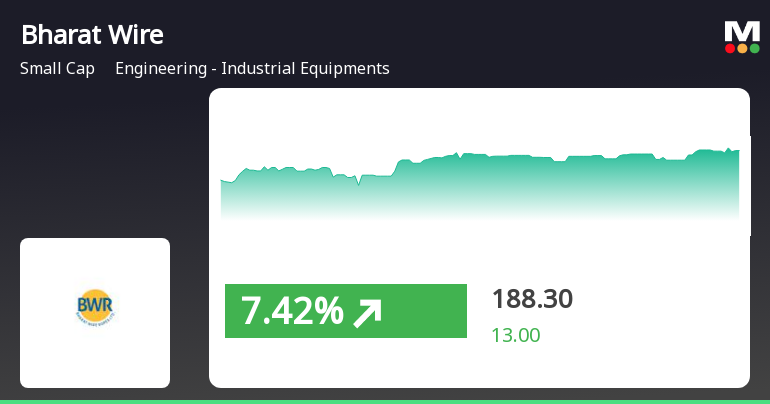

Bharat Wire Ropes Outperforms Market Amid High Volatility and Strong Momentum

2025-03-28 15:20:25Bharat Wire Ropes has demonstrated notable performance, gaining 7.42% on March 28, 2025, and outperforming its sector. The stock has shown strong momentum, reaching an intraday high of Rs 194, while also achieving a cumulative return of 9.48% over two days and 34.18% over the past month.

Read MoreBharat Wire Ropes Adjusts Valuation Grade, Showcasing Strong Financial Health and Market Position

2025-03-27 08:00:51Bharat Wire Ropes, a small-cap player in the Engineering - Industrial Equipment sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company currently boasts a price-to-earnings (P/E) ratio of 16.48 and an enterprise value to EBITDA ratio of 10.02, indicating a competitive standing within its industry. Additionally, Bharat Wire's return on capital employed (ROCE) is reported at 15.45%, while its return on equity (ROE) stands at 10.51%. In comparison to its peers, Bharat Wire Ropes demonstrates a favorable valuation profile. For instance, while companies like Bondada Engineer and Standard Glass exhibit significantly higher P/E ratios, Bharat Wire maintains a more attractive valuation relative to its operational performance. The company's recent stock performance has also shown resilience, with a notable return of 22.46% over the past month, ...

Read More

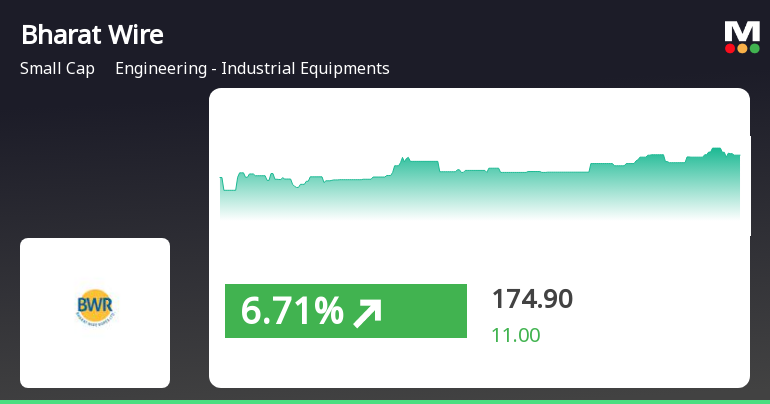

Bharat Wire Ropes Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-21 11:35:22Bharat Wire Ropes has experienced notable activity, gaining 7.5% on March 21, 2025, and outperforming its sector. The stock has shown consecutive gains over three days, totaling 15.95%. Despite recent performance, it remains down 30.66% over the past year, contrasting with the Sensex's positive trend.

Read MoreBharat Wire Ropes Faces Mixed Technical Trends Amid Market Volatility

2025-03-21 08:02:47Bharat Wire Ropes, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 175.30, showing a notable increase from the previous close of 163.90. Over the past year, the stock has experienced significant volatility, with a 52-week high of 330.00 and a low of 122.40. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands and moving averages also indicate a similar trend, with the daily moving average reflecting a mildly bearish stance. The Dow Theory presents a mixed picture, showing mild bullishness on a weekly basis but a bearish trend monthly. When comparing the stock's performance to the Sensex, Bharat Wire Ropes has shown varied returns. Over the past week, th...

Read More

Bharat Wire Ropes Outperforms Sector Amid Broader Market Rally and Positive Momentum

2025-03-20 13:50:21Bharat Wire Ropes has experienced notable trading activity, with a significant rise today and a cumulative return of 8.77% over the past two days. The stock is currently above its short-term moving averages but below its longer-term ones, amid a broader market rally led by the Sensex.

Read MoreBharat Wire Ropes Adjusts Valuation Grade Amid Competitive Industry Dynamics

2025-03-18 08:00:58Bharat Wire Ropes, a small-cap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (P/E) ratio of 15.07 and an enterprise value to EBITDA ratio of 9.24, indicating a competitive position within its industry. Bharat Wire's return on capital employed (ROCE) stands at 15.45%, while its return on equity (ROE) is recorded at 10.51%. In comparison to its peers, Bharat Wire Ropes demonstrates a more favorable valuation profile, particularly when contrasted with companies like Bondada Engineer, which does not qualify for valuation metrics, and several others that are categorized as very expensive. Notably, Bharat Wire's PEG ratio is at 0.00, suggesting a unique positioning in terms of growth expectations relative to its earnings. Despite recent fluctuations in stock price, with a current price of 162.00 and a...

Read MoreBharat Wire Ropes Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-12 08:02:56Bharat Wire Ropes, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 175.75, down from a previous close of 183.15, with a notable 52-week high of 330.00 and a low of 122.40. Today's trading saw a high of 180.40 and a low of 172.95. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Relative Strength Index (RSI) and On-Balance Volume (OBV) are currently signaling no trend, suggesting a period of consolidation. In terms of performance, Bharat Wire Ropes has shown varied returns compared to the Sensex. Over the past week, the stock has returned 32.64%, significantly outperforming the Sensex's 1.52%. However, on a year-to-date basis, the stock has declined by 17.18%, wh...

Read MoreBharat Wire Ropes Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-11 08:04:42Bharat Wire Ropes, a small-cap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 183.15, showing a notable increase from the previous close of 174.25. Over the past week, Bharat Wire Ropes has demonstrated a significant return of 42.25%, contrasting sharply with the Sensex's modest gain of 1.41%. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands and moving averages also reflect a similar trend, indicating a cautious market environment. Notably, the stock's performance over various time frames reveals a mixed picture; while it has experienced a substantial return of 161.64% over three years and an impressive 806.68% over five years, it has faced challenges in the sh...

Read MoreBharat Wire Ropes Adjusts Valuation Grade Amid Strong Market Performance and Competitive Metrics

2025-03-10 08:00:55Bharat Wire Ropes, a small-cap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment. The company's current price stands at 174.25, reflecting a notable increase from the previous close of 168.35. Over the past week, Bharat Wire has demonstrated a strong performance, with a return of 21.3%, significantly outpacing the Sensex's return of 1.55%. Key financial metrics for Bharat Wire include a PE ratio of 16.21 and an EV to EBITDA ratio of 9.87, indicating a competitive position within its industry. The company's return on capital employed (ROCE) is reported at 15.45%, while the return on equity (ROE) stands at 10.51%. These figures suggest a solid operational efficiency relative to its peers. In comparison, other companies in the sector exhibit a wide range of valuation metrics. For instance, Bondada Engineer does not qualify for valuation, while L G Balakr...

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window for the quarter ended 31.03.2025

Clarification On Price Movement

12-Mar-2025 | Source : BSEClarification on Price Movement

Clarification sought from Bharat Wire Ropes Ltd

11-Mar-2025 | Source : BSEThe Exchange has sought clarification from Bharat Wire Ropes Ltd on March 11 2025 with reference to significant movement in price in order to ensure that investors have latest relevant information about the company and to inform the market so that the interest of the investors is safeguarded.

The reply is awaited.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available