BIGBLOC Construction Adjusts Valuation Amid Competitive Industry Landscape

2025-03-27 08:00:52BIGBLOC Construction has recently undergone a valuation adjustment, reflecting its current standing in the construction and real estate sector. The company's price-to-earnings (PE) ratio stands at 51.79, while its price-to-book value is recorded at 6.80. Additionally, the enterprise value to EBITDA ratio is 29.36, indicating a significant valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of performance metrics, BIGBLOC boasts a return on capital employed (ROCE) of 11.83% and a return on equity (ROE) of 18.02%. The company also offers a modest dividend yield of 0.32%. When compared to its peers, BIGBLOC's valuation metrics reveal a competitive landscape. For instance, Garuda Construction is noted for its higher valuation, while Parsvnath Development is categorized as loss-making. Other competitors like Haz.Multi Projects and Peninsula Land exhibit varying ...

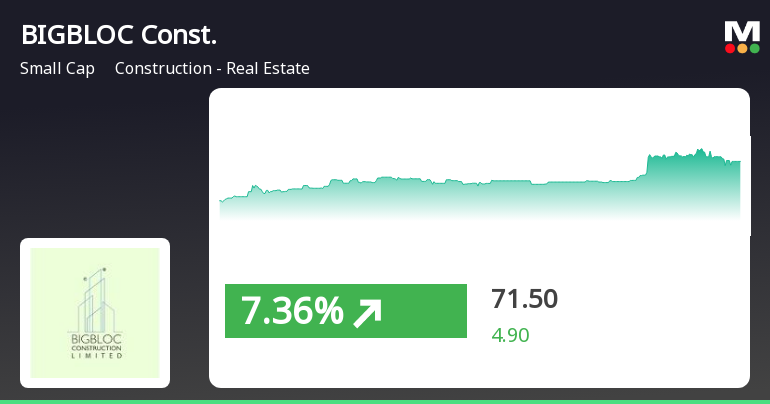

Read MoreBIGBLOC Construction Opens Strong with 5.34% Gain, Indicating Positive Market Momentum

2025-03-24 09:35:26BIGBLOC Construction, a small-cap player in the construction and real estate sector, has shown significant activity today, opening with a gain of 5.34%. The stock has outperformed its sector by 1.18%, marking a notable performance trend. Over the past two days, BIGBLOC has recorded a cumulative return of 8.66%, indicating a positive momentum. Today, the stock reached an intraday high of Rs 72.99, reflecting strong trading interest. In terms of moving averages, the stock is currently above its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-day averages, suggesting mixed signals in its short to medium-term performance. On a broader scale, BIGBLOC's one-day performance stands at 1.98%, compared to the Sensex's 0.53%, while its one-month performance is 4.00%, slightly ahead of the Sensex's 3.84%. Technical indicators present a bearish outlook on a weekly basis, with the MACD and KST ...

Read MoreBIGBLOC Construction Adjusts Valuation Grade Amid Competitive Market Dynamics

2025-03-20 08:00:58BIGBLOC Construction has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the construction and real estate industry. The company's price-to-earnings ratio stands at 53.74, while its price-to-book value is recorded at 7.05. Additionally, the enterprise value to EBITDA ratio is 30.30, indicating a significant valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of performance indicators, BIGBLOC boasts a return on equity (ROE) of 18.02% and a return on capital employed (ROCE) of 11.83%. The company also offers a modest dividend yield of 0.30%. When compared to its peers, BIGBLOC's valuation appears notably higher, with competitors like RDB Infrastructure and TransIndia Real also categorized as very expensive, yet they exhibit different financial metrics. For instance, RDB Infrastructure has a lower ...

Read MoreBIGBLOC Construction Adjusts Valuation Amidst Competitive Industry Landscape

2025-03-13 08:00:46BIGBLOC Construction, a microcap player in the construction and real estate sector, has recently undergone a valuation adjustment. The company's current price stands at 63.50, reflecting a notable decline from its 52-week high of 148.50. Key financial metrics reveal a PE ratio of 51.79 and an EV to EBITDA ratio of 29.36, indicating a premium valuation relative to its peers. In comparison, companies within the same industry exhibit a range of valuation metrics. For instance, Crest Ventures shows a significantly lower PE ratio of 10.5, while Garuda Construction and RDB Infrastructure also reflect higher valuations. Notably, BIGBLOC's return metrics indicate a mixed performance; over the past week, it has outperformed the Sensex with a return of 1.44%, while year-to-date, it has lagged with a decline of 39.41%. The company's return over three years stands at 65.04%, significantly outperforming the Sensex's 3...

Read MoreBIGBLOC Construction Adjusts Valuation Amidst Competitive Industry Landscape

2025-03-13 08:00:46BIGBLOC Construction, a microcap player in the construction and real estate sector, has recently undergone a valuation adjustment. The company's current price stands at 63.50, reflecting a notable decline from its 52-week high of 148.50. Key financial metrics reveal a PE ratio of 51.79 and an EV to EBITDA ratio of 29.36, indicating a premium valuation relative to its peers. In comparison, companies within the same industry exhibit a range of valuation metrics. For instance, Crest Ventures shows a significantly lower PE ratio of 10.5, while Garuda Construction and RDB Infrastructure also reflect higher valuations. Notably, BIGBLOC's return metrics indicate a mixed performance; over the past week, it has outperformed the Sensex with a return of 1.44%, while year-to-date, it has lagged with a decline of 39.41%. The company's return over three years stands at 65.04%, significantly outperforming the Sensex's 3...

Read More

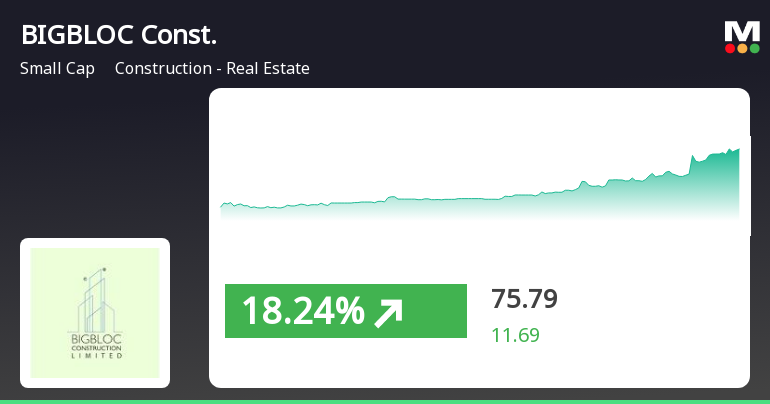

BIGBLOC Construction Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

2025-03-07 18:00:31BIGBLOC Construction has shown strong performance recently, gaining for four consecutive days and achieving a total return of 17.58%. Despite facing a decline over the past month, the company's three-year performance remains robust, significantly surpassing broader market indices. The stock's moving averages indicate mixed short to medium-term trends.

Read MoreBIGBLOC Construction Adjusts Valuation Amid Competitive Landscape in Real Estate Sector

2025-03-07 08:01:21BIGBLOC Construction has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the construction and real estate industry. The company's price-to-earnings ratio stands at 54.31, while its price-to-book value is recorded at 7.13. Additionally, BIGBLOC's enterprise value to EBITDA ratio is 30.58, indicating a significant valuation in relation to its earnings before interest, taxes, depreciation, and amortization. In comparison to its peers, BIGBLOC's valuation metrics highlight a competitive landscape. RDB Infrastructure, another player in the sector, has a slightly lower price-to-earnings ratio of 49.94, while Parsvnath Developers is currently facing challenges, being classified as loss-making. Peninsula Land presents a more favorable valuation with a price-to-earnings ratio of 48.26, showcasing a diverse range of financial health among competitors. D...

Read MoreBIGBLOC Construction Adjusts Valuation Amidst Competitive Industry Landscape and Stock Decline

2025-02-28 08:00:28BIGBLOC Construction has recently undergone a valuation adjustment, reflecting its current standing in the construction and real estate sector. The company's price-to-earnings ratio stands at 51.75, while its price-to-book value is noted at 6.79. Other significant metrics include an EV to EBIT ratio of 46.28 and an EV to EBITDA ratio of 29.34, indicating the company's valuation relative to its earnings and cash flow. In terms of performance, BIGBLOC has experienced a notable decline in stock returns over various periods, with a year-to-date return of -38.38% and a one-year return of -45.35%. However, the company has shown resilience over a longer timeframe, with a remarkable five-year return of 1558.02%. When compared to its peers, BIGBLOC's valuation metrics reveal a competitive landscape. For instance, Crest Ventures and Garuda Construction are positioned at higher valuation levels, while several other ...

Read More

BIGBLOC Construction Shows Strong Short-Term Gains Amidst High Volatility

2025-02-20 11:50:22BIGBLOC Construction has seen notable trading activity, with a significant gain today and strong performance compared to its sector. The stock reached an intraday high and low, reflecting high volatility. Despite recent challenges, it remains above its 5-day moving average while lagging behind longer-term averages.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEThe Company has informed the stock exchange regarding closure of Trading Window for declaration of Financial Results for the quarter and year ended as on 31st March 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

12-Mar-2025 | Source : BSEPlease find the attached Intimation

Announcement under Regulation 30 (LODR)-Investor Presentation

10-Mar-2025 | Source : BSEInvestor Presentation

Corporate Actions

No Upcoming Board Meetings

BIGBLOC Construction Ltd has declared 20% dividend, ex-date: 02 Aug 24

BIGBLOC Construction Ltd has announced 2:10 stock split, ex-date: 15 Nov 21

BIGBLOC Construction Ltd has announced 1:1 bonus issue, ex-date: 12 Sep 24

No Rights history available