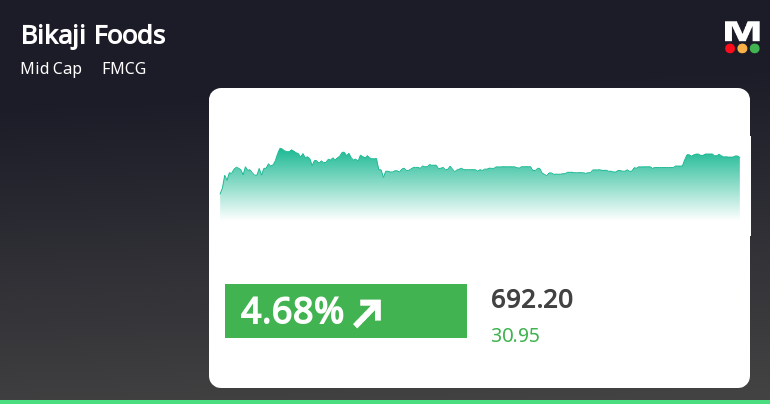

Bikaji Foods Outperforms Market Amid Broader Index Decline, Signals Positive Momentum

2025-04-01 14:20:28Bikaji Foods International has demonstrated strong performance, gaining 5.02% on April 1, 2025, and outperforming its sector. The stock has recorded consecutive gains over two days, with a total return of 6.01%. Despite broader market challenges, it has significantly outperformed the Sensex over the past month and year.

Read MoreBikaji Foods Shows Mixed Technical Trends Amidst Market Fluctuations

2025-03-13 08:02:52Bikaji Foods International, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 651.00, showing a slight increase from the previous close of 640.00. Over the past year, Bikaji Foods has demonstrated a notable return of 27.16%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the weekly MACD and RSI are currently bearish, while the monthly Bollinger Bands indicate a bullish trend. Daily moving averages also reflect bearish sentiment, suggesting a mixed technical outlook. The KST and Dow Theory show no definitive trends, indicating a period of uncertainty. When comparing the stock's performance over various time frames, it has faced challenges year-to-date with a return of -16.24%, contrasting with the Sensex's decline of -5.26...

Read MoreBikaji Foods Shows Mixed Technical Trends Amidst Market Fluctuations

2025-03-13 08:02:52Bikaji Foods International, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 651.00, showing a slight increase from the previous close of 640.00. Over the past year, Bikaji Foods has demonstrated a notable return of 27.16%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the weekly MACD and RSI are currently bearish, while the monthly Bollinger Bands indicate a bullish trend. Daily moving averages also reflect bearish sentiment, suggesting a mixed technical outlook. The KST and Dow Theory show no definitive trends, indicating a period of uncertainty. When comparing the stock's performance over various time frames, it has faced challenges year-to-date with a return of -16.24%, contrasting with the Sensex's decline of -5.26...

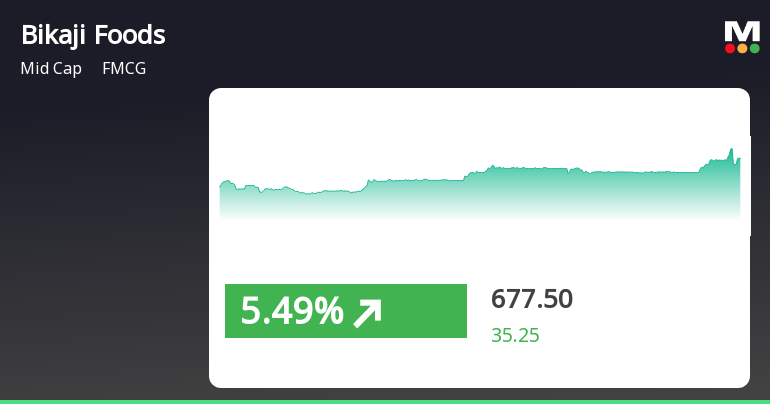

Read MoreBikaji Foods Faces Technical Bearish Trends Amid Market Volatility and Uncertainty

2025-03-11 08:05:43Bikaji Foods International, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 641.00, down from a previous close of 680.00, with a notable 52-week high of 1,005.00 and a low of 475.50. Today's trading saw a high of 677.00 and a low of 636.00, indicating some volatility in its performance. The technical summary for Bikaji Foods reveals a bearish sentiment across several indicators. The MACD and RSI metrics on a weekly basis are both bearish, while the daily moving averages also reflect a similar trend. Bollinger Bands indicate a bearish stance on the weekly chart, with a sideways trend on the monthly chart. Notably, the KST and Dow Theory show no definitive trends, suggesting a period of uncertainty. In terms of returns, Bikaji Foods has experienced a decline of 17.53% year-to-date, contrasting with a s...

Read More

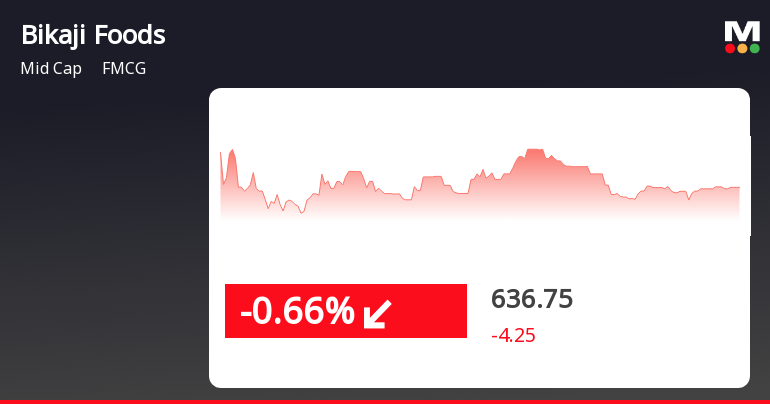

Bikaji Foods Stock Declines Amid Broader FMCG Sector Weakness and Mixed Trends

2025-03-10 15:20:26Bikaji Foods International's stock has declined significantly, reversing gains from previous days and underperforming against the FMCG sector. It is positioned variably against moving averages and has seen a notable drop over the past three months, despite a year-over-year increase. The broader market also reflects negative trends.

Read MoreBikaji Foods Faces Mixed Technical Trends Amidst FMCG Sector Challenges and Opportunities

2025-03-04 08:01:32Bikaji Foods International, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 654.15, showing a notable increase from the previous close of 627.05. Over the past year, Bikaji Foods has demonstrated resilience with a return of 25.2%, significantly outperforming the Sensex, which recorded a return of -0.98% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly indicators show a mixed outlook with the Bollinger Bands indicating a mildly bearish trend on a weekly basis and bullish on a monthly basis. The daily moving averages also reflect bearish sentiment, suggesting caution among traders. Despite recent fluctuations, the stock has shown a positive return over the past week, gaining 1.14% compared to the Sensex's decline of 1.84%. However, the one-mon...

Read MoreBikaji Foods Adjusts Valuation Amid Strong Performance Compared to FMCG Peers

2025-02-28 08:00:08Bikaji Foods International, a midcap player in the FMCG sector, has recently undergone a valuation adjustment. The company's current price stands at 624.05, reflecting a decline from its previous close of 643.90. Over the past year, Bikaji Foods has shown a return of 18.72%, significantly outperforming the Sensex, which recorded a return of 2.08% in the same period. Key financial metrics for Bikaji Foods include a PE ratio of 57.33 and an EV to EBITDA ratio of 37.85, indicating a robust market position despite the recent valuation revision. The company's return on capital employed (ROCE) is reported at 26.11%, while the return on equity (ROE) stands at 21.93%, showcasing effective management of resources. In comparison to its peers, Bikaji Foods' valuation metrics reveal a competitive landscape. For instance, Godrej Agrovet and Jyothy Labs are positioned attractively with lower PE ratios, while companies ...

Read More

Bikaji Foods Shows Strong Short-Term Performance Amid Broader Market Volatility

2025-02-21 15:20:24Bikaji Foods International experienced significant trading activity, outperforming its sector and reaching an intraday high. The stock is currently above its short-term moving averages but below longer-term ones, indicating mixed trends. Recent performance shows volatility, contrasting with the broader market's slight decline.

Read More

Bikaji Foods Faces Significant Stock Decline Amid Challenging Market Conditions

2025-02-20 09:35:24Bikaji Foods International has faced a notable decline in stock performance, losing 5.67% on February 20, 2025. The stock has underperformed its sector and experienced a 10.55% drop over the past month, contrasting with the Sensex's smaller decline. Long-term moving averages suggest a bearish trend.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

07-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Bikaji Foods International Ltd |

| 2 | CIN NO. | L15499RJ1995PLC010856 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 9.98 |

| 4 | Highest Credit Rating during the previous FY | AA-Stable |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | ICRA LIMITED |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Head Legal and Company Secretary

EmailId: cs@bikaji.com

Designation: Chief Financial Officer

EmailId: rishabh@bikaji.com

Date: 07/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

General - Non-Applicability Of Annual Disclosure Regarding Large Corporate For The Financial Year 2024-25

07-Apr-2025 | Source : BSENon-applicability of Annual Disclosure regarding Large Corporate for the Financial year 2024-25

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulation 2018

Corporate Actions

No Upcoming Board Meetings

Bikaji Foods International Ltd has declared 100% dividend, ex-date: 14 Jun 24

No Splits history available

No Bonus history available

No Rights history available