Biocon Ltd. Outperforms Sector Amid Market Volatility and Positive Momentum

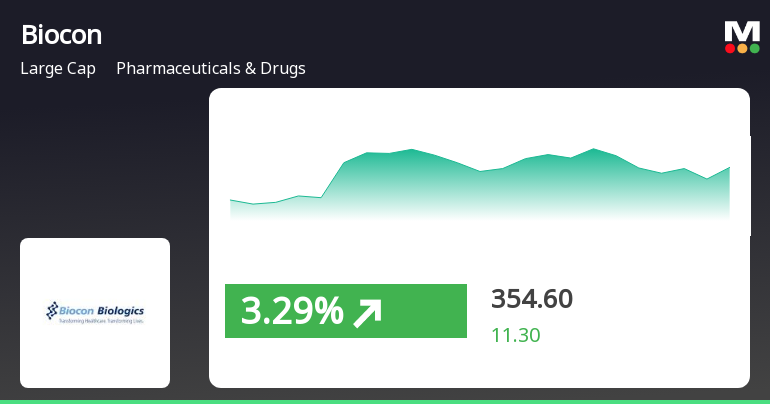

2025-04-03 09:30:23Biocon Ltd. has demonstrated strong performance in the Pharmaceuticals & Drugs sector, gaining 3.51% on April 3, 2025, and achieving a cumulative gain of 5% over two days. The stock is trading above key moving averages and has shown significant year-over-year growth, outperforming the broader market.

Read MoreBiocon Ltd. Sees Surge in Open Interest Amid Challenging Market Conditions

2025-03-28 15:00:06Biocon Ltd., a prominent player in the Pharmaceuticals & Drugs industry, has experienced a notable increase in open interest today. The latest open interest stands at 13,240 contracts, reflecting a rise of 1,511 contracts or 12.88% from the previous open interest of 11,729. The trading volume for the day reached 10,554 contracts, contributing to a total futures value of approximately Rs 18,641.72 lakhs and an options value of Rs 7,445.23 crores, bringing the total value to Rs 20,506.88 lakhs. Despite this surge in open interest, Biocon's stock has underperformed its sector by 0.34% today, with a 1D return of -0.67%. The stock has been on a downward trend, losing 1.48% over the past two days. While it is currently trading above its 20-day moving average, it remains below the 5-day, 50-day, 100-day, and 200-day moving averages. Additionally, investor participation has seen a decline, with delivery volume dro...

Read MoreBiocon Ltd. Sees Significant Open Interest Surge Amid Market Challenges

2025-03-28 14:00:05Biocon Ltd., a prominent player in the Pharmaceuticals & Drugs industry, has experienced a notable increase in open interest today. The latest open interest stands at 13,033 contracts, reflecting a rise of 1,304 contracts or 11.12% from the previous open interest of 11,729. This surge in open interest comes alongside a trading volume of 9,075 contracts, indicating active market engagement. In terms of financial metrics, Biocon's total futures value is approximately Rs 16,764.22 lakhs, while the options value is significantly higher at around Rs 6,327.04 lakhs, bringing the total value to Rs 18,325.27 lakhs. The underlying value of the stock is reported at Rs 340. Despite this increase in open interest, Biocon's stock has underperformed the sector by 0.91% today, with a 1D return of -1.32%. The stock has been on a downward trend, losing 2.2% over the past two days. Additionally, the weighted average price ...

Read More

Biocon Faces Technical Adjustments Amidst Strong Institutional Confidence and Profit Decline

2025-03-28 08:01:57Biocon has recently experienced an evaluation adjustment reflecting shifts in its technical trends, with indicators showing a cautious market outlook. Despite facing profit declines, the company maintains a low debt-to-equity ratio and strong institutional holdings, highlighting its financial stability amid changing market conditions.

Read MoreBiocon's Technical Indicators Shift Amidst Mixed Performance Trends in Pharmaceuticals Sector

2025-03-28 08:00:23Biocon, a prominent player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 344.05, slightly down from the previous close of 349.60. Over the past year, Biocon has demonstrated a stock return of 34.08%, significantly outperforming the Sensex, which recorded a return of 6.32% during the same period. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis, while the monthly perspective remains bullish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly evaluations. Bollinger Bands reflect a mildly bearish stance weekly, contrasting with a bullish monthly outlook. Daily moving averages are bearish, and the KST shows a bearish trend weekly, while remaining bullish monthly. Biocon's performance over various time frames...

Read MoreBiocon's Stock Performance Highlights Premium Valuation Amid Market Fluctuations

2025-03-27 18:00:22Biocon Ltd., a prominent player in the Pharmaceuticals & Drugs sector, has seen notable fluctuations in its stock performance today. The company, with a market capitalization of Rs 41,901.00 crore, is classified as a large-cap entity. Currently, Biocon's price-to-earnings (P/E) ratio stands at 53.66, significantly higher than the industry average of 37.39, indicating a premium valuation relative to its peers. Over the past year, Biocon has delivered a robust performance of 34.08%, outperforming the Sensex, which recorded a gain of 6.32%. However, today's trading session has seen the stock decline by 1.59%, contrasting with the Sensex's modest increase of 0.41%. In the short term, Biocon's performance over the past week is up by 0.97%, while it has gained 10.25% over the past month, again surpassing the Sensex's performance. Despite some recent volatility, Biocon's long-term trajectory remains noteworthy, ...

Read More

Biocon's Stock Rebound Signals Potential Trend Reversal Amid Mixed Market Signals

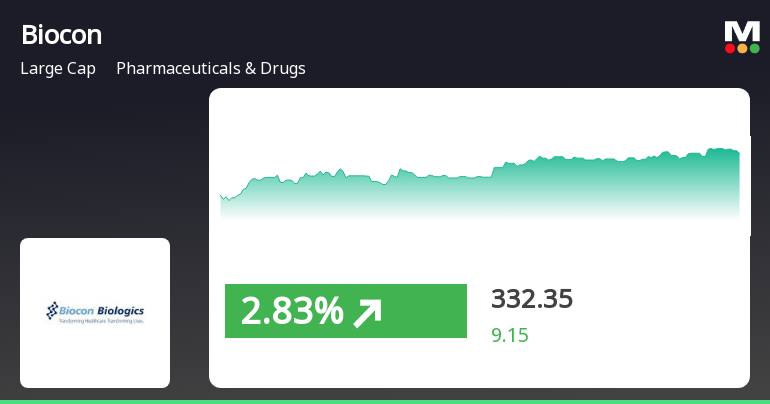

2025-03-17 12:15:18Biocon Ltd. experienced a notable rebound on March 17, 2025, gaining 3.09% after two days of decline. The stock is currently above its short-term moving averages but below longer-term ones. Year-to-date, Biocon is down 8.60%, while it has delivered a strong annual return of 32.41%.

Read More

Biocon Faces Profit Decline Amidst Strong Institutional Support and Manageable Debt Levels

2025-03-07 08:01:50Biocon has recently adjusted its evaluation amid challenging financial results for Q3 FY24-25, marked by a decline in profits. Despite this, the company maintains a low Debt to Equity ratio of 0.39, and institutional holdings stand at 21.02%, indicating investor confidence.

Read More

Biocon Ltd. Shows Resilience Amid Broader Market Fluctuations and Sector Challenges

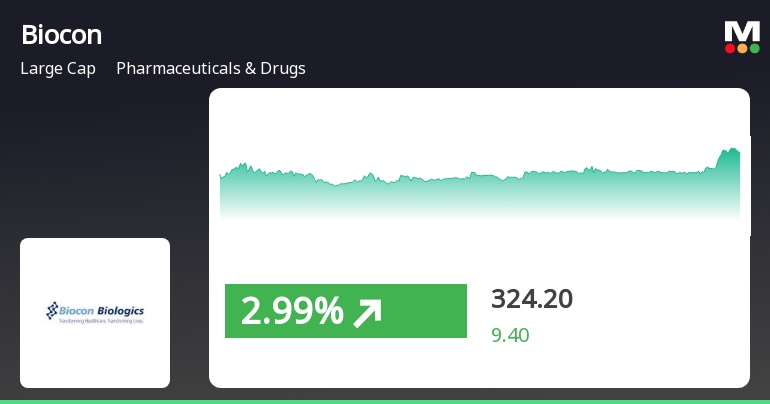

2025-03-05 14:15:18Biocon Ltd. has demonstrated significant stock activity, gaining 3.26% on March 5, 2025, and outperforming its sector. The stock has seen a total return of 6.05% over three days. Despite recent challenges, Biocon has shown resilience with a 16.05% gain over the past year.

Read MoreBoard Meeting Outcome for Outcome Of Board Meeting - Disclosure Under Reg 30

04-Apr-2025 | Source : BSEIssuance of Commercial Papers up to an amount not exceeding Rs. 600 Crores in one or more tranches on private placement basis

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

02-Apr-2025 | Source : BSEPostal Ballot Results

Shareholder Meeting / Postal Ballot-Scrutinizers Report

02-Apr-2025 | Source : BSEPostal Ballot Results

Corporate Actions

08 May 2025

Biocon Ltd. has declared 10% dividend, ex-date: 05 Jul 24

No Splits history available

Biocon Ltd. has announced 1:1 bonus issue, ex-date: 12 Jun 19

No Rights history available