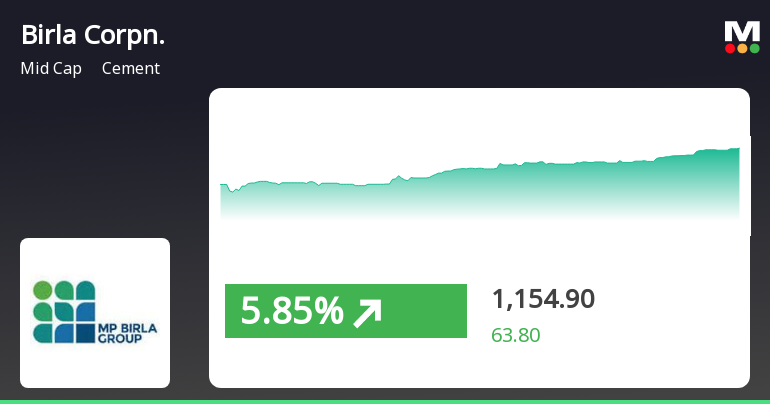

Birla Corporation Shows Resilience Amid Market Volatility with Notable Stock Gains

2025-04-03 12:00:23Birla Corporation has demonstrated strong performance in the cement sector, gaining 5.58% on April 3, 2025, and outperforming its sector. The stock has risen consistently over three days, with notable intraday highs. Despite broader market volatility, Birla Corporation's resilience is evident as it remains above several key moving averages.

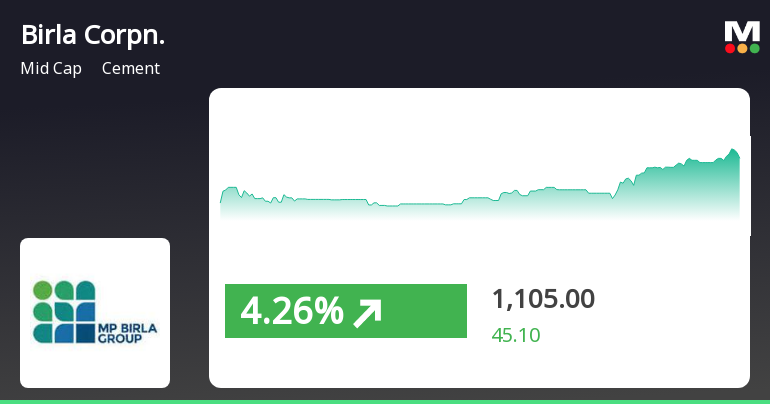

Read MoreBirla Corporation Faces Mixed Technical Trends Amid Challenging Market Conditions

2025-04-02 08:03:16Birla Corporation, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,088.25, showing a notable fluctuation with a daily high of 1,111.00 and a low of 1,050.80. Over the past year, the stock has faced challenges, with a return of -26.38%, contrasting with a modest gain of 2.72% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective remains bearish. Bollinger Bands and moving averages suggest a mildly bearish stance, reflecting cautious market sentiment. Notably, the KST remains bearish on both weekly and monthly charts, indicating underlying pressures. In terms of returns, Birla Corporation has experienced a decline of 11.48% year-to-date, while the S...

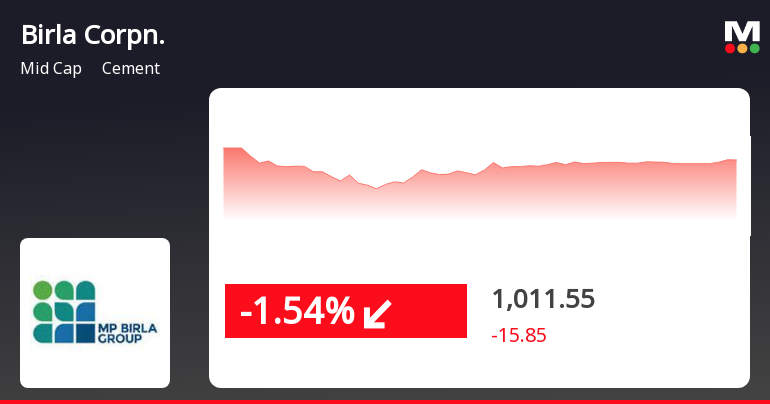

Read MoreBirla Corporation Faces Bearish Technical Trends Amidst Mixed Short-Term Performance

2025-04-01 08:01:12Birla Corporation, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,062.75, slightly down from the previous close of 1,077.00. Over the past year, the stock has faced challenges, with a notable decline of 25.39%, contrasting with a 5.11% gain in the Sensex during the same period. The technical summary indicates a bearish sentiment across various indicators. The MACD readings for both weekly and monthly periods are bearish, while the moving averages also reflect a bearish trend. The Bollinger Bands show a mildly bearish stance on both weekly and monthly charts. Additionally, the KST is bearish on a weekly basis and mildly bearish monthly, suggesting a consistent trend in the stock's performance. Despite the recent challenges, Birla Corporation has shown resilience in shorter time frames, with a 2...

Read MoreBirla Corporation Faces Mixed Technical Trends Amid Market Challenges and Evaluation Revision

2025-03-28 08:01:13Birla Corporation, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1077.00, showing a notable increase from the previous close of 1059.35. Over the past year, the stock has experienced a decline of 24.56%, contrasting with a 6.32% gain in the Sensex, highlighting the challenges faced by the company in comparison to broader market trends. The technical summary indicates a mixed performance across various indicators. The MACD remains bearish on both weekly and monthly scales, while the Bollinger Bands suggest a mildly bearish stance. The daily moving averages also reflect a mildly bearish trend, indicating some caution in the stock's performance. However, the Dow Theory shows a mildly bullish outlook on a weekly basis, suggesting some underlying strength. In terms of returns, Birla Corporation has ...

Read MoreBirla Corporation Faces Bearish Technical Trends Amid Mixed Performance Indicators

2025-03-27 08:01:04Birla Corporation, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,059.35, down from a previous close of 1,091.90, with a notable 52-week high of 1,678.00 and a low of 901.85. Today's trading saw a high of 1,103.20 and a low of 1,051.25. The technical summary indicates a bearish sentiment across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while the moving averages also reflect a bearish stance. The Bollinger Bands and KST metrics present mildly bearish signals, suggesting a cautious outlook. The Dow Theory, however, indicates a mildly bullish trend on a weekly basis, contrasting with the monthly bearish perspective. In terms of performance, Birla Corporation's stock return over the past week stands at 2.27%, slightly lagging behind the Sensex's return of...

Read MoreBirla Corporation's Technical Indicators Signal Mixed Trends Amid Market Evaluation Changes

2025-03-26 08:01:31Birla Corporation, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,091.90, showing a notable increase from the previous close of 1,059.90. Over the past week, the stock has demonstrated a return of 6.44%, outperforming the Sensex, which returned 3.61% in the same period. In terms of technical indicators, the MACD remains bearish on both weekly and monthly charts, while the Relative Strength Index (RSI) shows no significant signals. Bollinger Bands indicate a mildly bearish trend, and moving averages also reflect a similar sentiment on a daily basis. The KST is bearish on both weekly and monthly assessments, while the Dow Theory presents a mildly bullish outlook weekly, contrasting with a mildly bearish monthly view. Despite a year-to-date decline of 11.19%, Birla Corporation has shown resilie...

Read More

Birla Corporation's Recent Gains Highlight Resilience Amid Broader Market Trends

2025-03-25 12:30:26Birla Corporation, a midcap cement company, gained 5.01% on March 25, 2025, outperforming its sector. The stock reached an intraday high of Rs 1109.15 and is above its short-term moving averages. Despite recent gains, it has faced challenges with a year-to-date decline of 9.55%.

Read MoreBirla Corporation Adjusts Valuation Grade Amid Mixed Industry Performance Metrics

2025-03-21 08:00:14Birla Corporation, a midcap player in the cement industry, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings ratio stands at 35.42, while its price-to-book value is recorded at 1.16. Other key metrics include an EV to EBIT of 19.66 and an EV to EBITDA of 9.81, indicating its operational efficiency relative to its enterprise value. In terms of returns, Birla Corporation has shown a stock return of 4.61% over the past week, outperforming the Sensex, which returned 3.41% in the same period. However, the year-to-date performance reveals a decline of 15.09%, contrasting with the Sensex's modest drop of 2.29%. Over a longer horizon, the company has faced challenges, with a one-year return of -26.72%, while the Sensex gained 5.89%. When compared to its peers, Birla Corporation's valuation metrics present a mixed picture. Competitors like JK Lak...

Read More

Birla Corporation Faces Continued Decline Amid Broader Market Challenges

2025-03-13 09:35:17Birla Corporation's shares have declined significantly, continuing a downward trend over the past two days. The stock has underperformed relative to its sector and is trading below key moving averages. Over the past year, it has experienced a substantial decline, contrasting with the overall market's positive performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find enclosed the certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025

Announcement under Regulation 30 (LODR)-Change in Management

31-Mar-2025 | Source : BSECompletion of tenure of service of Shri Ghisaram Verma as Senior Management Personnel of the Company w.e.f. close of business hours on 31st March 2025

Closure of Trading Window

26-Mar-2025 | Source : BSEThe Trading Window for dealing in securities of the Company shall remain closed for all the Designated Persons and their immediate relatives w.e.f 1st April 2025 till 48 hours after the announcement to the Stock Exchanges of the Audited Standalone and Consolidated Financial Results of the Company for the quarter and year ending on 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Birla Corporation Ltd has declared 100% dividend, ex-date: 29 Jul 24

No Splits history available

No Bonus history available

No Rights history available