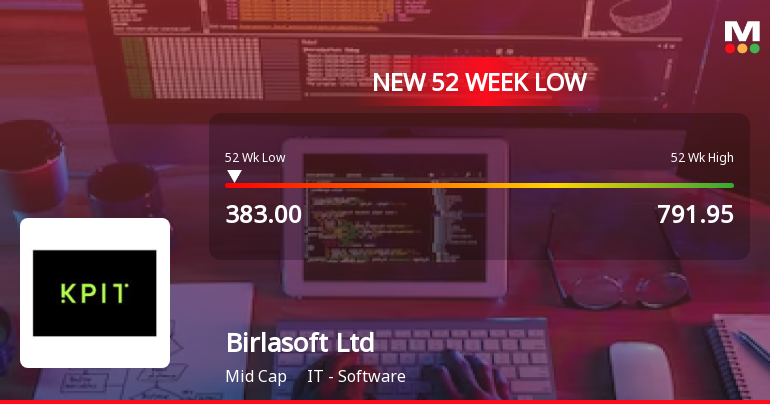

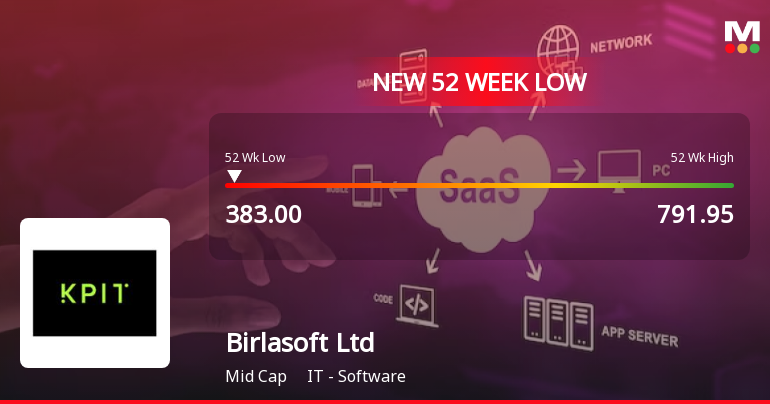

Birlasoft Hits 52-Week Low Amid Sector Downturn, Signals Potential Trend Reversal

2025-04-01 11:55:57Birlasoft has reached a new 52-week low amid a broader sector decline, despite outperforming its peers today. The company has faced significant challenges over the past year, including a notable drop in profitability. However, it maintains a low debt-to-equity ratio and strong institutional support.

Read More

Birlasoft Hits 52-Week Low Amid Sector Downturn, Signals Potential Trend Reversal

2025-04-01 11:55:54Birlasoft has reached a new 52-week low amid a broader downturn in the IT sector, despite outperforming its peers today. The company has faced a significant decline over the past year, with a notable drop in profit after tax. However, it maintains a low debt-to-equity ratio and strong long-term growth metrics.

Read MoreBirlasoft Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-28 15:00:31Birlasoft Ltd, a mid-cap player in the IT software industry, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 22,831 contracts, up from the previous 20,051, marking a change of 2,780 contracts or a 13.86% increase. The trading volume for the day reached 15,197 contracts, indicating robust market engagement. In terms of price performance, Birlasoft is currently trading close to its 52-week low, just 1.04% away from Rs 384.55. The stock touched an intraday low of Rs 385.45, representing a decline of 2.64% for the day. Notably, Birlasoft is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a bearish trend in the short to medium term. Additionally, the stock has seen a rise in delivery volume, with 14.89 lakh shares delivered on March 27, reflecting a 37.64% increase compared to the...

Read MoreBirlasoft Ltd Sees Significant Surge in Open Interest, Indicating Increased Market Activity

2025-03-28 14:00:30Birlasoft Ltd (BSOFT), a mid-cap player in the IT software industry, has experienced a notable increase in open interest today, signaling heightened activity in its futures market. The latest open interest stands at 22,144 contracts, reflecting a rise of 2,093 contracts or 10.44% from the previous open interest of 20,051. The trading volume for the day reached 10,038 contracts, contributing to a total futures value of approximately Rs 8,202.25 lakhs. In terms of price performance, Birlasoft is currently trading close to its 52-week low, just 1.61% away from Rs 384.55. The stock's performance today aligns closely with the sector, which saw a 1.56% decline, while the Sensex fell by 0.41%. Birlasoft is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend in the short to medium term. Additionally, the stock has seen a rise in delivery volume, with 14.89 lak...

Read More

Birlasoft Hits 52-Week Low Amid Broader Market Gains and Performance Concerns

2025-03-13 10:08:33Birlasoft has reached a new 52-week low, continuing a trend of losses despite some recovery today. The company's performance over the past year has been weak, with a significant drop in profit and low turnover ratios. However, it maintains a low debt-to-equity ratio and strong long-term growth potential.

Read MoreBirlasoft Ltd has emerged as one of the most active stock puts today amid bearish sentiment.

2025-03-13 10:00:08Birlasoft Ltd, a mid-cap player in the IT software industry, has emerged as one of the most active stocks today, particularly in the options market. The company’s put options, specifically with a strike price of Rs. 400 and an expiry date of March 27, 2025, have seen significant trading activity, with 2,758 contracts exchanged and a premium turnover of approximately Rs. 11,598.16 lakhs. The underlying stock value stands at Rs. 389.8, reflecting a recent dip as it hit a new 52-week low of Rs. 387.15 today. Despite the stock's performance aligning with sector trends, it has experienced a trend reversal after four consecutive days of decline. Birlasoft is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish sentiment in the short to medium term. Additionally, investor participation has waned, with a delivery volume of 5.43 lakhs on March 12, down 16.77%...

Read More

Birlasoft Faces Volatility Amid Broader IT Sector Decline and Financial Challenges

2025-03-12 12:07:27Birlasoft has faced significant volatility, reaching a new 52-week low amid a four-day decline. Despite a challenging year with a notable drop in performance metrics, the company shows potential for long-term growth and maintains a low debt-to-equity ratio, although technical indicators suggest a bearish outlook.

Read MoreBirlasoft Sees Surge in Open Interest Amid Challenging Market Conditions

2025-03-11 14:00:06Birlasoft Ltd, a mid-cap player in the IT software industry, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 23,363 contracts, up from the previous 19,825, marking a change of 3,538 contracts or a 17.85% increase. The trading volume for the day reached 30,473 contracts, indicating robust market engagement. In terms of price performance, Birlasoft hit a new 52-week low of Rs 389.15, down 5.03% from the previous day, and has underperformed its sector by 3.41%. The stock has been on a downward trend, recording a decline of 10.83% over the last three days. It is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a challenging market position. Additionally, the stock's delivery volume has decreased by 30.49% compared to its 5-day average, indicating a decline in investor pa...

Read MoreSurge in Open Interest Signals Increased Market Activity for Birlasoft Amid Price Decline

2025-03-11 13:00:04Birlasoft Ltd, a mid-cap player in the IT software industry, has experienced a notable increase in open interest (OI) today. The latest OI stands at 22,922 contracts, reflecting a rise of 3,097 contracts or 15.62% from the previous OI of 19,825. The trading volume for the day reached 27,661 contracts, indicating active participation in the market. In terms of price performance, Birlasoft hit a new 52-week low of Rs 389.15, marking a decline of 5.03% during intraday trading. The stock has underperformed its sector, showing a 1D return of -3.40%, compared to the sector's -1.07%. Over the past three days, Birlasoft has faced consecutive declines, accumulating a total drop of 10.07%. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. Additionally, delivery volume has decreased significantly, falling by 30.49% against the 5-day aver...

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Press Release / Media Release

24-Mar-2025 | Source : BSEPress Release - Birlasoft recognized by ISG for Innovative Digital Solutions

Disclosure Under Regulation 30 Of The SEBI (LODR) Regulations 2015

13-Mar-2025 | Source : BSEDisclosure under Regulation 30 of the SEBI ( LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Birlasoft Ltd has declared 125% dividend, ex-date: 31 Oct 24

Birlasoft Ltd has announced 2:5 stock split, ex-date: 04 Jan 07

Birlasoft Ltd has announced 1:1 bonus issue, ex-date: 13 Mar 12

No Rights history available