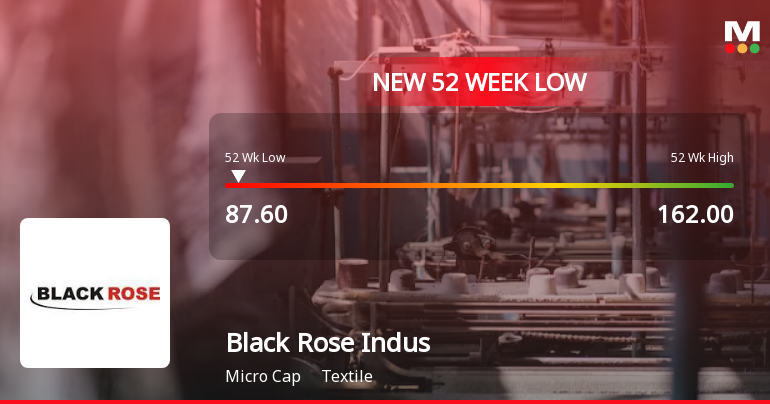

Black Rose Industries Faces Continued Volatility Amid Declining Performance Metrics

2025-03-27 15:35:14Black Rose Industries, a microcap textile company, has faced significant volatility, reaching a new 52-week low. The stock has declined notably over the past year and underperformed its sector. Despite a strong return on equity and low debt, its long-term growth prospects appear weak amid ongoing challenges.

Read More

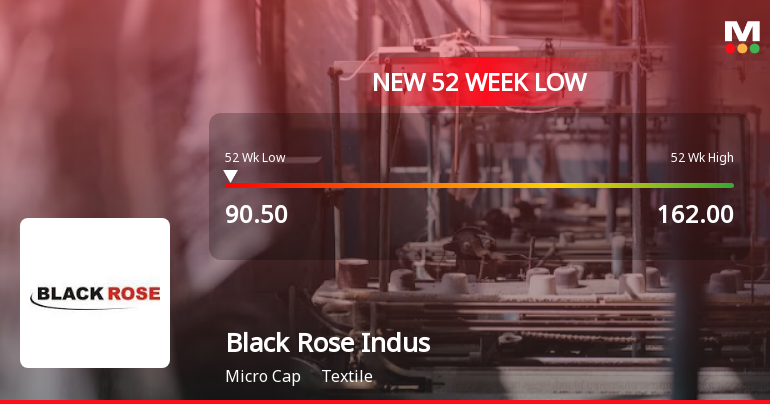

Black Rose Industries Faces Continued Volatility Amid Broader Market Resilience

2025-03-17 15:35:16Black Rose Industries, a microcap textile firm, has hit a new 52-week low, continuing a downward trend and underperforming its sector. Despite strong management efficiency and low debt, the company faces challenges with flat net sales and a significant decline in stock value over the past year.

Read More

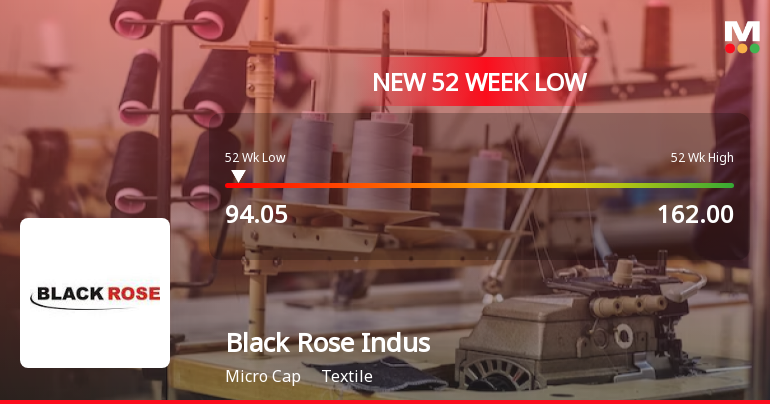

Black Rose Industries Faces Continued Volatility Amidst Declining Performance Metrics

2025-03-13 12:35:13Black Rose Industries, a microcap textile company, has faced significant volatility, hitting a new 52-week low. The stock has underperformed its sector and experienced a notable decline over the past year. Despite challenges, the company shows efficient management with a high return on equity and low debt-to-equity ratio.

Read MoreBlack Rose Industries Receives Quality Grade Upgrade Amidst Competitive Textile Sector Evaluation

2025-03-13 08:00:03Black Rose Industries, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its financial performance metrics. The company has demonstrated a modest sales growth of 3.21% over the past five years, while its EBIT has shown a decline of 4.09% during the same period. Notably, Black Rose Industries maintains a strong EBIT to interest ratio of 23.90, indicating solid earnings relative to its interest obligations. The company's financial structure appears robust, with a debt to EBITDA ratio of 0.50 and a net debt to equity ratio of just 0.08, suggesting a low level of leverage. Additionally, the sales to capital employed ratio stands at 3.26, which is indicative of efficient capital utilization. The tax ratio is reported at 26.14%, and the dividend payout ratio is relatively modest at 15.62%, reflecting a balanced approach to shareholder returns. In comparison to i...

Read MoreBlack Rose Industries Receives Quality Grade Upgrade Amidst Competitive Textile Sector Evaluation

2025-03-13 08:00:03Black Rose Industries, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its financial performance metrics. The company has demonstrated a modest sales growth of 3.21% over the past five years, while its EBIT has shown a decline of 4.09% during the same period. Notably, Black Rose Industries maintains a strong EBIT to interest ratio of 23.90, indicating solid earnings relative to its interest obligations. The company's financial structure appears robust, with a debt to EBITDA ratio of 0.50 and a net debt to equity ratio of just 0.08, suggesting a low level of leverage. Additionally, the sales to capital employed ratio stands at 3.26, which is indicative of efficient capital utilization. The tax ratio is reported at 26.14%, and the dividend payout ratio is relatively modest at 15.62%, reflecting a balanced approach to shareholder returns. In comparison to i...

Read MoreBlack Rose Industries Receives Quality Grade Upgrade Amidst Competitive Textile Sector Evaluation

2025-03-13 08:00:03Black Rose Industries, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its financial performance metrics. The company has demonstrated a modest sales growth of 3.21% over the past five years, while its EBIT has shown a decline of 4.09% during the same period. Notably, Black Rose Industries maintains a strong EBIT to interest ratio of 23.90, indicating solid earnings relative to its interest obligations. The company's financial structure appears robust, with a debt to EBITDA ratio of 0.50 and a net debt to equity ratio of just 0.08, suggesting a low level of leverage. Additionally, the sales to capital employed ratio stands at 3.26, which is indicative of efficient capital utilization. The tax ratio is reported at 26.14%, and the dividend payout ratio is relatively modest at 15.62%, reflecting a balanced approach to shareholder returns. In comparison to i...

Read MoreBlack Rose Industries Receives Quality Grade Upgrade Amidst Competitive Textile Sector Evaluation

2025-03-13 08:00:03Black Rose Industries, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its financial performance metrics. The company has demonstrated a modest sales growth of 3.21% over the past five years, while its EBIT has shown a decline of 4.09% during the same period. Notably, Black Rose Industries maintains a strong EBIT to interest ratio of 23.90, indicating solid earnings relative to its interest obligations. The company's financial structure appears robust, with a debt to EBITDA ratio of 0.50 and a net debt to equity ratio of just 0.08, suggesting a low level of leverage. Additionally, the sales to capital employed ratio stands at 3.26, which is indicative of efficient capital utilization. The tax ratio is reported at 26.14%, and the dividend payout ratio is relatively modest at 15.62%, reflecting a balanced approach to shareholder returns. In comparison to i...

Read MoreBlack Rose Industries Receives Quality Grade Upgrade Amidst Competitive Textile Sector Evaluation

2025-03-13 08:00:03Black Rose Industries, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its financial performance metrics. The company has demonstrated a modest sales growth of 3.21% over the past five years, while its EBIT has shown a decline of 4.09% during the same period. Notably, Black Rose Industries maintains a strong EBIT to interest ratio of 23.90, indicating solid earnings relative to its interest obligations. The company's financial structure appears robust, with a debt to EBITDA ratio of 0.50 and a net debt to equity ratio of just 0.08, suggesting a low level of leverage. Additionally, the sales to capital employed ratio stands at 3.26, which is indicative of efficient capital utilization. The tax ratio is reported at 26.14%, and the dividend payout ratio is relatively modest at 15.62%, reflecting a balanced approach to shareholder returns. In comparison to i...

Read MoreBlack Rose Industries Receives Quality Grade Upgrade Amidst Competitive Textile Sector Evaluation

2025-03-13 08:00:03Black Rose Industries, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its financial performance metrics. The company has demonstrated a modest sales growth of 3.21% over the past five years, while its EBIT has shown a decline of 4.09% during the same period. Notably, Black Rose Industries maintains a strong EBIT to interest ratio of 23.90, indicating solid earnings relative to its interest obligations. The company's financial structure appears robust, with a debt to EBITDA ratio of 0.50 and a net debt to equity ratio of just 0.08, suggesting a low level of leverage. Additionally, the sales to capital employed ratio stands at 3.26, which is indicative of efficient capital utilization. The tax ratio is reported at 26.14%, and the dividend payout ratio is relatively modest at 15.62%, reflecting a balanced approach to shareholder returns. In comparison to i...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulation 2018 for the quarter ended 31st March 2025.

Closure of Trading Window

25-Mar-2025 | Source : BSETrading Window for dealing in securities of the Company shall be closed for the Companys directors/officers and designated employees and their immediate relatives from 1st April 2025 till the declaration of financial results of the Company for the quarter and year ended 31st March 2025 and 48 hours thereafter.

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

13-Feb-2025 | Source : BSETranscript of Q3 FY25 Earnings Webinar held on Friday 7th February 2025.

Corporate Actions

No Upcoming Board Meetings

Black Rose Industries Ltd has declared 55% dividend, ex-date: 13 Sep 24

No Splits history available

Black Rose Industries Ltd has announced 1:1 bonus issue, ex-date: 30 Jun 11

No Rights history available