BLB Adjusts Valuation Grade Amidst Competitive Financial Landscape and Peer Comparisons

2025-03-27 08:00:38BLB, a microcap company in the Finance/NBFC sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 14.70, down from a previous close of 16.48, with a 52-week range between 12.35 and 35.61. Key financial metrics indicate a PE ratio of 17.19 and an EV to EBITDA of 8.88, suggesting a competitive position within its industry. In comparison to its peers, BLB's valuation stands out, particularly against companies like Centrum Capital and Adit.Birla Money, which are categorized as very expensive. BLB's return on capital employed (ROCE) is reported at 16.40%, while its return on equity (ROE) is at 4.18%. These figures highlight BLB's operational efficiency relative to others in the sector. Despite recent stock performance showing a decline over various periods, including a 58.72% drop over the past year, BLB's valuation metrics suggest a...

Read MoreBLB Experiences Valuation Grade Change Amidst Mixed Financial Metrics and Market Dynamics

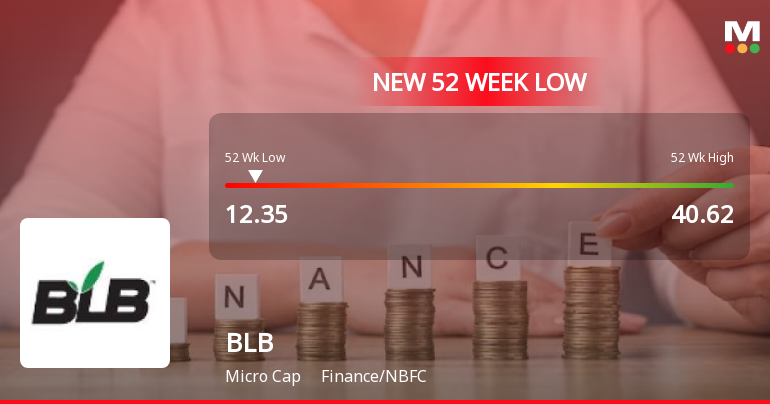

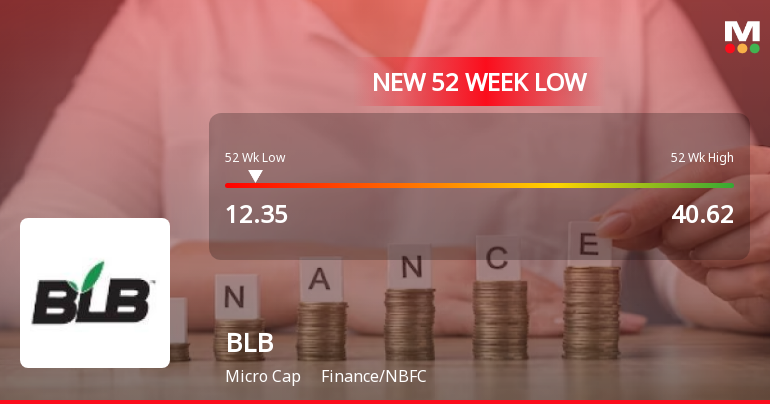

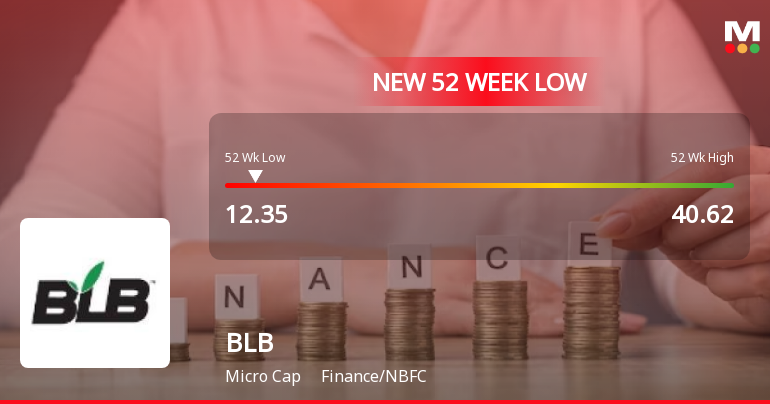

2025-03-20 08:00:41BLB, a microcap player in the finance/NBFC sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 16.32, with a notable 52-week range between 12.35 and 40.62. Key financial metrics reveal a PE ratio of 19.09 and an EV to EBITDA of 10.06, indicating its market positioning relative to its peers. In comparison to other companies in the industry, BLB's valuation metrics present a mixed picture. For instance, Fedders Holding maintains a higher PE ratio of 23, while Indl. & Prud. Inv. boasts a more attractive valuation with a PE of 16.61. On the other hand, companies like Oswal Green Tech and Meghna Infracon are positioned at the higher end of the valuation spectrum, with PE ratios significantly exceeding that of BLB. Despite recent fluctuations, BLB's performance over various time frames shows a stark contrast to the broader ma...

Read More

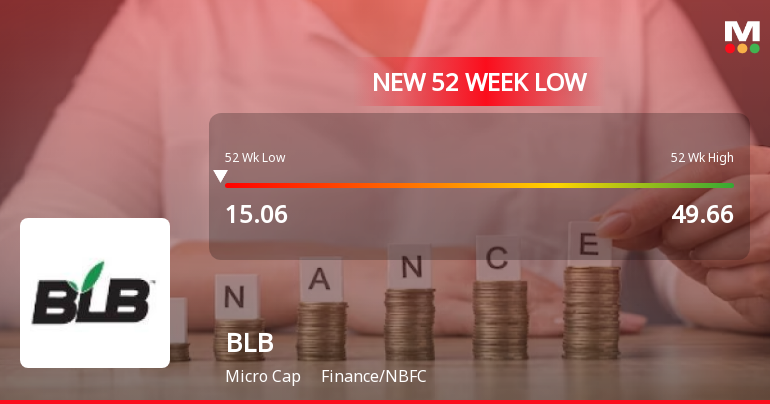

Microcap BLB Faces Significant Volatility Amidst Deteriorating Financial Performance

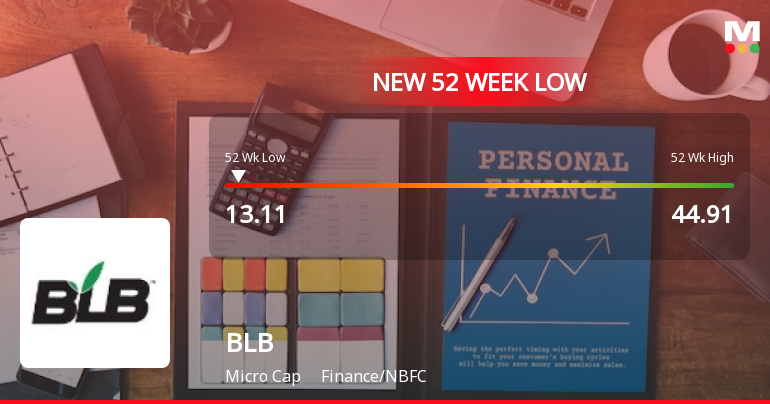

2025-03-17 09:48:43BLB, a microcap in the finance/NBFC sector, has hit a new 52-week low, reflecting a challenging year with a significant decline in performance. The company's recent financial results show a sharp drop in net sales and an operating loss, raising concerns about its long-term fundamental strength and market position.

Read More

Microcap BLB Faces Significant Challenges Amidst Broader Market Resilience

2025-03-17 09:48:40BLB, a microcap finance company, has faced substantial volatility, reaching a new 52-week low amid a 67.42% decline over the year. Recent financial results show a 55.3% drop in net sales and an operating loss, raising concerns about its long-term fundamentals and overall performance in the market.

Read More

Microcap BLB Faces Significant Volatility Amidst Dismal Financial Performance

2025-03-17 09:48:32BLB, a microcap finance company, has faced significant volatility, reaching a new 52-week low amid a challenging year marked by a 67.42% decline. Recent financial results show a steep drop in net sales and substantial operating losses, indicating weak long-term fundamentals despite a broader market uptick.

Read More

Microcap BLB Hits 52-Week Low Amidst Broader Market Gains and Weak Fundamentals

2025-03-12 09:41:18BLB, a microcap in the finance sector, reached a new 52-week low today, reflecting a 68.36% decline over the past year. The company reported a 55.3% drop in net sales and an operating loss, while the broader market shows small-cap stocks gaining. Long-term fundamentals for BLB appear weak.

Read More

Microcap BLB Hits 52-Week Low Amid Significant Financial Challenges and Declining Sales

2025-03-12 09:41:16BLB, a microcap finance company, has reached a new 52-week low amid a challenging financial environment, with a significant year-over-year stock price decline. The company reported a sharp drop in net sales and a substantial net loss, while its valuation metrics indicate some relative attractiveness despite ongoing operational difficulties.

Read More

Microcap BLB Faces Significant Financial Challenges Amidst Ongoing Stock Volatility

2025-03-11 10:36:40BLB, a microcap finance company, has hit a new 52-week low amid significant volatility, continuing a downward trend. The latest quarterly results reveal a sharp decline in net sales and profits, raising concerns about its financial health. The stock has underperformed its sector and is trading below key moving averages.

Read More

Microcap Finance Company BLB Faces Persistent Challenges Amid Market Volatility

2025-03-03 09:37:00BLB, a microcap company in the finance/NBFC sector, has reached a new 52-week low, continuing a downward trend with a significant decline over the past year. The stock has underperformed its sector and is trading below key moving averages, indicating ongoing challenges in the current market environment.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease find attached herewith Certificate under Reg 74(5) of SEBI (DP) Regulations

Disclosure Under SEBI (SAST) Regulations

03-Apr-2025 | Source : BSEPlease find enclosed herewith a disclosure under Reg 31(4) of SEBI (SAST) Regulations 2011 dated April 3 2025

Closure of Trading Window

29-Mar-2025 | Source : BSEIntimation regarding Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

BLB Ltd has declared 10% dividend, ex-date: 19 Jul 13

No Splits history available

No Bonus history available

No Rights history available