BLS E-Services Faces Mixed Technical Trends Amidst Market Volatility and Underperformance

2025-04-02 08:10:42BLS E-Services, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 150.90, showing a slight increase from the previous close of 149.10. Over the past year, BLS E-Services has faced significant challenges, with a return of -52.81%, contrasting sharply with a 2.72% gain in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly RSI suggests a bullish stance. However, the Bollinger Bands and moving averages indicate a mildly bearish sentiment on a weekly basis. Notably, the stock's 52-week high stands at 343.00, while the low is recorded at 145.05, highlighting considerable volatility. In terms of returns, BLS E-Services has underperformed relative to the Sensex across m...

Read More

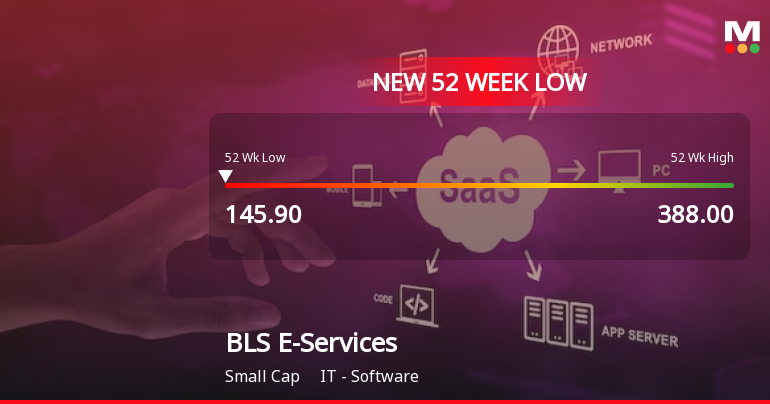

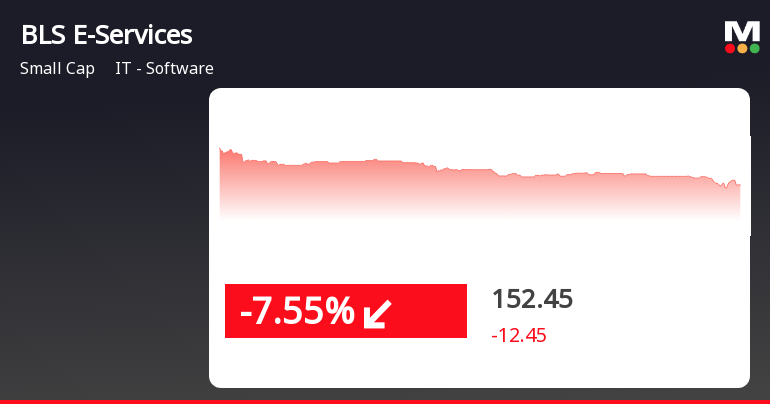

BLS E-Services Faces Significant Market Challenges Amidst Ongoing Volatility

2025-03-03 10:08:31BLS E-Services, a small-cap IT software firm, has hit a new 52-week low, reflecting significant volatility and a 61.02% decline over the past year. The stock has underperformed its sector and is currently trading below multiple moving averages, indicating ongoing challenges in the market.

Read More

BLS E-Services Hits All-Time Low Amidst Sector Underperformance and High Volatility

2025-02-28 16:05:23BLS E-Services, a small-cap IT software company, has faced significant challenges, hitting a new all-time low and experiencing a notable decline over the past week. The stock's performance has been volatile, underperforming its sector and the broader market, reflecting a bearish trend in its price action.

Read More

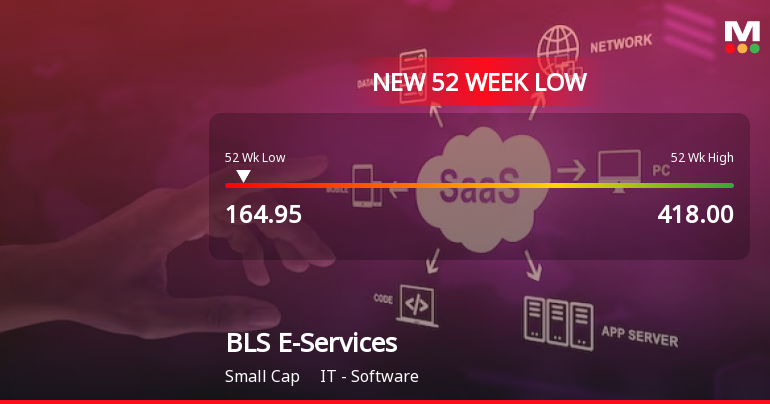

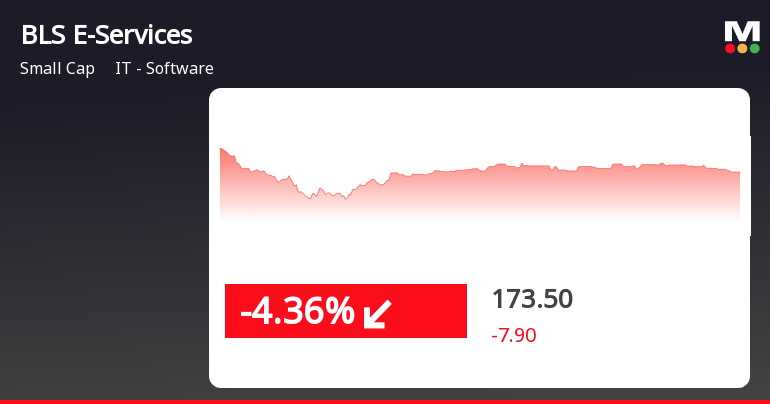

BLS E-Services Hits 52-Week Low Amid Ongoing Challenges in IT Sector

2025-02-28 09:39:34BLS E-Services, a small-cap IT software company, has reached a new 52-week low, continuing a downward trend over the past five days. Despite outperforming its sector slightly, the stock is trading below key moving averages and has declined significantly over the past year, highlighting ongoing challenges in the competitive landscape.

Read More

BLS E-Services Hits 52-Week Low Amid Sustained Market Weakness and Volatility

2025-02-17 10:06:47BLS E-Services, a small-cap IT software firm, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has dropped 6.94% over two days and is trading below multiple moving averages, reflecting ongoing market challenges and a 54.84% decline over the past year.

Read More

BLS E-Services Hits 52-Week Low Amidst High Volatility and Sector Underperformance

2025-02-12 10:36:23BLS E-Services, a small-cap IT software firm, has reached a new 52-week low amid significant trading activity and high volatility. The stock has underperformed its sector and experienced a notable decline over the past year, contrasting sharply with broader market gains.

Read More

BLS E-Services Faces Significant Volatility Amid Broader Market Challenges

2025-02-12 10:05:54BLS E-Services, a small-cap IT software company, has faced notable volatility, with a significant decline in its stock price. The company has underperformed its sector and is trading near its 52-week low. Recent trends indicate a bearish sentiment, as the stock has dropped substantially over the past month.

Read More

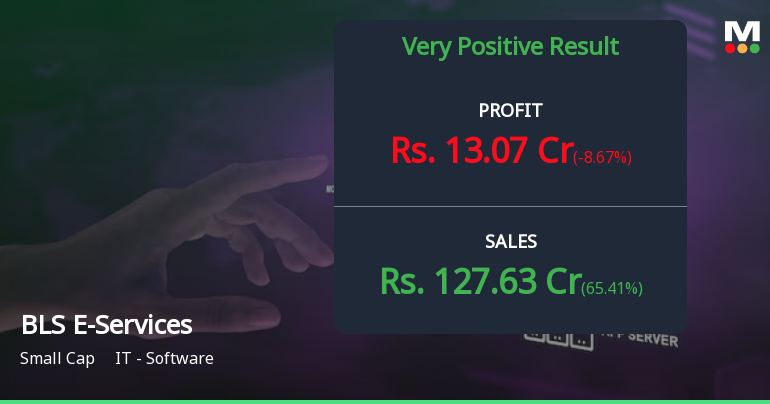

BLS E-Services Reports Strong Q3 FY24-25 Growth Amid Declining Institutional Interest

2025-02-11 18:05:36BLS E-Services, a small-cap IT software firm, recently adjusted its evaluation following a strong Q3 FY24-25 performance, with net sales reaching Rs 127.63 crore and a PAT of Rs 27.38 crore. However, a slight decline in institutional investor stakes and a challenging year in stock performance have influenced this change.

Read More

BLS E-Services Reports Strong Financial Growth for December Quarter 2024

2025-02-10 19:55:41BLS E-Services has announced its financial results for the quarter ending December 2024, highlighting significant growth in key metrics. The company reported a Profit After Tax of Rs 27.38 crore and quarterly net sales of Rs 127.63 crore, both reflecting strong performance over the past five quarters.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEConfirmation Certificate under Regulation 74(5) of SEBI(Depositories and Participants) Regulations 2018 for the quarter ended on March 31 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEThis is to inform you that in accordance with SEBI (PIT) Regulations 2015 and the Companys Code of Conduct framed thereunder the trading window for trading in the securities of the Company will be closed for the Designated persons and their immediate relatives w.e.f. April 1 2025 till completion of 48 hours after the Audited financial results of the Company for the fourth quarter and financial year ended on March 31 2025 is generally made available to the public. The date of the Board meeting to consider and approve the audited financial results for the fourth quarter and financial year ended on March 31 2025 shall be intimated separately in due course.

Announcement under Regulation 30 (LODR)-Monitoring Agency Report

13-Feb-2025 | Source : BSEMonitoring Agency Report for the Quarter Ended December 31 2024.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available