BLS International Services Adjusts Technical Outlook Amid Strong Financial Performance

2025-03-25 08:24:45BLS International Services has experienced a recent adjustment in its evaluation, indicating a shift in market sentiment. Despite this, the company showcases strong financial metrics, including a high return on equity and consistent profit growth, alongside increased institutional investor participation, reflecting confidence in its fundamentals.

Read MoreBLS International Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:05:31BLS International Services, a midcap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 422.05, showing a notable increase from the previous close of 396.65. Over the past year, BLS International has demonstrated a robust performance with a return of 29.94%, significantly outpacing the Sensex's return of 7.07% during the same period. The technical summary indicates a mixed outlook, with the MACD signaling bearish trends on both weekly and monthly scales. Meanwhile, Bollinger Bands suggest bullish conditions, highlighting some volatility in the stock's price movements. The moving averages present a mildly bearish stance, while the KST and Dow Theory metrics also reflect bearish tendencies on a monthly basis. In terms of returns, BLS International has excelled over longer time frames, achieving an impre...

Read MoreBLS International Services Shows Resilience Amid Mixed Market Signals and Strong Historical Returns

2025-03-24 18:00:40BLS International Services Ltd, a mid-cap player in the miscellaneous industry, has shown significant stock activity today, rising by 6.40%, outperforming the Sensex, which increased by 1.40%. This uptick is part of a broader trend, as the company has delivered a remarkable 29.94% return over the past year, significantly surpassing the Sensex's 7.07% performance during the same period. Despite a challenging three-month stretch where the stock declined by 11.59%, BLS International Services has demonstrated resilience with a robust three-year performance of 601.52% and an impressive five-year return of 5118.55%. The company's market capitalization stands at Rs 16,223.00 crore, with a price-to-earnings (P/E) ratio of 38.29, slightly above the industry average of 35.46. Technical indicators present a mixed picture, with weekly MACD and KST readings indicating bearish trends, while Bollinger Bands suggest bull...

Read More

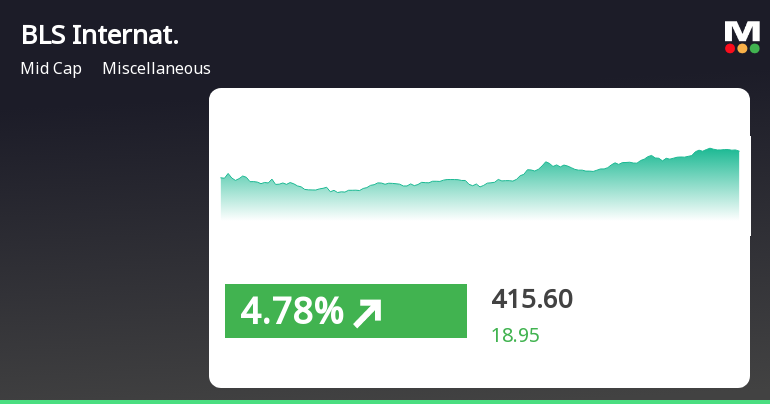

BLS International Services Achieves Strong Momentum Amid Broader Market Gains

2025-03-24 11:35:27BLS International Services has demonstrated strong performance, achieving six consecutive days of gains and a notable return over the past week. The stock is trading above key moving averages, reflecting a robust upward trend. Meanwhile, the broader market, including the Sensex and small-cap sector, continues to rise.

Read More

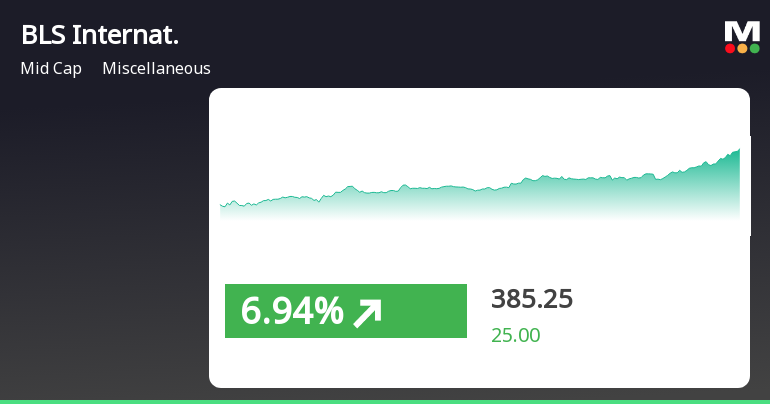

BLS International Services Shows Strong Momentum Amid Broader Market Recovery

2025-03-21 12:50:25BLS International Services has demonstrated strong performance, achieving consecutive gains over five days and significantly outperforming its sector. The stock is currently above its short-term moving averages, while the broader market, including small-cap stocks, has also shown positive trends. Over the past year, the company has delivered notable returns.

Read More

BLS International Services Reports Strong Sales Growth Amid Market Stabilization Trends

2025-03-21 08:03:42BLS International Services has recently adjusted its evaluation, reflecting significant changes in financial metrics and market position. The company reported strong net sales and profit before tax, indicating robust performance. Additionally, institutional investor participation has increased, showcasing growing confidence in the company's fundamentals and market standing.

Read MoreBLS International Services Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:03:29BLS International Services, a midcap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 349.40, showing a slight increase from the previous close of 348.25. Over the past year, BLS International has demonstrated resilience with a return of 7.56%, outperforming the Sensex, which recorded a 4.77% return in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates a bullish trend on a weekly basis, although there is no signal on the monthly chart. Bollinger Bands suggest a mildly bearish trend weekly, with a sideways movement monthly. Daily moving averages reflect a mildly bullish sentiment, while the KST and OBV indicators show bearish tendencies on a weekly basis. Notably, BLS Internationa...

Read More

BLS International Services Reports Strong Profit Growth Amid Elevated Valuation Concerns

2025-03-18 08:22:33BLS International Services has recently experienced an evaluation adjustment, reflecting changes in its financial landscape. The company reported strong third-quarter profits and maintained a solid return on equity, while institutional investors increased their stakes, indicating growing confidence in its fundamentals.

Read MoreBLS International Services Adjusts Valuation Grade Amid Strong Financial Metrics and Market Position

2025-03-18 08:00:59BLS International Services has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company, operating in the miscellaneous industry, has reported a price-to-earnings (PE) ratio of 30.56 and a price-to-book value of 9.71. Its enterprise value to earnings before interest and taxes (EV/EBIT) stands at 27.33, while the EV/EBITDA ratio is recorded at 24.09. Additionally, BLS International shows a robust return on capital employed (ROCE) of 60.84% and a return on equity (ROE) of 29.25%. In comparison to its peers, BLS International's valuation metrics indicate a competitive stance within the industry. For instance, while BLS International's PE ratio is significantly lower than that of Sagility India and Brookfield India, it maintains a favorable PEG ratio of 0.50, suggesting potential growth relative to its valuation. The company's recent performance has s...

Read MoreAnnouncement under Regulation 30 (LODR)-Acquisition

02-Apr-2025 | Source : BSEPursuant to the compliance with Regulation 30 read with Part A of Schedule III of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 (including any statutory modification(s) amendment(s) or re-enactment(s) thereof for the time being in force) We are pleased to inform you that BLS International FZE a subsidiary of the Company has completed the subscription of 99.99% of the share capital of BLS Worldwide Services Inc. a company incorporated under the laws of the Republic of the Philippines. As a result of this subscription BLS Worldwide Services Inc. is now a Step-Down Subsidiary of the Company (SDS).

Announcement under Regulation 30 (LODR)-Updates on Acquisition

31-Mar-2025 | Source : BSEPursuant to the compliance with Reg 30 of the SEBI (LODR) Regulations 2015 and in continuation to the our earlier corporate announcement dated November 26 2024 where it was informed the intention of BLS International Services Singapore PTE Ltd. (BLS Singapore) step down subsidiary of the Company to acquire Beijing Biaoshi Enterprise Consulting Co. Ltd. a company incorporated under the law of China. The said acquisition was expected to be completed by March 31 2025. We hereby report that the required approval from the Administration for Market Regulation also known as the Administration for Industry and Commerce China for the acquisition has not yet been received. Consequently the said acquisition is now expected to be completed by June 30 2025 subject to necessary approvals and conditions if any.

Closure of Trading Window

27-Mar-2025 | Source : BSEThis is to inform you that in accordance with Companys Code of Conduct and SEBI (Prohibition of Insider Trading) Regulations 2015 (including any statutory modification(s) amendment(s) and re-enactment(s) thereof for the time being in force) the Trading Window for trading in the securities of the Company will be closed for the Designated persons and immediate relatives of the Designated persons with effect from Tuesday April 01 2025 till completion of 48 hours after the audited financial results of the Company for the fourth quarter and financial year ended on March 31 2025 generally made available to the public.n

Corporate Actions

No Upcoming Board Meetings

BLS International Services Ltd has declared 50% dividend, ex-date: 05 Sep 24

BLS International Services Ltd has announced 1:10 stock split, ex-date: 26 Apr 17

BLS International Services Ltd has announced 1:1 bonus issue, ex-date: 08 Dec 22

No Rights history available