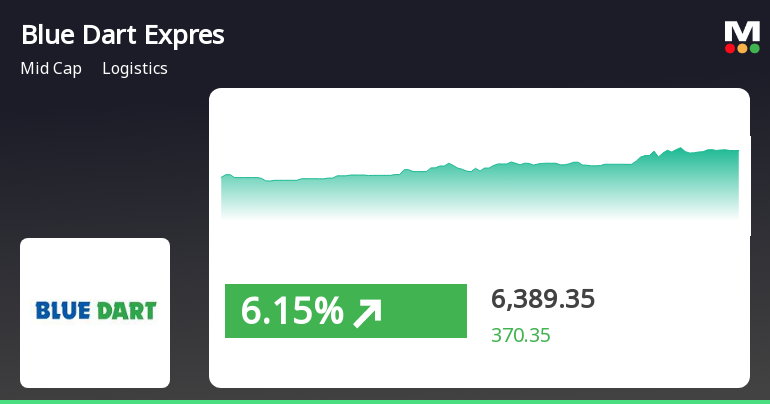

Blue Dart Express Shows Resilience with Strong Recent Gains Amid Mixed Performance

2025-03-25 11:05:21Blue Dart Express has demonstrated notable performance, achieving a series of gains over three consecutive days and outperforming its sector. While it faced a decline in the past three months, the stock has shown resilience over the past year and a remarkable increase over five years, surpassing the Sensex.

Read MoreBlue Dart Express Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-25 08:02:39Blue Dart Express, a midcap player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 6019.00, showing a notable increase from the previous close of 5907.40. Over the past year, Blue Dart has experienced a stock return of 3.27%, while the Sensex has returned 7.07%, indicating a relative underperformance in the broader market context. In terms of technical indicators, the weekly MACD remains bearish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) indicates bullish momentum on both weekly and monthly scales, suggesting some positive sentiment. However, the Bollinger Bands and moving averages present a bearish outlook on a daily basis, reflecting short-term challenges. The company's performance over various periods reveals mixed results. For instance, in the year-to-da...

Read MoreBlue Dart Express Faces Bearish Technical Trends Amid Market Challenges

2025-03-11 08:02:31Blue Dart Express, a midcap player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,801.10, down from a previous close of 5,987.45, with a 52-week high of 9,483.85 and a low of 5,490.00. Today's trading saw a high of 5,989.70 and a low of 5,750.00. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no significant movement is noted monthly. Bollinger Bands and moving averages also reflect bearish trends, suggesting a cautious market environment. In terms of performance, Blue Dart Express has faced challenges compared to the Sensex. Over the past week, the stock returned -1.51%, while the Sensex gained 1.41%. In the one-mo...

Read MoreBlue Dart Express Faces Bearish Technical Trends Amid Market Challenges

2025-03-11 08:02:31Blue Dart Express, a midcap player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,801.10, down from a previous close of 5,987.45, with a 52-week high of 9,483.85 and a low of 5,490.00. Today's trading saw a high of 5,989.70 and a low of 5,750.00. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no significant movement is noted monthly. Bollinger Bands and moving averages also reflect bearish trends, suggesting a cautious market environment. In terms of performance, Blue Dart Express has faced challenges compared to the Sensex. Over the past week, the stock returned -1.51%, while the Sensex gained 1.41%. In the one-mo...

Read MoreBlue Dart Express Faces Bearish Technical Trends Amid Market Challenges

2025-03-11 08:02:31Blue Dart Express, a midcap player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,801.10, down from a previous close of 5,987.45, with a 52-week high of 9,483.85 and a low of 5,490.00. Today's trading saw a high of 5,989.70 and a low of 5,750.00. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no significant movement is noted monthly. Bollinger Bands and moving averages also reflect bearish trends, suggesting a cautious market environment. In terms of performance, Blue Dart Express has faced challenges compared to the Sensex. Over the past week, the stock returned -1.51%, while the Sensex gained 1.41%. In the one-mo...

Read MoreBlue Dart Express Faces Bearish Technical Trends Amid Market Challenges

2025-03-11 08:02:31Blue Dart Express, a midcap player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,801.10, down from a previous close of 5,987.45, with a 52-week high of 9,483.85 and a low of 5,490.00. Today's trading saw a high of 5,989.70 and a low of 5,750.00. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no significant movement is noted monthly. Bollinger Bands and moving averages also reflect bearish trends, suggesting a cautious market environment. In terms of performance, Blue Dart Express has faced challenges compared to the Sensex. Over the past week, the stock returned -1.51%, while the Sensex gained 1.41%. In the one-mo...

Read MoreBlue Dart Express Faces Bearish Technical Trends Amid Market Challenges

2025-03-11 08:02:31Blue Dart Express, a midcap player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,801.10, down from a previous close of 5,987.45, with a 52-week high of 9,483.85 and a low of 5,490.00. Today's trading saw a high of 5,989.70 and a low of 5,750.00. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no significant movement is noted monthly. Bollinger Bands and moving averages also reflect bearish trends, suggesting a cautious market environment. In terms of performance, Blue Dart Express has faced challenges compared to the Sensex. Over the past week, the stock returned -1.51%, while the Sensex gained 1.41%. In the one-mo...

Read MoreBlue Dart Express Faces Bearish Technical Trends Amid Market Challenges

2025-03-11 08:02:31Blue Dart Express, a midcap player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,801.10, down from a previous close of 5,987.45, with a 52-week high of 9,483.85 and a low of 5,490.00. Today's trading saw a high of 5,989.70 and a low of 5,750.00. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no significant movement is noted monthly. Bollinger Bands and moving averages also reflect bearish trends, suggesting a cautious market environment. In terms of performance, Blue Dart Express has faced challenges compared to the Sensex. Over the past week, the stock returned -1.51%, while the Sensex gained 1.41%. In the one-mo...

Read MoreBlue Dart Express Faces Bearish Technical Trends Amid Market Challenges

2025-03-11 08:02:31Blue Dart Express, a midcap player in the logistics industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,801.10, down from a previous close of 5,987.45, with a 52-week high of 9,483.85 and a low of 5,490.00. Today's trading saw a high of 5,989.70 and a low of 5,750.00. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but no significant movement is noted monthly. Bollinger Bands and moving averages also reflect bearish trends, suggesting a cautious market environment. In terms of performance, Blue Dart Express has faced challenges compared to the Sensex. Over the past week, the stock returned -1.51%, while the Sensex gained 1.41%. In the one-mo...

Read MoreAnnouncement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

01-Apr-2025 | Source : BSEAs per attachment

Announcement under Regulation 30 (LODR)-Press Release / Media Release

27-Mar-2025 | Source : BSEAs per attachment

Clarification sought from Blue Dart Express Ltd

26-Mar-2025 | Source : BSEThe Exchange has sought clarification from Blue Dart Express Ltd on March 26 2025 with reference to Movement in Volume.

The reply is awaited.

Corporate Actions

No Upcoming Board Meetings

Blue Dart Express Ltd has declared 250% dividend, ex-date: 12 Jul 24

No Splits history available

No Bonus history available

No Rights history available