Bluechip Tex Industries Faces Challenges Amid Market Volatility and Weak Fundamentals

2025-04-01 14:35:27Bluechip Tex Industries, a microcap textile firm, hit a new 52-week low amid a broader market decline, despite outperforming its sector intraday. The company has struggled over the past year, with weak fundamentals and a low return on equity, indicating ongoing challenges in the current market environment.

Read MoreBluechip Tex Industries Faces Market Challenges Amidst Mixed Performance Trends

2025-03-04 11:07:40Bluechip Tex Industries, a microcap player in the textile industry, has shown notable activity today, reflecting a complex performance landscape. With a market capitalization of Rs 30.73 crore, the company currently has a price-to-earnings (P/E) ratio of -16.13, significantly lower than the industry average of 28.15. Over the past year, Bluechip Tex Industries has experienced a decline of 19.22%, contrasting sharply with the Sensex, which has fallen by just 1.18%. Today's trading session saw the stock decrease by 1.30%, while the Sensex recorded a minor drop of 0.11%. In the short term, the stock has shown some resilience, gaining 2.60% over the past week, even as the Sensex declined by 2.14%. Looking at longer-term performance, Bluechip Tex Industries has delivered a 14.50% increase over the past three years, although this is significantly lower than the Sensex's 34.36% rise during the same period. The f...

Read More

Bluechip Tex Industries Faces Financial Challenges Amidst Declining Performance Metrics

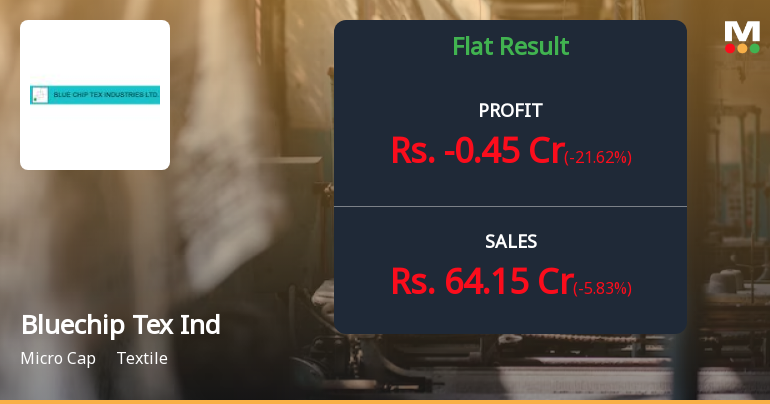

2025-03-03 18:41:11Bluechip Tex Industries has recently experienced an evaluation adjustment reflecting its financial status, reporting flat net sales of Rs 60.98 crore for the quarter ending December 2024. The company faces challenges, including a declining CAGR of operating profits and a low EBIT to interest ratio, indicating constrained debt management.

Read MoreBluechip Tex Industries Shows Mixed Technical Trends Amid Market Volatility

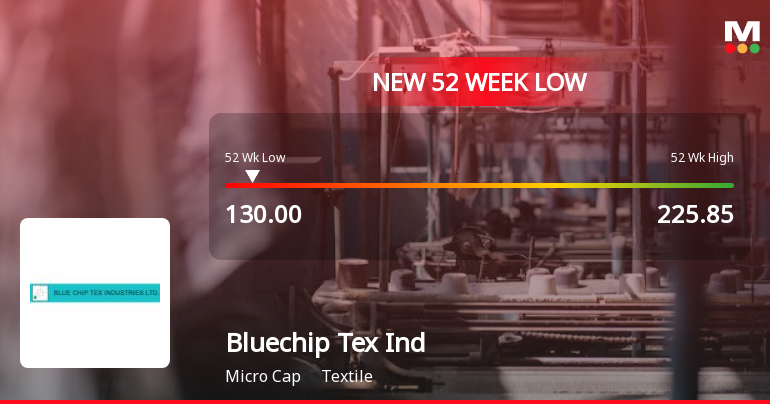

2025-02-25 10:26:08Bluechip Tex Industries, a microcap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company’s stock price is currently at 154.05, down from a previous close of 163.45, with a 52-week high of 225.85 and a low of 130.00. Today's trading saw a high of 165.05 and a low of 153.00, indicating some volatility in its performance. The technical summary reveals a mixed outlook, with the MACD showing bearish trends on a weekly basis and mildly bearish on a monthly basis. However, the Bollinger Bands and daily moving averages indicate bullish signals, suggesting some positive momentum in the short term. The KST reflects a bullish stance weekly, while the Dow Theory remains mildly bearish. In terms of returns, Bluechip Tex Industries has shown a notable performance over various periods. Over the past week, the stock returned 17.60%, contrasting ...

Read More

Bluechip Tex Industries Faces Financial Challenges Amidst Market Evaluation Adjustment

2025-02-24 18:23:22Bluechip Tex Industries, a microcap textile firm, recently experienced an evaluation adjustment amid flat financial performance for the quarter ending December 2024. Concerns have arisen regarding its long-term fundamentals, including declining operating profits and weak debt management, despite some signs of technical improvement in its stock position.

Read More

Bluechip Tex Industries Faces Significant Volatility Amidst Declining Stock Performance in October 2023

2025-02-13 13:35:12Bluechip Tex Industries, a microcap textile firm, has faced notable volatility, hitting a 52-week low of Rs. 130 after a four-day decline of 17.33%. Despite an initial gain, the stock underperformed its sector and is trading below all key moving averages, with a year-over-year decline of 12.02%.

Read More

Bluechip Tex Industries Reports Flat Q3 FY24-25 Results Amid Sales Decline and Improved Receivables Management

2025-02-11 21:30:58Bluechip Tex Industries has announced its financial results for the quarter ending December 2024, showing flat performance for Q3 FY24-25. The company achieved a Debtors Turnover Ratio of 40.79 times, indicating improved efficiency in managing receivables, while net sales declined to Rs 60.98 crore compared to previous quarters.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEEnclosed herewith certificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st March 2025

Non-Applicability Of SEBI Circular No. SEBI/HO/DDHS/CIR/P/2018/144 Dated 26Th November 2018 In Connection With Fund Raising By Issuance Of Debt Securities By Large Entities

03-Apr-2025 | Source : BSEBlue Chip Tex Industries Limited is not identified as Large Corporate as on 31st March 2025 as per the applicability criteria specified under SEBI Circular No. SEBI/HO/DDHS/CIR/P/2018/144 dated 26th November 2018

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation of closure of Trading Window for all Designated Persons and immediate relatives from Tuesday 1st April 2025 till the expiry of 48 hours after the declaration of audited financial results for the quarter and year ended 31st March 2025

Corporate Actions

No Upcoming Board Meetings

Bluechip Tex Industries Ltd has declared 10% dividend, ex-date: 17 Sep 24

No Splits history available

No Bonus history available

No Rights history available