BMW Industries Adjusts Valuation Grade Amid Strong Financial Metrics and Competitive Positioning

2025-04-02 08:02:57BMW Industries, a small-cap player in the engineering sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company's price-to-earnings ratio stands at 14.19, while its price-to-book value is recorded at 1.56. Additionally, BMW Industries showcases an EV to EBITDA ratio of 8.28 and an EV to EBIT of 11.34, indicating a solid operational performance. The company's return on capital employed (ROCE) is reported at 11.99%, and its return on equity (ROE) is at 10.15%, both of which highlight effective management of resources. Furthermore, the PEG ratio is notably low at 0.56, suggesting that the stock may be undervalued relative to its growth potential. In comparison to its peers, BMW Industries demonstrates a more favorable valuation profile. While competitors like Unimech Aerospace and Kennametal India are categorized with higher valuation metr...

Read More

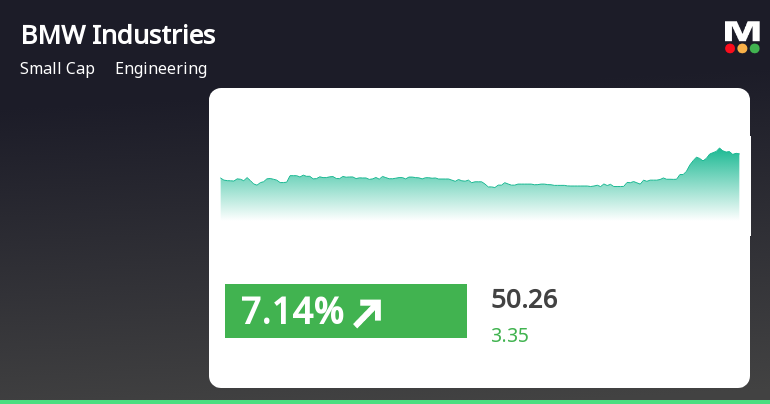

BMW Industries Outperforms Sector Amid Broader Market Decline, Highlights Resilience

2025-03-26 11:50:24BMW Industries has demonstrated notable performance today, gaining 7.1% amid a declining market. The stock has outperformed its sector and recorded consecutive gains over the past two days. Despite a recent decline over the month, it has shown significant growth over the past five years compared to the broader market.

Read More

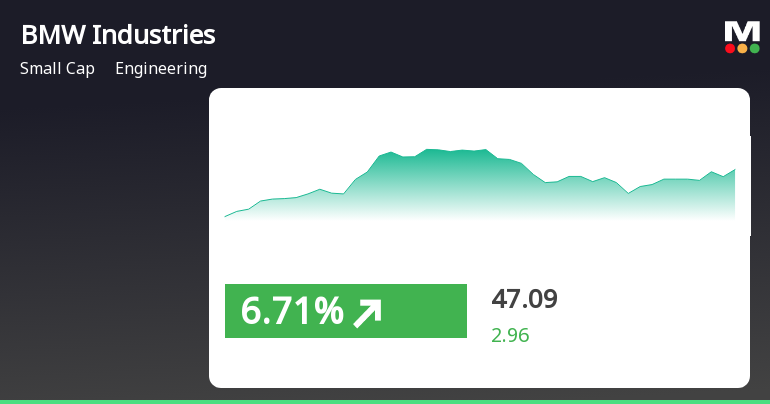

BMW Industries Stock Surges Amid Broader Market Gains, Reflecting Mixed Long-Term Trends

2025-03-25 09:50:24BMW Industries' stock surged today, gaining 9.04% and reaching an intraday high of Rs 49.51. The stock is currently above its short-term moving averages but below longer-term ones. Despite recent gains, it has faced challenges with a year-to-date decline, though it has shown significant growth over three years.

Read MoreBMW Industries Adjusts Valuation Grade, Highlighting Strong Financial Fundamentals and Market Position

2025-03-25 08:01:03BMW Industries has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position within the engineering sector. The company currently boasts a price-to-earnings (P/E) ratio of 13.26 and a price-to-book value of 1.46, indicating a favorable valuation relative to its assets. Additionally, BMW Industries shows robust operational efficiency with an EV to EBITDA ratio of 7.81 and an EV to EBIT of 10.70. The company's return on capital employed (ROCE) stands at 11.99%, while its return on equity (ROE) is recorded at 10.15%. These figures suggest effective management of resources and profitability. Furthermore, the PEG ratio of 0.52 highlights the company's growth potential relative to its earnings. In comparison to its peers, BMW Industries demonstrates a competitive edge, particularly when contrasted with companies like GMM Pfaudler and MTAR Technologies, which exhibit ...

Read More

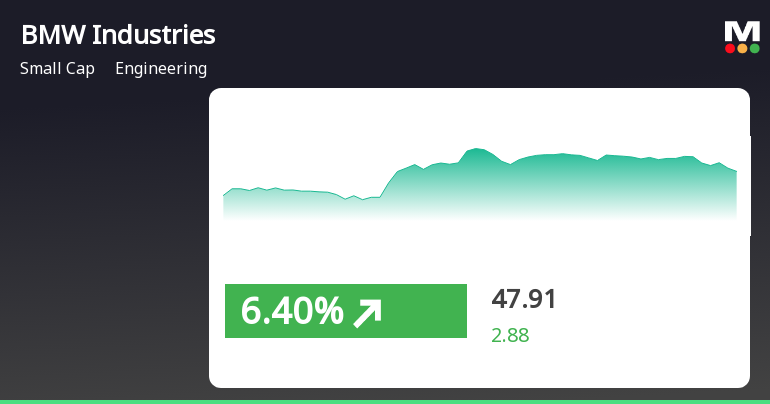

BMW Industries Stock Surges Amid Broader Market Gains and Small-Cap Momentum

2025-03-20 09:35:31BMW Industries has seen a notable rise in stock performance, gaining 7.95% on March 20, 2025, and outperforming its sector. The stock has shown a strong upward trend over four days, with a total return of 17.02%. Despite recent challenges, its long-term performance remains robust.

Read MoreBMW Industries Adjusts Valuation Grade, Highlighting Strong Financial Fundamentals and Market Position

2025-03-17 08:01:00BMW Industries has recently undergone a valuation adjustment, reflecting its financial metrics and market position within the engineering sector. The company's price-to-earnings ratio stands at 11.98, while its price-to-book value is recorded at 1.32. Additionally, BMW Industries shows a robust EV to EBITDA ratio of 7.18 and an EV to EBIT of 9.83, indicating efficient operational performance. The company's return on capital employed (ROCE) is at 11.99%, and its return on equity (ROE) is 10.15%, suggesting a solid return generation capability. The PEG ratio is notably low at 0.47, which may indicate favorable growth prospects relative to its earnings. In comparison to its peers, BMW Industries maintains a competitive edge with its valuation metrics. For instance, Gensol Engineering also shows strong performance, but with a higher PE ratio of 9.69. Other competitors like Axtel Industries and Permanent Magne...

Read More

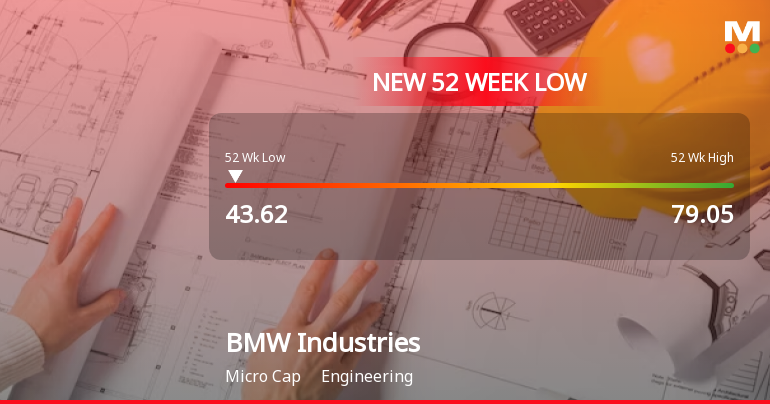

BMW Industries Hits 52-Week Low Amid Broader Market Volatility and Declining Performance

2025-03-13 12:36:18BMW Industries has faced notable volatility, hitting a 52-week low and experiencing a consecutive decline over five days. The stock has underperformed its sector and is trading below key moving averages. Over the past year, it has posted a negative return, contrasting with broader market performance.

Read More

BMW Industries Faces Significant Trading Volatility Amid Weak Fundamentals and Bearish Sentiment

2025-03-12 11:39:42BMW Industries has faced notable volatility, hitting a 52-week low and experiencing a four-day decline. Over the past year, the stock has decreased significantly, contrasting with the broader market. Weak long-term fundamentals and a lack of domestic mutual fund investment suggest ongoing concerns about its valuation and outlook.

Read More

BMW Industries Faces Significant Volatility Amid Broader Engineering Sector Decline

2025-03-10 15:07:17BMW Industries has faced notable volatility, nearing its 52-week low and experiencing a decline over the past two days. The stock is trading below key moving averages, reflecting a bearish trend. Over the past year, it has underperformed significantly compared to the Sensex, with weak long-term fundamentals.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEThis is to inform you that Trading Window for dealing in Securities of the Company will remain closed for Designated Persons and their immediate relatives for the period from Tuesday 1st April 2025 till 48 hours after declaration of audited Financial Results of the Company for the Quarter and Year ended on 31st March 2025.

Announcement under Regulation 30 (LODR)-Investor Presentation

26-Mar-2025 | Source : BSEA Presentation on Bokaro Green-field Downstream Steel Project is enclosed herewith for appropriate dissemination.

Announcement under Regulation 30 (LODR)-Investor Presentation

26-Mar-2025 | Source : BSEPlease find enclosed herewith the Nine (9) months Strategy Presentation on Bokaro Green-field Downstream Steel Project.

Corporate Actions

No Upcoming Board Meetings

BMW Industries Ltd has declared 21% dividend, ex-date: 23 Sep 24

No Splits history available

No Bonus history available

No Rights history available