Bodal Chemicals Faces Mixed Technical Signals Amidst Market Evaluation Revision

2025-04-02 08:04:06Bodal Chemicals, a microcap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 61.62, showing a notable increase from the previous close of 58.54. Over the past year, Bodal Chemicals has experienced a decline of 21.79%, contrasting with a modest gain of 2.72% in the Sensex during the same period. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective remains bearish. The Relative Strength Index (RSI) presents no clear signals, and Bollinger Bands reflect a mildly bearish stance for both weekly and monthly assessments. Moving averages also suggest a mildly bearish trend, indicating a cautious outlook. In terms of returns, Bodal Chemicals has outperformed the Sensex over the past month, with a retu...

Read MoreBodal Chemicals Faces Mixed Technical Trends Amid Ongoing Market Challenges

2025-03-27 08:01:21Bodal Chemicals, a microcap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 61.04, slightly down from the previous close of 61.39. Over the past year, Bodal Chemicals has faced challenges, with a notable decline of 20.66%, contrasting with a 6.65% gain in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Relative Strength Index (RSI) remains neutral, while Bollinger Bands and moving averages suggest bearish tendencies. The KST also reflects a bearish outlook, indicating potential headwinds for the stock. In terms of returns, Bodal Chemicals has experienced a significant drop over three years, with a decline of 42.63%, while the Sense...

Read MoreBodal Chemicals Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-20 08:01:22Bodal Chemicals, a microcap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 63.93, showing a notable increase from the previous close of 60.25. Over the past year, Bodal Chemicals has faced challenges, with a return of -18.20%, contrasting with a positive return of 4.77% from the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD remains bearish on both weekly and monthly charts, while the Relative Strength Index (RSI) shows no significant signals. Bollinger Bands and moving averages suggest a mildly bearish sentiment in the short term. However, the On-Balance Volume (OBV) reflects bullish trends on both weekly and monthly scales, indicating some underlying strength. In terms of stock performance, Bodal Chemicals has experienced ...

Read MoreBodal Chemicals Faces Mixed Technical Indicators Amidst Market Challenges

2025-03-17 08:00:42Bodal Chemicals, a microcap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 61.77, down from a previous close of 63.09. Over the past year, Bodal Chemicals has faced challenges, with a notable decline of 20.16% compared to a modest gain of 1.47% in the Sensex. The technical indicators present a mixed picture. The MACD and KST metrics are bearish on both weekly and monthly scales, while the moving averages indicate a bearish trend on a daily basis. The Bollinger Bands show a mildly bearish stance in both weekly and monthly assessments. Interestingly, the On-Balance Volume (OBV) remains bullish on both timeframes, suggesting some underlying strength despite the overall bearish sentiment. In terms of stock performance relative to the Sensex, Bodal Chemicals has struggled over various periods, partic...

Read MoreBodal Chemicals Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-12 08:01:06Bodal Chemicals, a microcap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 65.94, showing a slight increase from the previous close of 65.61. Over the past year, Bodal Chemicals has faced challenges, with a return of -26.18%, contrasting with a modest gain of 0.82% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD and KST metrics are bearish on both weekly and monthly scales, while the Bollinger Bands and Dow Theory suggest a mildly bearish outlook. Interestingly, the On-Balance Volume (OBV) shows bullish signals on both timeframes, indicating some underlying strength in trading volume. In terms of price movement, Bodal Chemicals has experienced a 52-week high of 97.24 and a low of 49.60, with today's trading range betwe...

Read More

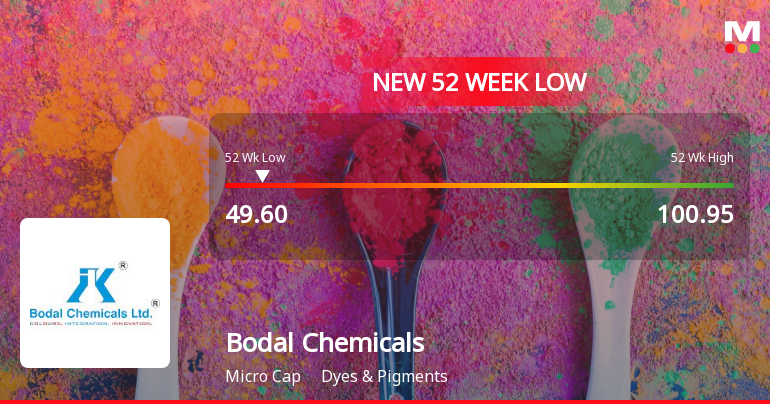

Bodal Chemicals Hits 52-Week Low Amidst Broader Market Challenges and Declining Profitability

2025-03-04 09:54:58Bodal Chemicals, a microcap in the Dyes & Pigments sector, reached a new 52-week low today, reflecting a significant decline over the past year. The company has struggled with negative growth in operating profits and low return on equity, amidst a broader market showing mixed performance.

Read More

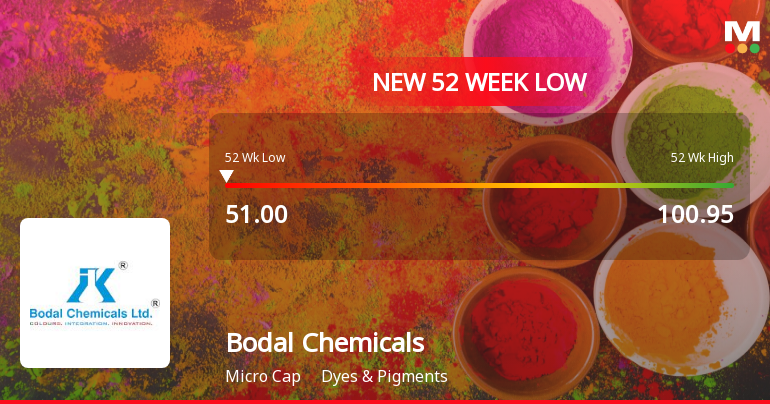

Bodal Chemicals Hits 52-Week Low Amidst Broader Market Trends and Sector Performance

2025-03-03 09:36:01Bodal Chemicals, a microcap in the Dyes & Pigments industry, has reached a new 52-week low, reflecting a significant decline over the past year. Despite this, the stock has shown some resilience today, outperforming its sector, though it remains below key moving averages, indicating ongoing challenges.

Read More

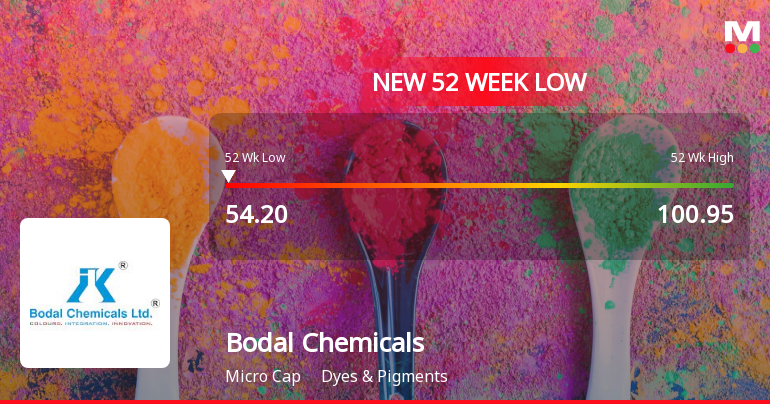

Bodal Chemicals Hits New Low Amid Broader Sector Struggles and Persistent Bearish Trend

2025-02-28 09:36:34Bodal Chemicals, a microcap in the Dyes & Pigments sector, has hit a new 52-week low, continuing a downward trend with a notable decline over the past year. The stock is trading below its moving averages, reflecting ongoing challenges within the company and the broader sector.

Read More

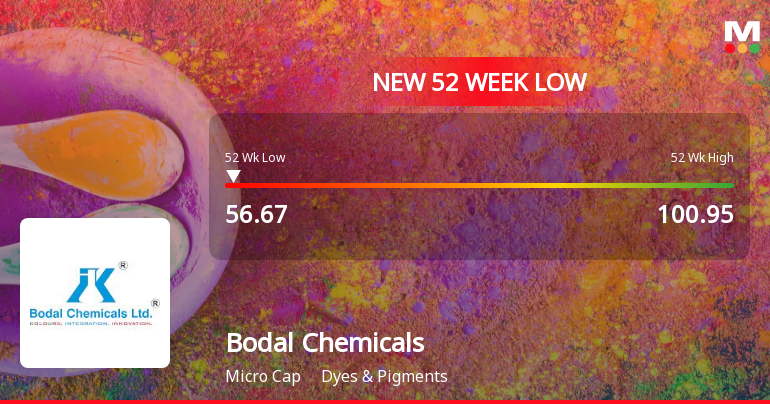

Bodal Chemicals Hits 52-Week Low Amidst Broader Market Challenges and Sector Resilience

2025-02-27 09:35:35Bodal Chemicals, a microcap in the Dyes & Pigments sector, has reached a new 52-week low, reflecting a 27.92% decline over the past year. Despite this, the company outperformed its sector slightly, though it remains below key moving averages, indicating ongoing challenges in a competitive market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEBodal Chemicals Limited herewith submit Certificate received from RTA under regulation 74(5) of SEBI (DP) Regulations

Closure of Trading Window

27-Mar-2025 | Source : BSEBodal Chemicals Limited herewith inform Exchange about closure of Trading window

Announcement Under Regulation 30 - Imposition Of Anti-Dumping Duty By Ministry Of Finance (Department Of Revenue) On Imports Of Trichloro Isocyanuric Acid (TCCA) In India.

08-Mar-2025 | Source : BSEBodal Chemicals Limited herewith inform Exchange about Imposing Anti Dumping Duty by Ministry of Finance on Imports of TCCA in India

Corporate Actions

No Upcoming Board Meetings

Bodal Chemicals Ltd has declared 5% dividend, ex-date: 22 Sep 23

Bodal Chemicals Ltd has announced 2:10 stock split, ex-date: 10 Jun 10

No Bonus history available

Bodal Chemicals Ltd has announced 1:2 rights issue, ex-date: 04 Mar 08