Borosil Experiences Valuation Grade Change Amid Elevated Financial Metrics and Market Positioning

2025-03-10 08:01:01Borosil, a small-cap player in the glass industry, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 62.79, while its price-to-book value is noted at 5.65. Additionally, Borosil's enterprise value to EBITDA ratio is recorded at 29.26, indicating a significant valuation in relation to its earnings before interest, taxes, depreciation, and amortization. In terms of return on capital employed (ROCE) and return on equity (ROE), Borosil reports figures of 10.36% and 9.24%, respectively. These metrics provide insight into the company's efficiency in generating profits from its capital and equity. When compared to its peers, Borosil's valuation metrics appear elevated. For instance, La Opala RG also holds a high valuation, but with a considerably lower price-to-earnings ratio of 25.73. Meanwhile, Borosil Sc...

Read More

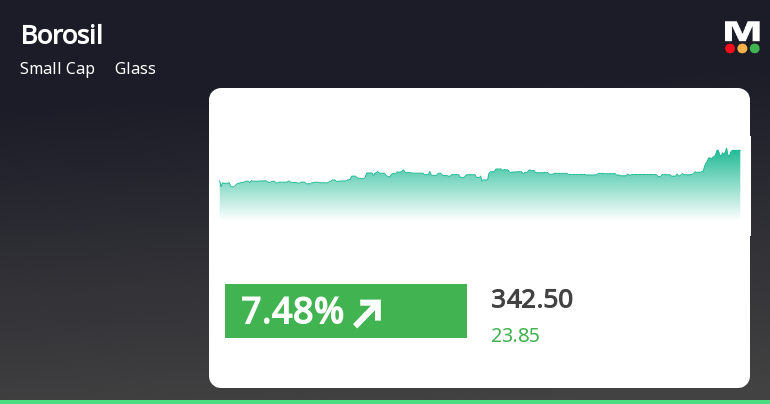

Borosil's Recent Surge Highlights Volatility Amid Mixed Market Performance

2025-03-05 15:50:45Borosil, a small-cap glass industry player, experienced notable trading activity on March 5, 2025, with a significant intraday rise. While the stock has shown short-term gains, its longer-term performance indicates a decline over the past month and year, reflecting volatility in the market.

Read More

Borosil Faces Market Challenges Amid Significant Stock Volatility and Decline

2025-02-18 11:57:29Borosil, a small-cap glass industry player, faced significant stock volatility today, with a notable decline following recent gains. The stock has underperformed its sector and is trading below key moving averages, reflecting broader market challenges and a bearish trend amid heightened intraday volatility.

Read MoreBorosil Faces Significant Market Challenges Amidst Broader Sector Declines

2025-02-18 09:35:19Borosil, a small-cap player in the glass industry, has experienced significant market activity today, opening with a notable loss of 18.77%. This decline marks a trend reversal after two consecutive days of gains. The stock's performance has underperformed its sector, which has seen a decrease of 2.82%, by a margin of 10.1%. Throughout the trading session, Borosil has exhibited high volatility, with an intraday fluctuation of 7.8%. The stock reached an intraday low of Rs 282.2, reflecting the day's challenges. Additionally, Borosil is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend in the short to medium term. In terms of broader market performance, Borosil's one-day decline of 10.22% stands in stark contrast to the Sensex, which has only dipped by 0.22%. Over the past month, Borosil has faced a substantial drop of 21.24%, while the Sens...

Read More

Borosil Faces Significant Volatility Amidst Declining Stock Performance and Market Challenges

2025-02-17 09:41:29Borosil, a small-cap glass industry player, faced significant volatility in trading, hitting a new 52-week low. The stock has declined 16.44% over the past year, underperforming the Sensex. Currently, it trades below multiple moving averages, indicating a persistent downward trend amid a challenging market environment.

Read More

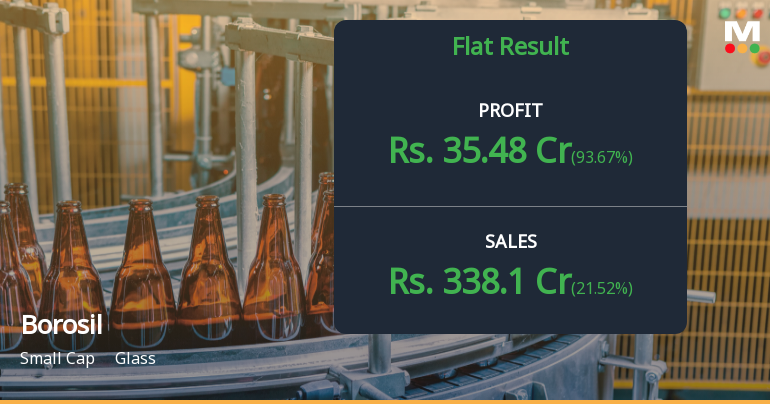

Borosil Faces Flat Q3 Performance Amidst Rising Interest and Market Challenges

2025-02-10 19:06:17Borosil, a small-cap glass industry player, has recently adjusted its evaluation amid flat financial performance in Q3 FY24-25. Despite a healthy long-term growth trajectory, challenges in profitability and a mildly bearish trend in technical indicators highlight the complexities of its current financial position and market dynamics.

Read More

Borosil Faces Significant Stock Decline Amid Broader Market Challenges and Volatility

2025-02-10 09:50:33Borosil, a small-cap glass industry player, faced a notable stock decline of 7.55% on February 10, 2025, reversing a four-day gain streak. The stock underperformed its sector and is trading below multiple moving averages, reflecting ongoing market challenges and a lackluster performance over the past month.

Read More

Borosil Reports Strong Q4 Results Amid Concerns Over Rising Interest Expenses and Liquidity

2025-02-08 08:49:26Borosil recently reported its financial results for the quarter ending December 2024, highlighting strong performance in Profit Before Tax and Profit After Tax, alongside a five-quarter high in net sales. However, rising interest expenses and low cash reserves raise concerns about future financial flexibility and liquidity.

Read MoreIncorporation Of A Wholly Owned Subsidiary Company

09-Apr-2025 | Source : BSEDisclosure is enclosed

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the Securities and Exchange Board of India (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

02-Apr-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulation 2015

Corporate Actions

No Upcoming Board Meetings

Borosil Ltd has declared 100% dividend, ex-date: 17 Aug 21

No Splits history available

No Bonus history available

No Rights history available