Borosil Scientific Faces Technical Trend Challenges Amid Market Volatility

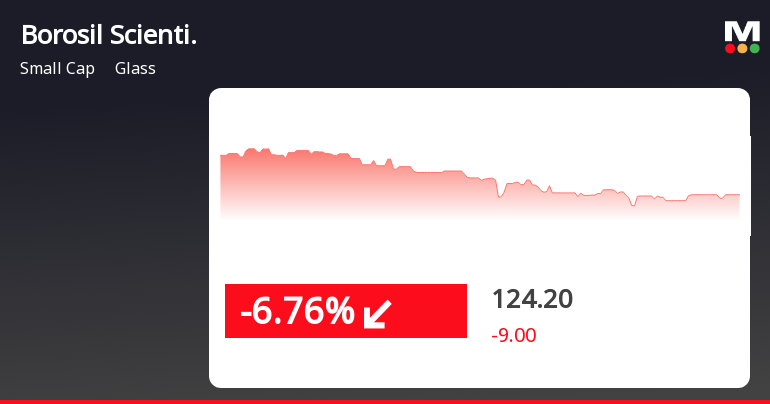

2025-04-02 08:10:53Borosil Scientific, a small-cap player in the glass industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 121.95, showing a slight increase from the previous close of 121.65. Over the past year, the stock has experienced significant volatility, with a 52-week high of 229.80 and a low of 115.60. Today's trading session saw a high of 126.45 and a low of 120.95. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the daily moving averages also reflect a bearish stance. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, contrasting with the mildly bearish outlook from the Bollinger Bands. Notably, the Dow Theory and On-Balance Volume (OBV) show no definitive trend at this time. When comparing Borosil Scientific's performance to the Sensex, the stock has faced challen...

Read MoreBorosil Scientific Experiences Valuation Grade Change Amidst Industry Challenges

2025-03-28 08:00:59Borosil Scientific, a small-cap player in the glass industry, has recently undergone a valuation adjustment. The company's current price stands at 116.50, reflecting a decline from its previous close of 120.50. Over the past year, Borosil has faced challenges, with a year-to-date return of -29.18%, contrasting sharply with the Sensex's slight decline of -0.68% during the same period. Key financial metrics for Borosil include a PE ratio of 32.93 and an EV to EBITDA ratio of 20.18, which position it differently compared to its peers. For instance, Borosil's peer, La Opala RG, exhibits a significantly lower PE ratio of 25.06 but a higher EV to EBITDA ratio of 17.75, indicating varying market perceptions and operational efficiencies within the industry. Borosil's return on capital employed (ROCE) is reported at 9.16%, while its return on equity (ROE) stands at 7.90%. These figures highlight the company's oper...

Read MoreBorosil Scientific Faces Bearish Technical Trends Amid Market Volatility and Declining Performance

2025-03-27 08:04:13Borosil Scientific, a small-cap player in the glass industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 120.50, down from a previous close of 124.10, with a 52-week high of 229.80 and a low of 115.60. Today's trading saw a high of 125.25 and a low of 120.00, indicating some volatility within the session. The technical summary for Borosil Scientific reveals a bearish sentiment across various indicators. The MACD and Bollinger Bands on a weekly basis are both signaling bearish trends, while the daily moving averages also reflect a bearish outlook. The Dow Theory corroborates this sentiment with a bearish indication on both weekly and monthly scales. Interestingly, the On-Balance Volume (OBV) shows a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly basis, suggesting mixed signals in trading volume. In...

Read MoreBorosil Scientific Experiences Valuation Grade Change Amidst Market Challenges and Competitive Landscape

2025-03-18 08:01:11Borosil Scientific, a small-cap player in the glass industry, has recently undergone a valuation adjustment. The company's current price stands at 116.75, reflecting a decline from its previous close of 120.35. Over the past year, Borosil has faced challenges, with a year-to-date return of -29.03%, contrasting with a modest -5.08% return for the Sensex during the same period. Key financial metrics for Borosil include a PE ratio of 33.00 and an EV to EBITDA ratio of 20.23. The company's return on capital employed (ROCE) is reported at 9.16%, while the return on equity (ROE) is at 7.90%. These figures indicate a competitive position within its sector, especially when compared to peers like Borosil, which has a significantly higher PE ratio of 56.25, and La Opala RG, which is noted for its very high valuation metrics. The evaluation revision reflects the ongoing dynamics in the market and highlights the rela...

Read More

Borosil Scientific Faces Persistent Downward Trend Amid Broader Glass Sector Challenges

2025-03-03 11:35:48Borosil Scientific, a small-cap glass industry player, has faced significant volatility, hitting a new 52-week low and experiencing a six-day decline totaling 15.52%. The stock underperformed its sector and is trading below multiple moving averages, reflecting ongoing challenges in the broader market environment.

Read More

Borosil Scientific Faces Significant Stock Volatility Amid Broader Market Challenges

2025-02-28 12:05:34Borosil Scientific, a small-cap glass industry player, has faced significant stock volatility, hitting a new all-time low. The stock has dropped 20.12% over the past month, underperforming its sector and broader market indices, indicating ongoing challenges in the trading environment.

Read More

Borosil Scientific Faces Market Challenges Amid Significant Stock Volatility and Sector Decline

2025-02-28 10:06:29Borosil Scientific, a small-cap glass industry player, has faced significant volatility, hitting a new 52-week low of Rs. 130. The stock has underperformed its sector and experienced a consecutive decline over the past five days. Its performance metrics indicate challenges in the current market landscape.

Read MoreBorosil Scientific Faces Increased Scrutiny Amid Significant Stock Volatility and Decline

2025-02-17 09:55:20Borosil Scientific, a small-cap player in the glass industry, has experienced significant volatility in today's trading session. The stock opened with a notable loss of 5.59%, reaching an intraday low of Rs. 130.05, marking a new 52-week and all-time low. This decline reflects a broader trend, as Borosil Scientific has underperformed its sector by 2.64% today. Over the past two days, the stock has seen a cumulative drop of 6.07%, indicating a consecutive fall that has raised concerns among market observers. In terms of performance metrics, Borosil Scientific's one-day decline stands at 4.10%, contrasting sharply with the Sensex, which has only dipped by 0.71%. Furthermore, the stock's performance over the past month reveals a staggering 21.53% decrease, while the Sensex has experienced a modest decline of 1.59%. Additionally, Borosil Scientific is currently trading below its 5-day, 20-day, 50-day, 100-day...

Read More

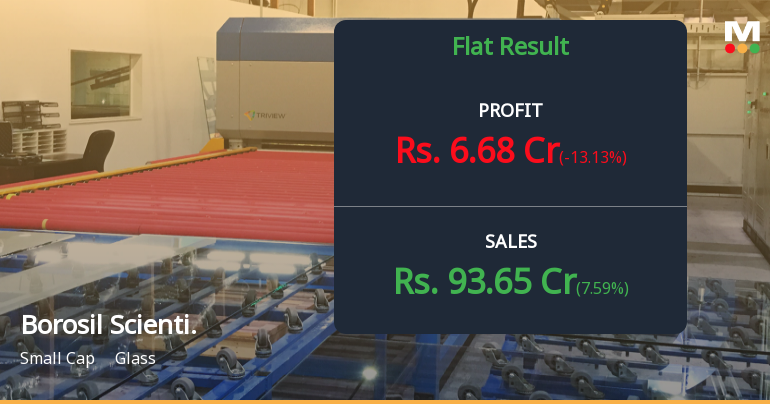

Borosil Scientific Reports Steady Q3 FY24-25 Results Amid Score Adjustment

2025-02-11 19:36:46Borosil Scientific has announced its financial results for the quarter ending February 2025, showing steady performance in Q3 of FY24-25. The company's stock evaluation has shifted, reflecting changes in its financial health and market position, which stakeholders may find significant as they assess the company's industry standing.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECompliance Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

24-Mar-2025 | Source : BSEESOP Allotment intimation

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation of closure of trading window is attached.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available