BPL Adjusts Valuation Grade, Highlighting Competitive Edge in Medical Equipment Sector

2025-03-13 08:00:19BPL, a microcap company in the Medical Equipment/Supplies/Accessories sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings (PE) ratio stands at 20.37, while its price-to-book value is recorded at 1.38. Other notable metrics include an enterprise value to EBITDA ratio of 36.39 and a return on equity (ROE) of 7.20%. In comparison to its peers, BPL's valuation metrics present a more favorable outlook. For instance, Prevest Denpro is categorized as expensive with a PE ratio of 27.47, while Nureca is noted as risky due to its loss-making status. Raaj Medisafe and Shree Pacetronix also show strong valuations, but BPL's metrics suggest a competitive edge in the current market landscape. Despite recent fluctuations in stock price, with a current price of 75.15, BPL's performance over the past five years has been remar...

Read MoreBPL Adjusts Valuation Grade, Highlighting Competitive Edge in Medical Equipment Sector

2025-03-13 08:00:19BPL, a microcap company in the Medical Equipment/Supplies/Accessories sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings (PE) ratio stands at 20.37, while its price-to-book value is recorded at 1.38. Other notable metrics include an enterprise value to EBITDA ratio of 36.39 and a return on equity (ROE) of 7.20%. In comparison to its peers, BPL's valuation metrics present a more favorable outlook. For instance, Prevest Denpro is categorized as expensive with a PE ratio of 27.47, while Nureca is noted as risky due to its loss-making status. Raaj Medisafe and Shree Pacetronix also show strong valuations, but BPL's metrics suggest a competitive edge in the current market landscape. Despite recent fluctuations in stock price, with a current price of 75.15, BPL's performance over the past five years has been remar...

Read MoreBPL Adjusts Valuation Amidst Competitive Landscape in Medical Equipment Sector

2025-03-06 08:00:29BPL, a microcap player in the Medical Equipment/Supplies/Accessories sector, has recently undergone a valuation adjustment. The company's current price stands at 79.57, reflecting a notable shift from its previous close of 76.81. Over the past year, BPL has experienced a stock return of -17.50%, contrasting with a slight gain of 0.07% in the Sensex. Key financial metrics for BPL include a PE ratio of 21.57 and an EV to EBITDA ratio of 38.40. The company's return on capital employed (ROCE) is reported at 3.34%, while the return on equity (ROE) is at 7.20%. These figures provide insight into BPL's operational efficiency and profitability. In comparison to its peers, BPL's valuation metrics reveal a diverse landscape. For instance, Prevest Denpro is positioned at a higher PE ratio of 30.46, while Nureca is currently loss-making. Raaj Medisafe and Bandaram Pharma show varying degrees of attractiveness in thei...

Read More

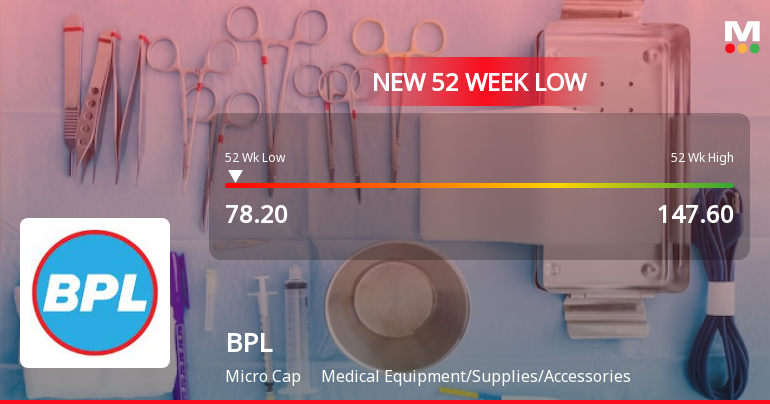

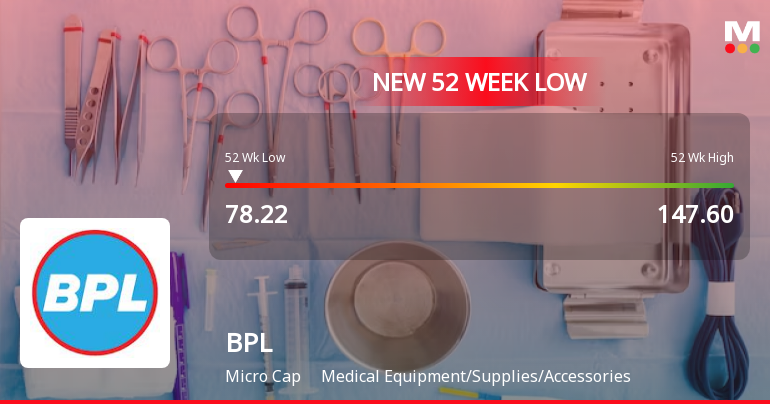

BPL Faces Sustained Downward Trend Amid Broader Sector Challenges and Volatility

2025-02-18 11:53:05BPL, a microcap in the Medical Equipment sector, has hit a new 52-week low, reflecting a significant decline over the past nine days. The stock is trading below key moving averages and has dropped 31.12% in the past year, contrasting with the Sensex's gains.

Read More

BPL Stock Shows Signs of Reversal Amidst Ongoing Market Challenges

2025-02-17 09:36:23BPL, a microcap in the Medical Equipment sector, is nearing its 52-week low, trading slightly above its recent low. After seven days of decline, the stock has shown a minor reversal and outperformed its sector today, though it remains below key moving averages and has declined significantly over the past year.

Read More

BPL Stock Hits 52-Week Low Amid Sustained Decline in Medical Equipment Sector

2025-02-14 13:05:23BPL, a microcap in the Medical Equipment sector, has reached a new 52-week low, reflecting significant volatility and a 17.57% decline over the past week. The stock has underperformed compared to the broader sector and the Sensex, indicating ongoing challenges in a competitive market.

Read More

BPL Reports Mixed Financial Results for December 2024, Highlighting Revenue Growth Amid Profit Decline

2025-02-12 21:02:08BPL has announced its financial results for the quarter ending December 2024, revealing net sales of Rs 19.32 crore, a 33.98% year-on-year increase. However, the company faces challenges with significant declines in Profit Before Tax and Profit After Tax, alongside a decrease in Earnings per Share and Debtors Turnover Ratio.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEClosure of trading window with effect from 1st April 2025 and will end 48 hours after the announcement of Financial Results for 4th Quarter and year ended 31st march 2025.

Board Meeting Outcome for Outcome Of Board Meeting

28-Mar-2025 | Source : BSEboard approved the following 1. Reappointment of Secretarial Auditor for the year 2024-2025 subject to shareholders approval 2. Reappointment of Mr.Ajit G Nambiar as Managing Director of the Company for the period of three years from 2025-2026 to 2027-2028. subject to shareholders approval 3. Review and adoption of Annual Operating Plan for the Financial year 2025-26.

Update on board meeting

24-Mar-2025 | Source : BSEBPL Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 28/03/2025 inter alia to consider and approve 1. Re-appointment of Secretarial Auditor. 2. Review and adoption of Annual Operating Plan for the Financial Year 2025-26. 3. Re-appointment of Mr. Ajit G Nambiar as Managing Directorsubject to shareholders approval.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available