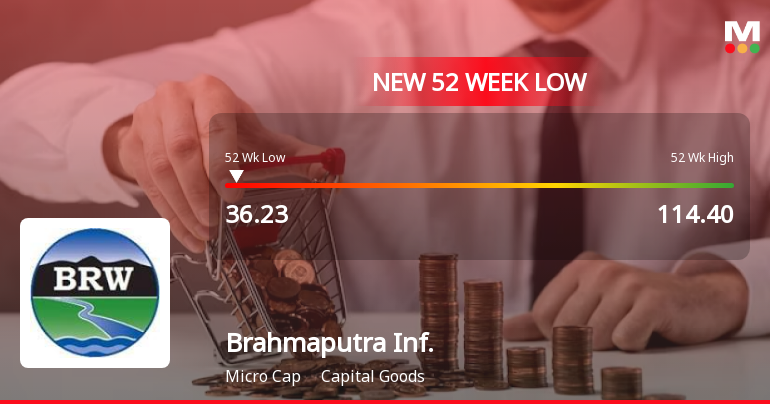

Brahmaputra Infrastructure Faces Challenges Amid Significant Stock Volatility and Weak Fundamentals

2025-03-04 09:36:42Brahmaputra Infrastructure has faced notable volatility, reaching a new 52-week low and declining for four consecutive days. Over the past year, the company has seen a significant drop, with weak long-term fundamentals, high debt levels, and low profitability, indicating a challenging environment for its operations.

Read More

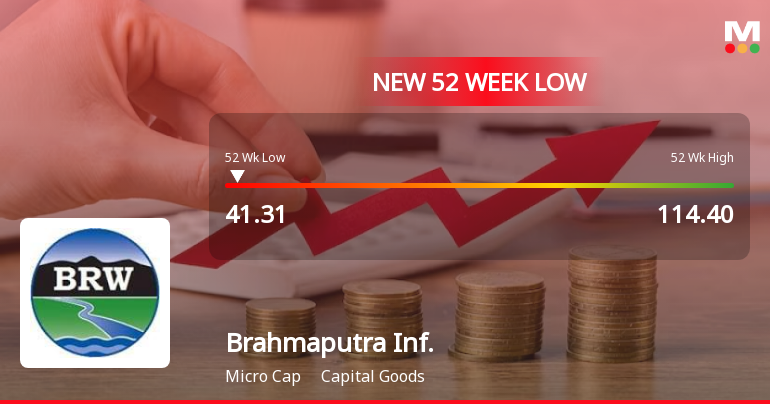

Brahmaputra Infrastructure Faces Significant Volatility Amid Persistent Downward Trend

2025-03-03 11:35:14Brahmaputra Infrastructure, a microcap in the capital goods sector, hit a new 52-week low today, reflecting significant volatility. The stock has fallen consecutively over three days, with notable intraday fluctuations. It is currently trading below all major moving averages and has declined substantially over the past year compared to the Sensex.

Read More

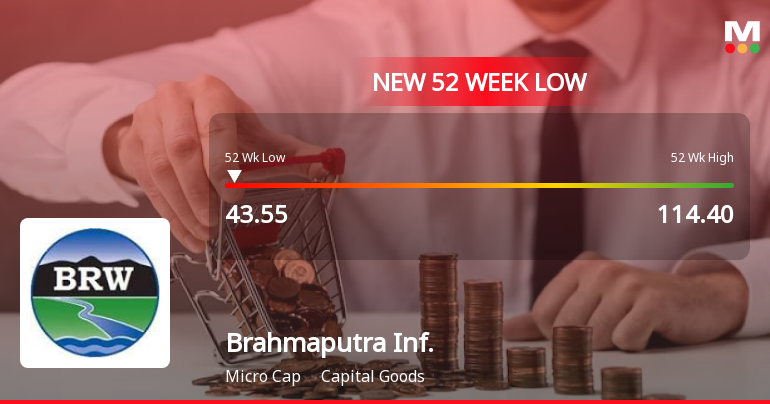

Brahmaputra Infrastructure Faces Significant Volatility Amid Sustained Downward Trend

2025-02-28 10:05:15Brahmaputra Infrastructure, a microcap in the capital goods sector, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has declined 47.63% over the past year, contrasting with the Sensex's gains, and is trading below multiple moving averages, indicating a persistent downward trend.

Read More

Brahmaputra Infrastructure Faces Significant Volatility Amidst Ongoing Market Challenges

2025-02-27 10:35:13Brahmaputra Infrastructure, a microcap in the capital goods sector, has hit a new 52-week low amid significant volatility. The stock has underperformed its sector and declined sharply over the past year, trading below key moving averages, indicating ongoing challenges in the market.

Read More

Brahmaputra Infrastructure Faces Continued Decline Amidst Competitive Market Challenges

2025-02-24 15:40:11Brahmaputra Infrastructure, a microcap in the capital goods sector, is nearing its 52-week low, trading just above it. The stock has underperformed its sector and is on a downward trend, with a significant decline over the past year, contrasting with the overall market's modest gains.

Read More

Brahmaputra Infrastructure Hits 52-Week Low Amid Broader Capital Goods Sector Struggles

2025-02-21 10:05:12Brahmaputra Infrastructure, a microcap in the capital goods sector, has reached a new 52-week low, underperforming its sector. The stock is trading below all key moving averages and has declined significantly over the past year, contrasting with the positive performance of the Sensex.

Read More

Brahmaputra Infrastructure Hits 52-Week Low Amidst Broader Market Challenges

2025-02-18 11:52:14Brahmaputra Infrastructure, a microcap in the capital goods sector, reached a new 52-week low today, reflecting a 39.86% decline over the past year. Despite recent struggles, the stock showed slight gains today, outperforming its sector, though it remains below key moving averages, indicating ongoing challenges.

Read More

Brahmaputra Infrastructure Faces Continued Volatility Amidst Market Challenges

2025-02-17 10:35:13Brahmaputra Infrastructure, a microcap in the capital goods sector, has hit a new 52-week low, continuing a downward trend. The stock has dropped significantly over the past two days and is trading below multiple moving averages, reflecting ongoing challenges and underperformance compared to the broader market.

Read More

Brahmaputra Infrastructure Reports Mixed Financial Results Amid Operational Challenges for December Quarter

2025-01-31 21:00:42Brahmaputra Infrastructure's financial results for the quarter ending December 2024 reveal mixed operational performance. While the company achieved its highest inventory turnover ratio and maintained a low debt-equity ratio, it faced challenges with a significant decline in net sales and profit before tax, alongside low operating profit margins.

Read MoreOptionally Convertible Cumulative Preference Shares (OCCPS) Redemption Update.

02-Apr-2025 | Source : BSEOptionally Convertible Cumulative Preference Shares (OCCPS) Partial redemption done that is due till 31st March 2025 now remaining OCCPS redemption will starts from FY 2027-28 and ends on 2023-24 Hence in next two financial years 2025-26 and 2026-27 no redemption / repayment is required towards OCCPS Balance amount 165.13 Crores. It will improve the cash flows and Profitability of the company.

Closure of Trading Window

29-Mar-2025 | Source : BSEClosure of trading window for March quarter Results - 25.

Announcement under Regulation 30 (LODR)-Newspaper Publication

01-Feb-2025 | Source : BSENewspaper Publication Pertaining to Q-3 Results

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available