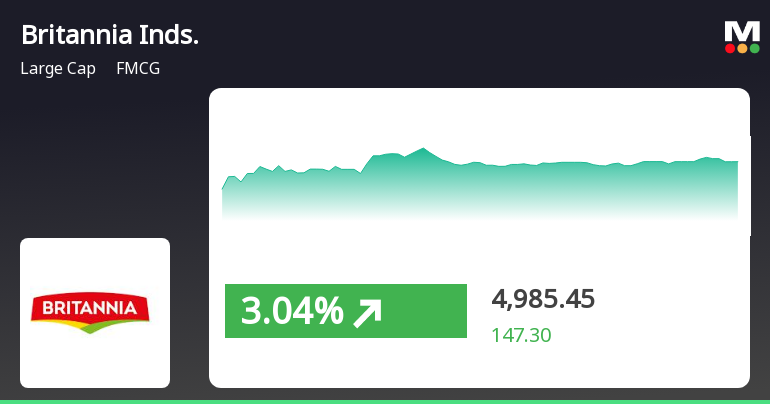

Britannia Industries Shows Strong Recovery Amid Broader Market Decline

2025-03-28 09:50:25Britannia Industries experienced a notable performance on March 28, 2025, reversing a two-day decline and reaching an intraday high. The stock outperformed the broader market and the FMCG sector, with significant gains over the past week and month, while also showing strong returns over the last three years.

Read MoreBritannia Industries Shows Resilience Amid Mixed FMCG Sector Performance

2025-03-28 09:21:02Britannia Industries, a prominent player in the FMCG sector, has shown notable activity today, outperforming its sector by 0.41%. After experiencing two consecutive days of decline, the stock has reversed its trend, gaining 2.28% in a single day. It opened at Rs 4,850.35 and has maintained this price throughout the trading session. With a market capitalization of Rs 1,19,193.68 crore, Britannia Industries holds a P/E ratio of 53.57, slightly above the industry average of 52.25. The stock's performance over various time frames reveals a mixed picture; while it has gained 2.50% over the past week and 7.50% over the past month, its one-year performance stands at just 0.72%, lagging behind the Sensex's 5.36%. In the broader FMCG sector, 92 stocks have reported results, with 26 showing positive outcomes, 39 flat, and 27 negative. Britannia's performance metrics indicate resilience in a competitive market, alth...

Read MoreBritannia Industries Faces Mixed Performance Amid Broader FMCG Sector Trends

2025-03-27 09:20:34Britannia Industries, a prominent player in the FMCG sector, has shown notable activity today, underperforming the sector by 1.47%. The stock has experienced a consecutive decline over the past two days, with a total drop of 1.77% during this period. It opened at Rs 4,760.4 and has maintained this trading price throughout the day. In terms of moving averages, Britannia's stock is currently above its 20-day moving average but below the 5-day, 50-day, 100-day, and 200-day moving averages, indicating mixed short-term performance. The company's market capitalization stands at Rs 1,15,339.78 crore, categorizing it as a large-cap stock. The price-to-earnings (P/E) ratio is recorded at 53.66, slightly above the industry average of 52.18. Over the past year, Britannia Industries has seen a decline of 2.66%, contrasting with the Sensex's performance of 5.76%. In the broader FMCG sector, out of 92 stocks that have ...

Read MoreBritannia Industries Shows Resilience Amidst Competitive FMCG Landscape and Market Trends

2025-03-26 09:20:11Britannia Industries, a prominent player in the FMCG sector, has shown notable activity today, outperforming its sector by 0.78%. The stock has experienced a consecutive gain over the last two days, with a total increase of 1.56% during this period. It opened at Rs 4,883.90 and has maintained this price throughout the trading session. In terms of moving averages, Britannia's stock is currently above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. The company's market capitalization stands at Rs 1,16,534.49 crore, categorizing it as a large-cap stock. The price-to-earnings (P/E) ratio is recorded at 53.66, slightly higher than the industry average of 52.38. Over the past year, Britannia Industries has faced a decline of 2.48%, contrasting with the Sensex's performance of 7.67%. However, the stock has shown resilience in shorter time frames, ...

Read MoreBritannia Industries Faces Market Challenges Amidst Broader FMCG Sector Trends

2025-03-25 09:20:48Britannia Industries, a prominent player in the FMCG sector, has experienced notable activity today, underperforming the sector by 0.88%. The stock has been on a downward trend for the past three days, with a cumulative decline of 1.16%. Today, it opened at 4775.1 and has maintained this price throughout the trading session. In terms of financial metrics, Britannia Industries holds a market capitalization of Rs 1,14,725.57 crore, categorizing it as a large-cap company. The stock's price-to-earnings (P/E) ratio stands at 53.24, slightly above the industry average of 52.45. When examining the stock's performance over various time frames, it has shown a year-to-date decline of 0.08%, contrasting with the Sensex's modest gain of 0.24%. Over the past year, Britannia's performance has decreased by 2.13%, while the Sensex has risen by 7.54%. Additionally, the stock's performance over three years has been robust...

Read MoreBritannia Industries Faces Volatility Amid Mixed FMCG Sector Performance

2025-03-24 09:31:30Britannia Industries, a prominent player in the FMCG sector, has experienced notable activity today, underperforming its sector by 0.72%. The stock has faced consecutive declines over the past two days, resulting in a total drop of 0.5%. Trading within a narrow range of Rs 21.25, Britannia has exhibited high volatility, with an intraday volatility rate of 180.04%, indicating significant price fluctuations. Currently, Britannia Industries holds a market capitalization of Rs 1,16,014.21 crore and has a price-to-earnings (P/E) ratio of 53.45, slightly above the industry average of 53.09. Over the past year, the stock has seen a decline of 1.03%, contrasting with the Sensex's performance of 6.25%. In terms of moving averages, the stock is positioned higher than its 5-day and 20-day averages but lower than the 50-day, 100-day, and 200-day averages. As the FMCG sector continues to report mixed results, with 26 ...

Read MoreBritannia Industries Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-21 08:02:42Britannia Industries, a prominent player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 4,831.25, showing a notable shift from its previous close of 4,720.00. Over the past year, the stock has reached a high of 6,473.10 and a low of 4,506.50, indicating a degree of volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and moving averages present a bearish trend on a daily basis, with mixed signals across other indicators such as the KST and OBV. When comparing the stock's performance to the Sensex, Britannia has shown varied returns. Over the past week, it recorded a return of 2.25%, while the Sensex returned 3.41%. Year-to-date, Britannia has outperformed the Sensex with a return o...

Read MoreBritannia Industries Faces Technical Trend Shifts Amid Mixed Market Signals

2025-03-20 08:03:17Britannia Industries, a prominent player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 4,720.00, down from the previous close of 4,771.25. Over the past year, Britannia has experienced fluctuations, with a 52-week high of 6,473.10 and a low of 4,506.50. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The daily moving averages also align with this sentiment, indicating a cautious outlook. Notably, the KST and OBV metrics present a mixed picture, with weekly readings showing mild bullishness, contrasting with the monthly bearish signals. When comparing the stock's performance to the Sensex, Britannia's returns have been underwhelming in the short term. Over the past week, the stock has declined by ...

Read MoreBritannia Industries Faces Trading Challenges Amidst High Volatility and Market Underperformance

2025-03-19 09:25:57Britannia Industries, a prominent player in the FMCG sector, has experienced notable trading activity today. The stock has underperformed its sector by 0.55%, reflecting a challenging market environment. It has traded within a narrow range of Rs 44.2, indicating limited price movement despite high volatility, with an intraday volatility rate of 146.67%. In terms of performance metrics, Britannia Industries holds a market capitalization of Rs 1,14,484.70 crore, categorizing it as a large-cap company. The stock's price-to-earnings (P/E) ratio stands at 52.83, slightly above the industry average of 51.17. Over the past year, Britannia's stock has declined by 1.30%, contrasting with the Sensex's gain of 4.54%. The company's performance over various time frames shows a consistent trend of underperformance relative to the Sensex, including a 0.29% decline year-to-date. However, the long-term outlook remains mo...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find enclosed the Certificate issued under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 by KFin Technologies Limited RTA of the Company for the period 1st January 2025 to 31st March 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEThis is to inform you that the trading window will remain closed with effect from 1st April 2025 until 48 hours after the declaration of the audited financial results of the Company for the quarter and year ending 31st March 2025.

Intimation Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

27-Mar-2025 | Source : BSEPursuant to Regulation 30 read with Clause 20 of Para A of Part A of Schedule III of the SEBI Listing Regulations 2015 this is to inform you that the Company has received an Order from the Assistant Commissioner Jurisdiction: Sector 3 (Mobile Squad) Etawah Uttar Pradesh.

Corporate Actions

No Upcoming Board Meetings

Britannia Industries Ltd has declared 7350% dividend, ex-date: 05 Aug 24

Britannia Industries Ltd has announced 1:2 stock split, ex-date: 29 Nov 18

Britannia Industries Ltd has announced 1:1 bonus issue, ex-date: 25 May 21

No Rights history available