BSEL ALGO Faces Financial Struggles Amidst Significant Stock Volatility and Losses

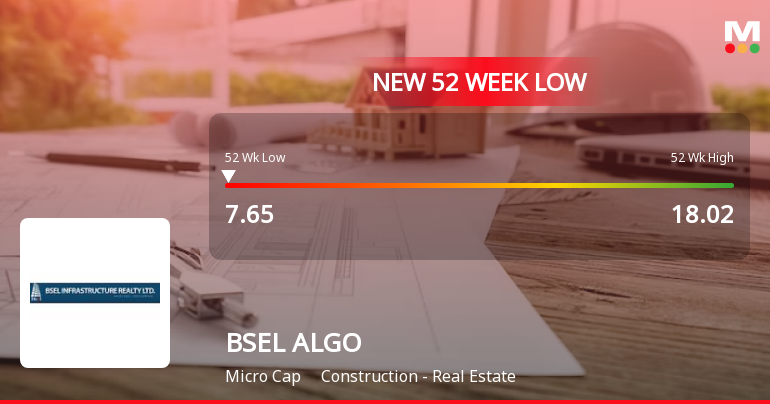

2025-03-27 09:52:33BSEL ALGO, a microcap in the construction and real estate sector, has hit a new 52-week low amid significant volatility. The company reported an operating loss and a sharp decline in profit, raising concerns about its financial health and long-term fundamentals, despite attractive valuation metrics.

Read More

BSEL ALGO Faces Financial Struggles Amid Continued Stock Volatility and Losses

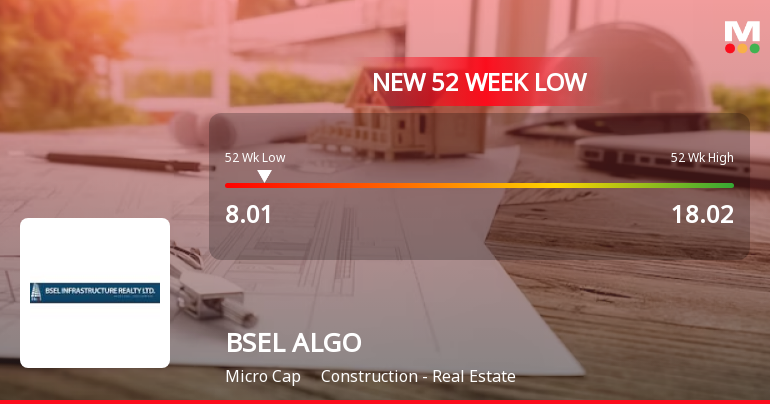

2025-03-27 09:52:25BSEL ALGO, a microcap in the construction and real estate sector, has hit a new 52-week low amid ongoing volatility. The company reported significant financial losses, including a negative profit after tax and operational struggles, while its stock has underperformed compared to broader market indices over the past year.

Read MoreBSEL ALGO Adjusts Valuation Grade Amidst Unique Market Position and Performance Trends

2025-03-26 08:00:24BSEL ALGO, a microcap player in the construction and real estate sector, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company currently exhibits a price-to-earnings (P/E) ratio of 2.73 and an enterprise value to EBITDA ratio of 2.42, indicating a relatively low valuation compared to its peers. Additionally, BSEL ALGO's price-to-book value stands at 0.15, suggesting that the market may be undervaluing its assets. In terms of performance, BSEL ALGO has shown a return of 131.64% over the past three years, significantly outperforming the broader market, which saw a 36.01% return in the same period. However, its year-to-date performance reflects a decline of 34.61%, contrasting with a slight decrease in the Sensex. When compared to its peers, BSEL ALGO's valuation metrics are notably lower, with competitors like Garuda Construction and RDB Infrastructu...

Read MoreBSEL ALGO Experiences Valuation Grade Change Amidst Underperformance in Real Estate Sector

2025-03-05 08:00:31BSEL ALGO, a microcap player in the construction and real estate sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of 2.77 and an EV to EBITDA ratio of 2.46, indicating a low valuation relative to its earnings and cash flow. Additionally, the price to book value stands at a mere 0.15, suggesting that the market may not fully recognize the company's asset value. In terms of performance, BSEL ALGO has faced challenges, with a year-to-date return of -33.65%, significantly underperforming the Sensex, which has seen a decline of only -6.59% in the same period. Over the past year, the stock has also lagged, with a return of -32.69% compared to the Sensex's -1.19%. When compared to its peers, BSEL ALGO's valuation metrics highlight a stark contrast. For instance, Garuda Construction and Crest Ventures are positioned at much higher valuation levels, reflectin...

Read More

BSEL ALGO Hits 52-Week Low Amid Ongoing Financial Struggles and Losses

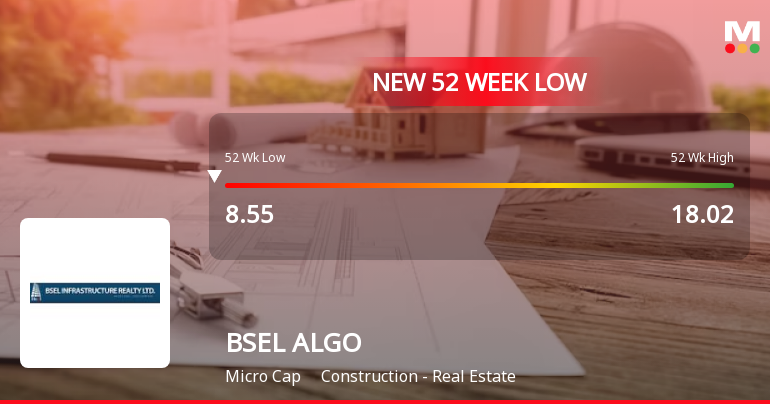

2025-03-04 10:44:00BSEL ALGO, a microcap in the construction and real estate sector, has reached a new 52-week low amid ongoing operational losses and declining financial metrics. The company has struggled over the past year, significantly underperforming the market, and faces a challenging outlook with deteriorating technical indicators.

Read More

BSEL ALGO Shows Signs of Reversal Amidst Ongoing Market Challenges

2025-02-17 09:38:20BSEL ALGO, a microcap in the construction and real estate sector, reached a 52-week low but has shown signs of recovery after five days of decline. Despite outperforming its sector today, the stock remains below key moving averages and has declined 38.72% over the past year, contrasting with the Sensex's gains.

Read More

BSEL ALGO Faces Significant Volatility Amid Broader Sector Downturn in February 2025

2025-02-14 12:05:27BSEL ALGO, a microcap in the construction and real estate sector, has faced notable volatility, recently hitting a 52-week low. Despite outperforming its sector today, the stock has declined significantly over the past week and is trading below key moving averages, reflecting ongoing challenges in the market.

Read More

BSEL ALGO Faces Persistent Challenges Amid Significant Market Volatility and Decline

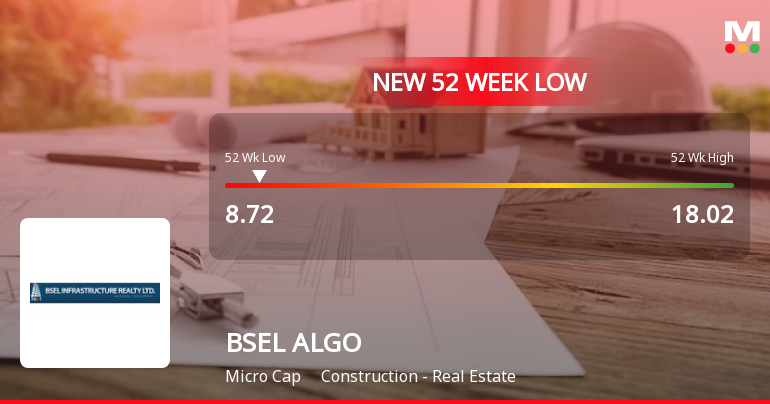

2025-02-12 09:36:29BSEL ALGO, a microcap in the construction and real estate sector, has hit a new 52-week low, continuing a downward trend with a notable decline over the past three days. The stock has underperformed its sector and recorded a significant annual performance drop, contrasting with broader market gains.

Read More

BSEL ALGO Faces Significant Volatility Amid Broader Construction Sector Challenges

2025-02-11 13:35:29BSEL ALGO, a microcap in the construction and real estate sector, has hit a new 52-week low amid significant volatility. The stock has declined 16.67% over two days and 32.61% over the past year, underperforming its sector and trading below key moving averages. The broader sector has also faced challenges.

Read MoreAppointment of Company Secretary and Compliance Officer

26-Mar-2025 | Source : BSEChange in name of the Company Secretary and Compliance Officer.

Closure of Trading Window

26-Mar-2025 | Source : BSETrading Window Closure for the quarter and year ended March 31 2025

Appointment of Company Secretary and Compliance Officer

24-Mar-2025 | Source : BSEAppointment of Company Secretary and Compliance Officer

Corporate Actions

No Upcoming Board Meetings

BSEL ALGO Ltd has declared 5% dividend, ex-date: 25 Sep 08

No Splits history available

No Bonus history available

No Rights history available