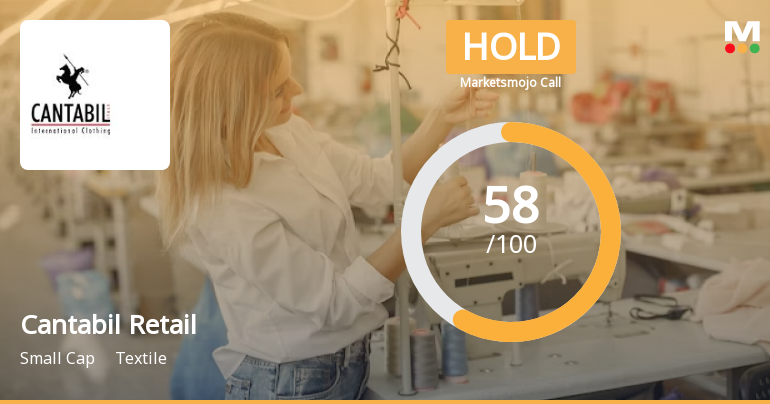

Cantabil Retail Shows Mixed Technical Trends Amid Strong Long-Term Performance

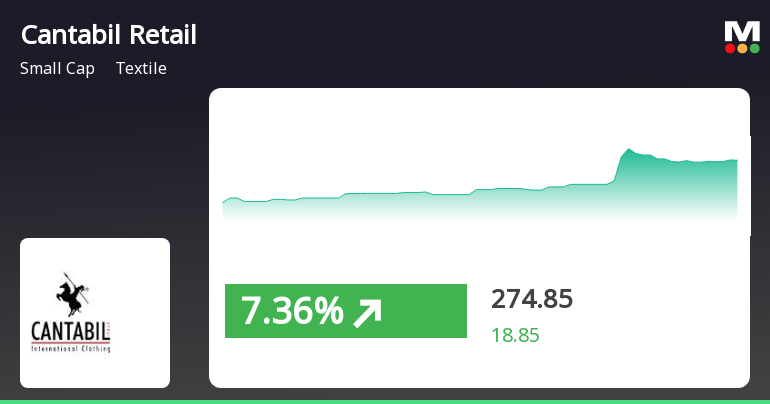

2025-03-24 08:02:02Cantabil Retail India, a small-cap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 272.25, having seen fluctuations with a previous close at 279.35. Over the past year, Cantabil has demonstrated a notable return of 21.00%, significantly outperforming the Sensex, which recorded a return of 5.87% in the same period. In terms of technical indicators, the weekly MACD shows a mildly bearish trend, while the monthly perspective remains bullish. The Bollinger Bands indicate a bullish stance on both weekly and monthly charts, suggesting some positive momentum. Daily moving averages reflect a mildly bullish trend, while the KST presents a mixed view with a mildly bearish weekly trend against a bullish monthly outlook. The company's performance over various time frames highlights its resilience, particularly in th...

Read MoreCantabil Retail Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:02:52Cantabil Retail India, a small-cap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 281.05, showing a notable increase from the previous close of 269.30. Over the past year, Cantabil has demonstrated impressive performance, with a return of 39.17%, significantly outperforming the Sensex, which recorded a return of 4.77% during the same period. In terms of technical indicators, the stock exhibits a mixed picture. The Moving Averages indicate a bullish sentiment on a daily basis, while the MACD shows a mildly bearish trend on a weekly basis but bullish on a monthly scale. Bollinger Bands also reflect a bullish stance for both weekly and monthly evaluations. The company's performance over various time frames highlights its resilience, particularly over the last five years, where it achieved a remarkable ret...

Read More

Cantabil Retail India Shows Strong Financial Performance Amid High Debt Concerns

2025-03-18 08:15:45Cantabil Retail India has recently experienced an evaluation adjustment reflecting its market dynamics. The company reported strong financial metrics for Q3 FY24-25, with high net sales and PBDIT. Despite a significant debt burden, its stock is trading at a discount compared to peers, indicating potential market interest.

Read MoreCantabil Retail's Technical Indicators Reflect Mixed Trends Amid Strong Performance

2025-03-13 08:01:51Cantabil Retail India, a small-cap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 261.90, showing a notable increase from the previous close of 256.25. Over the past year, Cantabil has demonstrated a strong performance with a return of 29.53%, significantly outpacing the Sensex, which recorded a mere 0.49% during the same period. In terms of technical indicators, the weekly MACD and KST are showing mildly bearish trends, while the monthly Bollinger Bands indicate a bullish stance. The daily moving averages suggest a mildly bullish outlook, contributing to the overall evaluation adjustment. When examining Cantabil's performance over various time frames, the company has shown remarkable growth, particularly over the last five years, where it achieved a staggering return of 425.27%, compared to the Sensex...

Read MoreCantabil Retail's Technical Indicators Reflect Mixed Trends Amid Strong Performance

2025-03-13 08:01:51Cantabil Retail India, a small-cap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 261.90, showing a notable increase from the previous close of 256.25. Over the past year, Cantabil has demonstrated a strong performance with a return of 29.53%, significantly outpacing the Sensex, which recorded a mere 0.49% during the same period. In terms of technical indicators, the weekly MACD and KST are showing mildly bearish trends, while the monthly Bollinger Bands indicate a bullish stance. The daily moving averages suggest a mildly bullish outlook, contributing to the overall evaluation adjustment. When examining Cantabil's performance over various time frames, the company has shown remarkable growth, particularly over the last five years, where it achieved a staggering return of 425.27%, compared to the Sensex...

Read More

Cantabil Retail India Faces Financial Stability Concerns Amid Positive Sales Growth

2025-03-11 08:14:29Cantabil Retail India has recently experienced a change in its evaluation, reflecting its financial performance for Q3 FY24-25, which includes net sales of Rs 222.92 crore and a strong operating profit to interest ratio. However, concerns persist regarding its significant debt burden and valuation metrics.

Read MoreCantabil Retail's Technical Trends Show Mixed Signals Amid Market Volatility

2025-03-11 08:03:57Cantabil Retail India, a small-cap player in the textile industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 256.35, down from a previous close of 266.40, with a 52-week high of 334.85 and a low of 181.85. Today's trading saw a high of 271.95 and a low of 255.35, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates a mildly bearish trend on both weekly and monthly scales, while the Bollinger Bands show a bearish stance weekly but bullish monthly. Moving averages suggest a mildly bullish outlook on a daily basis, contrasting with the overall bearish signals from the KST and Dow Theory metrics. In terms of performance, Cantabil Retail has shown notable returns over various periods. Over the past week, the stock returned 8.99%, significantly outperforming the Sensex, which returned 1.41%. How...

Read More

Cantabil Retail India Shows Strong Short-Term Gains Amid Broader Market Trends

2025-03-07 10:15:51Cantabil Retail India has experienced notable gains, marking its fourth consecutive day of increases and outperforming its sector. The stock is currently above several moving averages and has shown strong performance over the past week, despite a decline in the past month and year-to-date. Long-term growth remains impressive.

Read MoreCantabil Retail Opens Strong with 5.43% Gain, Outpacing Sector Performance

2025-03-06 11:05:14Cantabil Retail India Ltd, a small-cap player in the textile industry, has shown significant activity today, opening with a gain of 5.43%. The stock's performance has outpaced its sector by 1.15%, marking a notable achievement as it has recorded consecutive gains over the past three days, accumulating a total return of 6.7% during this period. Today, Cantabil Retail reached an intraday high of Rs 258.35. In terms of broader market performance, the stock increased by 2.61% compared to the Sensex, which only saw a modest rise of 0.16%. However, over the past month, Cantabil Retail has faced challenges, with a decline of 22.13%, while the Sensex fell by 5.39%. From a technical perspective, the stock's moving averages indicate it is performing above the 5-day average but below the longer-term averages of 20, 50, 100, and 200 days. The stock is classified as high beta, with an adjusted beta of 1.10, suggestin...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECompliances-Certificate under Reg. 74(5) of SEBI (DP) Regulations 2018

Announcement under Regulation 30 (LODR)-Monthly Business Updates

31-Mar-2025 | Source : BSEAnnouncement under Regulation 30 (LODR)- Monthly Business Updates

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Cantabil Retail India Ltd has declared 25% dividend, ex-date: 21 Feb 25

Cantabil Retail India Ltd has announced 2:10 stock split, ex-date: 02 Nov 23

No Bonus history available

No Rights history available