CARE Ratings Navigates Market Challenges Amid Broader Decline in Sensex

2025-04-01 18:00:21CARE Ratings, a small-cap player in the ratings industry, has shown notable activity today, with its stock price increasing by 0.34%. This performance contrasts with the broader market, as the Sensex declined by 1.80%. Over the past year, CARE Ratings has experienced a decline of 4.61%, while the Sensex has gained 2.72%. In terms of financial metrics, CARE Ratings has a market capitalization of Rs 3,398.00 crore and a price-to-earnings (P/E) ratio of 28.17, which is significantly lower than the industry average P/E of 40.77. Looking at recent performance trends, the stock has faced challenges, with a year-to-date decline of 17.56% compared to the Sensex's drop of 2.71%. However, over a longer horizon, CARE Ratings has demonstrated resilience, boasting a three-year performance increase of 112.13% and a five-year increase of 234.22%. Technical indicators suggest a bearish outlook in the short term, with...

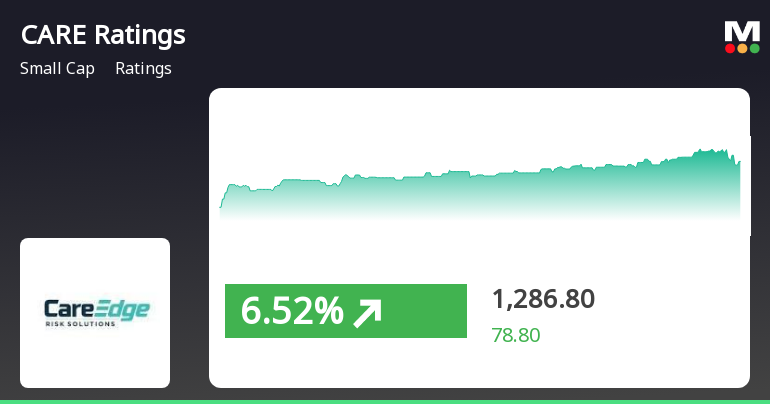

Read MoreCARE Ratings Opens 10.5% Higher, Signaling Potential Market Sentiment Shift

2025-03-19 09:35:05CARE Ratings, a small-cap player in the ratings industry, has shown significant activity today, opening with a notable gain of 10.5%. This uptick marks a trend reversal after six consecutive days of decline, indicating a potential shift in market sentiment. The stock reached an intraday high of Rs 1211, outperforming its sector by 2.26% for the day. Despite today's performance, CARE Ratings is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting ongoing challenges in maintaining upward momentum. Over the past month, the stock has experienced a decline of 4.83%, compared to a smaller drop of 0.72% in the Sensex. Technical indicators present a mixed picture, with the MACD showing bearish signals on a weekly basis and mildly bearish on a monthly basis. The stock's beta of 1.35 indicates that it tends to exhibit higher volatility compared to the broader market. A...

Read More

CARE Ratings Faces Evaluation Adjustment Amidst Mixed Financial Performance and Market Sentiment

2025-03-13 08:02:38CARE Ratings has recently adjusted its evaluation, reflecting a complex view of its financial health amid positive quarterly performance. While net sales and operating profit show modest growth, long-term challenges persist. Institutional confidence remains strong, and the company has seen a notable return over the past year.

Read MoreCARE Ratings Faces Mixed Technical Trends Amid Market Evaluation Revision

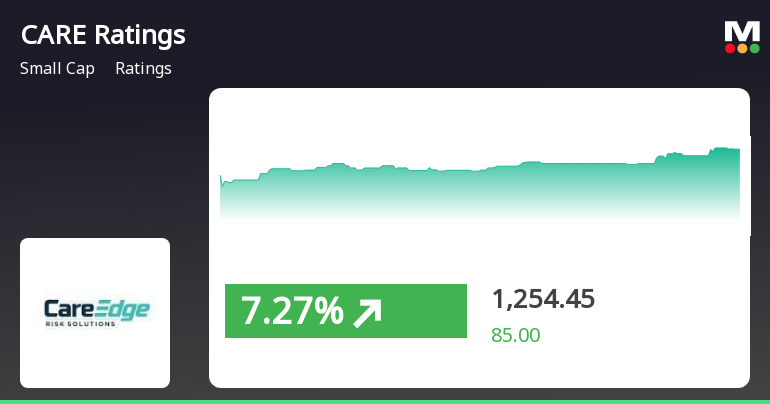

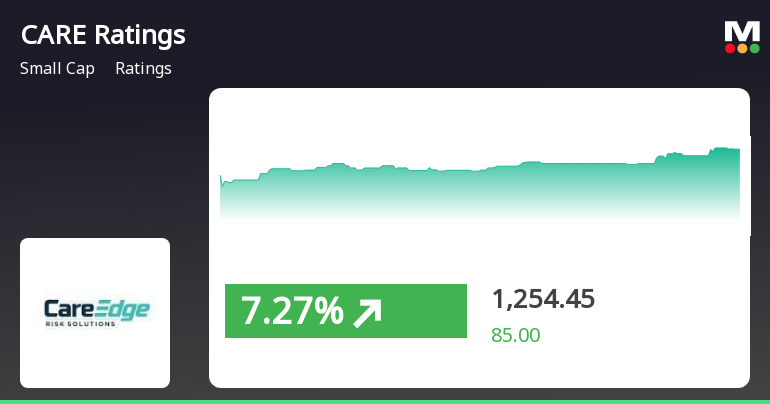

2025-03-13 08:01:38CARE Ratings, a small-cap player in the ratings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,148.00, slightly down from the previous close of 1,149.10. Over the past year, CARE Ratings has experienced a stock return of 4.22%, outperforming the Sensex, which returned 0.49% during the same period. However, the year-to-date performance shows a decline of 15.29%, compared to a 5.26% drop in the Sensex. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on both weekly and monthly charts. The Relative Strength Index (RSI) remains neutral, while Bollinger Bands present a bearish trend on the weekly scale but a bullish outlook monthly. Moving averages indicate a mildly bullish stance on a daily basis, contrasting with the bearish signals from the KST and OBV metrics. In terms of price movement...

Read MoreCARE Ratings Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-13 08:01:38CARE Ratings, a small-cap player in the ratings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,148.00, slightly down from the previous close of 1,149.10. Over the past year, CARE Ratings has experienced a stock return of 4.22%, outperforming the Sensex, which returned 0.49% during the same period. However, the year-to-date performance shows a decline of 15.29%, compared to a 5.26% drop in the Sensex. The technical summary indicates a mixed outlook, with the MACD showing bearish signals on both weekly and monthly charts. The Relative Strength Index (RSI) remains neutral, while Bollinger Bands present a bearish trend on the weekly scale but a bullish outlook monthly. Moving averages indicate a mildly bullish stance on a daily basis, contrasting with the bearish signals from the KST and OBV metrics. In terms of price movement...

Read MoreCARE Ratings Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-02-28 08:01:11CARE Ratings, a small-cap player in the ratings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,155.80, slightly down from its previous close of 1,164.00. Over the past year, CARE Ratings has experienced a stock return of -1.76%, contrasting with a positive return of 2.08% from the Sensex during the same period. In terms of technical indicators, the weekly MACD shows a mildly bearish trend, while the monthly perspective remains bullish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands present a bearish outlook on a weekly basis, while the monthly view is mildly bullish. Daily moving averages suggest a mildly bullish sentiment, although the KST and Dow Theory metrics indicate a mildly bearish trend on both weekly and monthly scales. Notably, the comp...

Read More

CARE Ratings Outperforms Sector Amid Mixed Market Dynamics and Moving Average Trends

2025-02-06 15:05:14CARE Ratings experienced notable activity on February 6, 2025, with a significant stock increase, outperforming its sector. The stock is currently above several moving averages, indicating a positive short-term trend, while facing challenges in the medium-term. Its recent performance contrasts with the broader market dynamics.

Read More

CARE Ratings Shows Resilience Amid Market Volatility with Notable Stock Recovery

2025-02-04 13:05:13CARE Ratings saw a significant rebound on February 4, 2025, after three days of decline, with a notable intraday high reached. The stock outperformed its sector, although it has experienced a decline over the past month. Its moving averages indicate a mixed technical position amid recent market volatility.

Read More

CARE Ratings Shows Resilience Amid Market Volatility with Notable Stock Recovery

2025-02-04 13:05:13CARE Ratings saw a significant rebound on February 4, 2025, after three days of decline, with a notable intraday high reached. The stock outperformed its sector, although it has experienced a decline over the past month. Its moving averages indicate a mixed technical position amid recent market volatility.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and participants) Regulations 2018

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

11-Mar-2025 | Source : BSEESOP Allotment

Corporate Actions

No Upcoming Board Meetings

CARE Ratings Ltd has declared 70% dividend, ex-date: 05 Nov 24

No Splits history available

No Bonus history available

No Rights history available