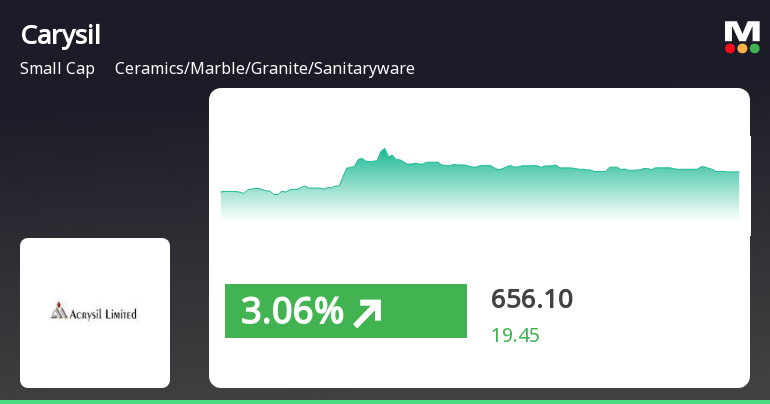

Carysil's Stock Rebounds Amid Broader Market Recovery, Signaling Potential Trend Shift

2025-03-27 10:05:15Carysil, a small-cap company in the ceramics and sanitaryware sector, experienced significant trading activity, recovering from earlier declines to achieve a notable intraday high. Despite this short-term rebound, the stock's longer-term performance remains down compared to the broader market, which has seen recent gains.

Read More

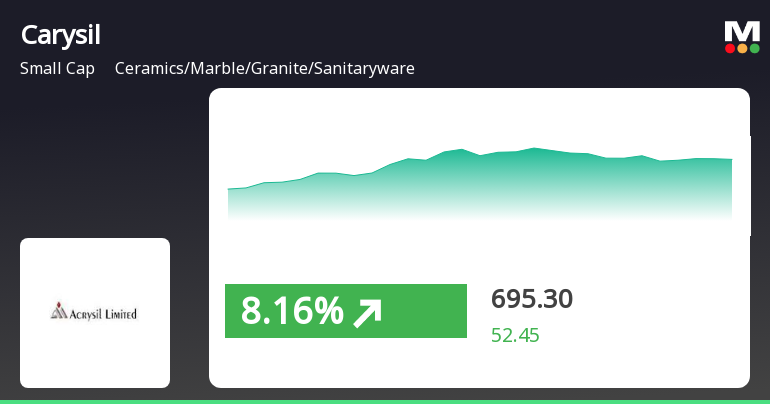

Carysil's Recent Surge Signals Potential Recovery Amid Market Fluctuations

2025-03-21 09:35:15Carysil, a small-cap company in the ceramics and sanitaryware sector, experienced a notable rebound on March 21, 2025, after two days of decline. The stock outperformed its sector and has shown significant gains over the past week and month, despite a decline over the past year and three years.

Read MoreCarysil Experiences Technical Trend Shifts Amid Market Volatility and Performance Disparities

2025-03-19 08:02:39Carysil, a small-cap player in the ceramics, marble, granite, and sanitaryware industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 662.90, showing a notable increase from its previous close of 588.00. Over the past week, Carysil has reached a high of 696.85 and a low of 586.30, indicating some volatility in its trading activity. In terms of technical indicators, the MACD and KST metrics are signaling bearish trends on both weekly and monthly bases, while the Bollinger Bands and moving averages suggest a mildly bearish outlook. The Dow Theory presents a mildly bullish perspective on a weekly basis, contrasting with the absence of a clear trend on a monthly scale. The On-Balance Volume (OBV) shows a bullish trend monthly, while weekly data indicates no significant movement. When comparing Carysil's performance to the Sensex, the st...

Read MoreCarysil Experiences Valuation Adjustment Amid Strong Stock Performance and Competitive Landscape

2025-03-19 08:00:32Carysil, a small-cap player in the ceramics, marble, granite, and sanitaryware industry, has recently undergone a valuation adjustment. The company's current price stands at 662.90, reflecting a notable increase from its previous close of 588.00. Over the past week, Carysil has demonstrated a strong stock return of 32.86%, significantly outperforming the Sensex, which returned only 1.62% in the same period. Key financial metrics for Carysil include a PE ratio of 31.04 and an EV to EBITDA ratio of 14.96. The company also reports a return on capital employed (ROCE) of 16.37% and a return on equity (ROE) of 12.85%. Despite these figures, Carysil's valuation has been adjusted, indicating a shift in market perception. In comparison to its peers, Carysil's valuation metrics reveal a competitive landscape. For instance, Pokarna is positioned with a PE ratio of 25.4, while Somany Ceramics boasts a lower EV to EBI...

Read More

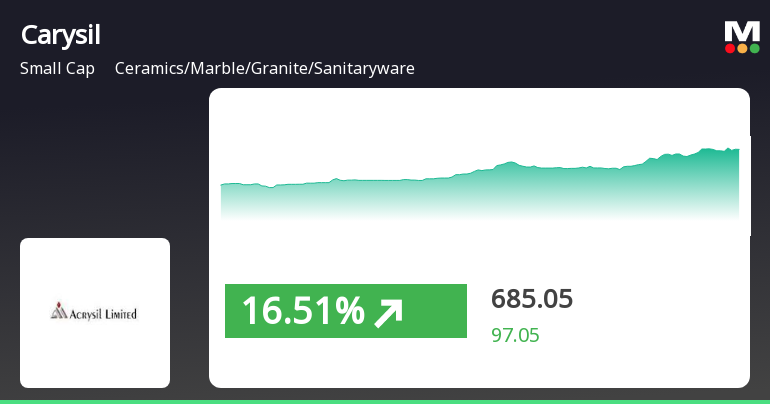

Carysil Experiences Significant Stock Activity Amid Broader Small-Cap Market Gains

2025-03-18 10:35:15Carysil, a small-cap company in the ceramics and sanitaryware sector, experienced notable trading activity, gaining 7.65% on March 18, 2025. The stock showed high volatility and outperformed its sector. Despite recent gains, Carysil's long-term performance has declined significantly over the past year compared to the broader market.

Read MoreCarysil Experiences Valuation Grade Change Amidst Competitive Industry Metrics

2025-03-13 08:00:32Carysil, a small-cap player in the ceramics, marble, granite, and sanitaryware industry, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 28.35 and a price-to-book value of 3.48. Its enterprise value to EBITDA stands at 13.77, while the EV to EBIT is recorded at 18.93. Carysil's return on capital employed (ROCE) is at 16.37%, and the return on equity (ROE) is 12.85%. In comparison to its peers, Carysil's valuation metrics reflect a different positioning. For instance, Pokarna has a lower PE ratio of 25.3 but a higher EV to EBITDA of 14.95, while Somany Ceramics shows a more attractive PE ratio of 24.99 and a significantly lower EV to EBITDA of 8.48. Carysil's stock performance has shown varied results, with a notable return of 15.74% over the past week, contrasting with a decline of 19.27% year-to-date. The company's stock price has fluctuat...

Read MoreCarysil Experiences Valuation Grade Change Amidst Competitive Industry Metrics

2025-03-13 08:00:32Carysil, a small-cap player in the ceramics, marble, granite, and sanitaryware industry, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 28.35 and a price-to-book value of 3.48. Its enterprise value to EBITDA stands at 13.77, while the EV to EBIT is recorded at 18.93. Carysil's return on capital employed (ROCE) is at 16.37%, and the return on equity (ROE) is 12.85%. In comparison to its peers, Carysil's valuation metrics reflect a different positioning. For instance, Pokarna has a lower PE ratio of 25.3 but a higher EV to EBITDA of 14.95, while Somany Ceramics shows a more attractive PE ratio of 24.99 and a significantly lower EV to EBITDA of 8.48. Carysil's stock performance has shown varied results, with a notable return of 15.74% over the past week, contrasting with a decline of 19.27% year-to-date. The company's stock price has fluctuat...

Read More

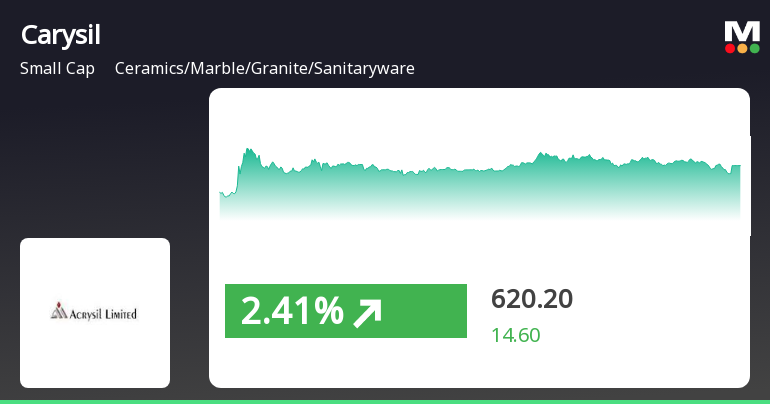

Carysil's Stock Rebounds Amid Broader Market Challenges and Sector Performance Variability

2025-03-12 12:35:15Carysil, a small-cap company in the ceramics and sanitaryware sector, experienced a significant uptick today, reversing a two-day decline. The stock outperformed its sector, although its moving averages present a mixed outlook. In contrast, the broader market, represented by the Sensex, is facing challenges, nearing its 52-week low.

Read MoreCarysil Faces Bearish Technical Trends Amidst Market Volatility and Mixed Performance

2025-03-11 08:02:48Carysil, a small-cap player in the ceramics, marble, granite, and sanitaryware industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 512.40, down from a previous close of 535.50, with a notable 52-week high of 1,036.00 and a low of 486.65. Today's trading saw a high of 544.50 and a low of 501.30, indicating some volatility. The technical summary for Carysil reveals a bearish sentiment across several indicators. The MACD shows bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect a bearish outlook. The daily moving averages align with this sentiment, further emphasizing the current market position. The KST indicates a bearish trend on a weekly basis, although it is mildly bearish on a monthly basis. In terms of performance, Carysil's returns have been mixed when compared to the Sensex. Over the pa...

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

08-Apr-2025 | Source : BSECredit Rating

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg 74 (5) of SEBI (DP) Regulation 2018 for quarter ended 31.03.2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Apr-2025 | Source : BSENewspaper publication on 03.04.2025 for notice of postal ballot.

Corporate Actions

No Upcoming Board Meetings

Carysil Ltd has declared 100% dividend, ex-date: 17 Sep 24

Carysil Ltd has announced 2:10 stock split, ex-date: 10 Jan 19

Carysil Ltd has announced 1:2 bonus issue, ex-date: 27 Sep 12

No Rights history available