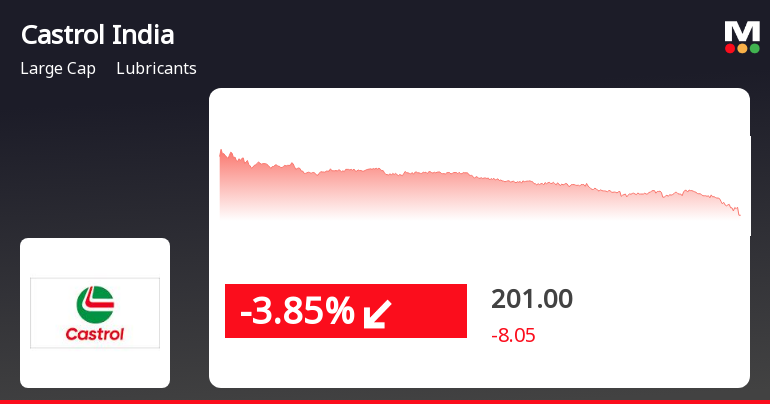

Castrol India Experiences Mixed Technical Trends Amid Market Volatility

2025-04-03 08:00:33Castrol India, a prominent player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 202.85, down from a previous close of 206.90, with a notable 52-week high of 284.40 and a low of 162.80. Today's trading saw a high of 208.40 and a low of 199.25, indicating some volatility. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments, suggesting a lack of strong momentum in either direction. Bollinger Bands indicate a bearish stance on a weekly basis, contrasting with a mildly bullish monthly view. Moving averages reflect a bearish trend on a daily basis, while the KST shows a bullish weekly trend but a mildly bearish monthly outlook. ...

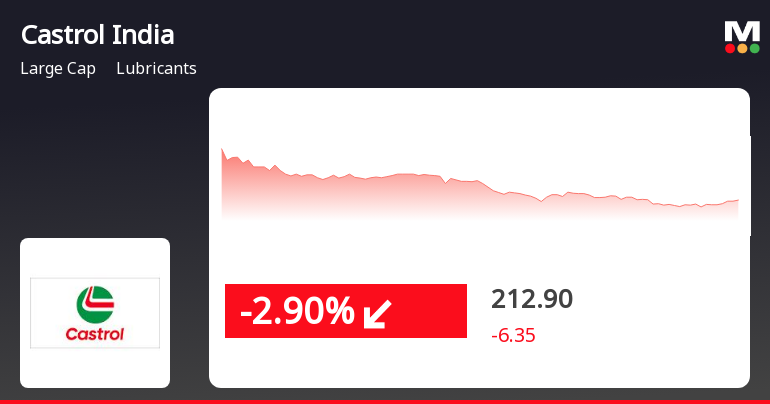

Read MoreCastrol India Shows Mixed Technical Trends Amidst Strong Long-Term Performance

2025-04-02 08:00:51Castrol India, a prominent player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 206.90, showing a slight increase from the previous close of 203.00. Over the past year, Castrol India has demonstrated resilience with a return of 2.71%, closely aligning with the Sensex's performance of 2.72%. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish trends on both weekly and monthly scales, suggesting some volatility in price movements. However, moving averages present a mildly bearish stance on a daily basis, indicating mixed signals in short-term performance. The company's performance over various time frames reveals interesting trends. Year-to-date, Castrol India has outp...

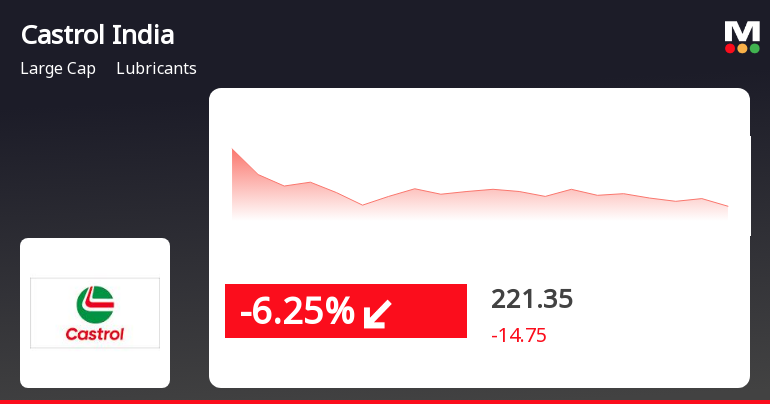

Read MoreCastrol India Experiences Mixed Technical Signals Amid Market Volatility

2025-04-01 08:00:21Castrol India, a prominent player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 203.00, down from a previous close of 209.05, with a 52-week high of 284.40 and a low of 162.80. Today's trading saw a high of 212.60 and a low of 201.00, indicating some volatility in the short term. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral for both weekly and monthly evaluations, suggesting a lack of strong momentum in either direction. Additionally, the Bollinger Bands indicate a sideways movement weekly, with a mildly bullish stance monthly. In terms of performance, Castrol India's returns have varied significantly over ...

Read More

Castrol India Faces Decline Amid Cautious Market Sentiment and Mixed Performance Trends

2025-03-28 15:30:17Castrol India Ltd. has seen a decline in stock performance, underperforming compared to the broader sector. The company remains above its 100-day moving average but below several shorter-term averages. Despite recent challenges, it offers a high dividend yield, reflecting potential returns for shareholders. Market sentiment remains cautious overall.

Read MoreCastrol India Experiences Mixed Technical Signals Amid Market Volatility

2025-03-26 08:00:22Castrol India, a prominent player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 208.60, down from a previous close of 219.25, with a 52-week high of 284.40 and a low of 162.80. Today's trading saw a high of 220.95 and a low of 207.50, indicating some volatility in its performance. The technical summary reveals mixed signals across various indicators. The MACD shows a bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly evaluations. Bollinger Bands indicate a mildly bullish stance in both time frames, suggesting some upward momentum. However, moving averages reflect a mildly bearish trend on a daily basis, and the KST shows a bullish weekly outlook but a mildly bearish monthly view. In te...

Read More

Castrol India's Stock Decline Signals Potential Trend Reversal Amid Market Resilience

2025-03-25 10:45:16Castrol India saw a decline on March 25, 2025, after two days of gains, indicating a potential trend reversal. The stock remains above its 50-day and 100-day moving averages but below shorter and longer-term averages. Despite recent performance, it has outperformed the Sensex over the past year.

Read MoreCastrol India Adjusts Valuation Amid Strong Performance and Competitive Profitability Metrics

2025-03-21 08:00:05Castrol India, a prominent player in the lubricants industry, has recently undergone a valuation adjustment. The company's current price stands at 216.95, reflecting a slight decline from the previous close of 218.65. Over the past year, Castrol India has delivered a return of 10.97%, outperforming the Sensex, which recorded a return of 5.89% in the same period. Key financial metrics for Castrol India include a PE ratio of 23.14 and an EV to EBITDA ratio of 15.69, indicating its market positioning within the sector. The company boasts a robust dividend yield of 8.07% and impressive returns on capital employed (ROCE) at 126.91% and return on equity (ROE) at 40.70%. In comparison to its peers, Castrol India maintains a competitive edge, particularly in terms of profitability metrics. However, its valuation metrics suggest a different positioning relative to the broader market. The company's performance ov...

Read More

Castrol India Faces High Volatility Amid Broader Market Gains and Sector Underperformance

2025-03-18 09:30:17Castrol India faced a notable decline on March 18, 2025, marked by high volatility and significant intraday price fluctuations. Despite this, the stock remains above several moving averages and offers a competitive dividend yield. In contrast, the broader market, led by small-cap stocks, showed positive momentum.

Read MoreCastrol India Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-18 08:00:20Castrol India, a prominent player in the lubricants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 236.10, showing a slight increase from the previous close of 231.50. Over the past year, Castrol India has demonstrated resilience with a stock return of 19.70%, outperforming the Sensex, which recorded a return of 2.10% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bullish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands reflect a bullish stance for both weekly and monthly assessments, suggesting potential volatility. Moving averages indicate a mildly bearish trend on a daily basis, while the KST presents a mildly bullish outlook weekly, contrasting with its monthly performance. In terms of returns, Castrol India has sign...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate pursuant to 74(5) of SEBI (Depository and Participants) Regulations 2018 for the quarter ended 31 March 2025.

Board Meeting Intimation for Intimation Of Board Meeting Scheduled To Be Held On 28 April 2025.

03-Apr-2025 | Source : BSECastrol India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 28/04/2025 inter alia to consider and approve the unaudited financial results of the Company for the quarter ended 31 March 2025.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

25-Mar-2025 | Source : BSEScrutinizers Report & updated Voting Results of 47th AGM are enclosed.

Corporate Actions

28 Apr 2025

Castrol India Ltd. has declared 100% dividend, ex-date: 18 Mar 25

No Splits history available

Castrol India Ltd. has announced 1:1 bonus issue, ex-date: 21 Dec 17

No Rights history available