Catvision Ltd Shows Resilience Amid Broader Market Decline and Short-Term Challenges

2025-04-01 18:00:14Catvision Ltd, a microcap player in the Consumer Durables - Electronics sector, has shown notable activity today, with its stock price increasing by 0.45%. This performance stands in contrast to the broader market, as the Sensex has declined by 1.80% on the same day. Over the past year, Catvision has outperformed the Sensex, achieving a return of 15.12% compared to the index's 2.72%. Despite this positive annual performance, Catvision's stock has faced challenges in the short term, with a weekly decline of 8.58% against the Sensex's 2.55% drop. The company's market capitalization is currently at Rs 13.00 crore, and it operates with a price-to-earnings (P/E) ratio of 13.37, significantly lower than the industry average of 87.76. In terms of longer-term performance, Catvision has demonstrated impressive growth, with a 5-year return of 308.50%, outpacing the Sensex's 168.97%. However, the stock has seen a ye...

Read More

Catvision Ltd Faces Mixed Technical Signals Amid Long-Term Fundamental Challenges

2025-03-27 08:02:15Catvision Ltd, a microcap in the Consumer Durables - Electronics sector, has experienced a recent evaluation adjustment reflecting a shift in its technical trend. Despite positive Q3 FY24-25 financial performance, the company faces long-term challenges, including modest ROE and slow net sales growth, alongside concerns about debt management.

Read More

Catvision Ltd Faces Mixed Financial Performance Amidst Growth and Debt Concerns

2025-03-19 08:03:00Catvision Ltd, a microcap in the Consumer Durables - Electronics sector, has recently experienced an evaluation adjustment. The company shows mixed financial performance, with positive quarterly results but concerns over long-term fundamentals, modest growth, and debt servicing challenges, despite strong inventory and debtors turnover ratios.

Read More

Catvision Ltd Reports Profit Growth Amid Long-Term Growth Challenges and Debt Concerns

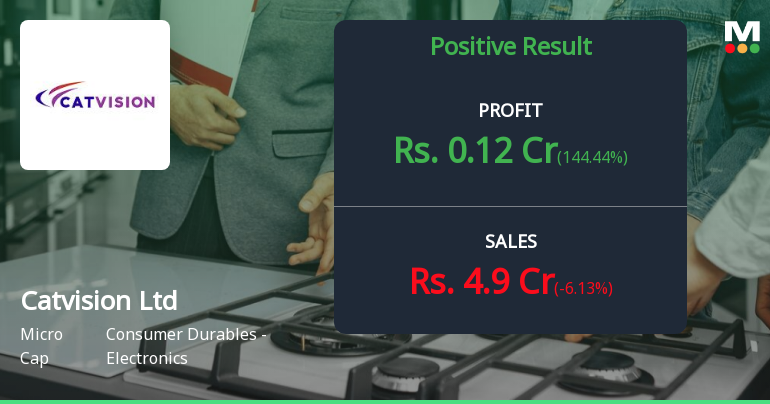

2025-03-11 08:06:07Catvision Ltd, a microcap in the Consumer Durables - Electronics sector, has recently adjusted its evaluation following a positive third-quarter performance for FY24-25. Despite increased profits, long-term growth challenges persist, highlighted by modest sales growth and concerns over debt management, while operational efficiency metrics show improvement.

Read More

Catvision Ltd Reports Strong Inventory Turnover Amid Long-Term Profitability Concerns

2025-03-06 08:02:25Catvision Ltd, a microcap in the Consumer Durables - Electronics sector, has recently adjusted its evaluation following a strong third-quarter performance, marked by high inventory and debtors turnover ratios. However, challenges persist with low Return on Equity and modest sales growth, raising concerns about long-term fundamentals.

Read MoreCatvision Ltd Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-02-25 10:31:03Catvision Ltd, a microcap player in the consumer durables electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price has shown fluctuations, with a current price of 24.58, up from a previous close of 23.51. Over the past year, Catvision has experienced a stock return of 2.20%, slightly outperforming the Sensex, which returned 2.09% in the same period. In terms of technical indicators, the MACD and KST metrics indicate a mildly bearish sentiment on both weekly and monthly scales. The Bollinger Bands present a mixed picture, with a bearish outlook on the weekly chart and a mildly bullish stance on the monthly chart. Moving averages suggest a mildly bullish trend on a daily basis, while the Dow Theory shows no clear trend on a weekly basis. Looking at the company's performance over various time frames, Catvision has demonstrated signifi...

Read More

Catvision Ltd Reports Improved Operational Metrics Amid Evaluation Adjustment in February 2025

2025-02-12 22:49:16Catvision Ltd has announced its financial results for the quarter ending December 2024, showcasing improved operational metrics. The company achieved a peak inventory turnover ratio of 4.12 and a debtors turnover ratio of 6.59, alongside a profit after tax of Rs 0.12 crore, indicating positive trends in efficiency and profitability.

Read MoreIntimation Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

04-Apr-2025 | Source : BSEIntimation under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Closure of Trading Window

26-Mar-2025 | Source : BSETrading window shall be closed for all the Directors Promoters KMPs and all the Designated Person(s) and their immediate relatives from 1st April 2025 till the conclusion of 48 hours from the declaration of financial results for the quarter and year ended 31st March 2025.

Corporate Actions

No Upcoming Board Meetings

Catvision Ltd has declared 10% dividend, ex-date: 21 Sep 17

No Splits history available

No Bonus history available

No Rights history available