Cenlub Industries Experiences Short-Term Stock Gain Amid Long-Term Declines and Market Challenges

2025-03-04 11:07:43Cenlub Industries, a microcap player in the engineering sector, has shown notable activity today, with its stock rising by 4.19%. This uptick comes amid a challenging performance over the past year, where the stock has declined by 29.36%, contrasting sharply with the Sensex's modest drop of 1.18%. Despite the recent daily gain, Cenlub Industries has faced significant headwinds over longer periods, including a 36.21% decrease over the last three months and a year-to-date decline of 32.19%. In comparison, the Sensex has only fallen by 6.57% during the same timeframe. Cenlub Industries holds a market capitalization of Rs 156.00 crore and a price-to-earnings (P/E) ratio of 17.72, which is notably lower than the industry average P/E of 27.62. Over the past five years, the company has demonstrated remarkable growth, with a staggering 798.94% increase, significantly outperforming the Sensex's 90.07% rise. As...

Read More

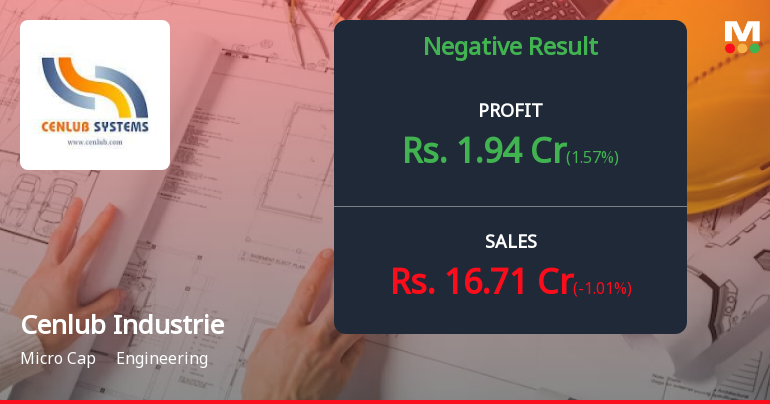

Cenlub Industries Faces Revenue Decline Amidst Challenging Financial Performance

2025-03-03 18:00:14Cenlub Industries has recently adjusted its evaluation following a challenging third quarter in FY24-25, reporting net sales of Rs 16.71 crore and a significant decline in profit after tax. Despite a low debt-to-equity ratio and a solid return on equity, the company has underperformed the broader market over the past year.

Read More

Cenlub Industries Reports Financial Results, Signals Shift in Performance Metrics for December 2024

2025-02-12 20:01:10Cenlub Industries has announced its financial results for the quarter ending December 2024, revealing a significant change in its performance metrics. The company's evaluation score has shifted notably, indicating a revised financial landscape that stakeholders should monitor closely for future developments.

Read More

Cenlub Industries Reports Flat Q2 Performance Amid Broader Market Gains

2025-01-27 18:25:59Cenlub Industries, a microcap engineering firm, has recently seen a change in its evaluation amid flat performance in Q2 FY24-25. With net sales at Rs 16.88 crore and low operating profit, the company has underperformed against the broader market, reflecting a lack of clear price momentum despite a low debt-to-equity ratio.

Read MoreDisclosure Under Regulation 31(4) Of Securities And Exchange Board Of India (Substantial Acquisition Of Shares & Takeovers) Regulations 2011

07-Apr-2025 | Source : BSEAs per the attachment

Closure of Trading Window

27-Mar-2025 | Source : BSEThe Trading Window for dealing in the securities of the Company will remain closed for all Designated Persons there immediate relatives and all connected persons(as defined in the Code) w.e.f 1st April 2025 till completion of 48 hours after the declaration of the Audited Standalone Financial Results for the quarter and financial year ended on 31st March2025 to the Stock Exchange.

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Feb-2025 | Source : BSENewspaper Advertisement of Un-Audited Financial Results for Quarter and Nine months ended 31st December 2024

Corporate Actions

No Upcoming Board Meetings

Cenlub Industries Ltd has declared 25% dividend, ex-date: 19 Sep 19

No Splits history available

No Bonus history available

No Rights history available